Fed Raises Rates and Says It Isn’t Done Yet. We Think It Is.

Even as the Fed says it expects “ongoing” rate hikes, we expect the next move will be to cut rates by year-end.

Although the Federal Reserve is still saying that further increases in the federal-funds rate are on the horizon, we’re skeptical. We believe the Fed is likely done with its rate hike campaign after the February meeting.

Ongoing data showing a drop in inflation, along with slowing economic growth, will induce the Fed to pivot to driving interest rates lower. We expect the Fed to even begin cutting the fed-funds rate before the end of 2023.

The Fed increased the fed-funds rate by 0.25 percentage points in its Wednesday meeting, a reduced pace compared with the 0.5-point increase at the last meeting in December and the 0.75-point increases in the four meetings before that. Altogether, the Fed has increased the fed-funds rate by 4.5 percentage points since March 2022. That’s the largest one-year increase since the 1980-81 hiking cycle, when the Fed sought to tame the “Great Inflation” which raged throughout the 1970s.

The tapering of the pace of rate hikes for the last two meetings had been widely telegraphed, but now investors are far more uncertain about what the Fed will do next. Officially, the Fed is saying that “ongoing increases in the [federal-funds rate] will be appropriate.” Fed Chair Jerome Powell added that he doesn’t see the Fed cutting rates this year.

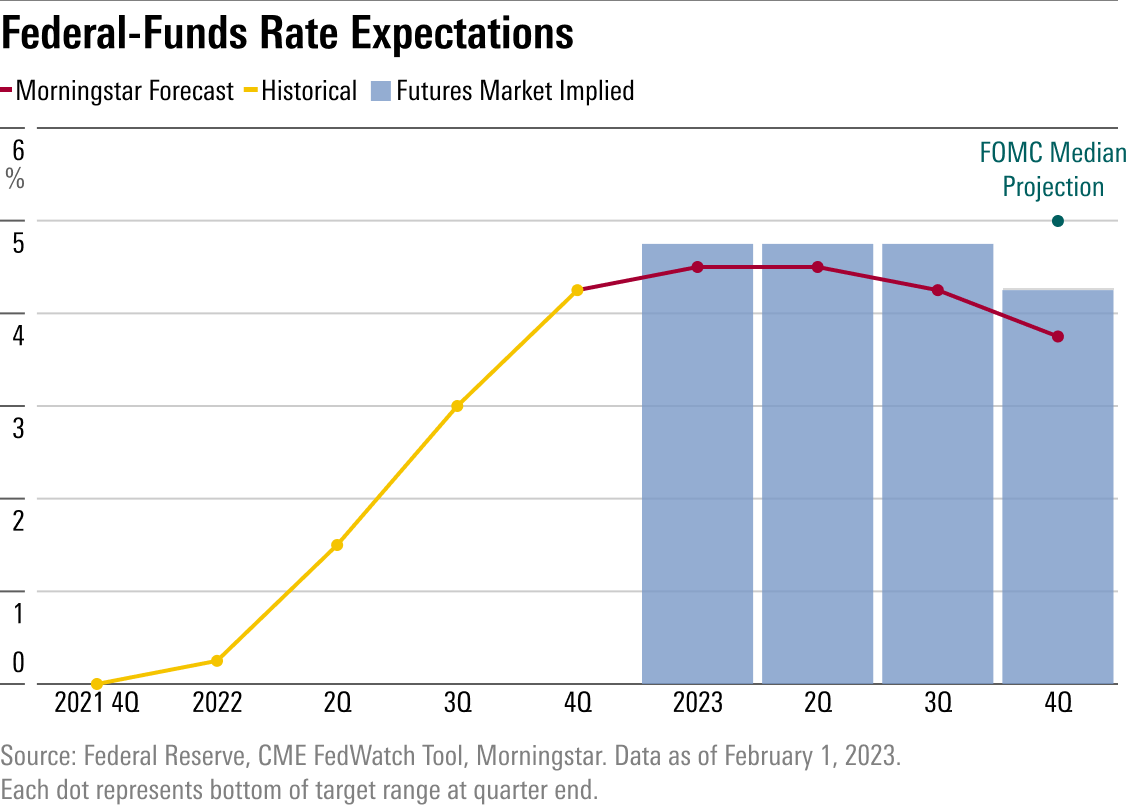

However, market expectations as well as our own forecast incorporate a lower path for the fed-funds rate than the Fed projects, including rate cuts before the end of 2023. Altogether, while the Fed is projecting a year-end 2023 fed-funds rate range of 5%-5.25%, market expectations based on federal funds futures are at just 4.25%-4.5%. Our forecast is lower still, at 3.75%-4%.

Fed chair Powell said in his news conference Wednesday afternoon that rates are “not yet in a sufficiently restrictive policy stance” and that the Fed expects “ongoing hikes”—note the plural—to be appropriate.

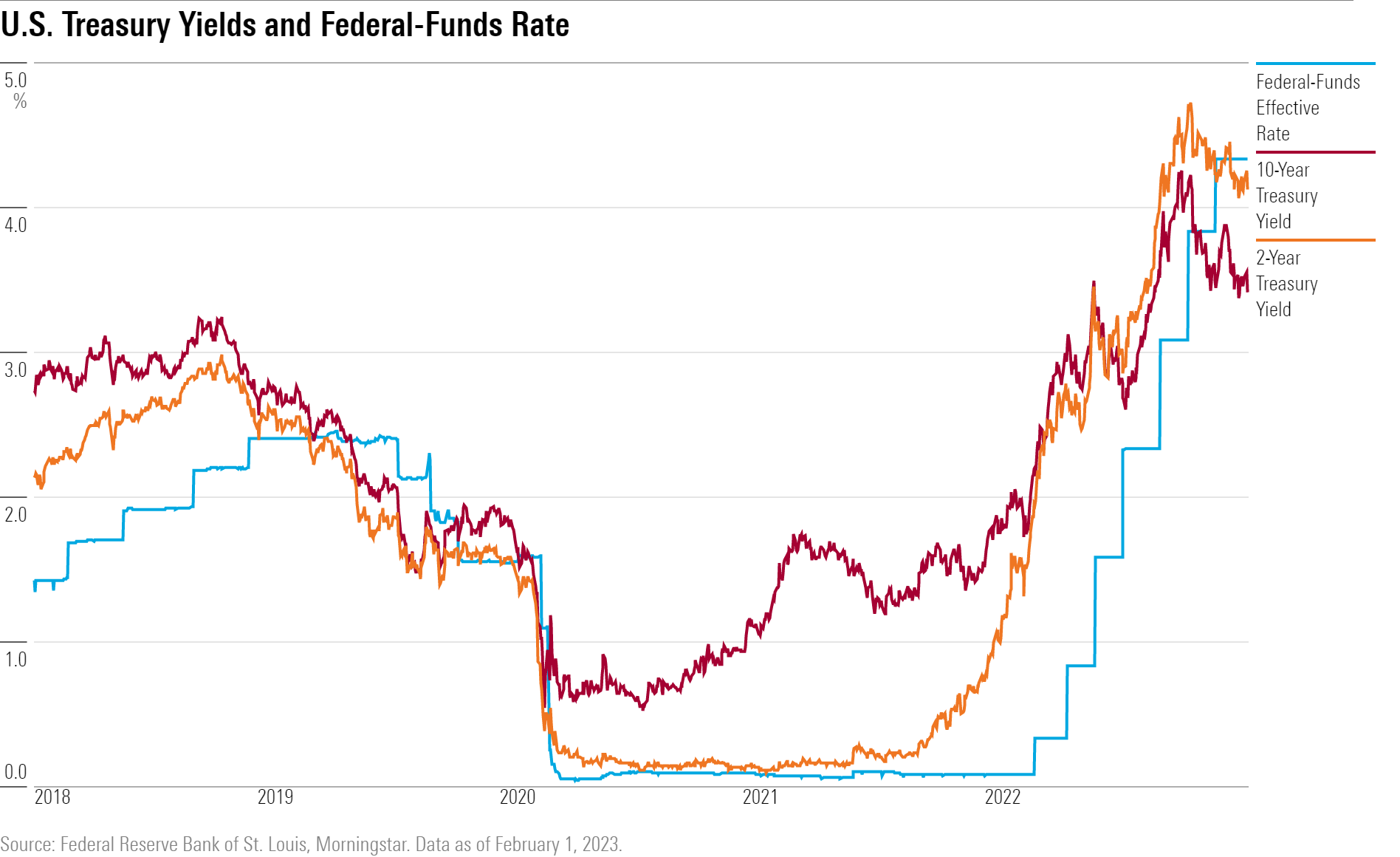

But Powell’s remarks failed to dissuade the market of its more-dovish views. Indeed, bond yields actually fell moderately, with the two-year Treasuries down about 0.10 percentage points on the day. Markets are probably focusing on Powell’s statements that the Fed’s decision-making will be heavily “data dependent” and conducted on a “meeting to meeting” basis.

Concretely, that means that if data comes in showing inflation coming down quicker than the Fed expects, then the Fed will adjust its anticipated monetary tightening downward. In particular, while the Fed is still expecting core inflation of 3.5% by the end of 2023 (in terms of year-over-year growth in the Personal Consumption Expenditures Price Index), we expect core inflation to fall much faster and reach about 2% by end of 2023.

In fact, bond yields have trended down substantially since last November in anticipation of looser monetary policy, in reaction to positive news on the inflation front. The 10-year Treasuries yield has fallen to about 3.4% from a peak of 4.2% in early November. This follows the large runup in bond yields starting in early 2022, as markets began to price in expectations of fed-funds rate hikes.

Bond yields across the curve are still much above prepandemic levels, and this is starting to drag on economic growth. Nonetheless, the Fed is eager to keep bond yields from falling too much prematurely, as this could allow the economy to heat back up before the battle against inflation is fully won. This desire helps account for the Fed’s continued hawkish rhetoric, even as we do think the Fed will ultimately pivot to fed-funds rate cuts before the end of this year.

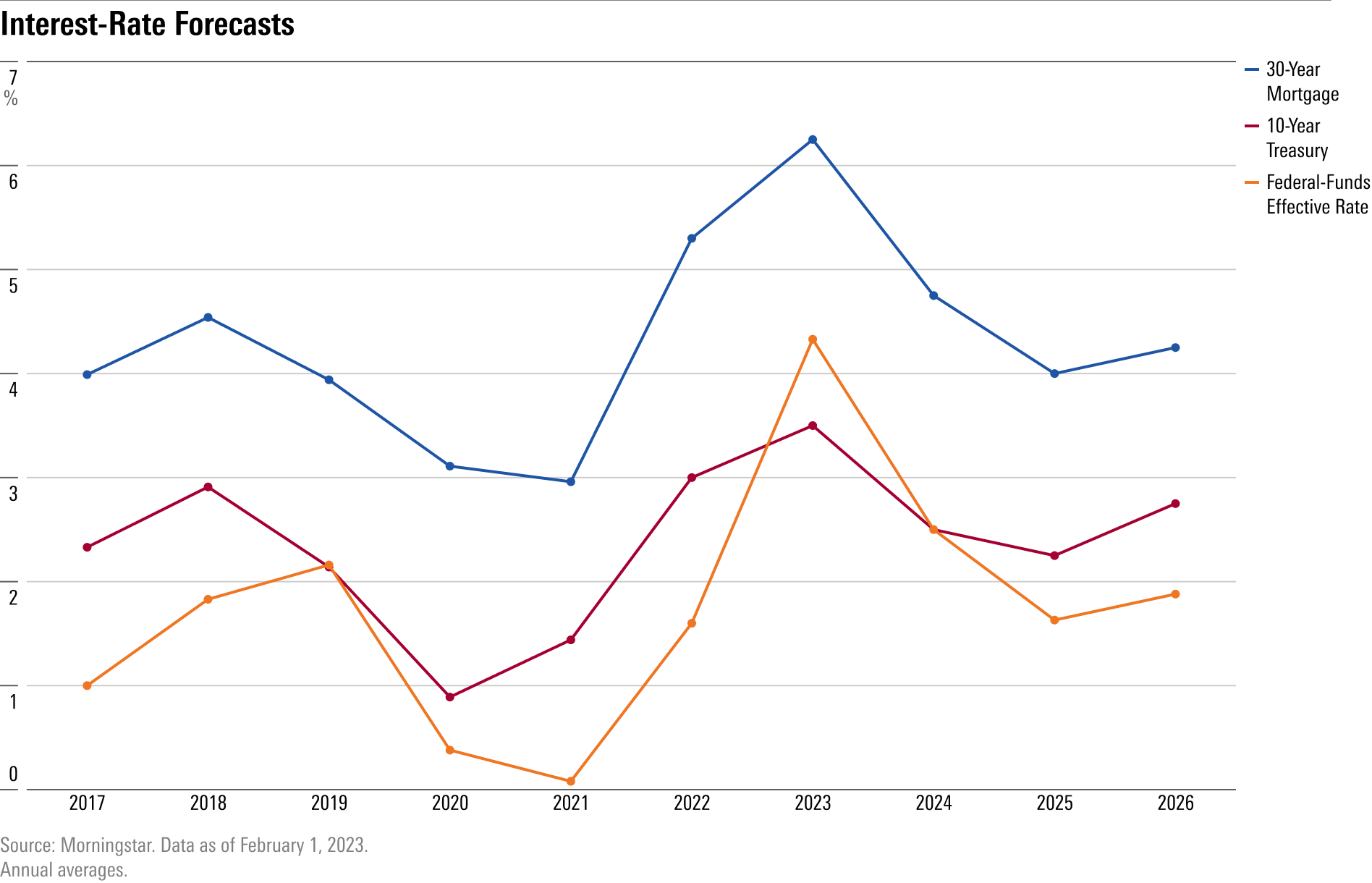

Once high inflation is quelled for good, the Fed will shift focus to lifting the rate of economic activity to its maximum sustainable level. Ultimately, this will entail substantial monetary policy loosening compared with current levels, in our view. In particular, the ailing housing sector will need a large reduction in mortgage borrowing rates in order to rebound. The housing sector is a key engine for the demand side of the economy.

We expect the Fed to drive the fed-funds rate to slightly below 2% by 2025. We expect the 10-year Treasuries yield to drop below 2.5% in 2024, before settling at our long-term projection of 2.75% in 2026 and thereafter.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)