Are Municipal Bonds an Attractive Option for Income Investors?

With state and local government coffers flush, the fundamentals appear strong for munis.

Investors may have bailed out of muni-bond funds in record numbers last year, but now the asset class is not only looking attractive thanks to high yields but also appears well positioned to ride out a recession.

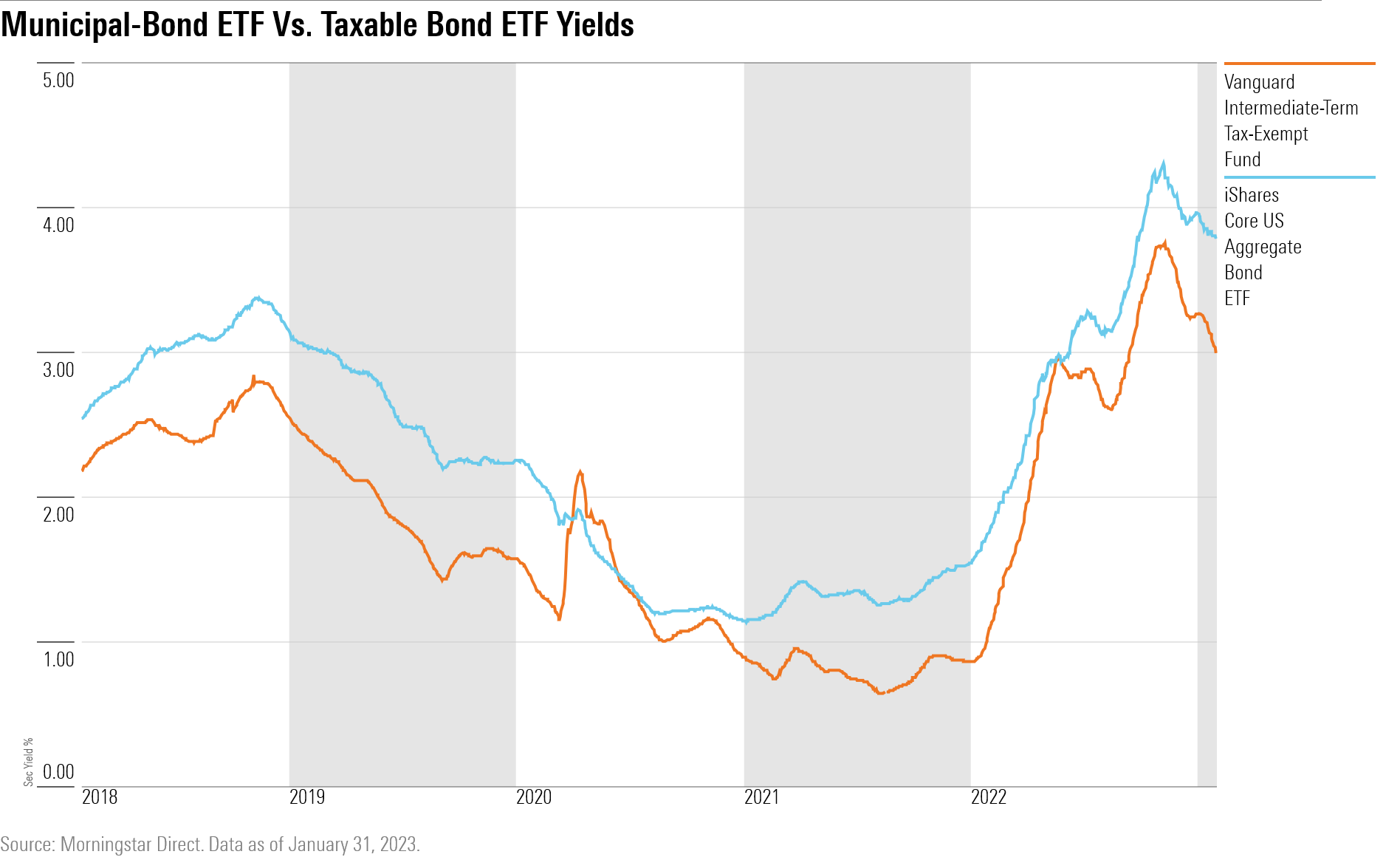

As with the rest of the bond market, yields on municipal securities are at their highest levels in many years. The average intermediate muni-bond fund stands at 3%, compared with roughly 1% just a year ago. When investors factor in the tax-exempt nature of many municipal bonds, the yield advantage is even greater, in some cases topping those found on comparable taxable-bond funds.

In addition, thanks to a general trend of many state and local governments strengthening their fiscal positions over the past several years, credit quality in the muni market is seen to be exceptionally strong. That should help muni-bond funds ride out the kind of recession that could hurt corporate bonds or other credit sensitive parts of the fixed-income market.

Muni-Bond Funds Struggled in 2022

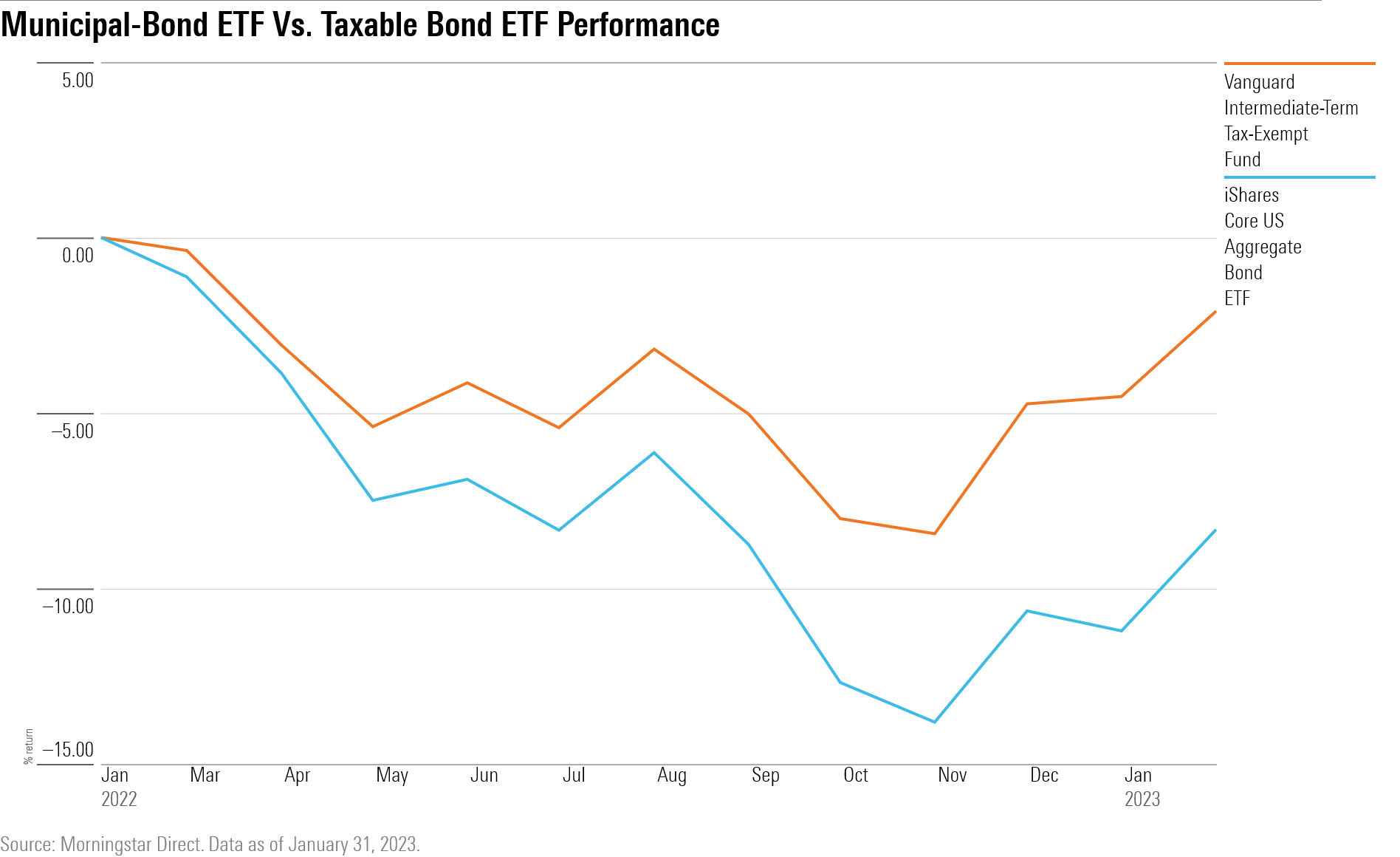

Like many corners of the investing world, muni-bond funds took a hit in 2022 as the Federal Reserve aggressively raised interest rates, resulting in big declines in bond prices. For many parts of the bond market, it was the worst year in modern history.

“The Federal Reserve interest-rate-hiking cycle was a primary factor that hurt municipal bond performance,” says Nathan Will, head of municipal credit research at Vanguard.

However, compared with other kinds of bond funds, muni bonds held up relatively well. The Morningstar Municipal Bond Index declined 7.2% while Morningstar US Core Bond Index fell 13%.

Among individual funds, the largest muni-bond fund, actively managed $68.9 billion Vanguard Intermediate-Term Tax Exempt VWIUX, posted a loss of 6.83%, and the largest indexed muni-bond fund, $32.2 billion Shares National Muni Bond ETF MUB, fell 7.5%. Meanwhile, the $240 billion Vanguard Total Bond Market VTBNX, which invests in U.S. government bonds and corporate bonds, lost 13.1%, and the $21.5 billion iShares US Treasury Bond ETF GOVT declined 12.7% in the year.

While losses weren’t as extreme for muni-bond funds compared with those for taxable-bond funds, investor outflows from the muni bond Morningstar Category were significant.

Investors fled the category, resulting in net withdrawals of $115 billion, equaling 11.5% of all money in muni-bond funds at the start of 2022. “It was the longest and deepest outflow cycle on record,” says Will.

Those outflows magnified losses in the muni market as fund managers were forced to sell bonds in order to raise cash to meet investor redemptions.

Munis Offering Higher Yields

The silver lining of the selloff is that for investors looking to put money to work, yields are much more attractive on muni-bond funds. That’s especially the case when factoring in the primary benefit that comes from tax-exempt muni-bond funds: They’re free from federal income taxes. Investors can also avoid paying state taxes on the income they receive if they purchase municipal bonds in the state they live in, making them even more attractive than taxable bonds.

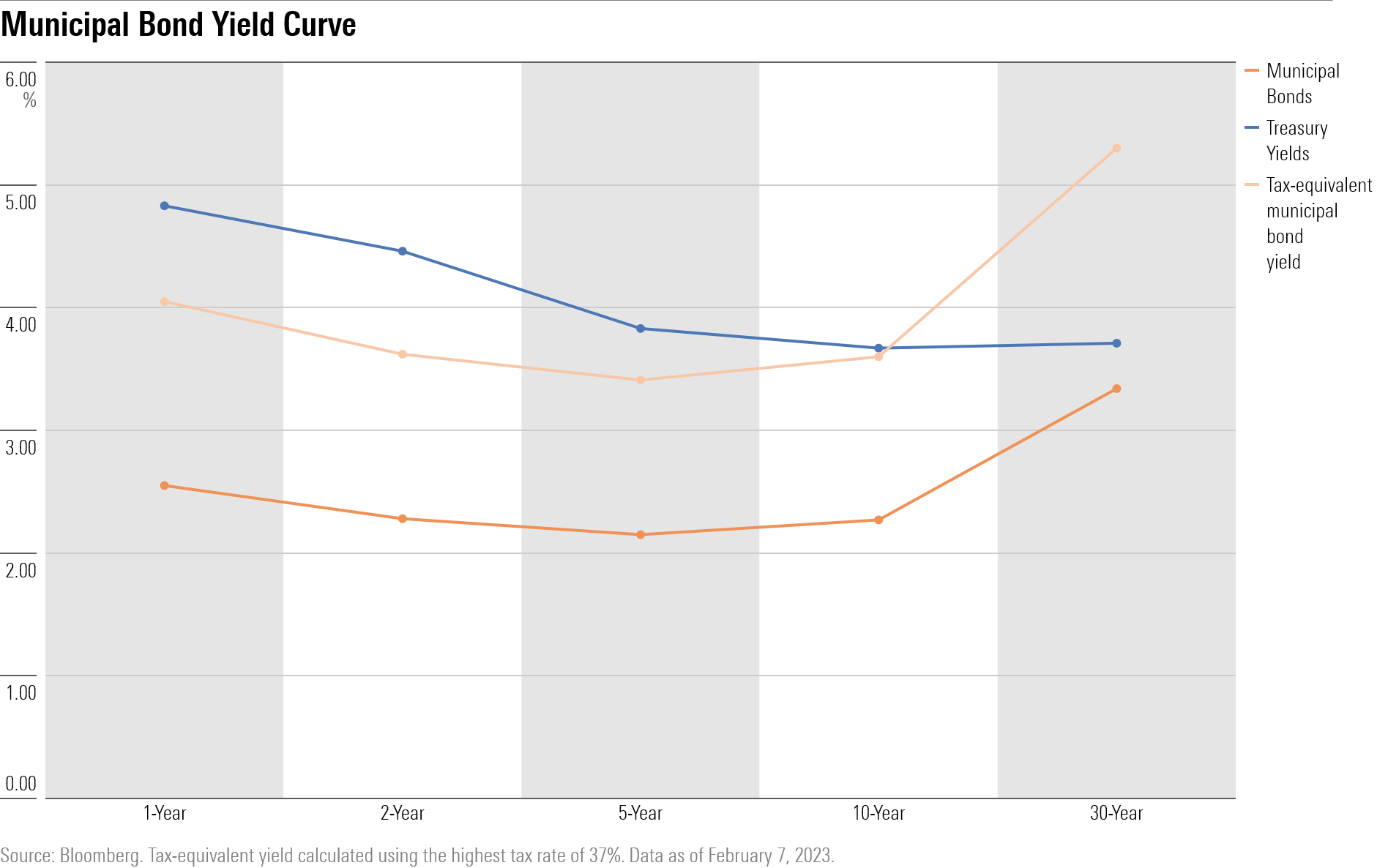

For that reason, investors measure yields on muni bonds on a taxable-equivalent basis.

The average intermediate-term national muni-bond fund offered an SEC yield of 3% as of Jan. 31. For investors who are married filing and jointly for 2022 taxes and who fall into the 24% tax bracket (those whose taxable income is between $178,51 and $340,100) that’s equal to a nearly 4% yield on a taxable-bond fund.

For investors who fall into the highest tax bracket of 37%, that’s equal to a 4.8% yield on a taxable-bond fund.

When compared with U.S. Treasury yields, muni bonds are offering higher-than-usual yields, managers say. “Longer-term valuations are more attractive relative to Treasuries,” says John Miller, head of municipals at Nuveen.

Strong Muni Market Fundamentals

Fund managers say that yields are only part of the story.

Factors such as investors’ exodus from muni-bond funds last year, “don’t detract from municipal bonds’ strong fundamentals,” says Miller.

The fiscal story at the state and local government level is particularly strong right now. Cities and states, the primary issuers of municipal bonds, are flush with cash thanks to COVID-19 federal stimulus money, according to Will. State tax revenue has remained high and elevated property values will provide a sticky stream of cash to cities, keeping them well positioned to pay back bondholders.

Fund managers note that there haven’t been any major downgrades or defaults recently, and in fact, some long-standing dubious issuers of municipal bonds, such as Chicago, have seen upgrades. Chicago also recently issued a “social bond” that is available to smaller investors to fund local projects.

“Credit fundamentals should provide stability,” says Vanguard’s Will.

Strong fundamentals and high credit quality become especially important if the U.S. enters a recession, which could squeeze city and state revenue, but their large rainy-day funds should provide a ballast. “If the U.S. enters a mild recession, municipal bonds can be very resilient,” says Nuveen’s Miller.

Fed policy is a risk to munis, as it is to the rest of the bond market. However, managers say future interest-rate hikes are already priced into shorter-term municipal bonds.

2023 Muni Bond Rebound

This year, as investors weighed new economic data and how much further the Fed will raise rates, bonds have made a comeback. The Morningstar US Core Bond Index has advanced 2.3% while the Morningstar Municipal Bond Index is up 2.5%.

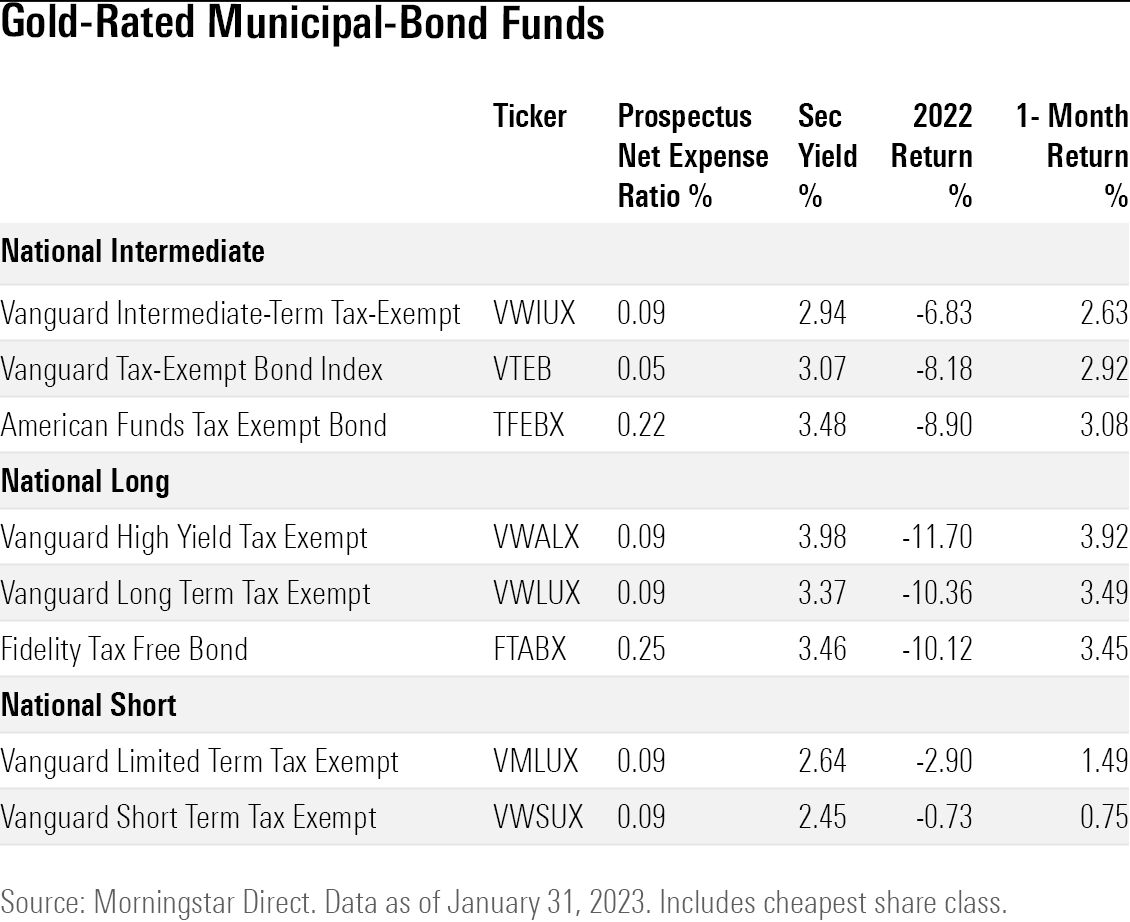

Gold-Rated Municipal Bond Mutual Funds and ETFs

Morningstar groups muni-bond funds by their maturity and based on whether they have a single-state or national focus. Many investors choose to own individual municipal bonds or create a bond ladder, but muni-bond mutual funds and exchange-traded funds provide diversification and exposure to a wide range of issuers.

Unlike many other kinds of bond funds, there aren’t many index-tracking muni-bond funds. But Thomas Murphy, manager research analyst at Morningstar, says active management in the muni-bond market can be an advantage. The muni-bond market is less liquid than many portions of the taxable-bond market, and active managers can help navigate the more-opaque market, he says.

Among the actively managed offerings, for investors wanting to limit interest-rate risk, $19.5 billion Vanguard Short Term Tax Exempt VWSUX (with a Morningstar Analyst Rating of Gold) carries one of the shortest durations. Duration measures a bond’s interest-rate sensitivity and was especially relevant last year as sharp increases in interest rates were the primary reason bonds experienced such severe losses. This Vanguard fund lost only 0.73% in 2022 and is up 0.75% in 2023 as of Jan. 31.

Longer-term muni-bond funds have made larger gains this year as good news on inflation led investors to think the Fed won’t need to hike interest rates as much as previously expected. The Gold-rated $2.9 billion Fidelity Tax Free Bond FTABX is up 3.5% as of Jan. 31. “The strategy’s higher-quality fare and security selection buoyed results in selloffs,” writes associate director Beth Foos.

For investors set on indexing, Gold-rated $25.3 billion Tax-Exempt Bond Index VTEB carries a Gold rating and comes with the lowest price tag in its category. “This fund provides broad exposure to investment-grade, tax-exempt muni bonds. The fund tilts toward the most liquid and high-quality bonds in this thinly traded market,” writes Morningstar analyst Lan Anh Tran.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)