The Fed and Markets Have Different Outlooks. Which One Will be Right?

Weekly Markets Brief: Reality check on recession chances sends stocks lower despite better news on inflation.

As investors look ahead to 2023, there are multiple, dueling narratives at play around the outlook for inflation, the chances for recession, and the outlook for the Federal Reserve’s policy on interest rates.

And they can’t all be right.

First is the stock market’s narrative, where based on valuations, expectations appear to be that the economy either slides into just a short, shallow recession or avoids one altogether in a “soft landing.” From there, with inflation under control, the Fed is seen being able to lower interest rates by the end of next year. (Although this past week saw a bit of a reality check in stocks, which slid by 2.1%. See the second half of this article for the week in review.)

The bond market, meanwhile, is flashing red with its main recession indicator—the U.S. Treasury yield curve—signaling a recession as extremely likely.

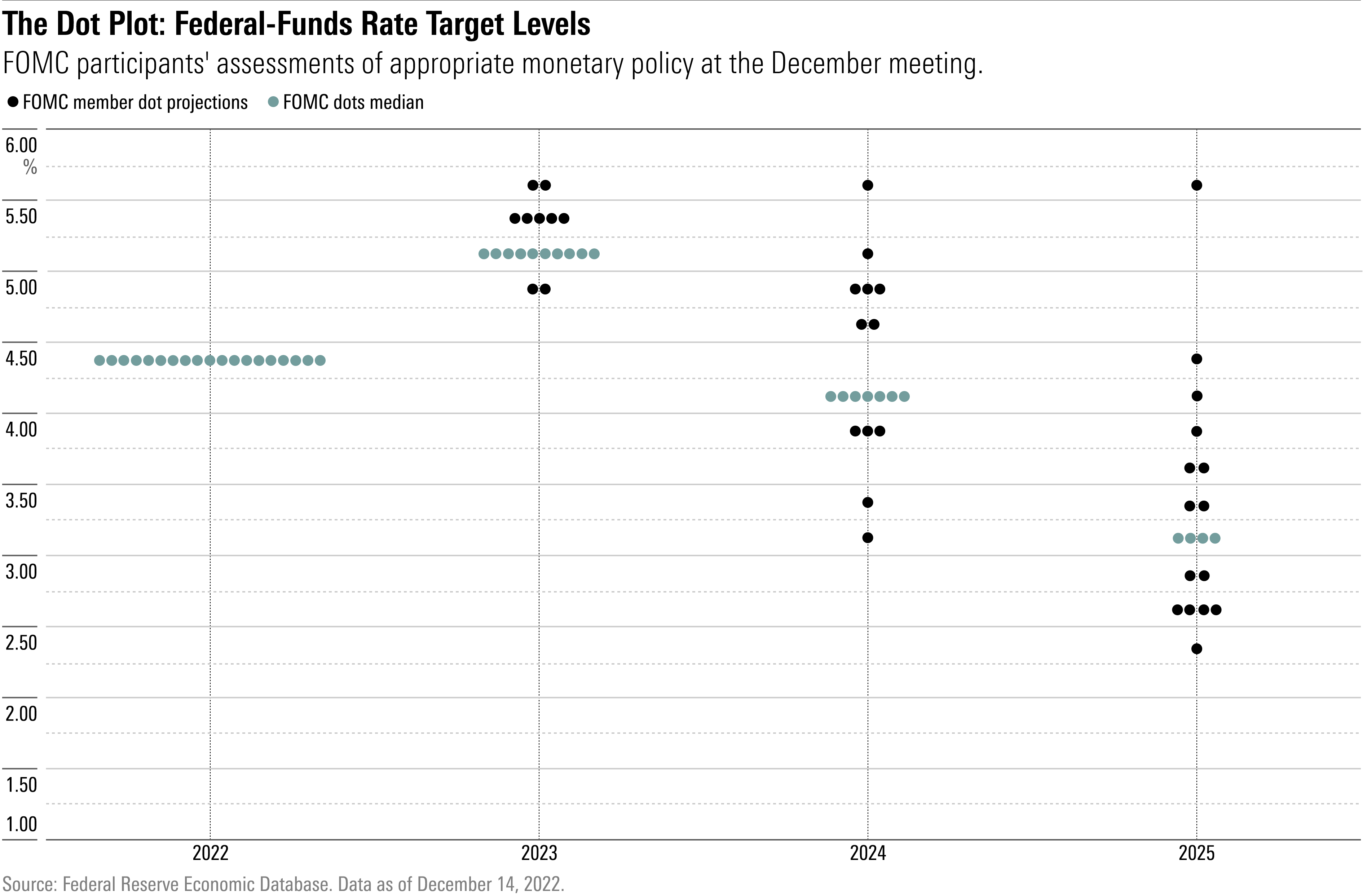

Then there’s the Fed’s own forecasts, which predict no recession despite rising unemployment, coupled with falling inflation throughout the year—but no rate cuts.

“It’s either some degree of magical thinking or some degree of contradictory thinking,” says Steve Sosnick, chief strategist at Interactive Brokers.

One possibility is that there may be some market jawboning at work from the Fed. Morningstar’s chief U.S. economist, Preston Caldwell, wrote last week that the Fed may be worried that if the market’s optimism about inflation declining is driving bond yields lower, “economic activity could bounce back too quickly and prevent inflation from coming down to normal. We think this is why Fed projections currently look so hawkish, as the Fed is clearly trying to `talk’ the market away from letting financial conditions ease too much.”

Jawboning aside, how these variables play out in coming months will be crucial to the paths that markets and portfolios take.

Veteran Fed-watcher Robert Brusca of FAO Economics says he is shaking his head at the contradictions he sees coming out of the Fed and in the markets.

“The market seems to be of the opinion that the Fed’s policies are going to be very effective, very quickly,” Brusca says. In addition, “the market thinks the Fed is going to be more successful—and its policy is going to be more effective—than what the Fed thinks,” Brusca says.

On the one hand, Brusca says, it’s certainly possible for inflation to decline to 2.1% by 2025, as the Fed predicts. “But the thing that worries me is that there are things the Fed needs to be doing there, and it’s not doing them: A high real funds rate and a moderate to severe recession,” Brusca says. In its forecasts, the Fed isn’t predicting recession, just very slow growth next year. (Brusca says that for appearances sake, it’s unlikely the Fed would predict a recession at this point even if officials think there will be one.)

In addition, the Fed’s 2023 year-end forecast for the federal-funds rate of 5.1% may be higher than what the market is expecting, but it’s also most likely not restrictive enough policy in “real” terms—when measured against the inflation rate. “It’s the real funds rate that matters,” Brusca says. “And they need to make the real funds really restrictive,” on the order of 2% above the rate of inflation.

That would mean, for example, that the funds rate would likely need to be pushed north of 5% next year to reach a 2% real rate.

Interactive’s Sosnick says that while investors are “by definition optimistic” about the outlook, “we have to decide between optimism and realism, and that’s where I’m scratching my head about the potential contradictions.”

Ultimately, “it’s going to be up to the data to tell us if the Fed can thread this needle that the market hopes for, which is a soft landing amidst a return to 2% inflation,” Sosnick says. “Other than that, the Fed has to be forced to blink.”

Events scheduled for the coming week include:

- Tuesday: General Mills (GIS), Nike (NKE), and FedEx (FDX) report earnings.

- Wednesday: Micron Technology (MU) and Carnival (CCL) report earnings.

- Thursday: CarMax (KMX) reports earnings.

For the trading week ended Dec. 16:

- The Morningstar US Market Index fell 2.06%.

- The best-performing sector was energy, which gained 1.83%.

- The worst-performing sector was consumer cyclical, which lost 3.80%.

- Yields on the U.S. 10-year Treasury fell to 3.48% from 3.56%.

- West Texas Intermediate crude oil prices rose 4.60% to $74.29 per barrel.

- Of the 846 U.S.-listed companies covered by Morningstar, 200, or 24%, were up, and 646, or 76%, declined.

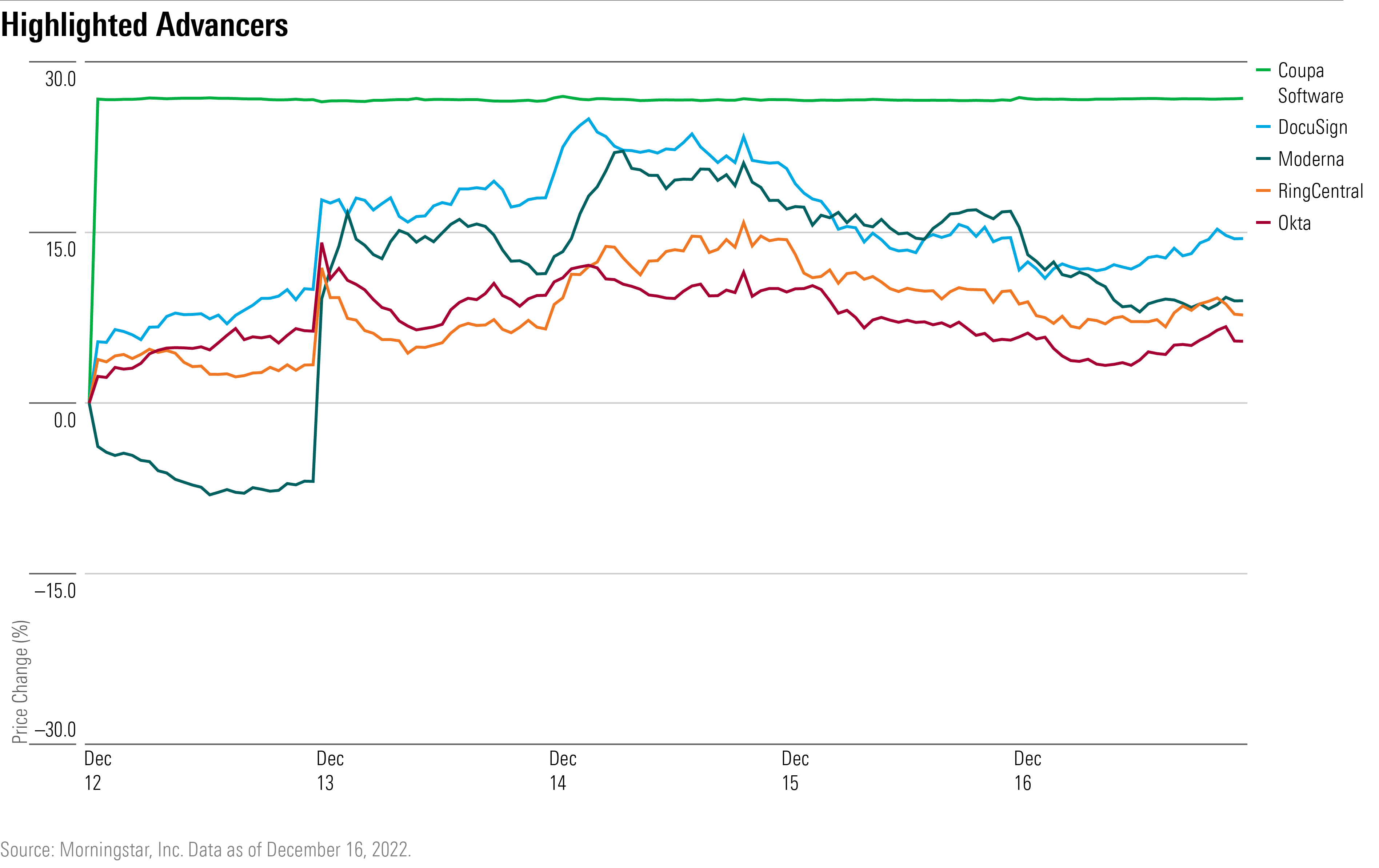

What Stocks Are Up?

Coupa Software (COUP), a business spending management solutions provider, rallied on news that private equity firm Thoma Bravo would acquire the firm in an $8 billion deal that values the company at $81 per share. The transaction is expected to close in the first half of 2023 after clearing the necessary regulatory hurdles, says Julie Bhusal Sharma, a Morningstar equity analyst. Morningstar’s fair value estimate for Coupa was reduced to $81 from $108 to reflect the terms of the deal.

“While we are glad to see Coupa trade at a high premium to its share price, we think the deal terms are still leaving money on the table for shareholders,’’ she says. ``If the deal fell through, our stand-alone fair value estimate would return to $108 per share.”

Other software stocks that did well this past week were RingCentral (RNG), DocuSign (DOCU), and Okta (OKTA).

Moderna (MRNA) surged after phase 2 clinical trial results showed that mRNA-4157, a vaccine to treat melanoma, a deadly form of skin cancer, is performing positively when combined with Merck’s (MRK) drug Keytruda.

“We’ve raised our assumed probability of approval for mRNA-4157 to 50% from 20% to account for this promising data, which gives Moderna $2 billion in 2031 sales from the program (assuming a 50/50 split with Merck.),” Morningstar sector strategist Karen Andersen says.

What Stocks Are Down?

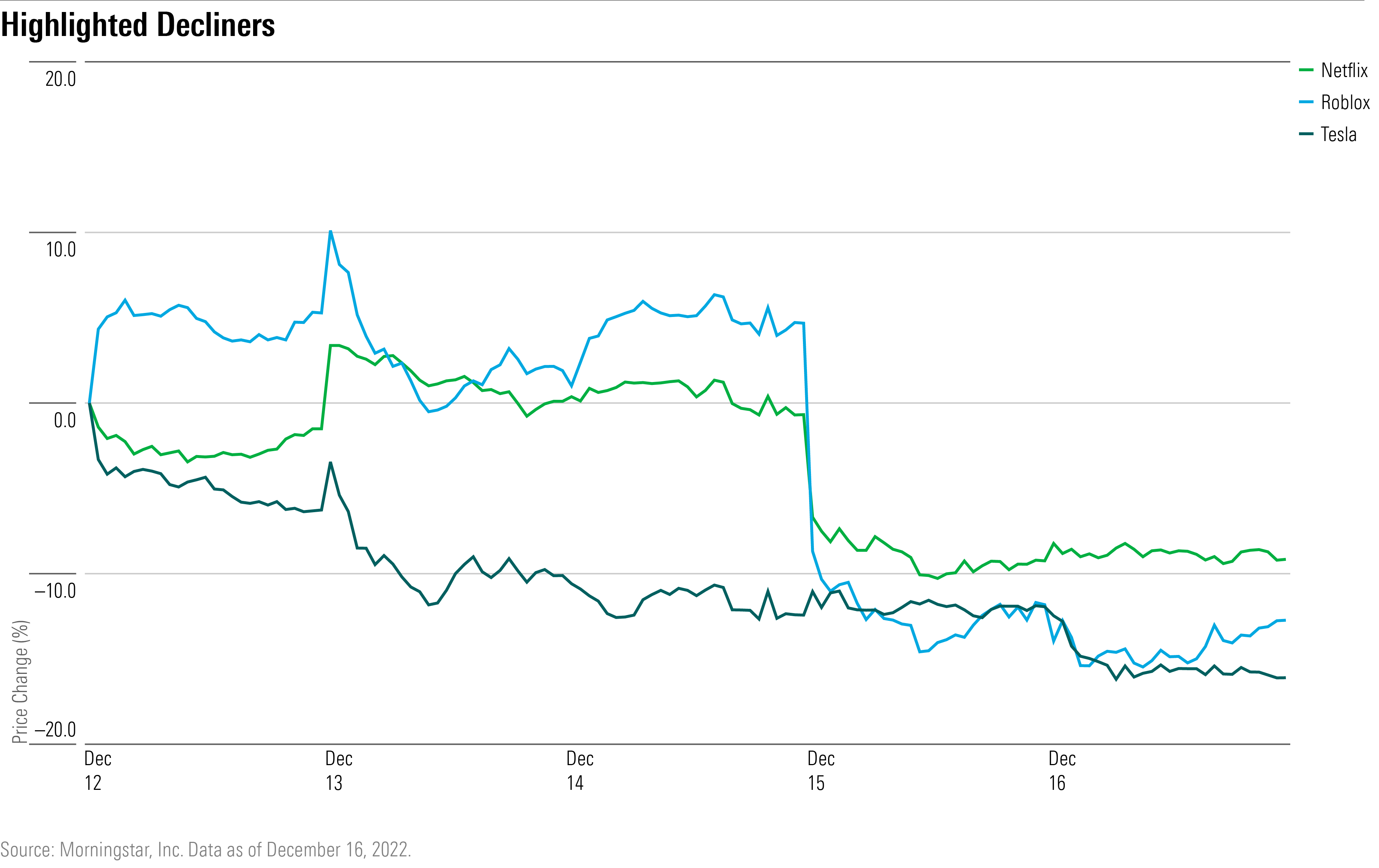

Tesla (TSLA) slid after SEC filings showed chief executive Elon Musk sold 22 million shares of the company earlier this month.

``The shares sold were worth $3.58 billion, and the proceeds will probably be used to supply additional funds to Twitter, which Musk acquired in late October,’’ says Seth Goldstein, a Morningstar strategist. “Twitter could continue to affect Tesla shares, since some potential investors may want to avoid the stock while it is still unclear whether Musk may need to sell more shares.”

Video game platform operator Roblox (RBLX) fell after disclosing key metrics for November. The company saw a negative impact from the strong U.S. dollar on bookings, which are estimated to have risen 5%-7% year over year, while average bookings per daily active user, or ABPDAU, were down 7%-9% in the same period.

On a constant currency basis, the company says estimated bookings growth would have been 10%-12%, and ABPDAU would have been down 3%-5%, both on a year-over-year basis.

Netflix (NFLX) fell after advertising agencies said the streaming service was providing refunds, even for ads that have yet to run, for failing to deliver a big enough audience on its new ad-supported subscription tier, Digiday reports. That indicates growth is slower-than-expected for the company’s advertising business, according to Digiday.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TNJY62P2RRG2PP5MMRLA5IZXYY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)