Markets Brief: As Q3 Winds Down, the Stock Market Bounce Is History

As recession fears grow, stocks slide, with retailers and energy stocks facing new pressure.

With only days to go before the end of the third quarter, what had looked like a turnaround quarter for the markets has taken a turn for the worse for investors.

At one stage in August, the Morningstar US Market Index had bounced more than 18% from its mid-June lows, and bond yields began to decline amid hopes that inflation was peaking, and that the Federal Reserve could cool off its aggressive rate hikes.

But as it became clear that inflation was much stickier than most investors—and Fed officials—had expected, sentiment soured. As Fed officials signaled last week, there’s still plenty more in the way of rate hikes to come in the next few months.

This week may not bring much to change the near-term outlook, with the calendar relatively light on key economic and corporate news. However, one key report will come Friday with the release of August data for the Fed’s preferred inflation indicator, the Personal Consumption Expenditures Price Index.

In July, the PCE inflation index posted a 12-month increase of 6.3%, down from 6.8% in June. Economists are expecting the PCE index to post a 6.1% year-over-year rise for August, according to FactSet. A bad reading could further cement negative sentiment in both the bond and stock markets.

While third-quarter earnings still won’t be out for a few more weeks, investors will also need to be on guard for companies coming out with preliminary earnings releases—also known as preannouncements—such as the recent one by FedEx warning about business slowing thanks to economic headwinds.

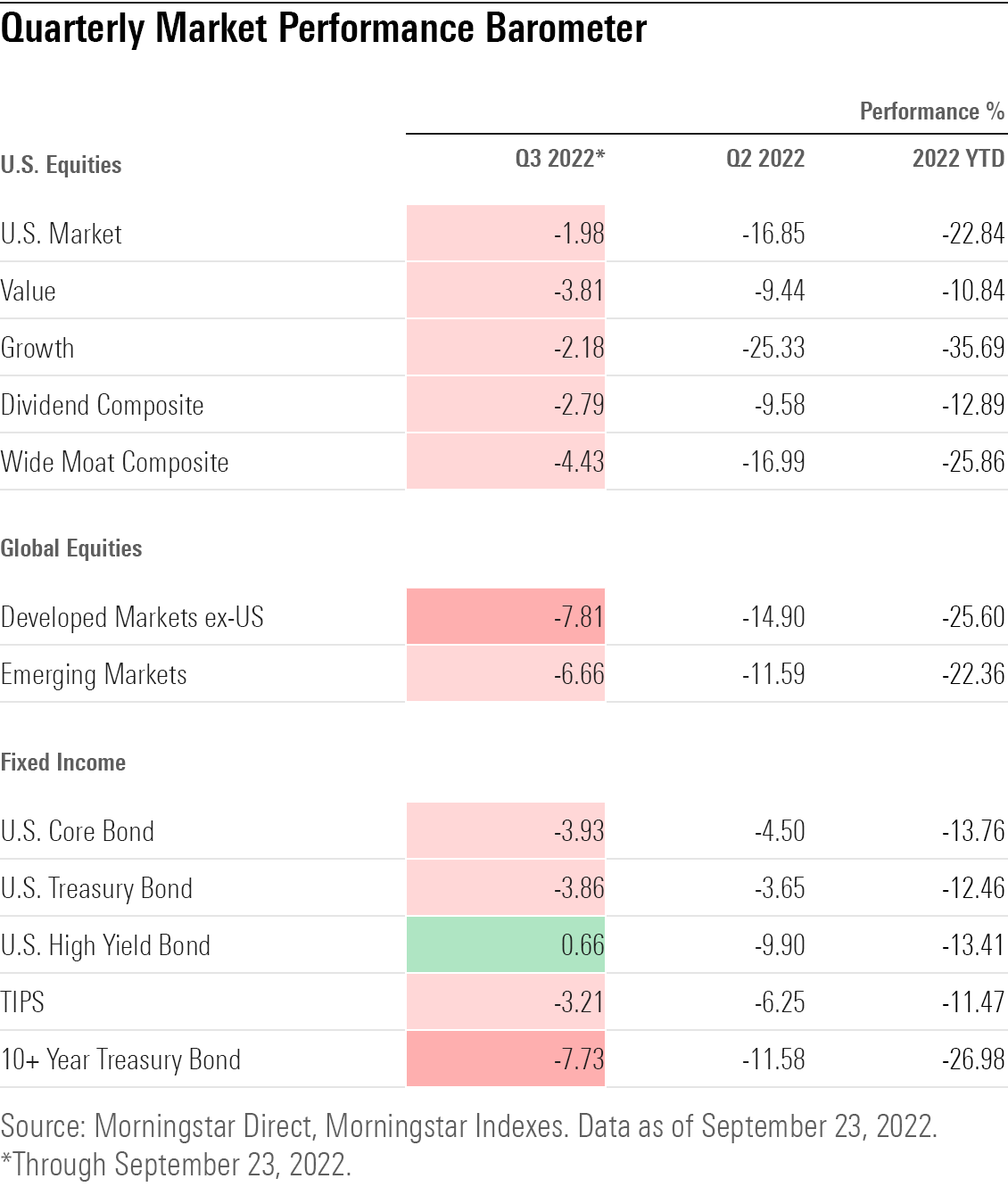

Meanwhile, for investors who haven’t checked their portfolios lately, the third quarter itself doesn’t look that bad when measured from start to finish. As of Friday’s close, the Morningstar US Market Index is down 2% for the quarter.

But that masks the round trip the market has taken over the last three months. By mid-August stocks were up 18.4% from their bear-market low in June. Had the market made it just a little bit higher, and broken above the 20% mark, that would have qualified for a new bull market.

That wasn’t to be the case. Stocks have now fallen back 14.4% from that high, and the US Market Index is down 22.8% so far in 2022. That leaves the index only 1.3% ahead of its bear market low on June 16.

The other bit of bad news for investors is that bonds continue to see losses as well. This means that traditional diversification strategies—such as a 60/40 split between stocks and bonds—aren’t offering much of a haven.

Given that the Fed has made it clear that it will take an economic slowdown to get inflation under control, there’s not much optimism to be had in the market.

“There’s no reason this (stock) market can’t fall much further,” Richard Weiss, chief investment officer for multi-asset strategies at American Century Investments. “If history is any guide, the market could easily go down another 10% to 20%.”

Events scheduled for the coming week include:

- Thursday: Bed Bath & Beyond BBBY, and Nike NKE report earnings.

- Friday: Personal Consumption Expenditures Price Index August update.

For the trading week ended Sept. 23:

- The Morningstar US Market Index fell 4.97%.

- All sectors declined for the week, with energy down 9.38%, and consumer cyclical, off 7.43%, the worst performers.

- Yields on the U.S. 10-year Treasury rose to 3.69% from 3.45%.

- West Texas Intermediate crude oil prices fell 7.48% to $78.74 per barrel.

- Of the 851 U.S.-listed companies covered by Morningstar, 35, or 4%, were up, and 816, or 96%, declined.

What Stocks Are Up?

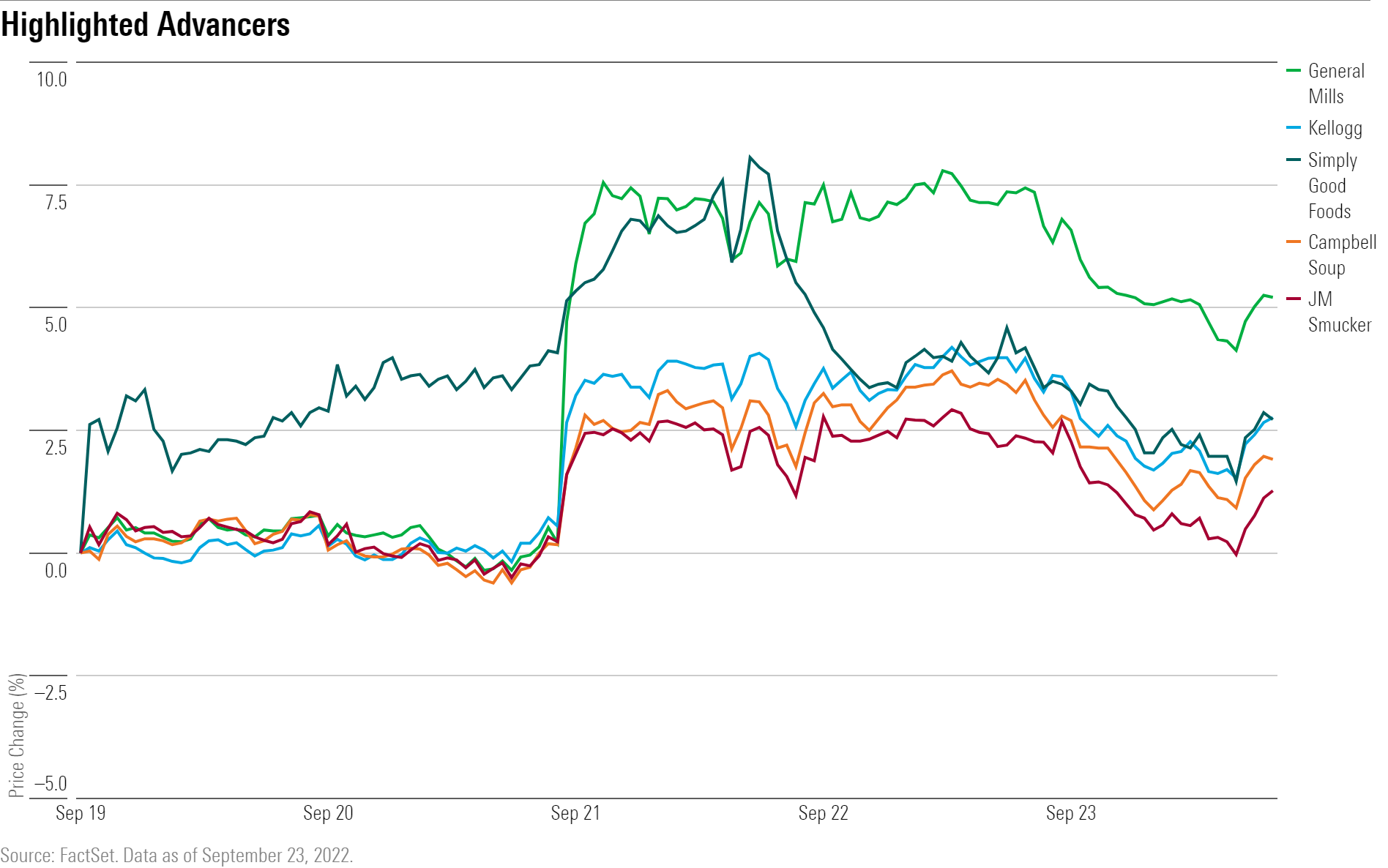

Packaged food stocks inched higher led by gains in General Mills GIS after the company reported first-quarter results that showed organic sales growing by 10%.

“We think the firm is also benefiting from consumers switching to at-home food consumption to help combat inflation, per management commentary and restaurant traffic data, which has softened in recent months,” says Rebecca Scheuneman, senior equity analyst at Morningstar.

The company also increased its fiscal 2023 organic sales guidance to 5% to 6% from 4% to 5%. Competitors Kellogg K, Simply Good Foods SMPL, Campbell Soup CPB, and JM Smucker SJM saw their shares close higher.

What Stocks Are Down?

Cyclical stocks were down as the Fed’s most recent rate hike coupled with Chairman Jerome Powell’s comments pushed expectations of a recession higher.

In response, investors sold shares of retailers including The RealReal REAL, Farfetch FTCH, and Wayfair W.

Renewable energy companies also declined after the Fed’s meeting, continuing their volatility of the past few weeks. Among those in the industry down the most were high-growth companies that have yet to become profitable, such as ChargePoint CHPT and Plug Power PLUG .

“The impact of rising rates is more severe [for them] given cash flows are longer dated,” says Brett Castelli, Morningstar equity analyst.

Oil and gas companies also fell on sliding natural gas and crude oil prices, with Antero Resources AR and Patterson-UTI Energy PTEN among the largest decliners.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_eae1cd6b656f43d5bf31399c8d7310a7_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)