Bond Funds Start 2022 in a Sea of Red

As the Fed looks to raise interest rates, funds most sensitive to rate changes have been hit hardest.

Lately, there’s been virtually no place for bond investors to hide.

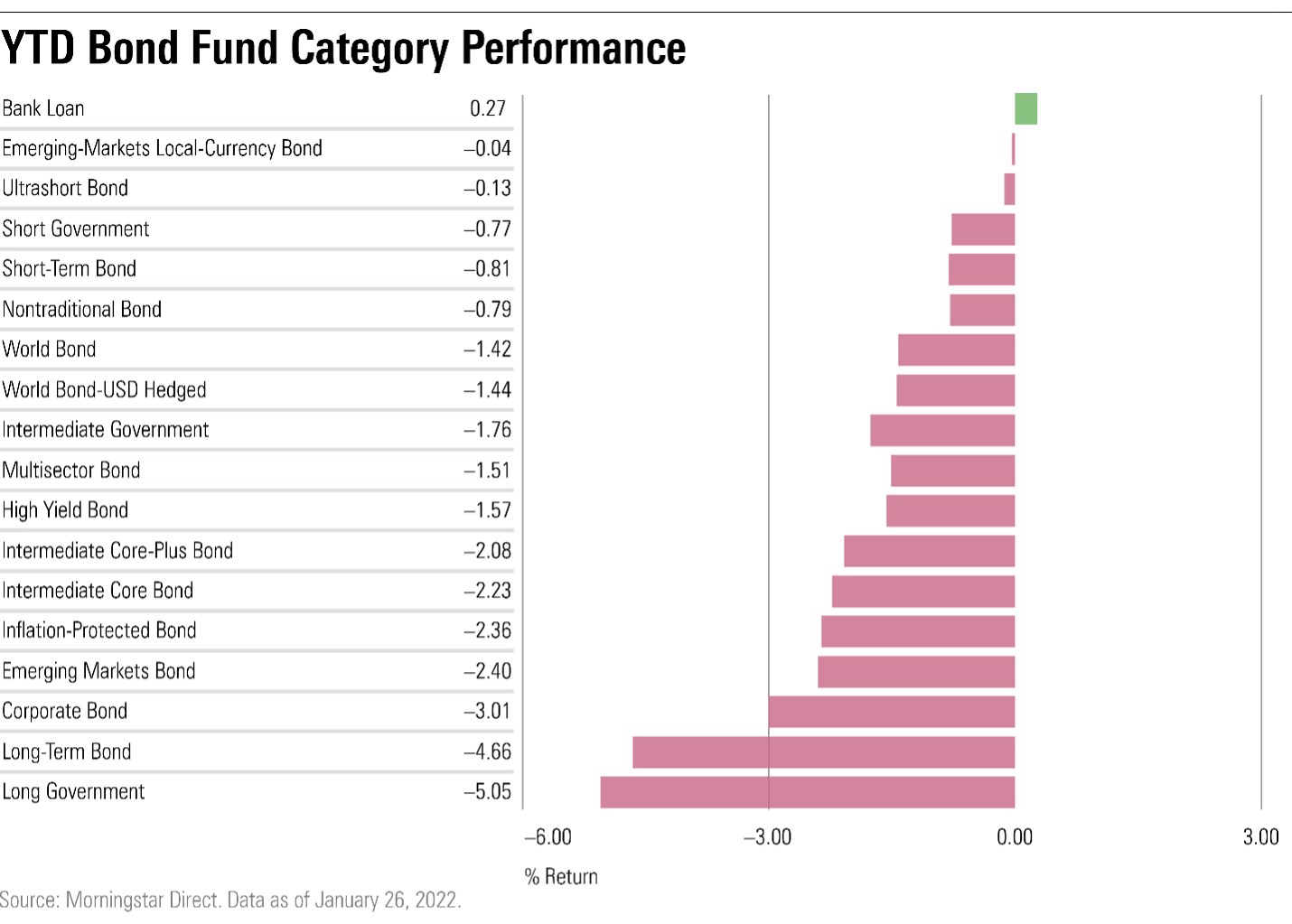

Every major category of bond funds--with exception of funds that invest in bank loans--has started 2022 with losses, and in most cases, extending declines posted last year.

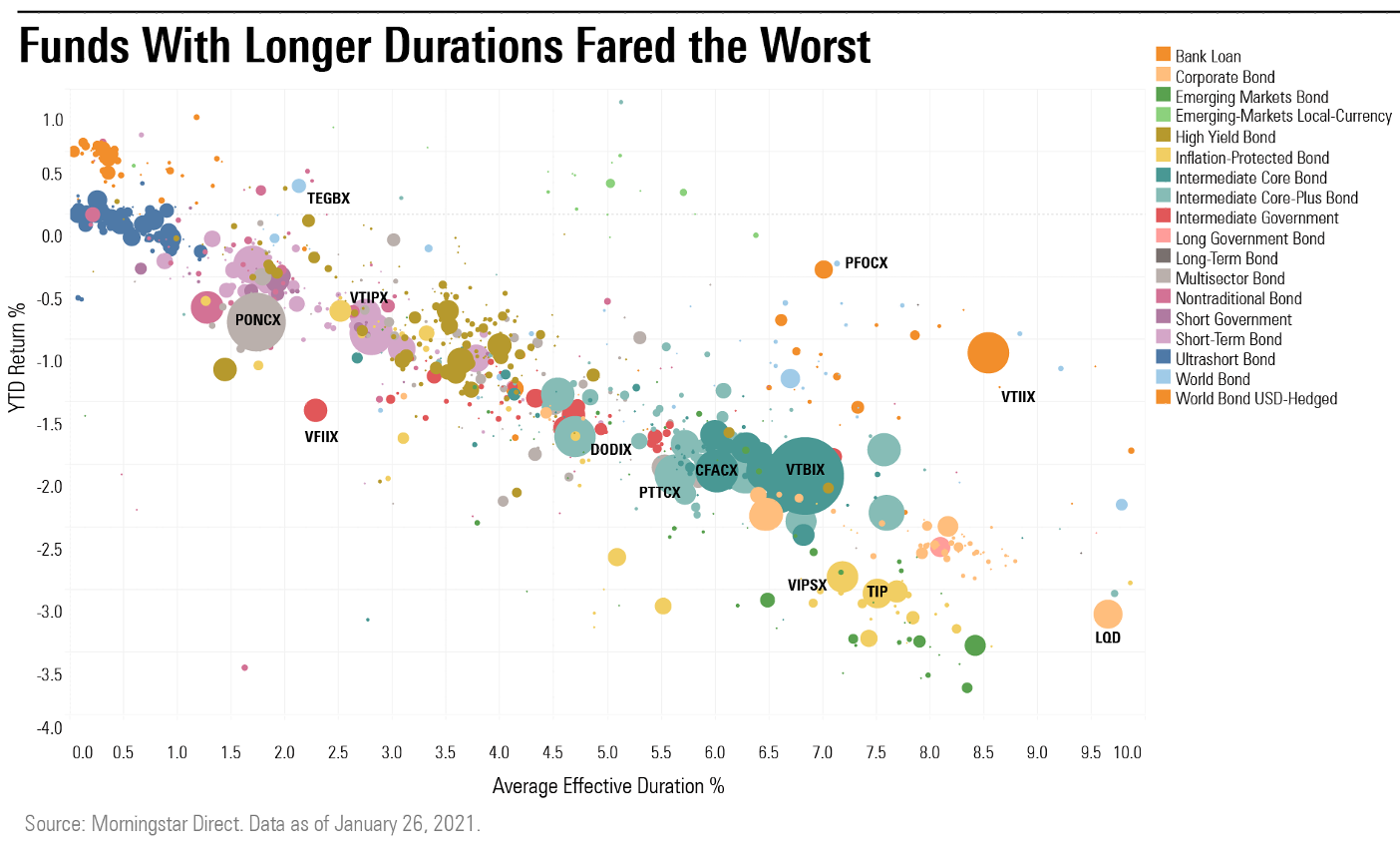

With inflation rising and the Federal Reserve signaling that a series of interest-rate increases are on the way, funds holding bonds that are the most sensitive to changes in interest rates have been the hardest hit. Morningstar analyst Sam Kulahan points out that longer-duration funds are doing worse, while shorter-duration funds are doing better on a relative basis given their lower rate sensitivity and the rise in rates.

For example, long government funds--which tend to move the most when yields rise or fall--have taken the great hit among major bond fund categories, losing 5.1% since the start of the year.

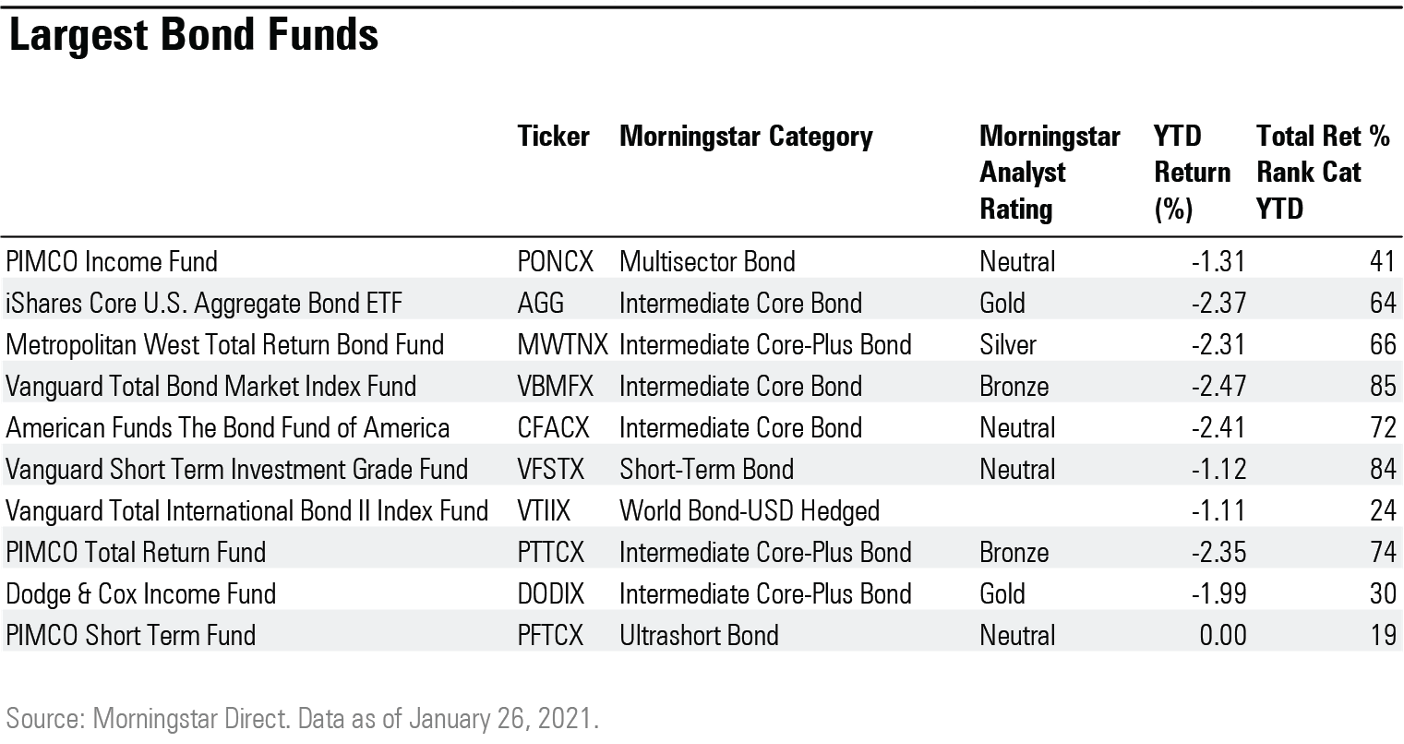

But the damage has been much more broad-based than that. Funds that normally provide some level of cushion against rising rates--such as short-term bond funds--and those with equity-market-like attributes, such as corporate bonds and high-yield bond funds--are also in the red. In fact, the 10 largest bond funds are all in the red so far in 2022. Vanguard’s Total Bond Market strategies, the largest bond fund in the world, is down 2.42%. And even the best-performing funds in most categories are still posting negative returns. Fidelity Intermediate Bond Fund FTHRX is one of the top-performing intermediate-bond funds this year but is still down 1.44%.

Bank-loan funds, which invest in bonds with floating-rate coupons that often benefit from a rising rate environment, have held up the best, says Kulahan. Emerging-markets local-currency bond funds have also generally produced positive returns so far, as some emerging-markets central banks raised rates last year and the dollar has been weaker this year, he says.

But inflation-protected bond funds, the top-performing group of 2021 and the area that saw the most inflows, are down 2.36%, though the sell-off has proved that not all inflation-protected bond funds are created equal. Vanguard Short-term Inflation Protected Securities Index Fund VTIPX is faring the best, only down 0.74%, while Pimco Real Return PRRIX is down 3.24%.

Broadly, the worst damage has been among funds the most sensitive to interest-rate increases, as measured by the average effective duration of their portfolio.

The largest intermediate-term bond funds have declined in similar fashion. The largest bond fund, Vanguard Total Bond Market VTBIX, is down 2.42%. American Funds Bond Fund of America CFACX has lost 2.41%, and Metropolitan West Total Return Bond Fund MWTNX is down 2.31%.

Dodge & Cox Income DODIX is managing slightly better with a loss of only 1.99%. Kulahan says the strategy's long-standing shorter-than-benchmark duration makes it less sensitive than its competitors to changes in interest rates. This structural stance helps it hold up better than its benchmark and most peers when rates spike, but also leads to relative underperformance when rates are falling, he says.

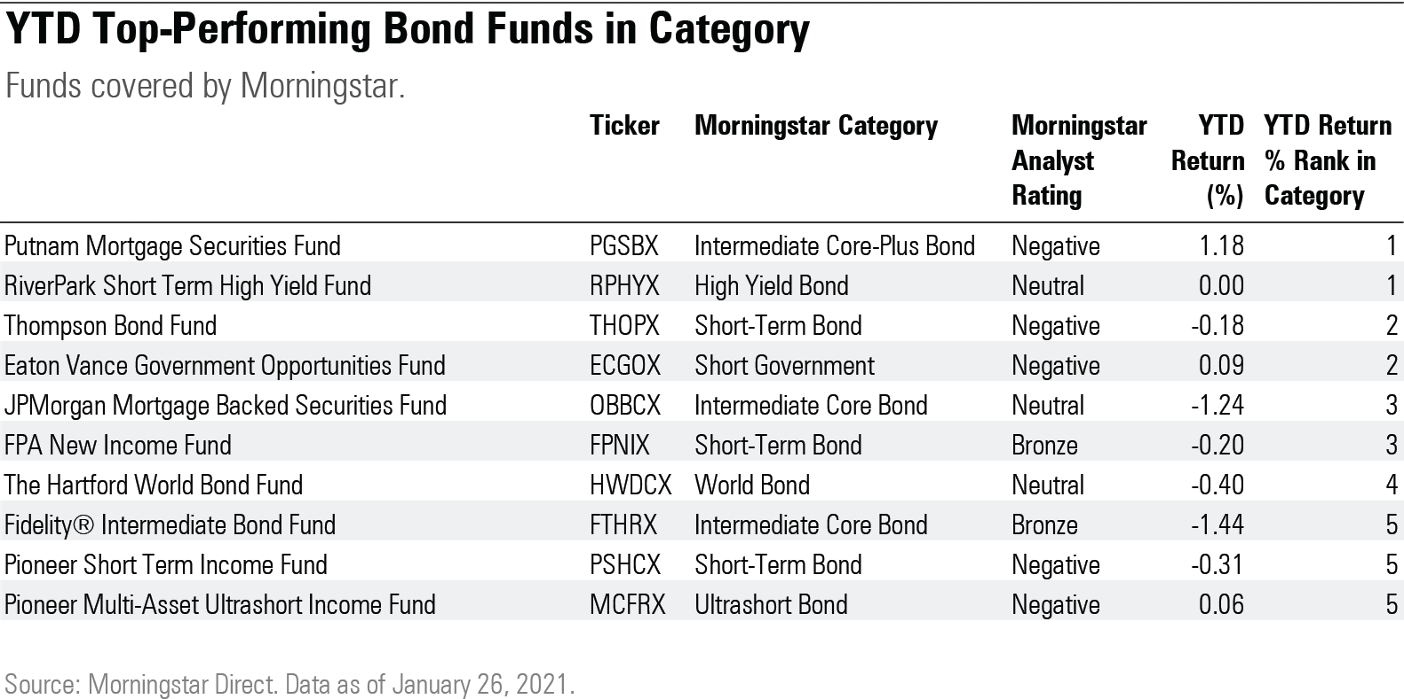

Funds that ventured outside the typical realm of intermediate-term bonds are holding up the best. Hartford Schroder’s Tax-Aware HTAB holds an outsize stake in municipal bonds compared with the average intermediate-core bond fund and Putnam Mortgage Securities PGSBX takes risks in mortgage credit. Both funds rank in the top 10% of their categories this year to date.

Bronze-rated Fidelity Intermediate Bond Fund is down 1.44% compared with the average 2.23% decline in the category. Supreet Grewal wrote in August that the fund has behaved reliably through credit and interest-rate events. For example, it held up well during interest-rate sell-offs, owing to its persistent shorter duration, including in late 2016 and early 2018, she says.

Among high-yield funds, RiverPark Short Term High Yield Retail RPHYX is posting positive returns for the year, while the category is down 1.57%. Kulahan says since approximately 40%-50% of the portfolio rolls into cash every 30 days, which the team must quickly invest in available issues, results in a lower average effective maturity (typically three to five months) than both the high-yield category and a subset of high-yield strategies with a short-term mandate. As of that shorter-maturity focus its duration is one of the lowest in the category, which helps insulate it when rates rise. Its duration is 0.4 years as of December 2021 versus the high-yield category norm of 3.5 years, he adds.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)