TIPS Are on Sale

It’s time to buy shares of TIPS funds, not redeem them.

Treasury Inflation-Protected Securities reward their owners in two ways. One payment consists of a real interest rate. In January 2015, for example, the Treasury Department issued new 30-year TIPS that carried a real interest rate of 0.32%. Investors who bought those bonds at their par value would receive, as a starting point, an annual check equal to 32 basis points of their bond’s price.

That’s not much! Fortunately, TIPS also offer an inflation rate. Every six months, the Treasury adjusts the underlying price of outstanding TIPS by the amount of recent inflation, using the Consumer Price Index for all Urban Consumers, or CPI-U. For example, if the CPI increased by 2% over the previous six months, the Treasury would reprice a TIPS with a par value of $10,000 at $10,200.

That process continues every six months until the TIPS matures, which can be either five, 10, or 30 years after it was issued. On that date, the Treasury redeems the security at its fully adjusted amount, which might be far above its issuance price. For example, after 30 years’ worth of 3% annual inflation, a TIPS initially worth $10,000 would be valued by the Treasury at $24,273. That is the sum the Treasury would pay an investor who held that bond on its maturity date.

So far, so good. For those who wish to buy a bond and stash it away without regard to its current market price, TIPS are easy on the mind. They will deliver what the government pledges in real terms. Unlike with other bonds, there is no danger that inflation will erode TIPS’ purchasing power. Unfortunately, while the destination is assured, the journey has been exceedingly rough. In recent years, the prices of TIPS have plunged, distressing many of their owners.

Rising Yields

To understand why, let’s return to 2015. The change in the CPI that year was 0.1%. In 2014, the change was 1.6%, the previous year 1.5%. Apparently, inflation had been vanquished. Consequently, yields on conventional bonds were unusually low. When the year began, traditional 30-year Treasury bonds paid 2.6%.

Since that time, inflation fears have resurfaced. The Federal Reserve is currently struggling to push the annual inflation rate below 3%, never mind reaching half that amount. Unsurprisingly, the yield on a conventional 30-year Treasury bond is much higher than in January 2015. As I write these words, it stands at 4.71%.

Let’s run through the math. In January 2015, the yield on conventional 30-year Treasuries was 2.60%, and the real yield on 30-year TIPS was 0.32%. The difference between those two amounts, called the breakeven rate, is the level of future inflation that will equate those two investments. That is, if inflation from 2015 through 2044 were to average 2.60% - 0.32% = 2.28%, then nominal bonds and TIPS would have matching total returns. If inflation is above 2.28%, the TIPS investor would be better off. Below 2.28%, the owner of the conventional bond comes out ahead.

The calculation for today’s 30-year TIPS is 4.71% (nominal yield) - 2.37% (real yield) = 2.34%. The breakeven rate is almost the same, but the nominal yield is much higher. That is a disastrous result for TIPS. When the nominal yield on 30-year Treasuries increases, so must either 1) the breakeven rate or 2) the real interest rate on TIPS. Since the first barely budged, the second must have soared—and it has. The real interest rate on 30-year TIPS has ballooned to 2.34% from 0.32%.

Plummeting Prices

This has been deeply unpleasant for TIPS investors who look at their balance sheets, as rising bond rates necessarily mean falling bond prices. That did not happen immediately. Real interest rates on TIPS declined from 2015 through late 2021, bottoming at negative 0.56%. (Yes, that figure is correct. Investors at that time paid the US government to take their money. I do not recommend it.) Since then, the returns on long TIPS have been awful, as evidenced by the returns of the Morningstar 10+ Year TIPS Index.

Down, Down, Down!

What a shock! Not only did investors in long TIPS lose one third of their money—in a government-guaranteed security no less!—but they did so precisely during the very circumstance those bonds were designed to safeguard against: an increase in inflation. As hedges go, that ranks with buying a dealership in Stanley Steamers, in case the automobile industry were to hurt one’s buggy-whip sales.

Fund investors have responded exactly as one would expect: They have fled. Technically speaking, TIPS have delivered on their promises. The Treasury has credited TIPS bonds with the required inflation adjustments and paid their stated real interest rates. Contract fulfilled. But nobody told investors who bought long TIPS that the very worst environment for investments that carried the words “inflation-protected” would be … when inflation surfaced.

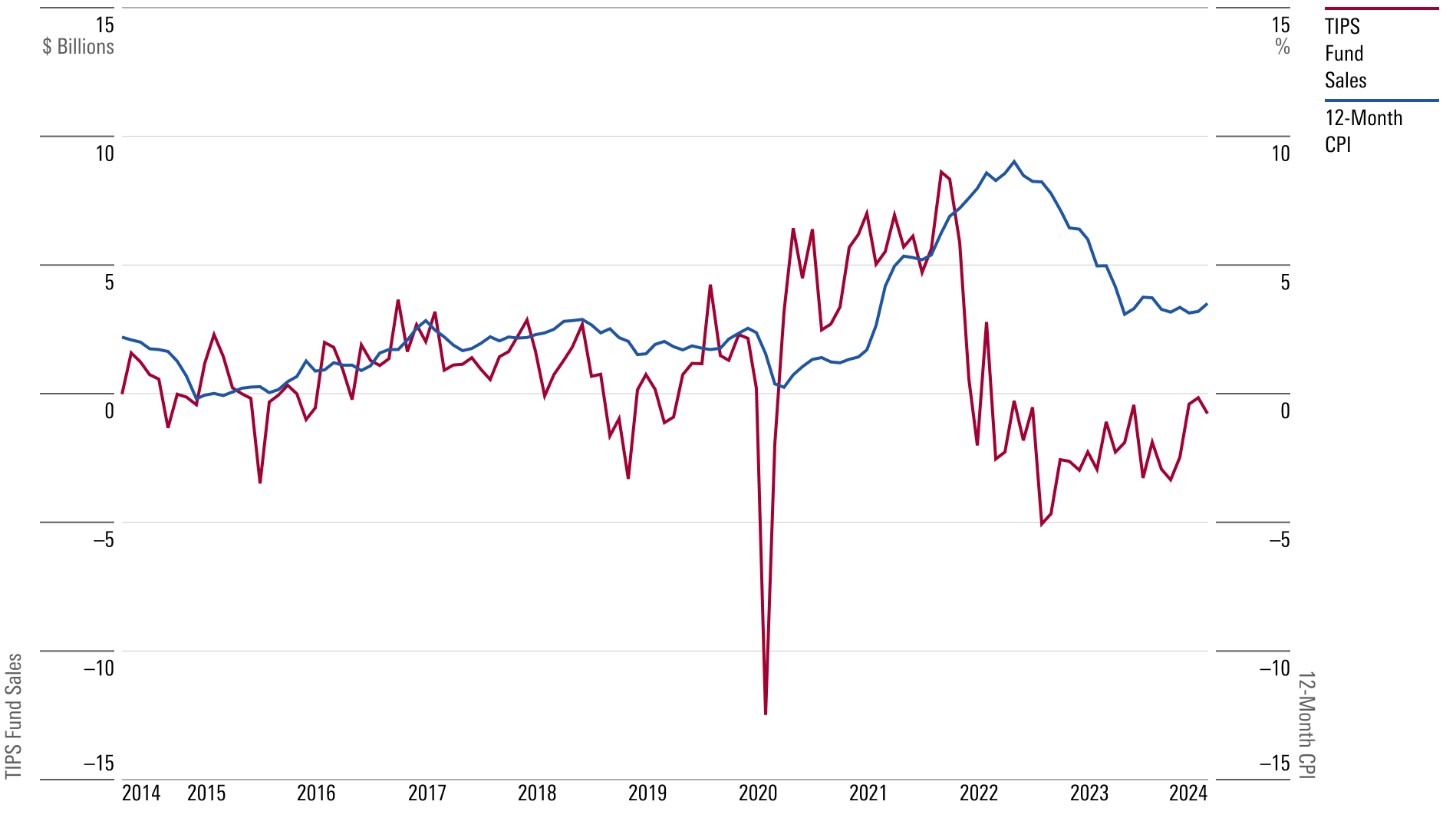

The chart below plots 1) the red line of monthly net sales, in USD billions, for inflation-protected mutual funds and exchange-traded funds against 2) the blue line of the 12-month change in the CPI. As you can see, shareholders in TIPS funds were generally happy with their purchases, with the brief but sharp exception of the coronavirus pandemic’s onset, until the start of 2022 when it became clear that inflation would persist. Since then, they have steadily redeemed their investments.

TIPS Fund Sales and Inflation

Conclusion

I empathize with TIPS fund investors. They had no idea. When inflation spiked from summer 2007 through 2008, long-term TIPS rallied, as one might expect from an inflation-hedging investment. The theoretical work of the Cleveland Federal Reserve, which estimated the breakeven rate on 10-year Treasuries over the past 40 years, gave no hint that long TIPS prices would collapse when inflation surged. The losses were worse than even skeptics would have imagined.

That said, I do not believe that they should now be selling. With real interest rates ranging from 2.3% to 2.4%, the yields on TIPS with maturity dates of 10 years or greater are unusually generous. Not only will buy-and-hold investors be rewarded, receiving meaningful ongoing payments while sheltering their assets against damage from inflation, but they may also reap capital gains. After all, real interest rates can fall as well as rise. And when they do, TIPS’ prices will recover.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-03-2024/t_cdd595ea947840269e7ce34438bd5a08_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)