Pullback an Opportunity to Pick Up Undervalued Stocks

Value remains attractive, but time to rotate back into growth … and even some tech.

It's time to get back into growth and pick through those high-quality companies caught up in the broad market sell-off.

We continue to find the value category attractively priced. However, carnage across growth stocks pushed them down well into undervalued territory. Even the technology sector, which had been one of the most overvalued at the beginning of the year, is now littered with undervalued opportunities.

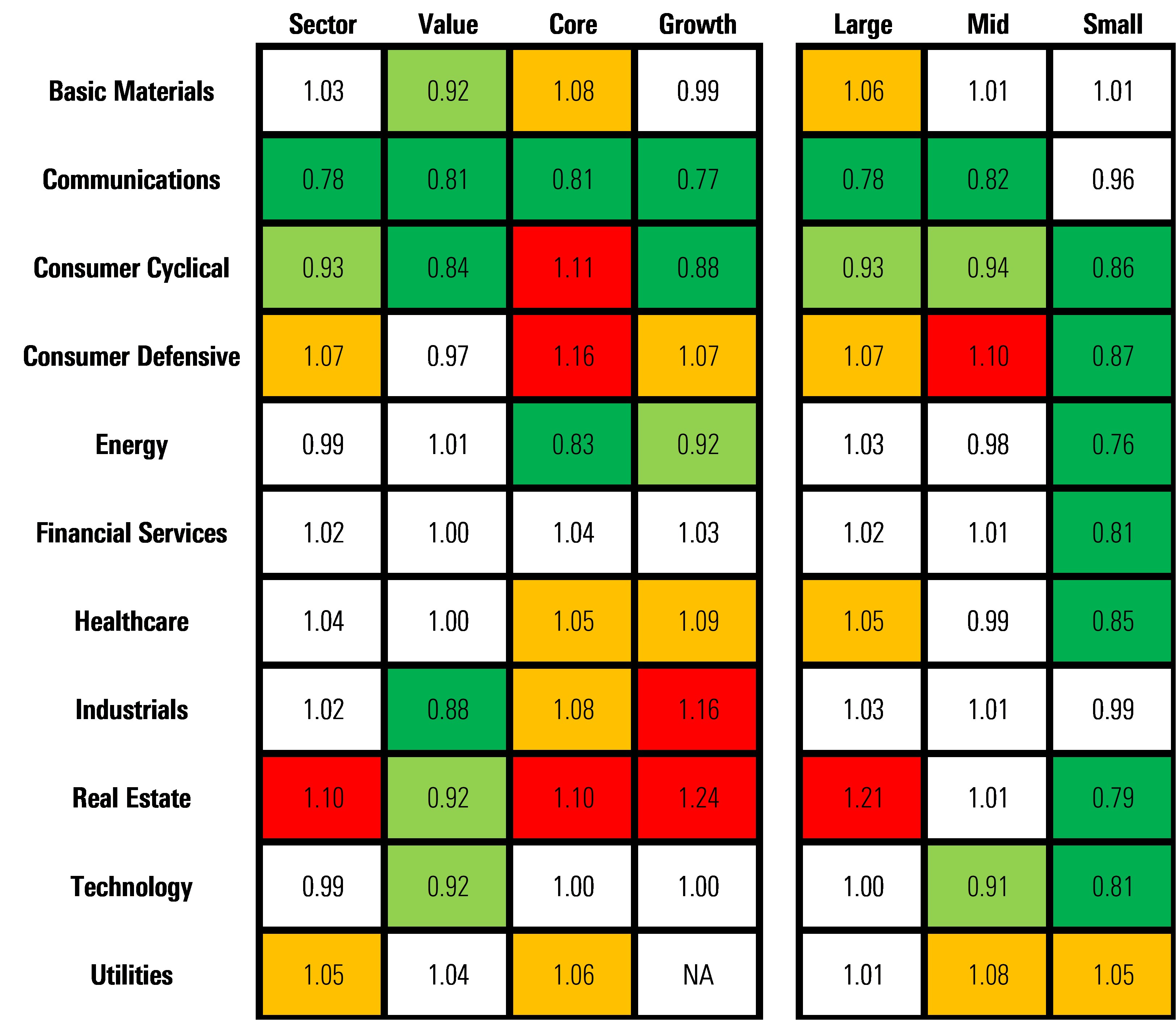

After the January sell-off, the market is trading at a price to fair value of 0.96 according to a composite of our U.S. stock coverage. This valuation places stocks near the bottom of the range that we consider to be fairly valued.

Source: Morningstar. Data as of Jan. 28, 2022.

Looking forward, we expect volatility will remain higher than usual. At the beginning of January, we published our 2022 U.S. Equity Market Outlook in which we noted that the markets were overvalued and facing strong headwinds coming into the new year:

- Slowing rate of U.S. economic growth

- Tightening monetary policy

- High inflation

- Rising interest rates

These headwinds have already taken their toll on the markets. Through Jan. 28, the Morningstar US Market Index has dropped 7.93% and we are updating our valuations accordingly as some of what we had expected has already played out, and some still has yet to occur. Much like the cold winter winds blowing off Lake Michigan, these headwinds will remain in our face for months to come.

Growth stocks have been hammered and dropped precipitously in just a few weeks as the Morningstar Growth Index declined 14.65%. This pushed the price to fair value ratio of growth stocks down to 0.92 from 1.05 at the end of 2021. We now see a substantial number of growth stocks that have been unfairly caught up in this broad downdraft are now trading at attractive valuations.

Coming into the year, we noted that the best opportunities for investors was in the value category and small-cap stocks. Compared with the broad market, the Morningstar US Value Index has generally held up during this downturn, dropping 0.47%. The price to fair value of value stocks has remained unchanged at 0.96. Considering we continue to forecast a relatively robust real U.S. GDP growth of 3.9% this year and 3.5% in 2023, we think value stocks still have a strong tailwind behind them.

With a price/fair value of 1.05, core stocks remain overvalued, even though the Morningstar Core Index has fallen 7.73%. At the beginning of the year, with a price to fair value of 1.14, we had viewed core stocks as substantially overvalued.

Across different capitalization levels, the Morningstar large, mid, and small cap indexes have declined 7.47%, 8.71%, and 10.74%, respectively. According to our valuations, at a price to fair value of 0.87, small-cap stocks have become more undervalued, and the large-cap and mid-cap are fairly valued at 0.96 and 0.99, each. Although small-cap stocks have underperformed thus far this year, based on their attractive valuations and our outlook for robust economic growth, we continue to think they will perform well for long-term investors.

Where to Look for New Investments: Trade Up in Quality to Wide-Moat Stocks

In our 2022 U.S. Market Outlook, we highlighted the better relative valuation of companies with wide economic moats compared with those with narrow or no moat at all. Year-to-date, the Morningstar Wide Moat Focused Index has only declined 3.66%.

In addition to the better relative value, we also opined that these stocks will hold up better in an inflationary environment. Wide Moat companies typically will exhibit better pricing power, and have the ability to pass through their own cost increases to their customers. As such, they will be able to maintain margins if inflation remains more persistent than we currently forecast and thus hold their valuations.

Yet, with the downturn in large-cap growth stocks, we note that there is now a rare opportunity to trade up in quality to large cap and growth stocks of companies with wide economic moats. Among small-cap stocks, we note that both narrow and wide-moat categories are attractively valued.

Source: Morningstar.

Data as of Jan. 28, 2022.

Scouring the Sectors--Where to Invest Now

At the end of 2021, there were only two sectors that we viewed as undervalued –energy and communications--and one sector that was fairly valued, financials. The others were different shades of overvalued.

Following the sell-off, communications has become further undervalued and the energy sector is now fairly valued. Through Jan. 28, the Morningstar Energy Index soared 16.96%--the only sector to post a positive return. Taking its place, after being especially hard-hit during January, the consumer cyclicals sector has dropped into the undervalued range. Only real estate, consumer defensive, and utilities remain in overvalued ranges as the rest of the sectors trade near fair value.

Source: Morningstar.

Data as of Jan. 28, 2022.

Basic Materials

The price to fair value for the basic materials sector dropped to 1.03 from 1.13, placing it within the fair value range. We see value for long-term investors in this sector along three main themes.

>First, is in the industrial gas space. Firms such as Air Products & Chemicals benefit from long-term customer agreements with take-or-pay clauses, prices that are indexed to inflation, and energy cost pass-throughs. These traits help to position these companies to weather inflation and energy price volatility.

Second, is in the specialty chemical space. This is a play on both our forecast for robust economic growth and our above consensus projection on the rate of adoption of electric vehicles. EVs require more specialty chemicals in their manufacturing process than internal combustion engines. We think DuPont de Nemours DD is well positioned to take advantage of these trends.

Third, is in the lithium business. We think that investing in lithium is one of the best ways to participate in the long-term, structural shift to electric vehicles.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SACNVSNDS5FTTFAEDRHVHNFB7M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5GAX4GUZGFDARNXQRA7HR2YET4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q34JH4TM3JHGRMOWGT7EPZBE3A.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)