Integrating Sustainable Investing: Assessing Current Portfolios

Morningstar provides many data points for analyzing portfolios.

The following article is part two of a series of excerpts from the Morningstar Research report, "Integrating ESG Into Your Client's Portfolio," available to Morningstar Office and Direct clients here.

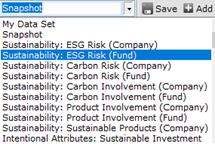

Once the investor’s ESG goals have been established, the next step is assessing the ESG profile of the current portfolio. Morningstar offers a range of ESG data points that can be used both affirmatively, in selecting investments, and analytically, in assessing the current portfolio. One can gain access to many of these data points via the dropdown menu in Morningstar Direct (shown below) and in other Morningstar products:

In this section, we will review the most relevant of these metrics and discuss how they can help determine the investor’s level of ESG exposure. These metrics exist only at the fund level currently, but with some relatively simple calculations advisors can easily apply the data points at the portfolio level.

Forming the Big Picture: Intentional Attributes

A philosophical question advisors should address with clients is whether their definition of ESG funds pertains only to those that intentionally target ESG attributes in their portfolio holdings or also includes funds with unintentionally strong ESG qualities. For the moment, we will make a default assumption that investors prefer intentional ESG funds. The Intentional Attributes set of data points in Morningstar Direct (as well as advisor products such as Advisor Workstation and Office) achieve exactly that, indicating whether a fund pursues ESG goals by design (according to the fund’s prospectus). At the broadest level, there are indicators for whether a fund has any sustainability objectives and whether it has a broad ESG mandate. For many investors, this may be a sufficient line to draw. But further gradations can be made. There are attributes that describe whether a fund has an impact or environmental mandate. Even more granularly, investors can identify specific attributes within the broader mandates, such as renewable energy or community development.

An advisor can use the broad intentional attributes to quickly assess which funds in a portfolio pursue an ESG mandate, what percentage of the portfolio it involves, and in what asset classes those funds land. This can provide a baseline for how much of the portfolio may need to be reallocated during the transition.

Example:

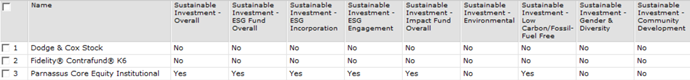

We created a list of three well-known large-cap U.S. stock funds in Morningstar Direct to demonstrate how one can use various sustainability data points: Dodge & Cox Stock DODGX (large value), Parnassus Core Equity PRILX (large blend), and Fidelity Contrafund FLCNX (large growth). Using the Intentional Attributes: Sustainable Investment dropdown, we can see that the Dodge & Cox and Fidelity vehicles do not have intentional mandates, while the Parnassus fund does, as indicated by “Yes” in the Sustainable Investment-Overall column.

Continuing along the column sets informs us that Parnassus Core Equity additionally maintains intentional sustainability objectives in the areas of ESG incorporation, ESG engagement, impact, and low carbon/fossil-fuel free, while other categories remain outside the fund’s stated mandates (which is not to say management ignores those areas entirely but that they are not explicitly part of the investment mandate).

Setting Boundaries: Exclusion Screens

Earlier iterations of socially responsible investing approaches tended to focus on exclusions--eliminating certain types of stocks, such as tobacco- or gambling-related shares--and many ESG funds still use exclusion screens in one form or another. The Intentional Attributes: Employs Exclusions tags identify whether a fund uses exclusionary screens as well as which specific categories, among the most common, are excluded.

Funds using exclusions are typically identified by the broad Intentional Attribute tag, but exclusions can be useful for assessing the portfolios of investors seeking less robust approaches to incorporating ESG data or whose ethical principles direct them toward an exclusionary mindset.

Example:

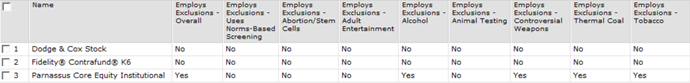

To view the exclusions used by our three funds, we switch to the Intentional Attributes: Employs Exclusions dropdown. As expected, the Dodge & Cox and Fidelity funds show “No” for Employs Exclusions-Overall. Parnassus Core Equity, by contrast, indicates “Yes.” Those exclusions are further specified in additional columns, showing that the fund uses screens to exclude companies involved in tobacco and weapons production, as well as alcohol, gambling, and thermal coal, among other categories.

Assessing ESG Risk: The Morningstar Sustainability Rating

The Morningstar Sustainability Rating (also referred to colloquially as the globe rating, for the signature globe element used in the visual rating icon) provides a different lens into a portfolio’s ESG characteristics, one that applies to both intentional and nonintentional strategies.

The Sustainability Rating rolls up Sustainalytics’ ESG Risk Ratings for individual companies within a fund’s portfolio to create a fund-level snapshot of ESG risks. The individual company ratings assess how well Sustainalytics believes a company is managing its financially material ESG risks relative to industry peers. The Sustainability Rating frames those aggregate ESG risks relative to a fund’s Morningstar Global Category peers, using a 1- to 5-globe scale.

One advantage of the Sustainability Rating is that it covers all funds with a sufficient number of ratable holdings, regardless of whether the fund pursues an intentional ESG mandate. This provides advisors with a lens to assess a current portfolio that has not been designed with ESG in mind. For an investor concerned about exposure to ESG risk but less so about achieving a desired risk profile through intentional strategies, it is a very useful tool.

One limitation of the Sustainability Rating is that it applies primarily to equity funds and some fixed-income funds with significant corporate credit exposure. Most fixed-income funds do not receive a Sustainability Rating. The Sustainability Rating also is less useful for investors who want their investments to have an impact or who are interested in specific ESG themes.

The structure of the globe rating should be familiar to advisors, as it uses the same bell-curve distribution as the traditional Morningstar Rating for funds, aka the star rating. Taking an investor’s portfolio, the advisor can easily view the Sustainability Ratings on a fund-by-fund basis, as well as roll them up to calculate an average or asset-weighted Sustainability Rating for the portfolio or by asset class. A portfolio with a preponderance of funds rated 3-globes or lower is likely ripe for improvement.

Example:

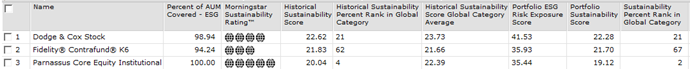

Our set of three mutual funds shows an instructive range of Sustainability Ratings. These data points are available under the Sustainability: ESG Risk (Fund) dropdown in Morningstar Direct and the Sustainability Ratings section of the fund's Portfolio page accessible via Morningstar.com as well as software products such as Morningstar Advisor Workstation and Morningstar Office. (Users can also generate a separate Sustainability Report for individual funds in all of these products.) We see a positive correlation between the intentional mandate of Parnassus Core Equity and its Sustainability Rating, which is 5-globes, the highest rating. Fidelity Contrafund presents a less favorable picture, with a 3-globe rating. Dodge & Cox Stock offers an example that investors may run into frequently: Despite not having an intentional sustainable investment mandate, the fund still earns 4-globes because of the lower relative ESG risk of its holdings. Thus, for investors who want a high-quality fund with strong sustainability characteristics, irrespective of the fund managers’ intentions, Dodge & Cox Stock could make the grade.

This dropdown section includes more-granular data points that can help pinpoint the sources of ESG risk that affect the fund’s globe rating. For instance, looking at the percentage of assets under management with High Controversies, we can see that the Fidelity fund has 18.5% of assets in firms with such risks, while Dodge & Cox drops to 11.7% and the Pax fund sits at only 5.4%.

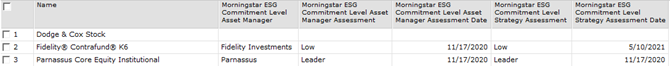

Gauging Commitment: Morningstar ESG Commitment Levels

As noted above, Sustainability Ratings are agnostic about a fund’s ESG intentionality. Morningstar has launched its ESG Commitment Level rating for funds and asset managers to address this. The ESG Commitment Level is a qualitative rating, akin to the Morningstar Analyst Rating for funds. This evaluation expresses our analysts’ assessment of the extent to which funds and asset managers incorporate ESG into their investment processes. The rating scale has four levels: Leader, Advanced, Basic, and Low.

The ESG Commitment Level ratings are being rolled out gradually. As of May 2021, these assessments cover nearly 900 funds and more than 70 asset managers.

The qualitative nature of the ESG Commitment Level rating does not lend itself as easily to quantitative interpretation, but if desired an advisor could convert the text-based ratings to a numerical system to derive a portfolio-level rating. The ESG Commitment Level can illuminate how much of an investor’s portfolio is devoted to funds run by managers highly committed to ESG processes. There can be conflicts between the ESG Commitment Level and the Sustainability Rating; for instance, a fund might have a Low ESG Commitment Level but a favorable globe rating or, conversely (though less common), an Advanced ESG Commitment Level but a less favorable globe rating. Using the ESG Commitment Level in concert with the Sustainability Rating provides an even finer-grained view of a portfolio’s ESG properties.

Example:

ESG Commitment Level data is a new feature available in Morningstar products as of May 2021. Of the three funds used in our sample set, Parnassus Core Equity and Fidelity Contrafund are currently covered under the ESG Commitment Level format. As noted in the graphic below, Parnassus receives Leader status for both the fund and the asset manager, providing investors with additional affirmation from Morningstar’s analysts that the strong underlying sustainability data for the fund are supported by a robust process and resources. Fidelity, by contrast, earns a Low status for both the asset manager and this fund. While Fidelity has established a small team of ESG analysts, their findings are purely informational and nonbinding for fund managers.

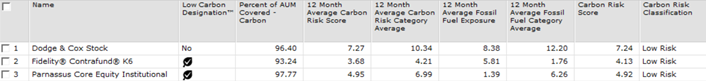

Minimizing Climate Impact: Low Carbon Designation

The Low Carbon Designation is most useful for advisors working with ESG-motivated investors who have a specific interest in minimizing climate impact. Funds that receive the Low Carbon Designation are deemed to have aggregate portfolio holdings with low carbon risk and low exposure to fossil fuels, using underlying Sustainalytics metrics.

The Low Carbon Designation is a binary metric; either a fund receives it or it does not. Thus, it cannot be used to build up to higher-level portfolio analytics, but it can serve as a baseline check of an investor’s portfolio to determine whether the fund's holdings align with the investor’s low-carbon objectives. Like the Sustainability Rating, the Low Carbon Designation applies to all funds with a sufficient number of applicable holdings. Funds may still have relatively low carbon risk even if they do not earn the Low Carbon Designation, which is reserved for a select group. More-detailed data points related to carbon risk and fossil fuel involvement are also available within Morningstar Direct and other advisor software products. Users can also generate a separate Carbon Risk Report on individual funds.

Example:

Turning to the Sustainability: Carbon Risk dropdown in Direct or the Morningstar Carbon Metrics section of the fund's Portfolio page, we learn that Parnassus Core Equity earns a Low Carbon Designation, as would be expected.

Perhaps more surprisingly, Fidelity Contrafund earns the designation while Dodge & Cox Stock does not. Why does the Fidelity strategy receive an inferior globe rating yet still earn a Low Carbon Designation? Much of this can be chalked up to the funds’ investment approaches: Growth strategies tend to hold significant exposures to technology and healthcare companies, which generally have low fossil-fuel impact, while value strategies tend to hold more in sectors such as energy and utilities, which often have exposure to traditional fossil fuel industries. That said, Dodge & Cox Stock still earns a Low Risk Carbon Risk Classification--just not low enough to earn the leaf. (Carbon Risk Classification is shown in the far right column of the above graphic).

Sustainalytics is an environmental, social, and governance and corporate governance research, ratings, and analysis firm. Morningstar acquired Sustainalytics in 2020. Sustainalytics provides ESG scores on companies, which are evaluated within global industry peer groups, and tracks and categorizes ESG-related controversial incidents on companies. Morningstar uses Sustainalytics’ company level ESG analytics to calculate ratings for managed products and indexes using Morningstar’s portfolio holdings database.

/s3.amazonaws.com/arc-authors/morningstar/2e13370a-bbfe-4142-bc61-d08beec5fd8c.jpg)

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/2e13370a-bbfe-4142-bc61-d08beec5fd8c.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)