Putting Infrastructure to Work in Your Portfolio

The pros and cons of infrastructure funds.

Editor's note: A version of this article originally ran November 2020.

Infrastructure often comes up in the context of political discussions. Politicians love to talk about our country’s crumbling infrastructure and the need to invest in it, but they’re frequently shy when it comes to actually ponying up the billions required.

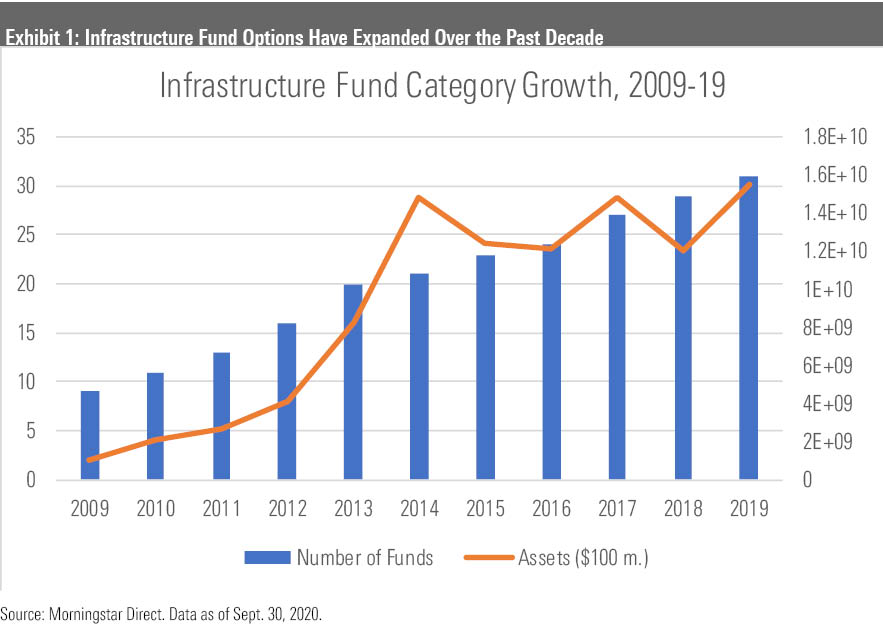

Infrastructure is also a fertile area for investment. Indeed, institutional investors have long included infrastructure as part of their allocations, usually through private funds. Over the past decade, however, the market has opened up to individual investors through growth in listed infrastructure funds, though there are important differences between the two structures, as I’ll discuss further below. Whereas in 2009 there were nine funds amounting to less than $1 billion in assets, by the end of 2019 there were 31 funds approaching $16 billion in assets under management.

First, let’s define our terms. What is infrastructure, from an investment perspective? We can think of infrastructure investments as sharing several key characteristics:

- Important role in a country's social and economic structure

- Long-lived physical assets that require heavy initial capital investments

- Low operating costs with recurring sources of revenue once established

Think of toll roads, airports, transportation systems, and energy distribution as typical infrastructure projects requiring major influx of capital. While governments play a central role in managing and financing infrastructure, lack of funding often leads them to turn to private investors, whether in partnerships or fully privatized arrangements.

The potential investment benefits of infrastructure, relative to other asset classes or sectors, derive from intrinsic properties of the underlying assets, which can include inelastic demand for certain services (such as energy or highway access), monopolistic position in a market (such as an airport), regulated prices, stable revenues, and long duration. Such traits (this isn’t a comprehensive list) in turn lead to some potentially desirable investment characteristics, including:

- Downside resilience

- Stable yields

- Reduced correlations to traditional asset classes

- Favorable risk-adjusted return profile

Notice that I couched my phrasing with the hedge “potentially.” While the benefits of infrastructure make sense from an intuitive and economic perspective, whether they hold up to scrutiny in the real world, particularly in the open-end fund structure, is a question we need to explore.

Private vs. Public Funds Institutional investors typically invest in infrastructure through private funds that can make direct investments in infrastructure projects. The typical retail investor is limited to open-end mutual funds or exchange-traded funds (often labeled "listed infrastructure" vehicles), which must invest in publicly traded infrastructure stocks (an investor could choose to invest in the underlying securities as well). This is a key difference, as private funds, which typically have lockup periods of 10-15 funds, allow their investors to fully benefit from the long-lived nature of infrastructure assets, which contributes to an illiquidity premium as well as volatility-smoothing in their risk profiles. Mutual fund investors, by contrast, are subject to the price variance of stocks, as well as higher potential correlations with equities.

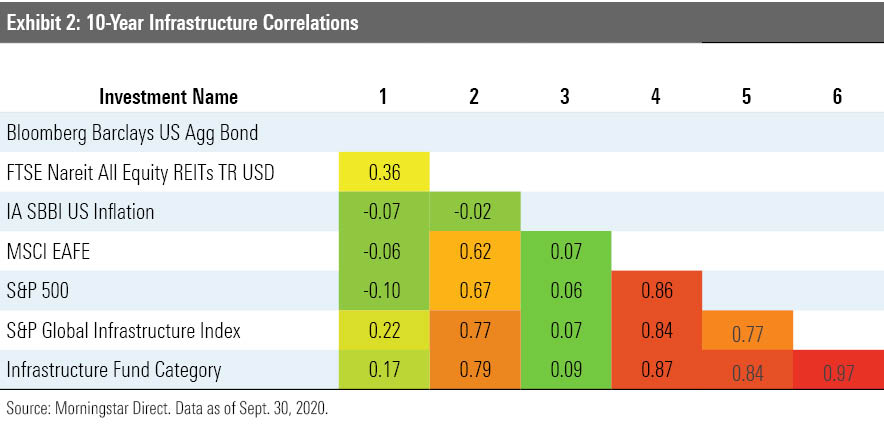

Digging Into the Numbers As anticipated, the supposed advantages of listed-infrastructure investing don't fully hold up in the light of analysis. Let's look first at correlations. I compared the infrastructure Morningstar Category and the S&P Global Infrastructure Index with benchmarks covering a number of asset classes, including the Bloomberg Barclays US Aggregate Bond index, the S&P 500 (a proxy for U.S. large caps), MSCI EAFE (foreign developed stocks), the FTSE NAREIT REIT index (both infrastructure and REITs can be classified under the umbrella of real assets), and an inflation proxy.

The correlation matrix, which covers a 10-year period, indicates relatively high correlations between infrastructure funds and U.S. equities, international equities, and REITs, lessening their case as a diversifier. Meanwhile, the correlation to inflation was very low, demonstrating little value as an inflation hedge. Correlation to bonds was also low, not surprising given the higher equity association.

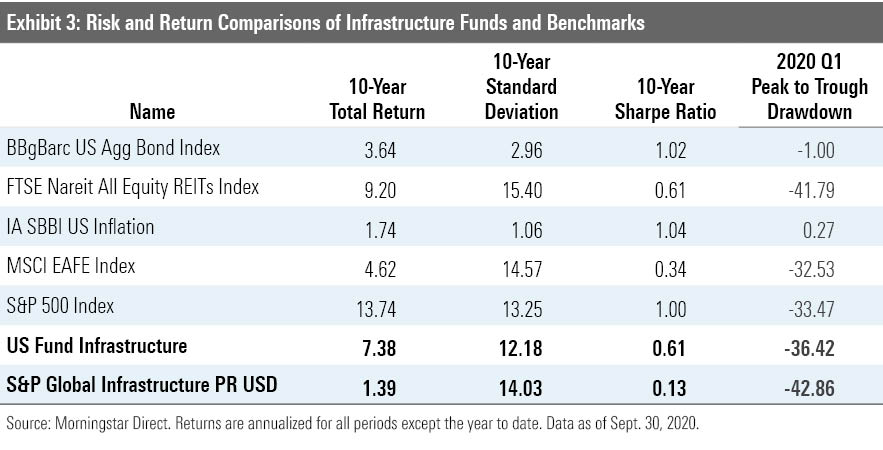

Risk and return data are also equivocal. The 10-year Sharpe ratio for infrastructure funds is on par with that of REITs, but it is generated with a lower-volatility/lower-return profile than its real estate counterpart. That Sharpe ratio is lower than the S&P 500, with lower volatility but significantly lower returns, albeit in the face of a tremendous bull-market run for U.S. stocks. Infrastructure funds, which average about 60% in non-U.S. stocks, did outperform the EAFE index over the period. Downside resilience has not been particularly in evidence. During the early-2020 coronavirus bear market, infrastructure funds did worse than equities. While they held up better during the fourth-quarter 2018 drawdown, during the 2008 bear market, they did no better than the stock market as a whole. (Note, too, that infrastructure appears to be a rare area in which active funds have significantly outperformed a passive benchmark.)

Infrastructure funds do provide a relatively attractive yield given the current interest-rate environment. The 12-month yield for the category, as of the end of February 2021, was 1.91%, slightly lower than that of the intermediate core bond Morningstar Category (2.1%) and ahead of the Vanguard Dividend Appreciation ETF’s VIG 1.65% yield.

One caveat to the above data is that they cover only a discrete period, and an unusual one at that, given an equity bull market, declining interest rates, tame inflation, and rising correlations between asset classes. It’s quite possible that infrastructure funds will have a more favorable investment profile in different market environments. That said, a number of academic studies investigating private infrastructure deals have generally found a superior risk-adjusted return profile over a similar period, so it stands to reason that many of the benefits of investing in unlisted infrastructure deals are lost when translated to public markets. This is not the same as saying that infrastructure funds have no benefit or place in a portfolio.

Concluding Thoughts and Potential Fund Picks Infrastructure mutual funds are perhaps best thought of as thematic types of investment strategies; if you believe that infrastructure represents an interesting and fruitful domain, such funds can provide access. They could occupy a small slice of a real-assets sleeve in a portfolio, alongside REIT and utilities funds, all of which can provide some yield and potential inflation-hedging, along with exposure to asset classes with a basis in the real economy. While infrastructure would likely not contribute excessive risk relative to equities (from which it makes most sense to be funded), at the same time it won't provide much of a diversification benefit, based on the historical data. Investors should also consider how such an investment would affect their foreign/domestic and sector exposures, as infrastructure funds tend to have a heavy international component and load up in the industrials and utilities sectors.

Morningstar analysts recommend two funds, Lazard Global Infrastructure GLIFX and Nuveen Global Infrastructure FGIYX. The Lazard fund, which receives a Morningstar Analyst Rating of Silver, features an experienced management team and a concentrated portfolio of 25-50 holdings. Morningstar senior analyst Patty Oey commends the fund for its “strict, quality-focused, value-based process.” The fund has grown quite large, though Oey still believes the team can execute its process successfully. The Nuveen fund receives an Analyst Rating of Bronze for its cheapest share classes, owing to another experienced manager in Jay Rosenberg along with a solid track record. This fund has a more diversified portfolio, with around 130 holdings, and a more active approach focused on relative-value trades. Oey cautions that “it is not clear this high-turnover approach is adding significant value.” Investors may also want to consider Cohen & Steers Global Infrastructure CSUZX, which receives a Morningstar Quantitative Rating of Gold and is the oldest fund in the category. Cohen & Steers is known for its expertise in real assets strategies, and this fund’s lead manager has been at the helm for 16 years.

/s3.amazonaws.com/arc-authors/morningstar/2e13370a-bbfe-4142-bc61-d08beec5fd8c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/2e13370a-bbfe-4142-bc61-d08beec5fd8c.jpg)