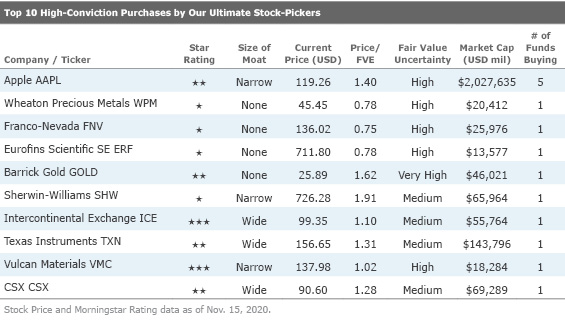

Our Ultimate Stock-Pickers' Top 10 High-Conviction Purchases

Several funds see value in basic materials and industrials.

For roughly the past decade, our primary goal with the Ultimate Stock-Pickers concept has been to uncover investment ideas that reflect the most recent transactions of our Ultimate Stock-Pickers in a timely enough manner for investors to get some value from them. In cross-checking the most current valuation work and opinions of Morningstar’s own cadre of stock analysts against the actions of some of the best equity managers in the business, we hope to uncover a few good ideas each quarter that investors can dig into a bit deeper to see if they warrant an investment. With 19 of our Ultimate Stock-Pickers having reported their holdings for the third quarter of 2020, we now have a good sense of the stocks that piqued their interest during the period.

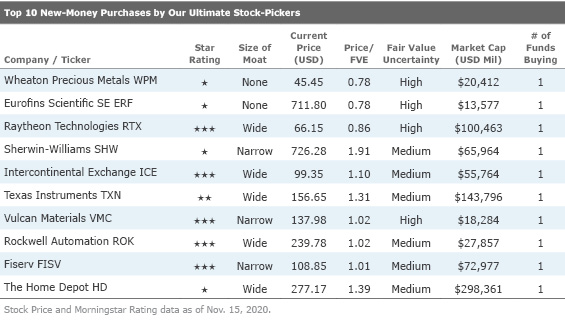

Recall that when we look at the buying activity of our Ultimate Stock-Pickers, we focus on high-conviction purchases and new-money buys. We think of high-conviction purchases as instances when managers have made meaningful additions to their portfolios, as defined by the size of the purchase in relation to the size of the portfolio. We define a new-money buy strictly as an instance where a manager purchases a stock that did not exist in the portfolio in the prior period. New-money buys may be done either with or without conviction, depending on the size of the purchase, and a conviction buy can be a new-money purchase if the holding is new to the portfolio.

We recognize that our Ultimate Stock-Pickers' decisions to purchase shares of any of the securities highlighted in this article could have been made as early as the start of July, so the prices paid by our managers could be substantially different from today’s trading levels. Therefore, we believe it is always important for investors to assess for themselves the current attractiveness of any security mentioned here based on myriad factors, including our valuation estimates and our moat, stewardship, and uncertainty ratings.

The last few months have seen the global economy reeling from the economic headwinds brought on by the COVID-19 pandemic. The market has continued to recover as the pandemic-induced demand slowdowns have moderated. Even so, certain industries remain hard-hit (e.g. tourism, in-person shopping), though governments worldwide continue to take steps to mitigate the economic impact. The U.S. Federal Reserve has maintained the federal-funds rate to 0.00%-0.25%, and the U.S. government has taken many drastic measures since then to cushion the blow on the economy, including stimulus programs for consumers, unemployment benefits, easing pressures on debt markets, and establishing the PPP facility to help small businesses. Similar programs have been implemented across Europe and Asia, as countries seek to boost their economies. Amid all this volatility and uncertainty, our Ultimate Stock-Pickers have managed to find value in certain stocks in a wide range of sectors such as basic materials, healthcare, technology, and industrials.

Looking more closely at the top 10 high-conviction purchases, the buying activity heavily leaned toward the basic materials sector that received five high-conviction purchases this quarter. Industrials and technology sectors followed with two high-conviction purchases each this quarter. Bucking the trend, this quarter only six out of 10 companies in the high-conviction purchases list received a wide or narrow economic moat from Morningstar analysts. The three names we find most interesting on the high-conviction purchases and new-money lists are no-moat rated Barrick Gold GOLD, and wide-moat rated Raytheon Technologies RTX and Texas Instruments TXN. Barrick Gold had one high-conviction purchase. Raytheon had one new-money purchase, and Texas Instruments reported one new-money purchase that was also a high-conviction purchase.

There was a moderate amount of crossover between our two top 10 lists this period, with six names appearing on both lists. This quarter, nine stocks received one high-conviction purchases from our Ultimate Stock-Pickers. Apple AAPL led the pack with five high-conviction purchases from Vanguard Dividend Growth Investor VPMCX, American Funds American Mutual AMRMX, Columbia Dividend Income Fund LBSAX, Parnassus Core Equity Fund PRBLX, and T. Rowe Price Blue Chip Growth Fund TRBCX.

All 10 stocks on the new-money purchases list received one new-money purchase from our Ultimate Stock-Pickers. With six companies appearing on both top 10 lists this period, we saw a trend of funds not only investing money in companies they did not hold previously but also committing substantial capital to these names.

One high-conviction and new money purchase that we found interesting is Alleghany’s Y purchase of no-moat Barrick Gold, one of the world’s largest gold producers. The name currently trades at almost a 62% premium to Morningstar analyst Kristoffer Inton's fair value estimate of $16. The Fed's decision to lower the federal-funds rate to 0%-0.25% significantly lowered the 10-year Treasury yield, reducing the opportunity cost of holding gold. Bullish investor sentiment toward gold (as many see it as a safe bet in these volatile times) has recently led to a historic runup in gold prices, which is one of the main contributors to the higher valuations the stock is currently seeing. However, Inton contends that the current valuations are not sustainable in the long term; the eventual slowing of investment demand and higher recycling supply should drive gold prices lower. The slowdown of investment demand, combined with a shift in jewelry demand and preferences from Chinese and Indian consumers despite rising incomes, will further depress future gold prices.

Inton has assigned Barrick a no-moat rating, as a majority of the firm's mines do not exhibit enough of a cost advantage from a low-cost production perspective. Further, Inton argues that since Barrick spent vast sums of cash on assets during peak prices, the firm is unlikely to generate economic returns above its cost of capital, even if it can reduce its costs. While some of its mines do operate below industry average costs, all-in sustaining costs of $850-$950 per ounce are not enough to grant the company an economic moat.

Our Ultimate Stock-Pickers see some value in the industrials sector with one high-conviction purchase and two new-money purchases within the sector. Wide-moat Raytheon Technologies appeared on the new-money purchases list with Markel MKL making a new-money purchase into the company. The name currently trades at a 16% discount to Morningstar analyst Burkett Huey’s fair value estimate of $77.

Raytheon Technologies is composed of United Technologies' aerospace businesses and legacy Raytheon—powerhouses in the commercial aerospace supply chain and defense prime contracting industries, respectively. The company enjoys a wide moat designation as a result of intangible assets and switching costs, both of which create a stiff barrier to entry for competitors. Huey argues that three out of the four segments of Raytheon Technologies—Pratt & Whitney, Collins Aerospace, and Defense and Missile Systems—deserve a wide moat on a standalone basis and that the remaining segment, Intelligence, Space & Airborne Systems, more closely resembles a narrow-moat business.

Huey believes that Pratt & Whitney, Raytheon’s engine manufacturing business, operates a razor-and-blade business where jet engines are sold at steep discounts to develop as large of an installed base as possible to gain access to high-margin, ultra-sticky servicing revenue. Further, the company’s placement on the A320 and A220 aircraft could materially increase Raytheon's installed base of engines, unlocking the high-margin servicing revenue. Its missile segment produces products that are prioritized by the National Defense Strategy, making the products sticky and leading to consistent growth. Due to increased emphasis on defense spending, Huey expects this segment of Raytheon’s business to also generate economic returns over its cost of capital.

Raytheon’s relatively even balance between commercial aerospace and defense prime contracting offers it two different exposures, partially insulating the firm from sharp economic downturns in either segment. Naturally, efforts by Boeing BA and Airbus EADSY to compress margins by renegotiating prices with Raytheon in the commercial aerospace segment could lead to economic headwinds for Raytheon down the line. However, Huey contends that the firm’s scale allows Raytheon technologies significant negotiating leverage on pricing with Boeing and Airbus.

Our Ultimate Stock-Pickers also invested in wide-moat Texas Instruments, with Amana AMANX making a new-money, high-conviction purchase into the company. Texas Instruments is currently trading at a 32% premium to Morningstar analyst Brian Collelo’s fair value estimate of $120.

Texas Instruments is the world's largest analog chipmaker and a key supplier of embedded chips into a wide range of applications. Texas Instruments has a leading share of the fragmented, yet lucrative, analog chip market. Analog chips are used to convert real-world signals, such as sound and temperature, into digital signals that can be processed. Collelo asserts that the firm’s intangible assets around proprietary analog chip design and manufacturing expertise, as well as switching costs that make it difficult to swap out analog chips for competing offerings once they are designed into a given electronic device, will also allow the company to generate economic returns in excess of its cost of capital, meriting its wide moat classification.

Collelo argues that the size and scale of Texas Instruments’ salesforce and engineers allow it to broaden its customer base, increasing share in the analog chip market. This increased revenue is then used to fund the salesforce that only a handful of chip manufacturers can match. The company’s salesforce allows it to generate additional revenue and fund future sales team expansion, creating a virtuous cycle for the firm. It remains unlikely that any other chipmaker would be able to compete, in the near future, with Texas Instruments’ massive sales team.

Texas Instruments has allocated capital very efficiently in recent times. Its shrewd purchases of manufacturing equipment, at pennies on the dollar, have allowed the firm to remain cash-heavy and return that cash to shareholders. While the company leveraged these purchases to expand gross margins, this “easy” expansion is over. Looking forward, Collelo sees the “Internet of Things” as an intriguing economic tailwind for Texas Instruments, as the firm’s chips could see increased demand from new electronic devices with improved connectivity and processing power.

Malik Ahmed Khan and Eric Compton have no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar’s Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)