What Would Happen to ESG Proposals If Vanguard, BlackRock and State Street Didn’t Vote?

There’s much stronger shareholder support for ESG resolutions than headline figures suggest.

Our September review of U.S. shareholder resolutions addressing environmental, social, and governance themes highlighted a sharp increase in the number of resolutions this year, along with a reduction in shareholder support for them, led by the largest firms.

Among the Big Three index managers, BlackRock and Vanguard blamed a perceived decline in the quality of proposals for the fall in support. However, given these firms’ weight in the market, it can be difficult to separate cause from effect when assessing these trends.

Our latest research paper attempts to do just that.

ESG Proposals Jumped in 2023 Proxy-Voting Season

When it came to environmental and social shareholder resolutions, trends among U.S. large-cap companies were similar to those for the wider market including mid-caps and small caps. The large-cap companies also contain most of the high-profile proposals—we covered several of these at Amazon.com AMZN, Alphabet GOOGL, Meta META and Starbucks SBUX during the proxy season.

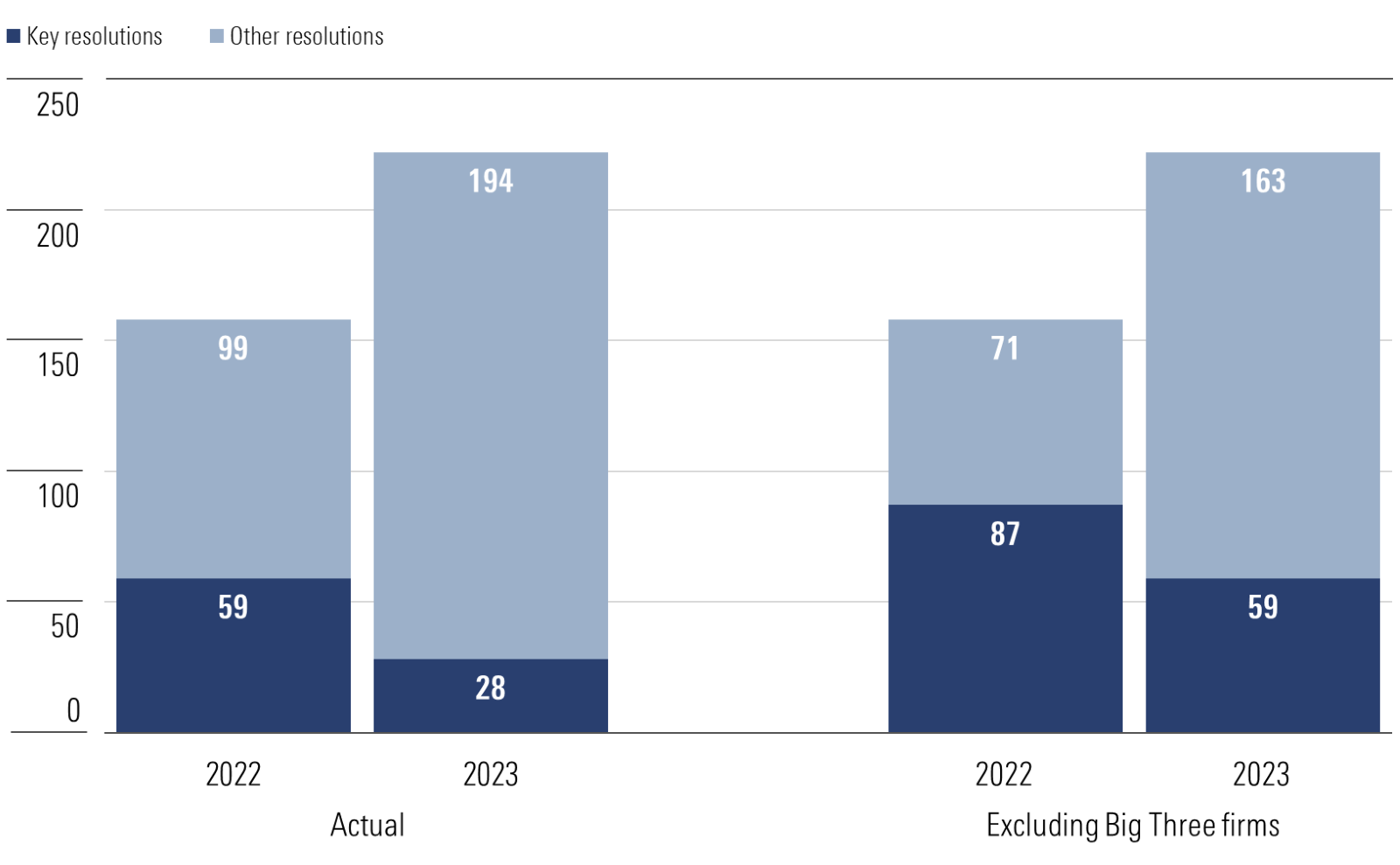

So, for this study, we looked at 380 E&S resolutions filed at S&P 100 index constituents in the last two proxy years. (A proxy year is the 12 months to the end of June.) There were 158 proposals in the 2022 proxy year and 222 in 2023—the wider market showed a similar percentage increase in the volume of E&S proposals over the last two years.

We then assessed how many resolutions in the large-cap market became key resolutions. Key resolutions receive at least 40% adjusted support, which includes only votes by a company’s independent shareholders, in two scenarios:

- The actual result, including all independent shareholders’ votes.

- A scenario excluding the Big Three firms’ votes.

Although many have questioned the voting power of the large index fund managers over the years, that is not the focus of this exercise. But analyzing voting trends excluding the Big Three is an effective way of quantifying the effect of their voting power and assessing if voting trends in the rest of the market differ meaningfully. At a time when the Big Three are beginning to offer a wider range of proxy-voting options to their clients, understanding those differences is becoming more important.

Scenario Analysis: Number of E&S Shareholder Resolutions, U.S. Large-Cap Companies

1. There Would Have Been Many More Key Resolutions if the Big Three Didn’t Vote

We found that there’s an important group of ESG shareholder proposals that we’ve called “near misses.” Near-miss resolutions are those that didn’t quite hit the 40% adjusted support threshold to become key resolutions but did gain the support of more than 30% of independent shareholders.

Our analysis showed that among the near-miss resolutions, support by the Big Three is considerably lower than that of other independent shareholders in the U.S. market. Indeed, if the Big Three didn’t vote their shares, around 30 near-miss resolutions at U.S. large caps in each of the last two years would actually have been key resolutions.

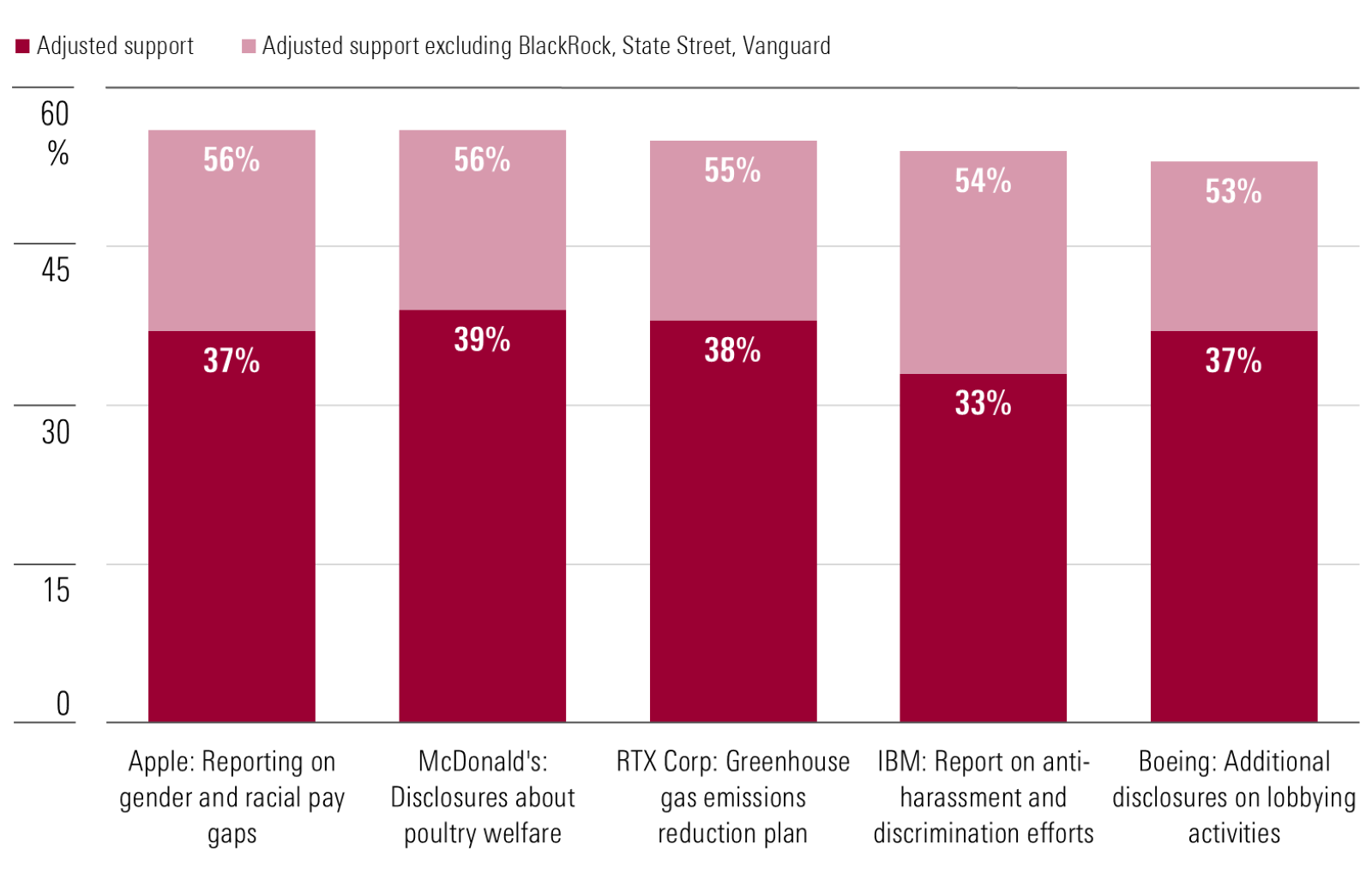

Several of these resolutions achieved majority support among independent shareholders. We found nine such resolutions in each of the last two years among the U.S. large caps. Five of these resolutions from the 2023 proxy year are shown on the chart below.

Five Near-Miss Resolutions With Highest Support Outside the Big Three

All five proposals gained the support of just over one third of independent shareholders. BlackRock, State Street, and Vanguard all voted “Against” these proposals and altogether controlled between 30% and 40% of the independent shareholder votes at each company. This means that the majority of shareholders outside the Big Three supported these five resolutions.

Following the general trend for E&S resolutions, the majority of these five request additional disclosures on social and ethical themes. Only one is climate related: a proposal at RTX RTX (formerly Raytheon) requesting a transition plan for reducing greenhouse gas emissions.

Also reflecting wider trends, some proposals are appearing on the proxy card for the second year in a row, such as the requests for gender and racial pay gap reporting at Apple AAPL and lobbying activities at Boeing BA. BlackRock rejected these resolutions, as well as proposals addressing antiharassment and discrimination efforts at IBM IBM and animal welfare at McDonald’s MCD. The firm considered most of them to be covered by existing policies and management actions at each company, but it considered the proposal at McDonald’s to be “either not clearly defined, too prescriptive, not in the purview of shareholders, or unduly constraining on the company.” (Vanguard and State Street have not publicly communicated their rationales for voting “Against” these proposals.)

2. Confirmed: Shareholder Resolution Quality Deteriorated in 2023

This also means that complaints about the lower average quality of resolutions in 2023 compared with previous years have a solid basis in the evidence. The chart above shows that during the 2023 proxy year, there were 194 ESG resolutions at large-cap companies that didn’t reach the key-resolution threshold that we use as a means for ensuring a consistent level of resolution quality from year to year.

That number falls to 163 if we exclude the Big Three’s votes. But, either way, the number of resolutions the market perceives as lower quality has roughly doubled between 2022 and 2023. That’s well over 150 such resolutions among the large caps alone this year in either scenario.

Whether you include the effects of the largest voters or not, there has undeniably been a large increase in the number of resolutions receiving lower levels of shareholder support.

Important Lessons for ESG Investing

It’s fair to say that the Big Three’s voting policies for 2023 did not change radically compared with 2022. However, voting policies are written to include an element of flexibility to accommodate current market realities. It’s clear that changes in the composition and specific wording of this year’s resolutions, as well as managers’ interpretation of ongoing management actions to respond to previous resolutions, have prompted changes in voting outcomes among the largest managers.

The key message here is: If social and environmental priorities are a core element in how you choose the fund you invest in, it’s important to keep an eye on actual voting outcomes as well as managers’ voting policies.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)