Are There Too Many ESG Shareholder Proposals?

BlackRock, Vanguard lamented ‘poor quality’ or even ‘redundant’ shareholder proposals. Here’s what our proxy-season analysis found.

During the latest proxy season, investors voted on many more environmental, social, and governance-focused resolutions at U.S. companies’ shareholder meetings.

Yet, these higher volumes of resolutions haven’t resulted in increased support from asset managers. In fact, our latest research on proxy voting shows the opposite is true.

These developments are important, as proxy voting is one of few areas where we can deduce clear signals on sustainability intentions. They can show the extent to which asset managers are acting in line with their declared sustainability objectives. Let’s examine exactly what’s going on.

ESG Shareholder Resolutions: Higher Volumes, Lower Support

What’s driven the volume of shareholder resolutions higher this year? Aside from the rising interest in businesses’ environmental and social impacts, there’s also a bit of a tailwind from regulation. Twice in the last two years, the SEC has rolled back restrictions on the topics that shareholders can add to a company’s annual meeting agenda.

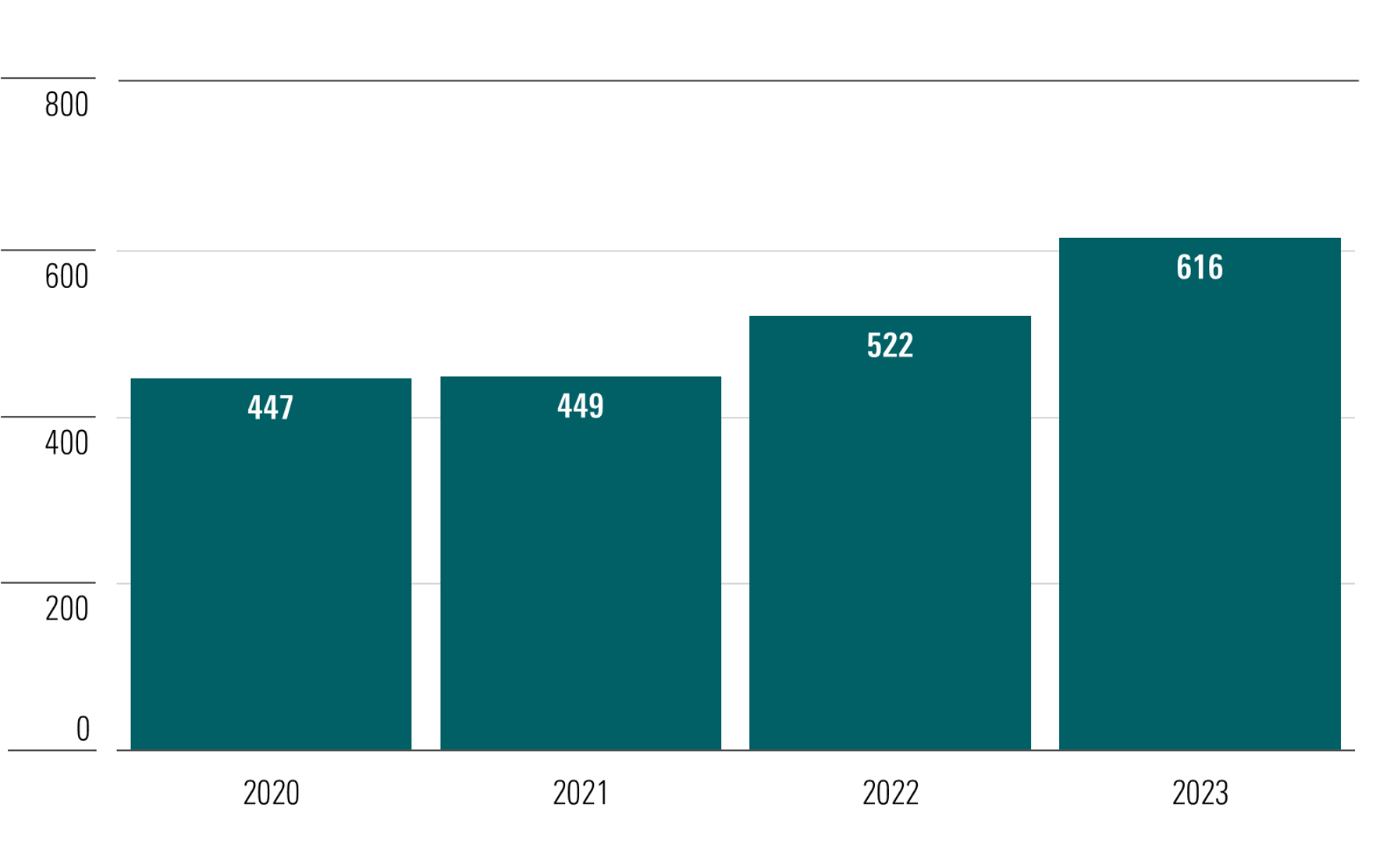

The SEC’s decisions have triggered sharp increases in the number of shareholder resolutions voted on at U.S. companies in the 2022 and 2023 proxy years. (A proxy year covers the 12 months to June 30.) This year, the number of shareholder resolutions stands 37% higher than in 2021, as the chart below shows.

Number of ESG Shareholder Resolutions

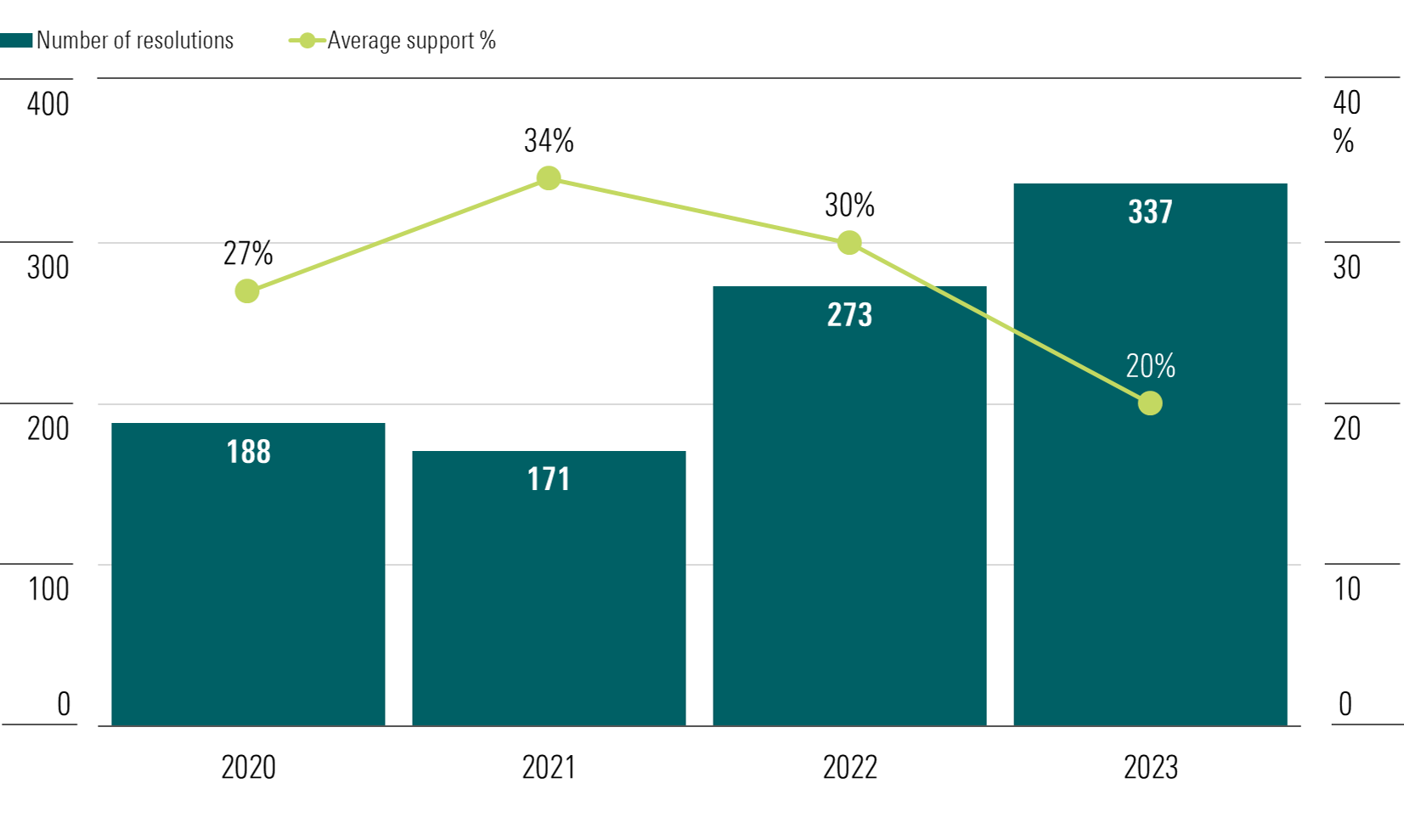

The 2022 proxy year marked the first year that the majority of shareholder resolutions addressed environmental and social issues, such as climate change and workers’ rights, rather than traditional governance themes like shareholder rights. This trend continued in 2023. The 337 E&S resolutions in the 2023 proxy year represented 54% of the total, compared with 52% in 2022, as shown on the chart below.

E&S Shareholder Resolutions: Volume and Average Support

Are Shareholder Proposals Too Prescriptive?

Amid the higher volumes of E&S shareholder proposals in the last two proxy years, there has been an increase in the number of resolutions that asset managers identify as overly prescriptive. Among others, the two largest U.S. managers, BlackRock and Vanguard, have highlighted this trend for the last couple of years.

The increased share of these resolutions in 2023 compared with previous years has prompted a dramatic fall in shareholder support levels. Average shareholder support dropped a full 10 percentage points from 30% in the 2022 proxy year to 20% in 2023, a level not seen since 2017.

BlackRock pulled no punches on this in its recently published 2023 Voting Spotlight, lamenting “the poor quality of many shareholder proposals.” The firm noted that “because so many proposals were overreaching, lacking economic merit, or simply redundant, they were unlikely to help promote long-term shareholder value and received less support from shareholders, including BlackRock, than in years past.” The firm supported only 7% of E&S shareholder resolutions in the 2023 proxy year—well down from 22% last year.

Vanguard also recently announced a drop in its support for E&S shareholder resolutions. The firm backed only 2% of E&S shareholder resolutions in the 2023 proxy year, down from 10% in the 2022 proxy year, according to Morningstar estimates. Admittedly, Vanguard has never been a prolific supporter of these kinds of proposals, but an 80% annual drop in the proportion of E&S resolutions the firm supported is still very striking.

Additional Insights From Analyzing Key Resolutions

Both BlackRock and Vanguard insist that their approach to analyzing shareholder resolutions has not changed since last year, but that the nature of the resolutions coming to vote are different. Is this right?

Analyzing key resolutions can help us assess what’s really going on. We define key resolutions as the subset of E&S shareholder resolutions that are supported by at least 40% of the relevant companies’ independent shareholders. (That is, excluding company insiders such as founders, directors, executives, and strategic investors with large equity stakes, all of whom are unlikely to support shareholder resolutions.)

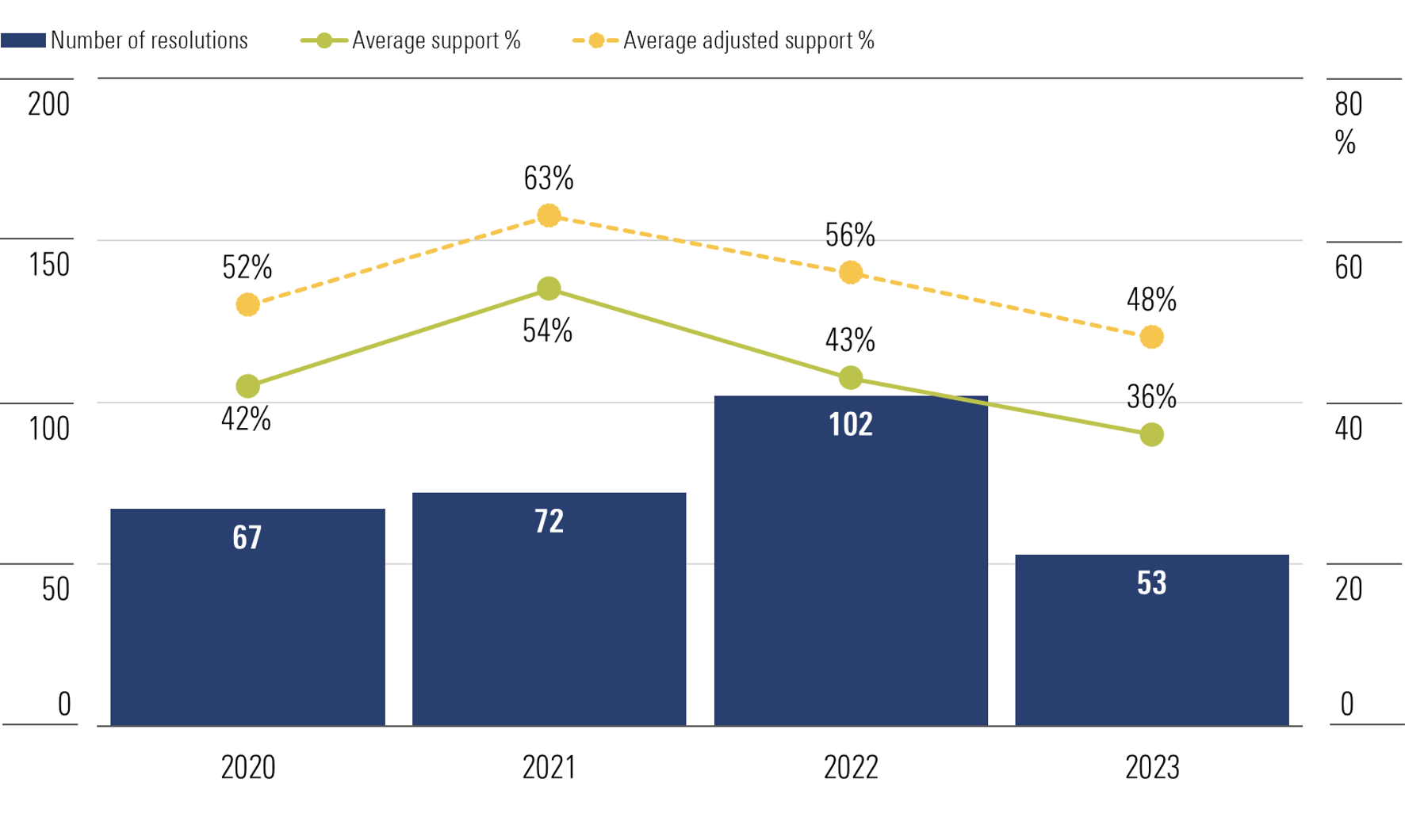

The chart below shows the number of key resolutions at U.S. companies over the last four proxy years and the average level of support for them. Adjusted support excludes votes cast by insider shareholders, which explains why it is consistently higher over the period.

Key Shareholder Resolutions: Volume and Average Support

We can see that average support for key resolutions fell at only half the rate of E&S resolutions more broadly. Also, on average, almost half (48%) of independent shareholders supported key resolutions in the 2023 proxy year—down from previous years but still representing a very substantial cohort of investors.

But the volume of resolutions this proxy year shows a striking trend. In 2023, the number of key resolutions almost halved to just 53. This comes after the number of key proposals increased by 42% in the 2022 proxy year to hit a peak of 102.

Note that the decline in 2023 comes despite an increase in the overall number of E&S resolutions. To put it another way, prior to this year, the proportion of E&S resolutions that gain enough support from asset managers to become key resolutions held steady at around 35% to 40%. As a rule, when the population of E&S resolutions increased, the population of key resolutions also increased broadly in proportion.

Number of E&S Shareholder Resolutions

That trend ended in 2023, as the graphic above shows. This year, only 16% of E&S resolutions gained enough support to become key resolutions—less than half the rate of the three previous years.

This result does indicate that BlackRock’s and Vanguard’s statements on the perceived lower quality of resolutions is shared by the wider market to some extent. However, we should also highlight that there’s an element of circularity to this conclusion, because the two firms control such a large proportion of votes themselves. This trend certainly needs further analysis, and we will publish more detailed research on it later in the year.

BlackRock, Vanguard Support Drops. State Street, Not So Much.

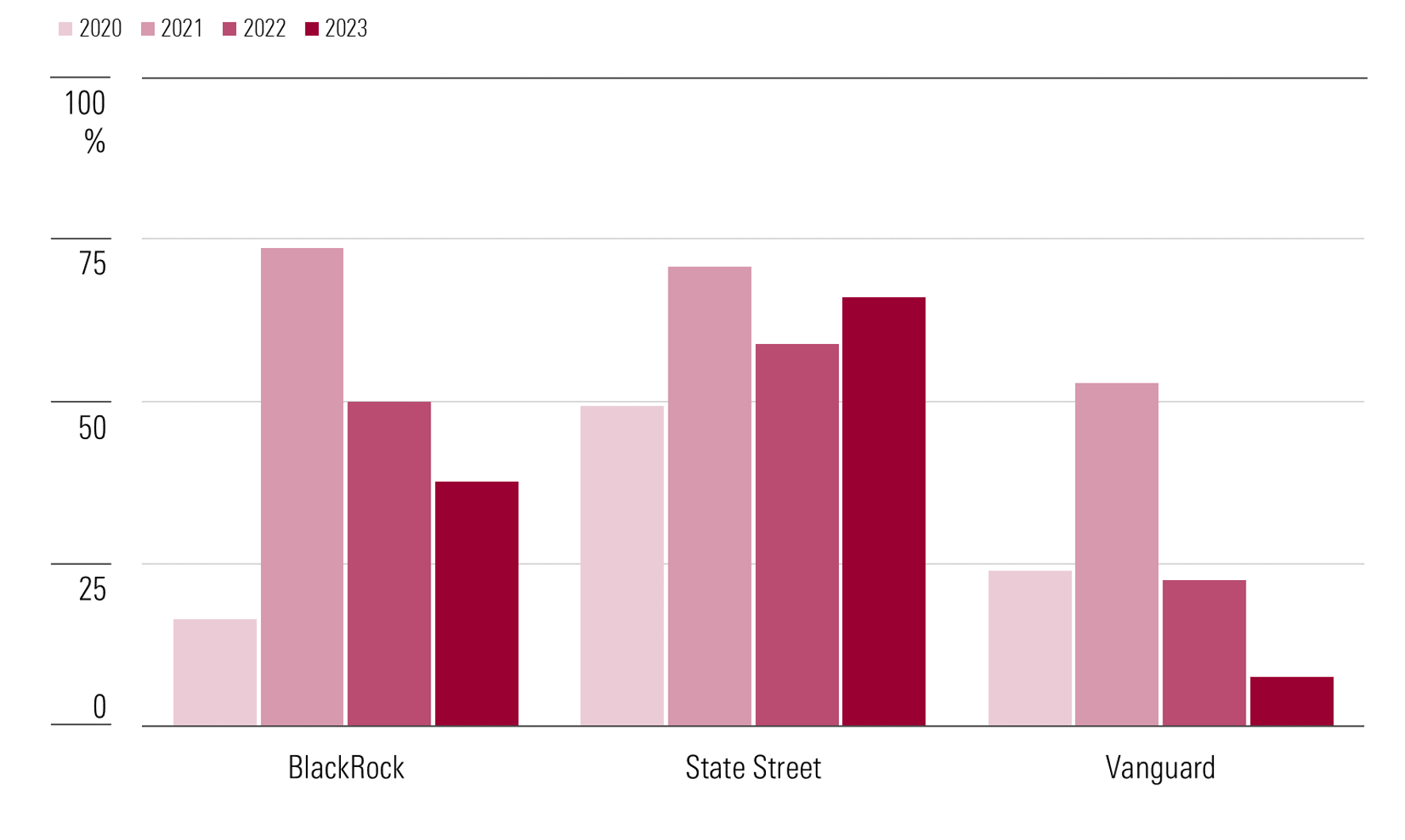

That said, we do see evidence that BlackRock’s and Vanguard’s opinions on what constitutes a supportable environmental or social resolution have diverged from those of the wider market. This is illustrated by the chart below, which shows the percentage of key resolutions supported by the Big Three index managers in the last four proxy years.

BlackRock, State Street, and Vanguard: Percentage of Key Resolutions Supported

We see a sharp reduction in the percentage of key resolutions supported by both BlackRock and Vanguard in 2023 versus the previous year—just like their support for all E&S resolutions. Why is that important?

Definitions of the “quality” of resolutions vary, of course. But we think it is fair to conclude that the market considers key resolutions to have all reached the same minimum standard of quality. This is because they are all supported by a majority, or a near majority, of independent shareholders. The number of key resolutions may vary greatly from year to year, but the minimum quality standard varies much less, in our opinion.

So, we can conclude that a dramatic year-on-year reduction in support for that subset of key resolutions by a particular manager indicates a widening gap in the judgment being applied by that manager relative to the rest of the market. This appears to be the case for BlackRock and Vanguard.

Interestingly, State Street’s voting record for key resolutions shows a more stable trend in percentage support, with an increase in support in 2023. This suggests that, compared with BlackRock and Vanguard, State Street’s perception of the “quality” of E&S resolutions has remained closer to the wider market’s this year. (State Street has not yet commented publicly on its voting record for the 2023 proxy season.)

Of course, the market extends well beyond the Big Three. Other firms and institutions, in the United States and abroad, have a considerable influence on these voting outcomes. As we did last year, we’ll be analyzing the largest asset managers’ proxy-voting records on key resolutions to assess how their voting patterns may have changed in the last 12 months. Stay tuned for that.

In the meantime, our latest landscape report covering over 100 asset managers worldwide provides a useful guide to which managers are prioritizing ESG in their investment process and to what extent. If you’re an investor with an interest in achieving sustainability outcomes as well as financial ones, our research can help you find the manager that best fits your own objectives.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)