Ahead of COP28, More Climate-Related Shareholder Proposals, Less Support

Climate lobbying is in the spotlight. Berkshire Hathaway draws fire.

The world’s political and business leaders will soon gather in Dubai for the COP28 climate conference, and the stakes are high. A “global stocktake” of climate progress will confirm that the world is way off track when it comes to meeting its goal of limiting global temperature rise to 1.5 degrees Celsius.

All this means we’re a long way from the heady optimism of COP26 two years ago when finance was expected to lead the transition to a decarbonized economy. Now, with the financials sector having extensively deliberated the shape and span of new climate and sustainability regulations, the limits of the actions it can take have become much clearer. Asset managers, banks, and insurers are looking now to governments and regulators to set a clear policy framework within which the financials sector can direct capital toward the transition.

Unsurprisingly, this shift has affected how asset managers are evaluating climate-related resolutions at company shareholder meetings. Here’s a quick stocktake of our own covering what’s changed and what it means for investors. Among other things, we’re seeing a wider array of climate-related resolutions, shareholder demands that go beyond climate disclosure, and increased scrutiny of Berkshire Hathaway BRK.B.

More Shareholder Resolutions, Lower Support in the U.S.

In our recent review of the 2023 proxy season, we saw a steep rise in the number of shareholder resolutions at U.S. companies addressing environmental and social themes. We also saw a drop in average shareholder support for these proposals, as the topics being addressed became more specific over time and split opinion among asset managers over their materiality and impact.

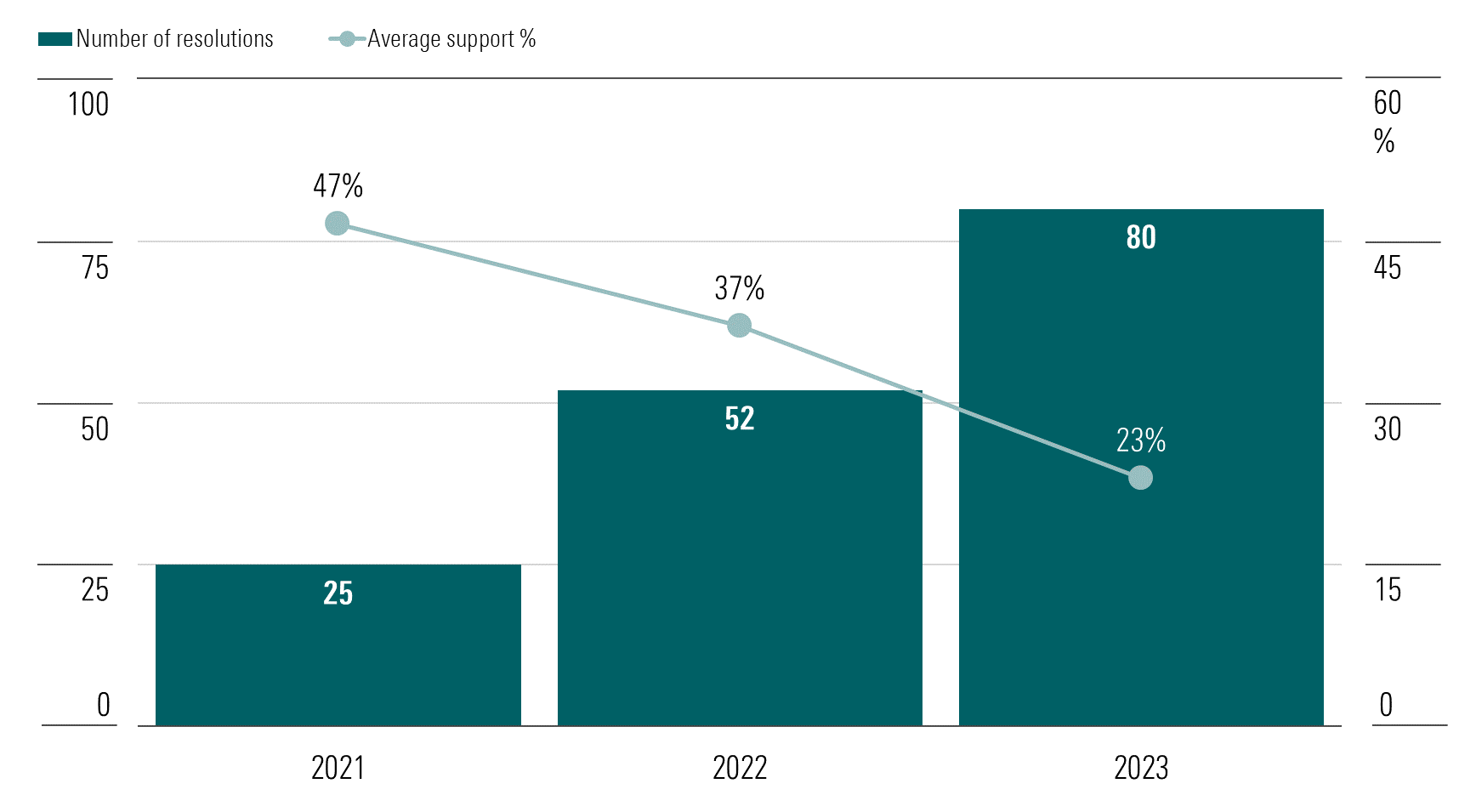

Voting results for climate-related resolutions reflected this overall trend. The volume of climate-related resolutions globally has grown, and recently, investors have been applying greater scrutiny to companies’ climate strategies. Much of the activity in this area has focused on the U.S. market, where most such resolutions are filed. According to Morningstar data, the number of proposals at U.S. companies addressing climate matters has more than tripled from 25 in the 2021 proxy year to 80 in 2023. (A proxy year is the 12 months to June 30.)

Climate-Related Shareholder Resolutions at U.S. Companies, Volume and Average Support, 2021 to 2023 Proxy Years

Over the same period, support for these resolutions halved from 47% in the 2021 proxy year to 23% in 2023.

What happened?

Back in 2021, most of the shareholder proposals addressed what we would now consider the basics of climate reporting, in the absence of any regulation requiring such disclosures. Two years on, such regulation is beginning to come into effect, which—in the minds of many asset managers—reduces the need for shareholder proposals addressing those matters.

As a result, shareholder support for the growing number of proposals in this area has fallen. In particular, the decline in support for environmental and social resolutions from the two largest asset managers, Vanguard and BlackRock, has had a strong impact on the overall average.

Broader Topics, Differing Opinions

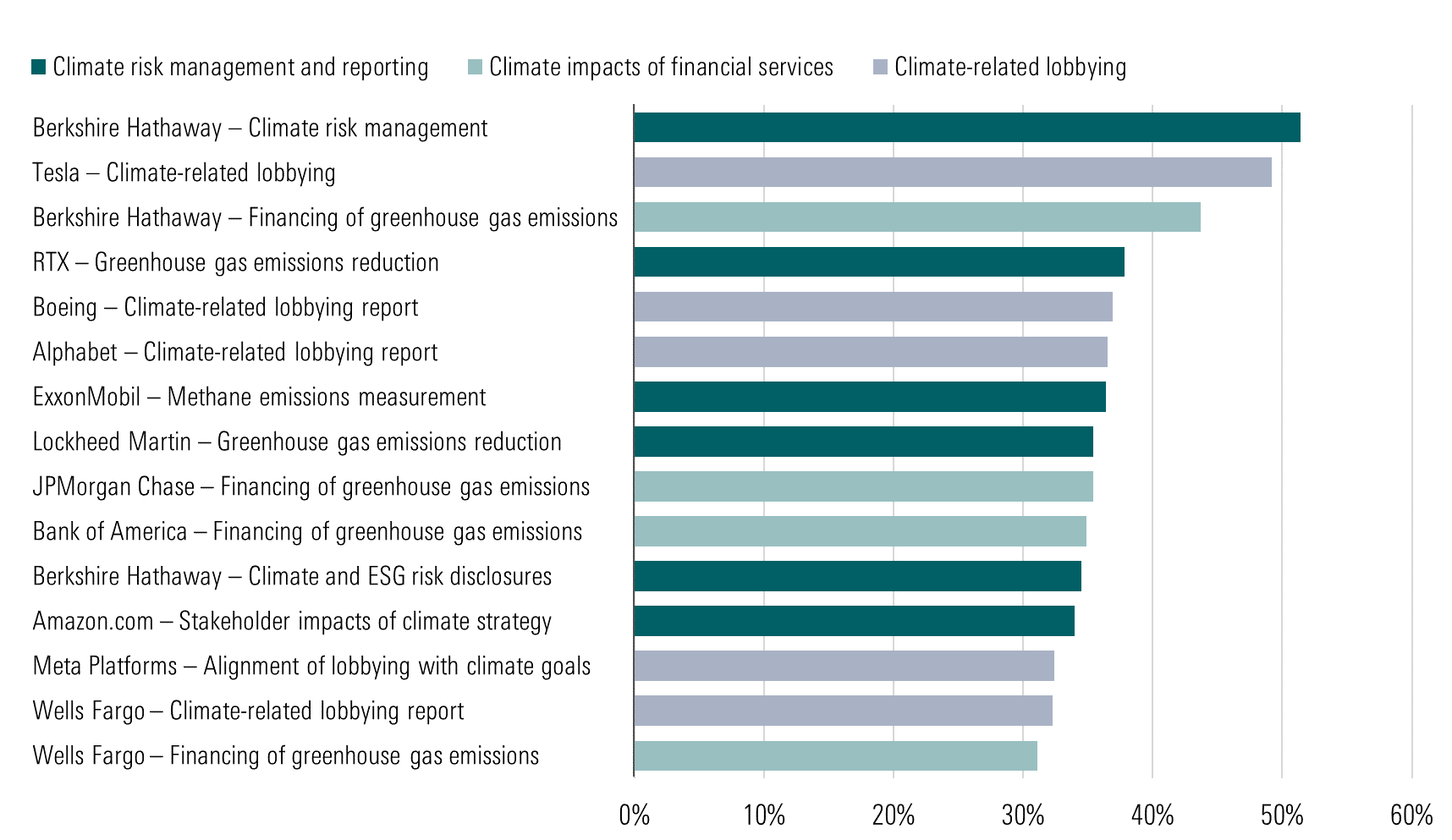

The conversation on climate between asset managers and companies has broadened to cover more than just greenhouse gas emissions and general climate risk management. To illustrate, the chart below shows the 15 best-supported shareholder proposals on climate at U.S. large-cap companies, ranked by adjusted support. (That is, support by shareholders independent of the companies in question, which excludes management, founders, and strategic investors.)

Adjusted Support for 15 Well-Backed Climate-Related Shareholder Resolutions at U.S. Large-Cap Companies, 2023 Proxy Year

Nine of the 15 resolutions addressed topics outside the conventional climate risk management theme. For example, there were resolutions addressing climate-related lobbying and political activity at Boeing BA, Alphabet GOOG, Tesla TSLA, Meta Platforms META, and Wells Fargo WFC. Another five resolutions at financial-services companies, including Bank of America BAC and JPMorgan Chase JPM, proposed phased reductions in financing and underwriting linked to greenhouse-gas-intensive activities. Asset managers’ opinions on these broader matters have tended to differ more, and this has contributed to falling average support.

Six of the 15 resolutions addressed more common climate risk management and reporting issues. But even among these six resolutions, more niche subjects like methane emissions (at Exxon Mobil XOM) and stakeholder impacts of climate strategy (at Amazon.com AMZN) were addressed.

Berkshire Hathaway in the Spotlight

Berkshire Hathaway features three times in the list of resolutions above and appears to be gaining a reputation among asset managers as a laggard in addressing climate risk.

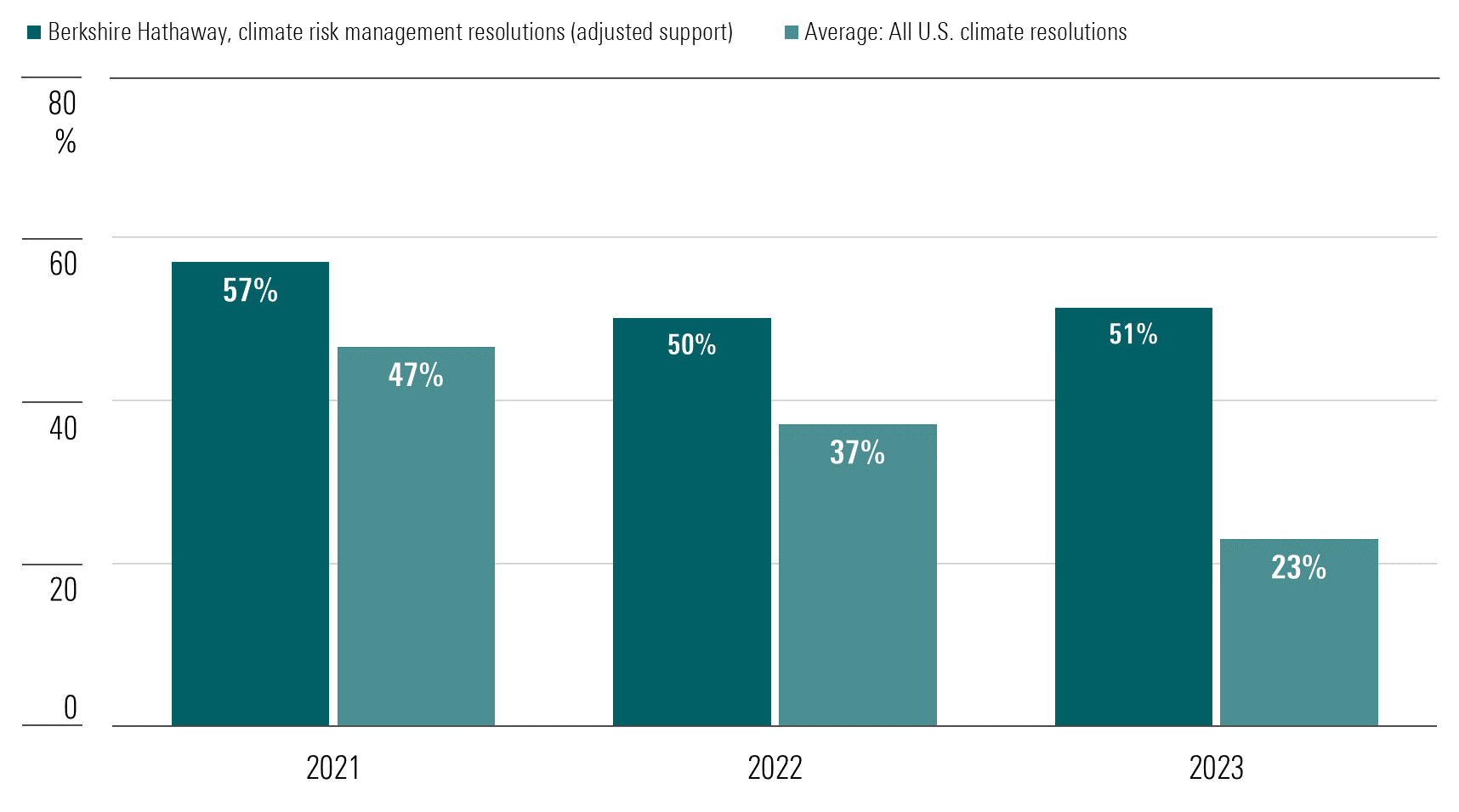

The best-supported proposal on the list has been filed at Berkshire Hathaway for the past three years running, addressing general climate risk management. BlackRock notes that “the company does not meet our aspirations for disclosing a plan for how their business model will be compatible with a low-carbon economy.” Vanguard, not known for being a strong supporter of these resolutions, determined that “the proposal addressed material risk(s), a gap in oversight or disclosure, and supported long-term investment returns.”

Adjusted Support for Climate Risk Management Resolutions at Berkshire Hathaway, 2021 to 2023 Proxy Years

While average support for climate resolutions has fallen in that time, a steady majority of independent shareholders have supported this proposal year after year, as the chart above shows.

The key message here is that even at a time of greater fragmentation in asset managers’ views on climate action, perceived failures to implement basic risk management and governance are still widely acted upon.

Say-on-Climate Votes: Lower Volumes, Rising Scrutiny

In Europe, although there have also been some notable shareholder proposals, particularly at large-cap energy companies, management resolutions allowing shareholders to cast advisory votes on companies’ climate transition strategies have become commonplace.

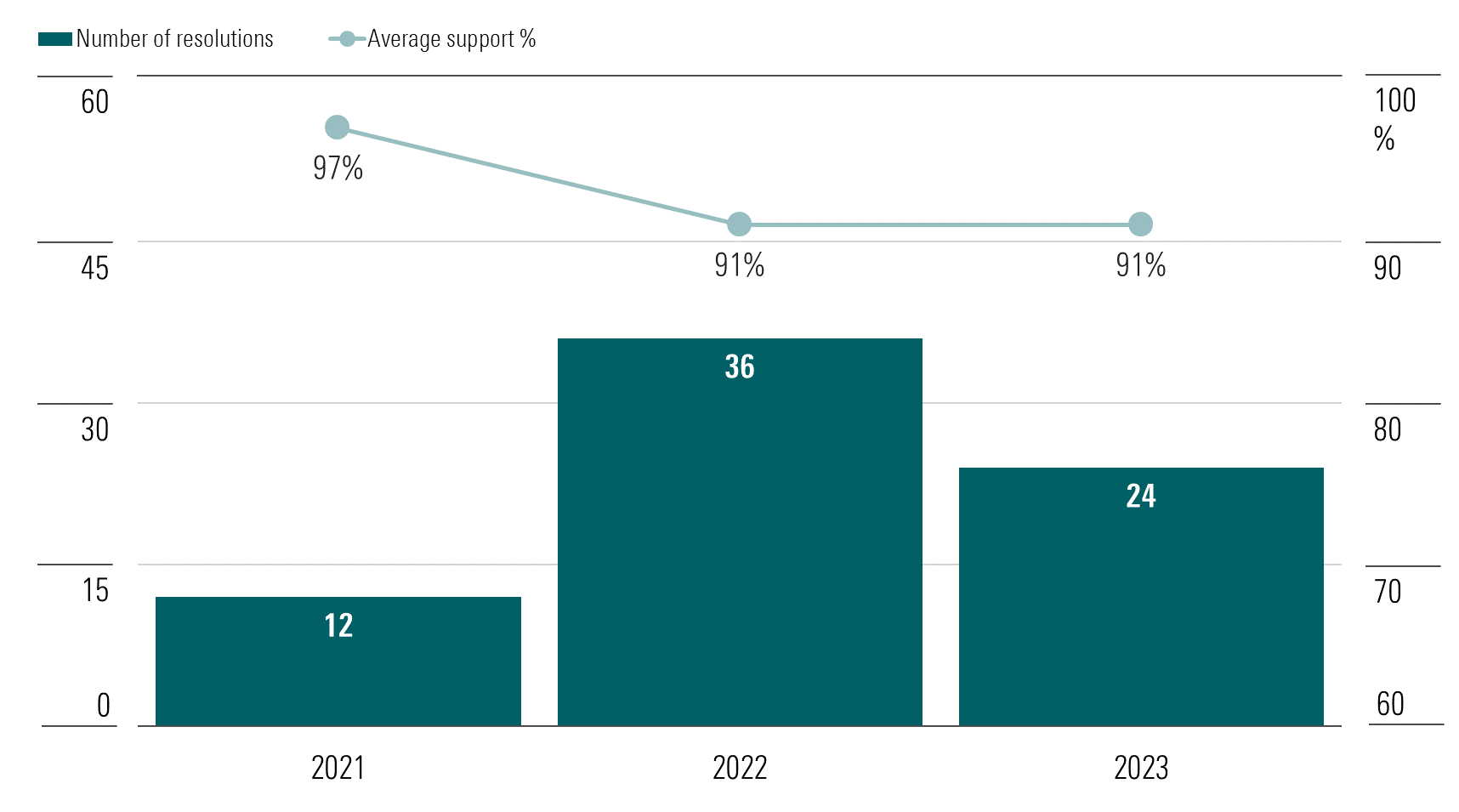

The number of these say-on-climate proposals fell by a third to 24 in the 2023 proxy year. As the chart below shows, average support for these proposals held steady at 91%, indicating that 9% of voting shareholders on average wished to signal to companies a desire for greater ambition in their climate plans. This is triple the 3% seen in 2021, when say-on-climate votes started to gain momentum, indicating rising scrutiny from asset managers over the quality of companies’ transition plans.

Say-on-Climate Management Resolutions at European Companies, Volume and Support, 2021 to 2023 Proxy Years

Similar to our observations on U.S. shareholder proposals, there appears to be one repeat offender when it comes to say-on-climate proposals in Europe.

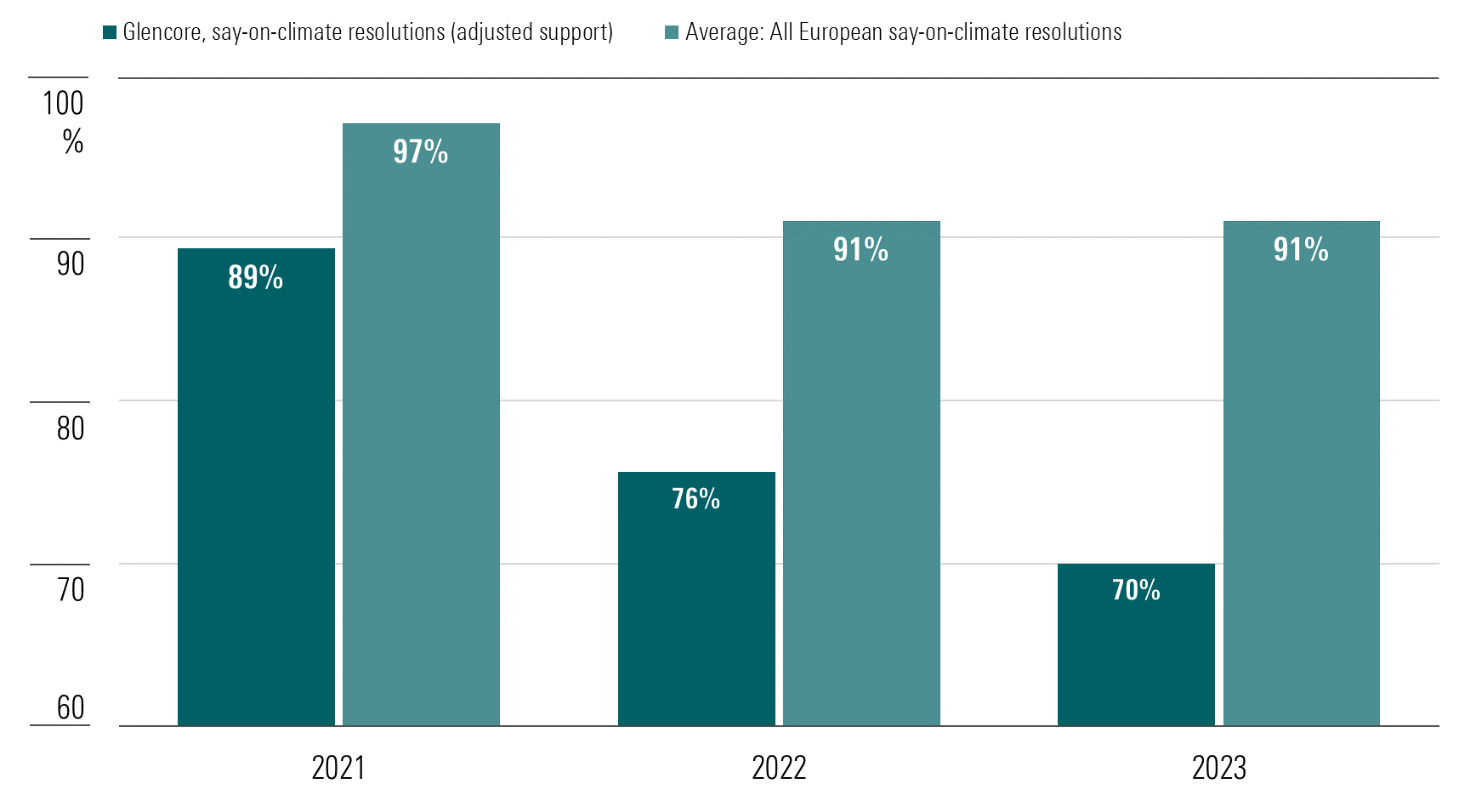

As the chart below shows, mining and metals giant Glencore GLEN has filed say-on-climate votes in each of the past three proxy years, receiving lower support from shareholders each time and culminating in a 30% vote against the company’s climate transition plan in 2023. At the same time, 29% of shareholders backed a shareholder proposal at Glencore requesting greater ambition on climate.

Support for Say-on-Climate Resolutions at Glencore, 2021 to 2023 Proxy Years

The issue revolves around the company’s significant thermal coal assets. Coal is a particularly carbon-intensive fuel, and many investors are keen to see accelerated plans to phase out its use for energy supply. Glencore has proposed a slower phaseout than many shareholders see as ideal, prompting claims that the company’s plan is not compatible with the 1.5-degree climate objective.

As with Berkshire Hathaway, the message from shareholders is clear. Even though opinions may vary on how companies should implement certain aspects of the transition to net zero, there remains a firm expectation that companies should by now have a firm handle on the basics of climate risk management and governance. Any additional clarity we get from COP28 on the speed and policy backing for the transition to net zero will only bolster those expectations from investors.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)