What We Learned From Meta’s and Alphabet’s 2023 Shareholder Meetings

Shareholders lose patience with tech giants on governance.

The annual shareholder meetings for Amazon.com AMZN, Meta Platforms META, and Alphabet GOOG arrived toward the end of the U.S. proxy season. Yet investors in Big Tech remained energetic in protesting directors, executive pay, multiple share classes, and social risk in a swath of resolutions. From these annual meetings, we can gain important insights into what asset managers are thinking about the societal risks and ethical challenges thrown up by advances in technology. We cover this in more depth later.

On Governance, Shareholders Have Issues With Big Tech

Investors expressed considerable dissatisfaction with corporate governance at Amazon at the company’s May 2023 shareholder meeting. Amazon’s independent shareholders voted against what they perceived as high executive pay that was misaligned with company performance. They also voted against the reelection of the directors they hold responsible for insufficient oversight of the matter.

Those issues are not unique to Amazon among the Big Tech companies. Investors cast even larger protest votes at Alphabet, which owns Google, and at Meta, which owns Facebook.

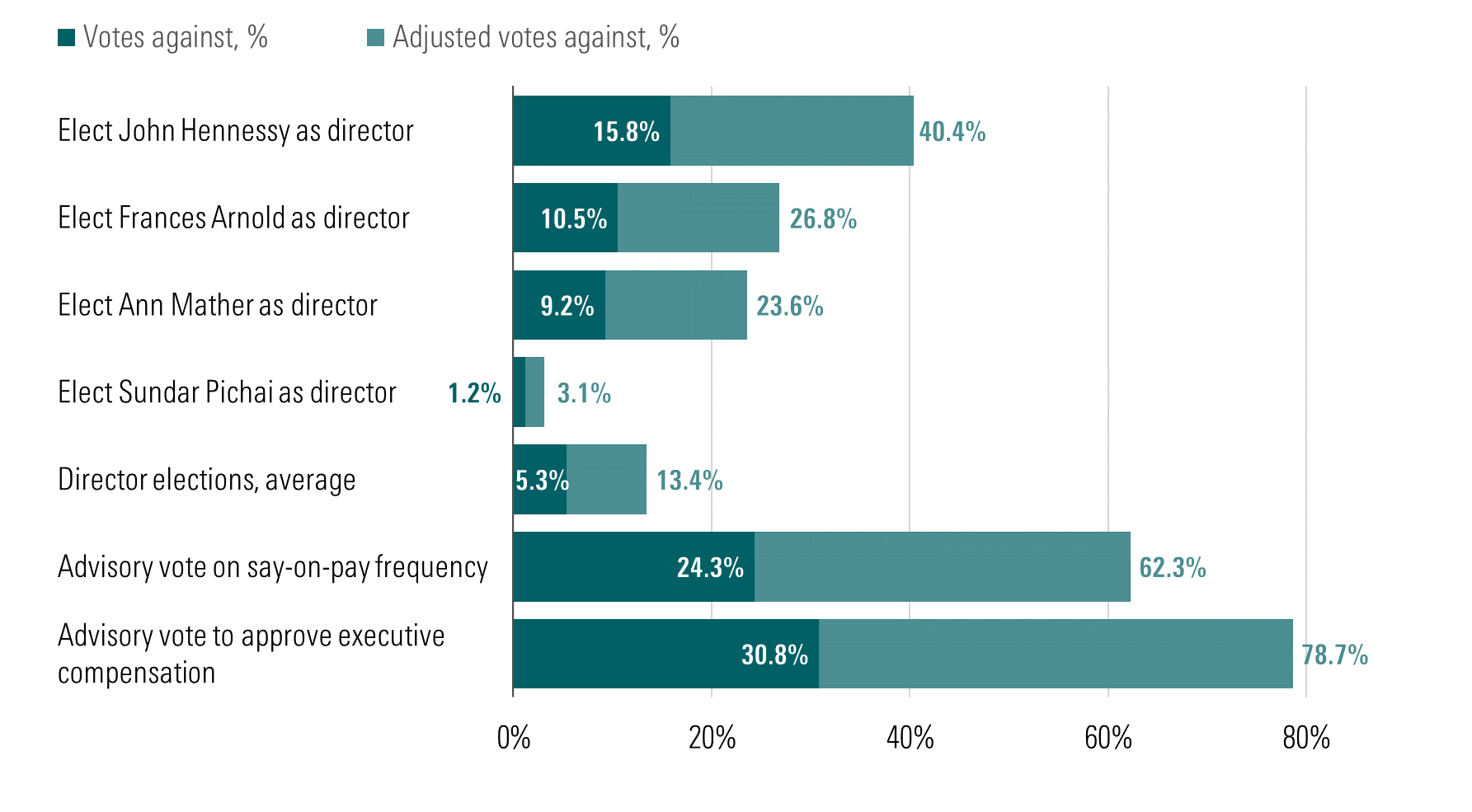

Alphabet 2023 Shareholder Meeting: Votes Against Director Elections and Executive Compensation

The average of votes against director elections by Alphabet’s independent shareholders was over 13% at the June 2 meeting. (These votes exclude those of founders Sergey Brin and Larry Page, shown as “adjusted votes against” on the chart above).

Alphabet chair John Hennessy bore the brunt of shareholder dissatisfaction, with over 40% of independent shareholders voting against his reelection. The reelections of Ann Mather and Frances Arnold were also opposed by around a fourth of Alphabet’s independent shareholders.

Why the opposition? A few asset managers that have reported their voting rationales focused on two key issues. (We reviewed disclosures by Abrdn, AllianceBernstein, Allianz Global Investors, Columbia Threadneedle, Legal & General, and Schroders.)

- Shareholders believe these directors have served on the Alphabet board too long to remain independent.

- The gender balance of the Alphabet board is perceived to be insufficient, prompting some managers to vote against Hennessy. (Three of the 11 directors are women.)

There were also robust votes against executive pay at the company (opposed by almost 80% of independent shareholders) and against management’s preferred option to hold a “say-on-pay” vote every three years (over 60%). Most asset managers prefer that such a vote be held annually.

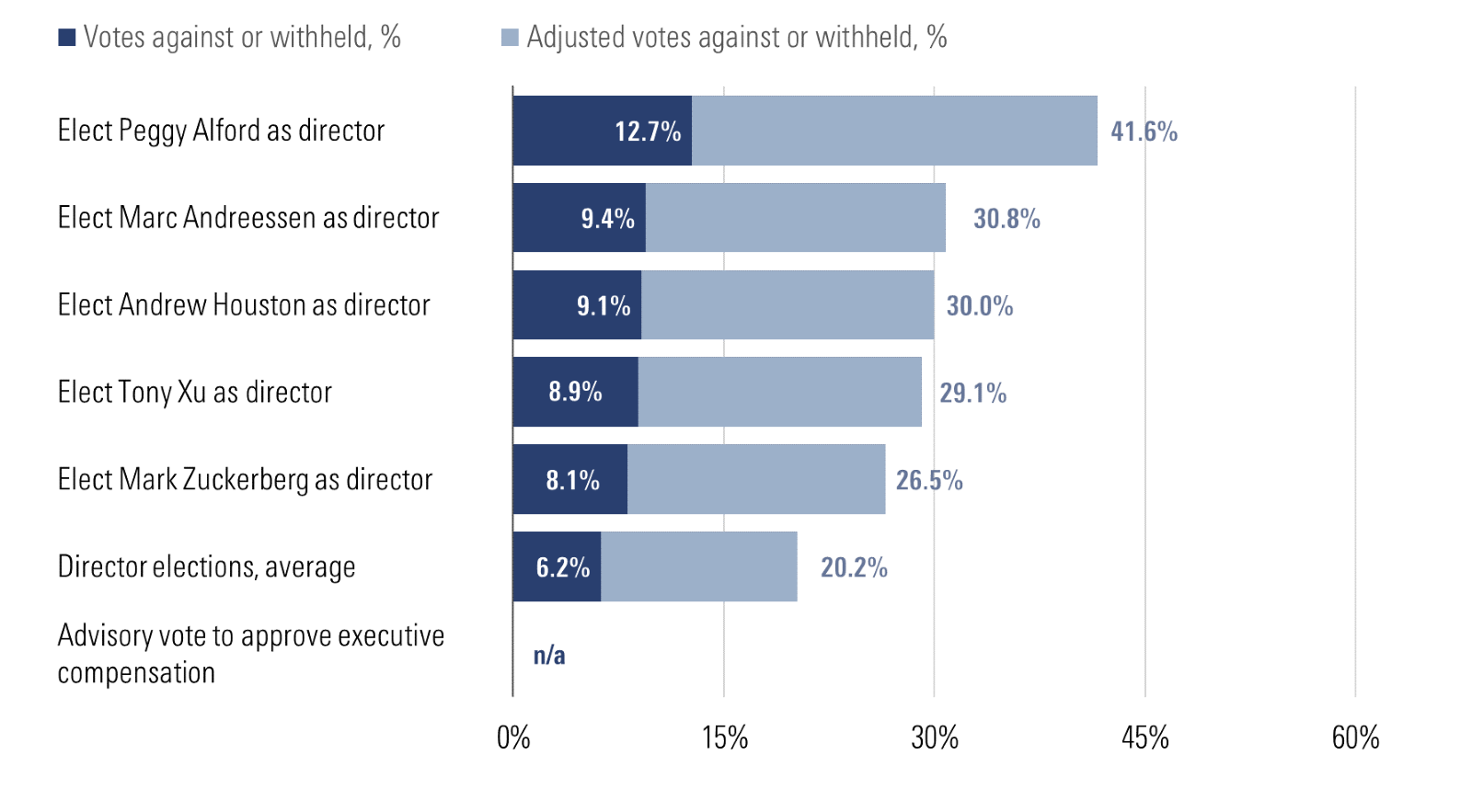

Meta Platforms 2023 Shareholder Meeting: Votes Against Director Elections

Dissent against directors was even higher at Meta, at over 20%. Peggy Alford, chair of the company’s compensation, nominating, and governance committee, received the lowest support on the Meta board. Over two fifths of the company’s independent shareholders (that is, those not named Mark Zuckerberg) voted against her reelection. The reelections of three other directors on the committee were opposed by around three fifths of Meta’s independent shareholders.

Similar to Alphabet, shareholders have concerns with the size and structure of the executive pay packets at Meta and are holding the committee members accountable. Also, the company’s decision not to hold a say-on-pay vote this year certainly didn’t help to ease shareholders’ consternation.

Chair and CEO Zuckerberg’s reelection to the board was also opposed by over a fourth of Meta’s independent shareholders. This is noteworthy because most asset managers vote against the election of named executive officers only in extreme circumstances.

One other issue unites shareholders in opposition to director elections at both Meta and Alphabet: multiple-class share structures.

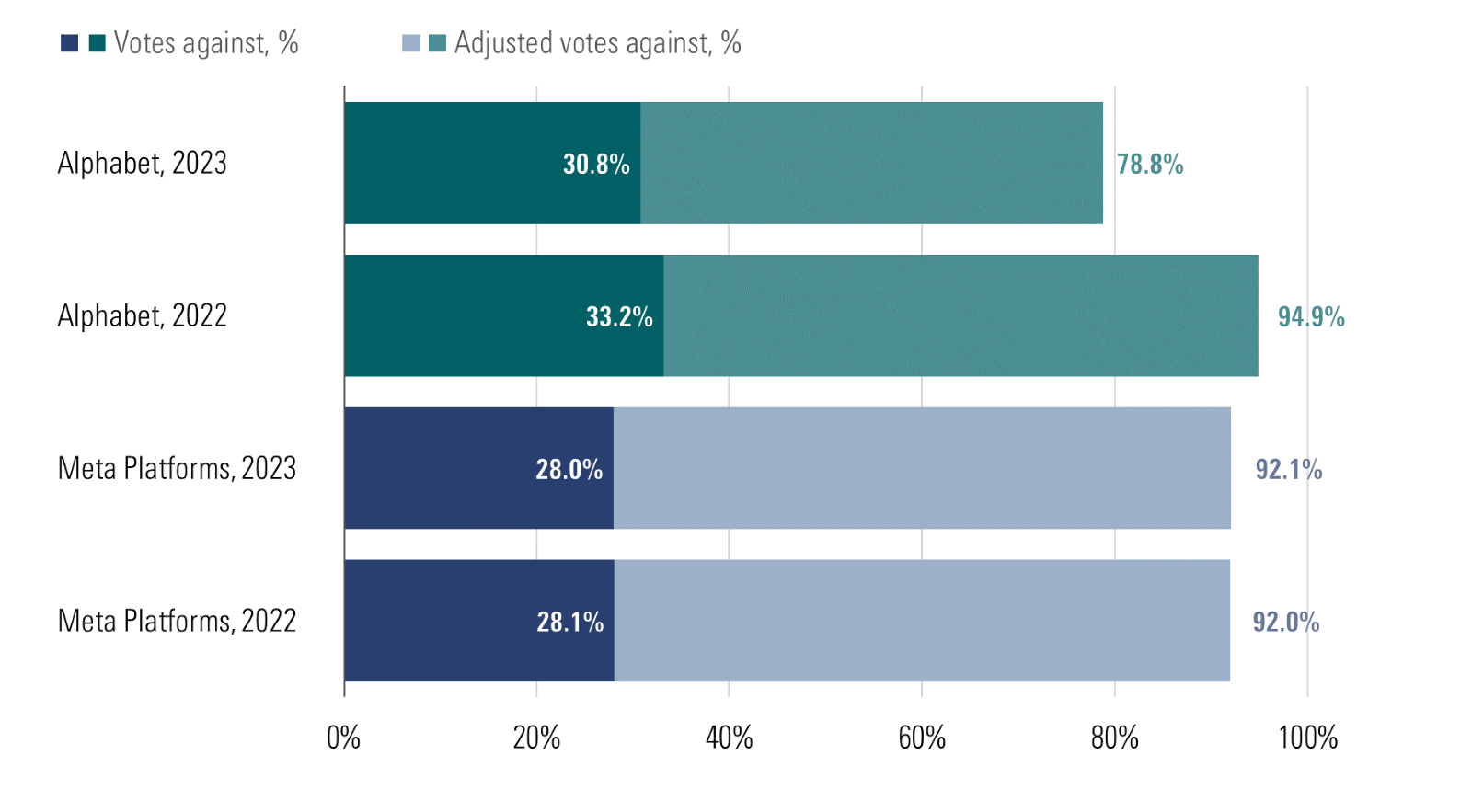

On ‘One Share, One Vote,’ Shareholders Speak With One Voice

At Meta, Class B shares owned by CEO Zuckerberg allow him to control the company while owning only 14% of its equity. Alphabet has three classes of shares, one of which has no voting rights at all. Founders Page and Brin control the company with Class B shares representing just 6% of the company’s equity each.

Few environmental, social, and governance topics command a clear consensus among shareholders. But one is opposition to multiple-class share structures. As the chart below shows, shareholder resolutions in consecutive years at both Alphabet and Meta demanding a switch to a “one share, one vote” structure were supported by a large majority of independent shareholders every time.

Alphabet and Meta: Support for Resolutions Proposing 'One Share, One Vote'

The two companies’ founders show no sign of relinquishing control of the businesses, so the battle over share structure is looking like a stalemate for the time being. There’s a strong chance we’ll see the same resolutions in 2024 with similar results.

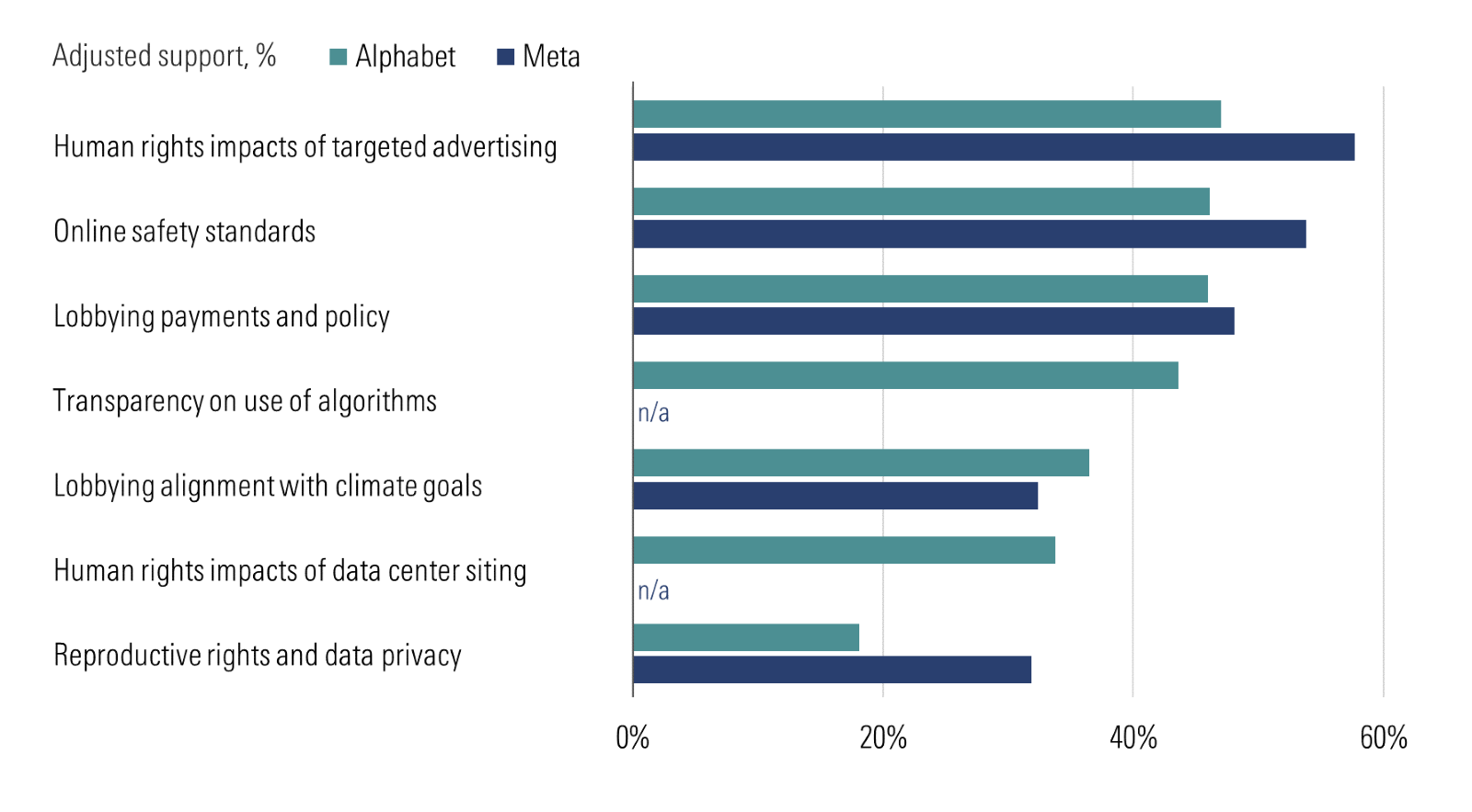

Shareholder Resolutions Focus on Societal Impacts

Similar to Amazon, the lists of shareholder resolutions at Alphabet and Meta this year were in double digits. The chart below shows a selection of the better-supported resolutions on the companies’ proxy cards. The resolutions illustrate that shareholders in Big Tech companies are increasingly focused on the societal impact of their practices.

Alphabet and Meta: Well-Supported Shareholder Resolutions Share Common Themes in 2023

Seven shareholder resolutions across the two companies were supported by more than 40% of independent shareholders. (We call these key resolutions.) These resolutions were related to social risk.

- Human rights. Shareholders filed proposals at both companies requesting reporting on the human rights impacts of targeted advertising. The resolution at Alphabet gained 47% adjusted support; the proposal at Meta gained 58% adjusted support. Also, over one third of Alphabet’s independent shareholders backed a resolution requesting reporting on the human rights impacts of data center siting. The proposal focused on certain countries with limited freedom of expression. (There were no similar proposals at Meta.)

- Online safety. Two proposals, one at each company, addressed online safety standards. At Alphabet, 46% of independent shareholders supported a resolution requesting a report on how YouTube’s policies align with online safety regulations. Meanwhile, at Meta, 54% of independent shareholders backed a call for reporting on child safety impacts and reduction of harm to children.

- Lobbying. Proposals at both companies requesting reporting on lobbying payments and policies were backed by over 45% of independent shareholders. This has been a common and well-supported theme for at least the past four proxy years.

- Gender and racial discrimination. A proposal requesting greater transparency on the use of algorithms at Alphabet, with a focus on preventing gender-based and racial discrimination, gained adjusted support of over 40%.

Rationales supporting these votes indicate that risks around privacy and human rights are front-of-mind for many asset managers, which are concerned about the risk of potential penalties for regulatory violations as well as broader societal acceptance of Big Tech companies’ practices.

Such concerns were also raised regarding the proposal at both Alphabet and Meta for greater transparency on how the companies protect individuals’ sensitive data in the context of increasing restrictions on access to abortions in some U.S. states. The resolution at Meta was supported by 32% of independent shareholders, compared with 18% at Alphabet. Three of the six asset managers we reviewed believed that Meta “could be doing more to protect consumers’ data privacy” in this matter.

What Does This Mean for Investors?

There’s been a lot of emphasis on the polarization of views in the United States around some ESG topics, such as climate change or diversity, equity, and inclusion. However, votes on several resolutions at Big Tech companies illustrate that on governance and topics of high societal impact, there’s plenty that investors can agree on, too.

Either way, as investors it’s always worth finding out more about a manager’s thinking on key ESG topics by using the disclosures they are increasingly willing to make public. Even managers with similar investment styles often don’t take the same stance on ESG issues. It’s becoming all the more important to assess voting decisions to ensure that your manager’s position on key ESG topics aligns with your own.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)