U.S. Sustainable Funds See Outflows for the First Time in Five Years

Sustainable bond funds shine a light in an otherwise dim quarter.

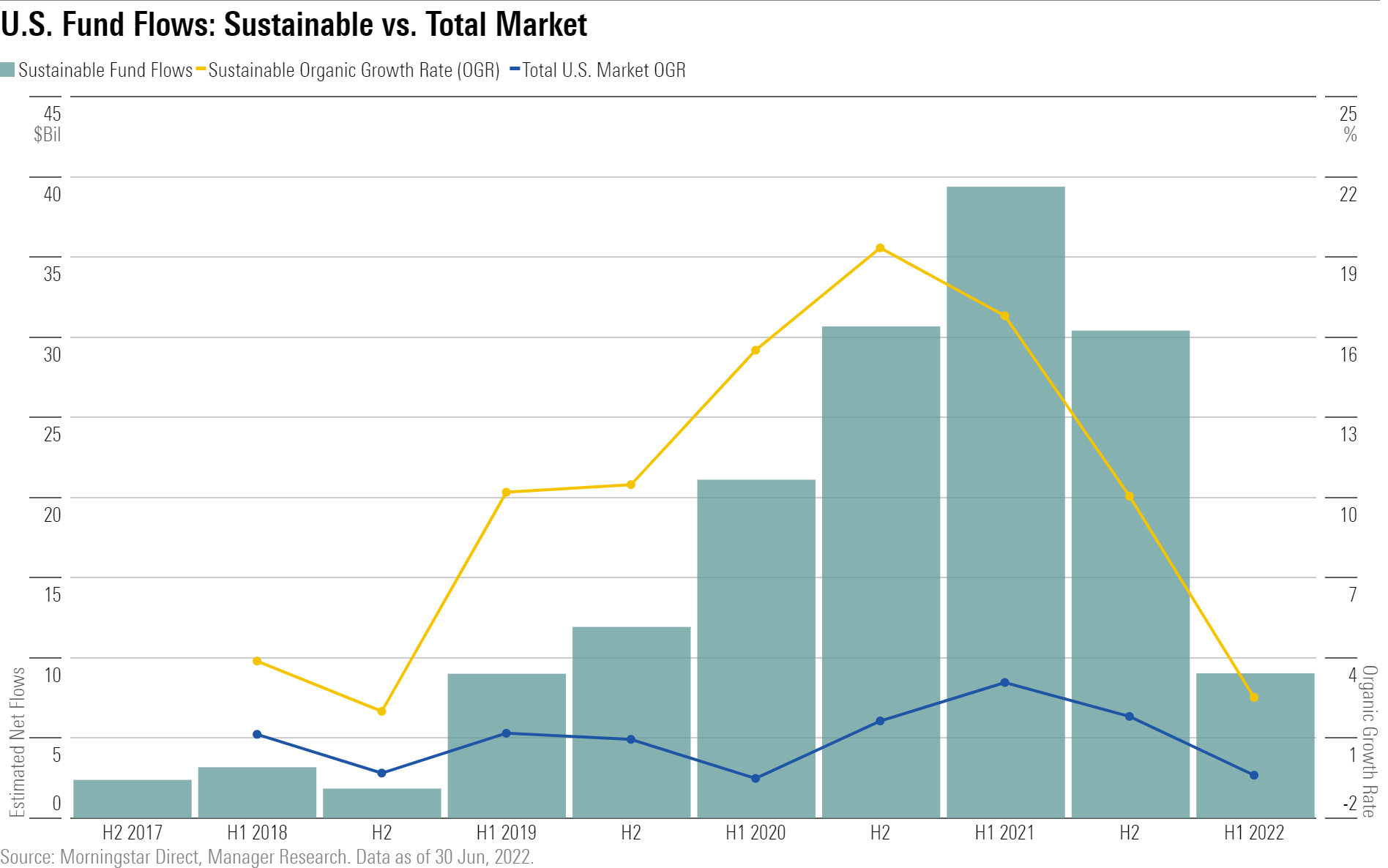

U.S. sustainable funds shed $1.6 billion during the second quarter of 2022 amid fears of recession, inflation, rising interest rates, and a global energy crisis. This was the first quarter of outflows in more than five years, before sustainable funds made it to the main stage. Still, the outlook for sustainable funds remains bright.

In a Brutal Second Quarter, Sustainable Funds Fared Better Than the Broad U.S. Market

Though down from last quarter’s all-time record, flows into sustainable fixed-income funds stayed positive. This was a notable departure from the total U.S. market, where taxable- and municipal-bond funds shed $150 billion during the quarter.

Together with market depreciation, sustainable funds’ net outflows drove assets in these funds to $296 billion, their lowest point since the first quarter of 2021. However, the U.S. sustainable funds market sustained a higher organic growth rate than the overall U.S. market. Calculated as net flows as a percentage of total assets at the start of a period, the OGR puts the magnitude of fund flows into perspective.

The continued growth of U.S. sustainable funds even during a period of poor performance could signal that investor demand for sustainable funds is “stickier” than broader U.S. demand. On a semiannual basis, the U.S. sustainable funds market grew 2.5% during the first half of 2022; by comparison, the total U.S. market shrunk by 0.39%. From July 2021 through June 2022, the sustainable funds market grew by 13%; the total market grew more modestly by 1.4%.

Investors Fled Renewable Energy Funds

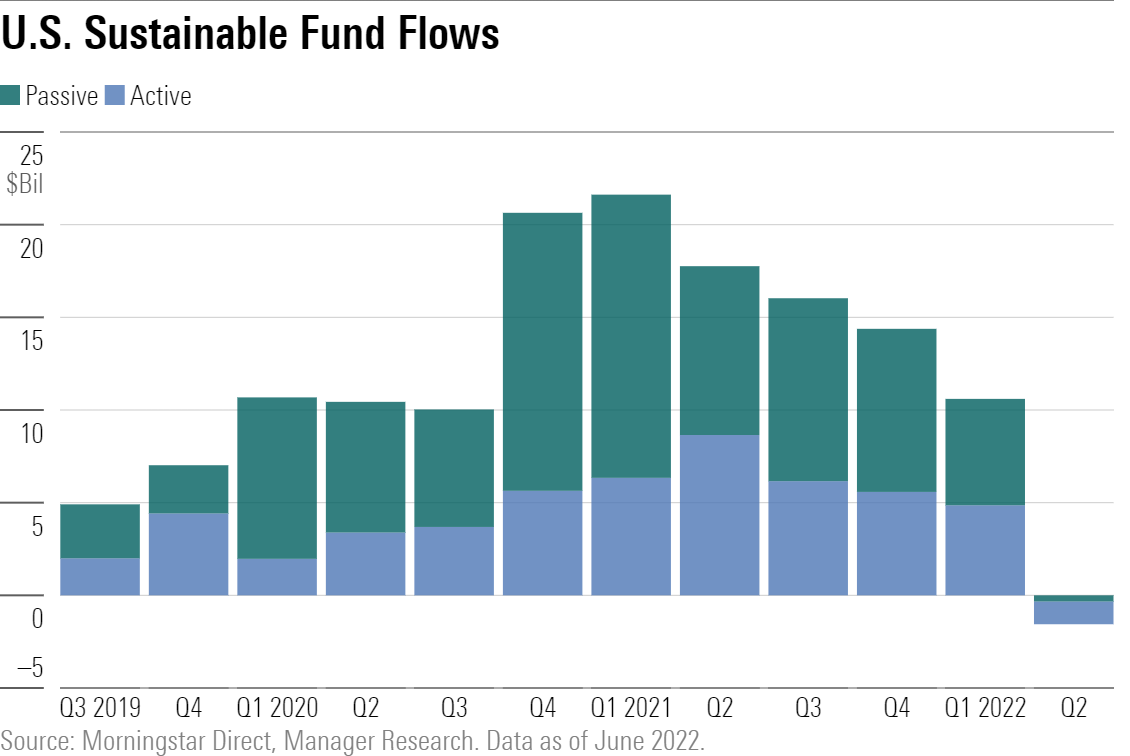

Sustainable active funds bore the brunt of the second quarter’s outflows, shedding $1.2 billion during the period. Sector equity funds, including many clean energy/tech climate funds, were the hardest hit. Against the backdrop of the ongoing volatility in energy markets and all-time record high gasoline prices in the United States, investors shied away from downtrodden renewable energy funds. This was compounded by rising commodity prices, since energy is often used as a hedge against inflation.

While active funds were hit the hardest, passive funds were not immune to investor flight. Index-based sustainable funds netted $8.4 billion on average during the preceding four quarters but bled $337 million during 2022′s second quarter. In the longer term, investor preference has shifted steadily toward passive options. Over the past three years, an average 60% of quarterly flows went to index-based offerings.

Floating-Rate Bond Funds Stayed on Top in Terms of Fund Flows

Investors continued to pour money into Invesco Floating Rate ESG AFRAX. It saw $381 million in net flows for the quarter, landing it in second place among U.S. sustainable funds with the largest inflows. This strong demand boosted the fund’s total year-to-date flows to $1.6 billion to secure the lead for the first half of 2022. Invesco Floating Rate ESG also topped the chart for net flows in 2021; investors may use floating-rate bonds as a hedge in the face of rising interest rates.

In addition to Invesco Floating Rate ESG, the other two funds topping the chart for second-quarter flows are familiar faces. IShares ESG Aware MSCI USA ETF ESGU, despite a $490 million outflow in May, was among the top flow-getters in every quarter since 2019′s third quarter. Vanguard ESG U.S. Stock ETF ESGV was fifth on last quarter’s top-10 list and was one of the few funds on this chart to sustain positive inflows in each of the first six months in 2022.

Amid a growing focus on climate investing, one fund changed its name and changed its fortune. On Earth Day of 2022 (April 22), SPDR MSCI ACWI Low Carbon Target ETF became SPDR MSCI ACWI Climate Paris Aligned ETF NZAC. At the same time, the fund’s mandate became more robust, adding a decarbonization strategy that aligns with the objective of the Paris Agreement by reducing exposure to energy-intensive industries. During the month of April, the fund netted $149 million, more than 6 times the fund’s total flows in 2021.

A Shift in a Model Portfolio Series Drove Sustainable Fund Outflows

IShares ESG Aware MSCI Emerging Markets ETF ESGE shed $1.3 billion and topped the list for worst outflows among U.S. sustainable funds in the second quarter. The fund’s assets totaled $4.4 billion at the end of the quarter, down 31% from the previous quarter. One factor driving these outflows was a change in BlackRock’s recommendations for the Target Allocation ETF model portfolio series, which had nearly $40 billion in assets under advisement as of March 2022. In May 2022, the firm reduced exposure to ESGE across the model portfolio series; for example, in the 60/40 equity/bond portfolio, the firm revised the recommended exposure to 0% from 3% in April.

Sustainable Bond Funds Shone a Light in Dark Places When All Other Lights Went Out

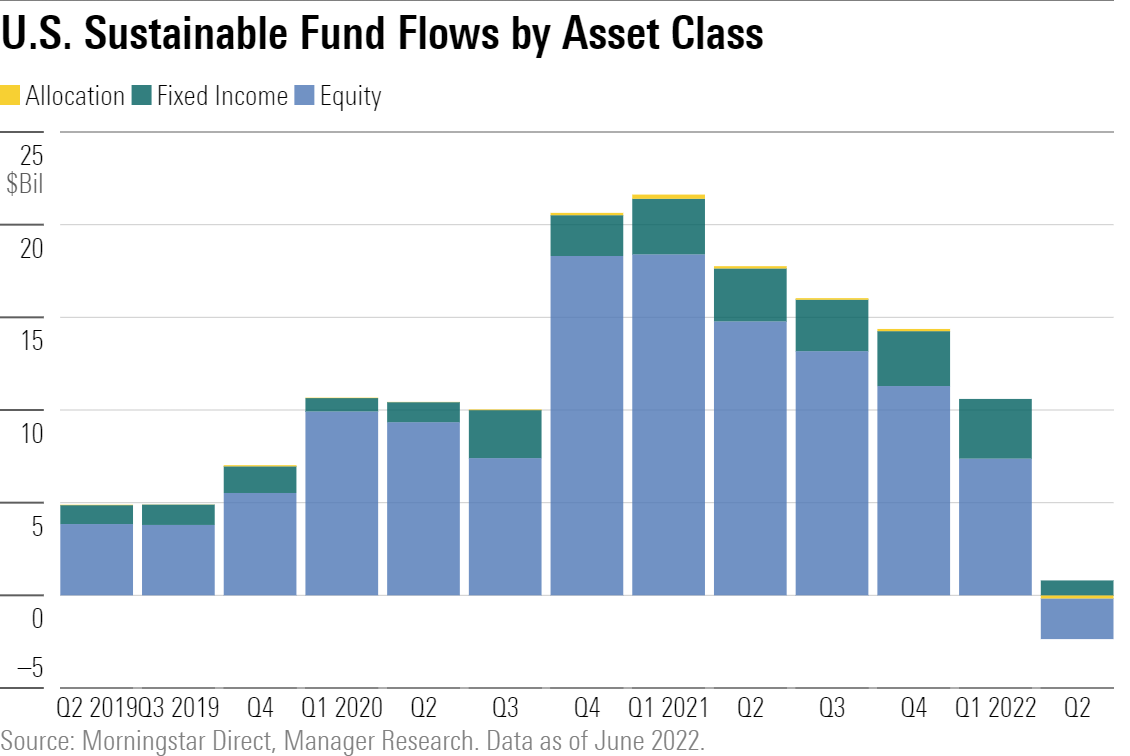

Flows into sustainable equity funds have declined steadily since their $18.4 billion record inflow in 2021′s first quarter and suffered outflows during the second quarter of 2022. In contrast, sustainable fixed-income funds were one of the few bright spots in an otherwise dim quarter.

Led by Invesco Floating Rate ESG and iShares ESG USD Corporate Bond ETF SUSC, sustainable bond funds netted $804 million during 2022′s second quarter. While down significantly from their $3.2 billion record take in 2022′s first quarter, flows stayed positive, a notable departure from the total U.S. market, where taxable- and municipal-bond funds bled $150 billion during the quarter.

Longer-term signals indicate this quarter might be a small blip on the radar for sustainable bond funds. Demand for sustainable fixed-income strategies has grown steadily in recent years, blowing past the $2 billion mark in 2020′s third quarter and staying above that level since (until this quarter). The number of sustainable fixed-income funds has increased substantially in the past three years, to 116 from 46. More fixed-income choices help investors fill their bond allocations, making environmental, social, and governance-focused multi-asset portfolios more viable and ultimately helping drive more flows.

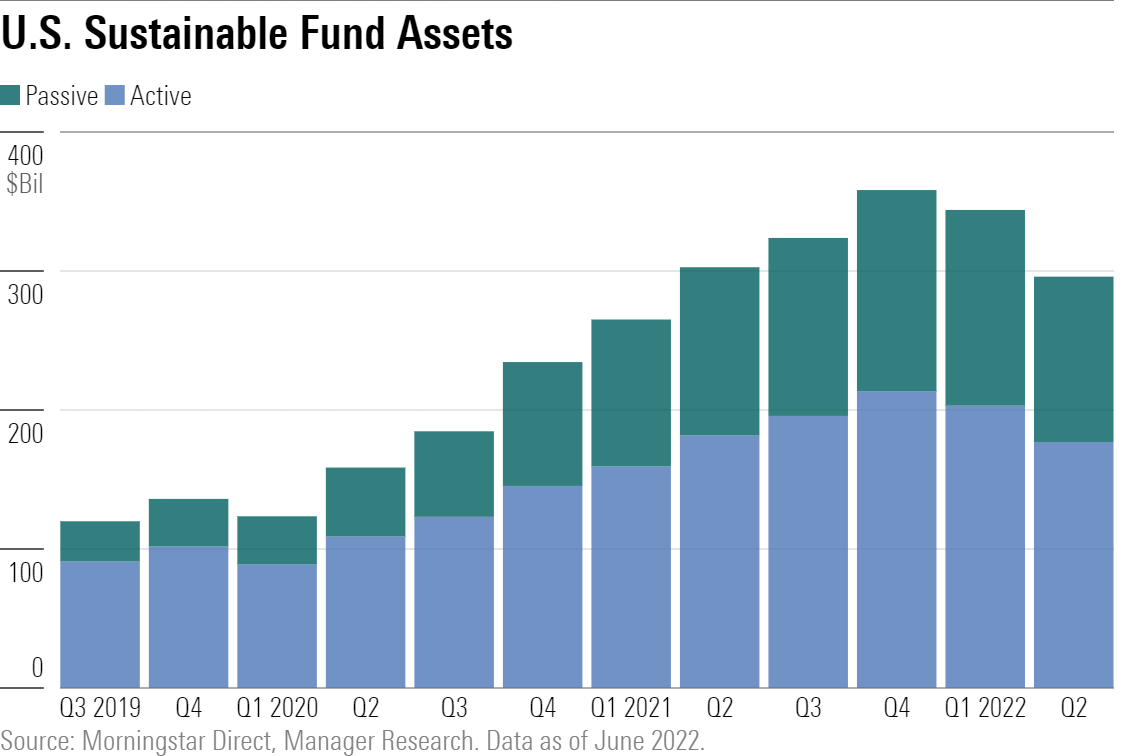

Assets in U.S. Sustainable Funds Dipped to the Lowest Level Since Early 2021

Together with market depreciation, sustainable funds’ net outflows drove assets in these funds to $296 billion, their lowest point since the first quarter of 2021. This represents a 17% decline from the all-time record of $358 billion at the end of 2021. By comparison, assets in the broader U.S. market also peaked at the end of 2021 (at $28 trillion) and slid by 19% to $22.8 trillion at the end of 2022′s second quarter.

Fidelity Upped Its Sustainable Fund Offerings

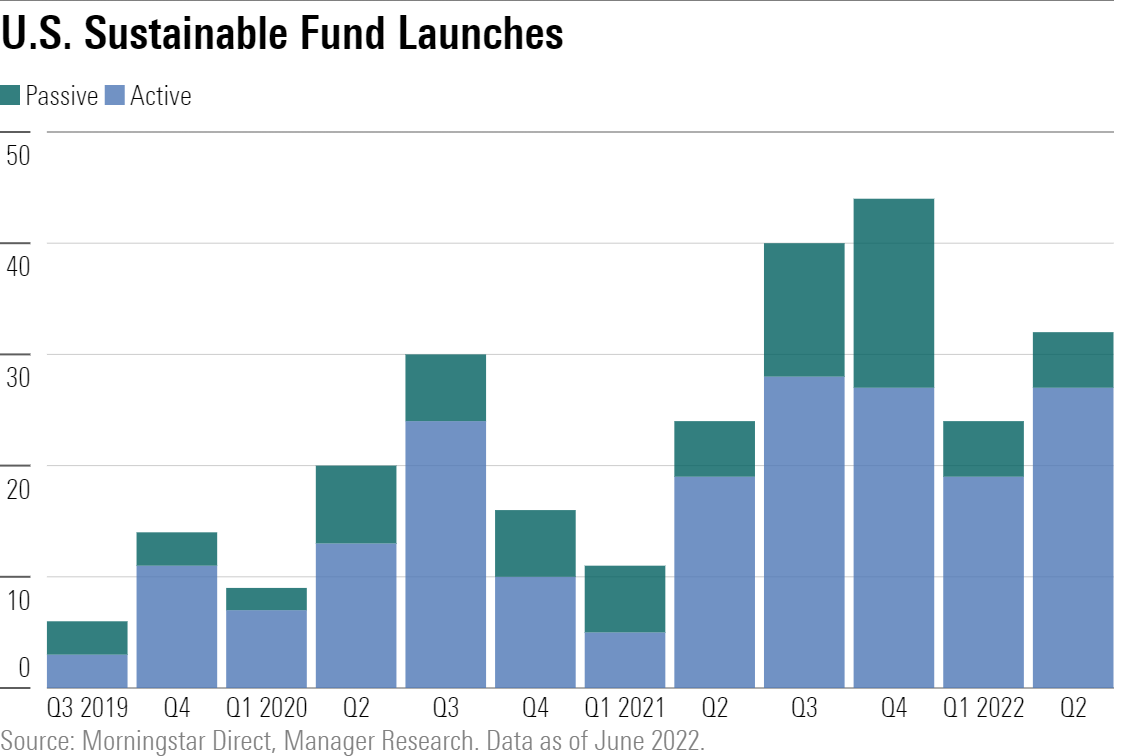

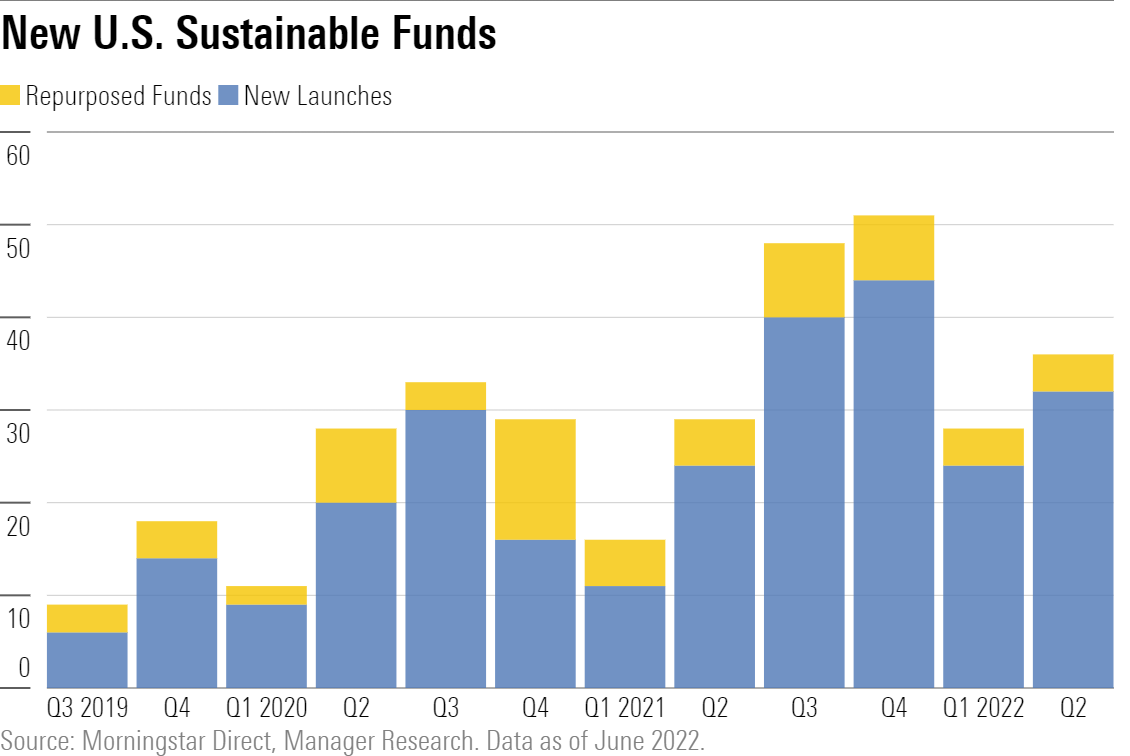

In response to investor demand for sustainable offerings, asset managers continued to expand their sustainable fund lineups. In the second quarter of 2022, 32 funds, including 12 exchange-traded funds, were launched in the U.S. with sustainable mandates. Of those, 20 are equity funds.

Once again, most of the new sustainable funds available in the U.S. are actively managed offerings. On average over the past three years, active funds have accounted for 70% of sustainable fund launches, and this quarter’s 84% exceeded that trend.

Fidelity significantly expanded its sustainable fund lineup, launching 14 new actively managed funds (two of them ETFs) during the second quarter. These launches boosted Fidelity’s overall U.S. sustainable fund offerings to 31, tied with Calvert for second place behind BlackRock/iShares with 62 sustainable funds.

New Sustainable Funds Led the Way on Climate

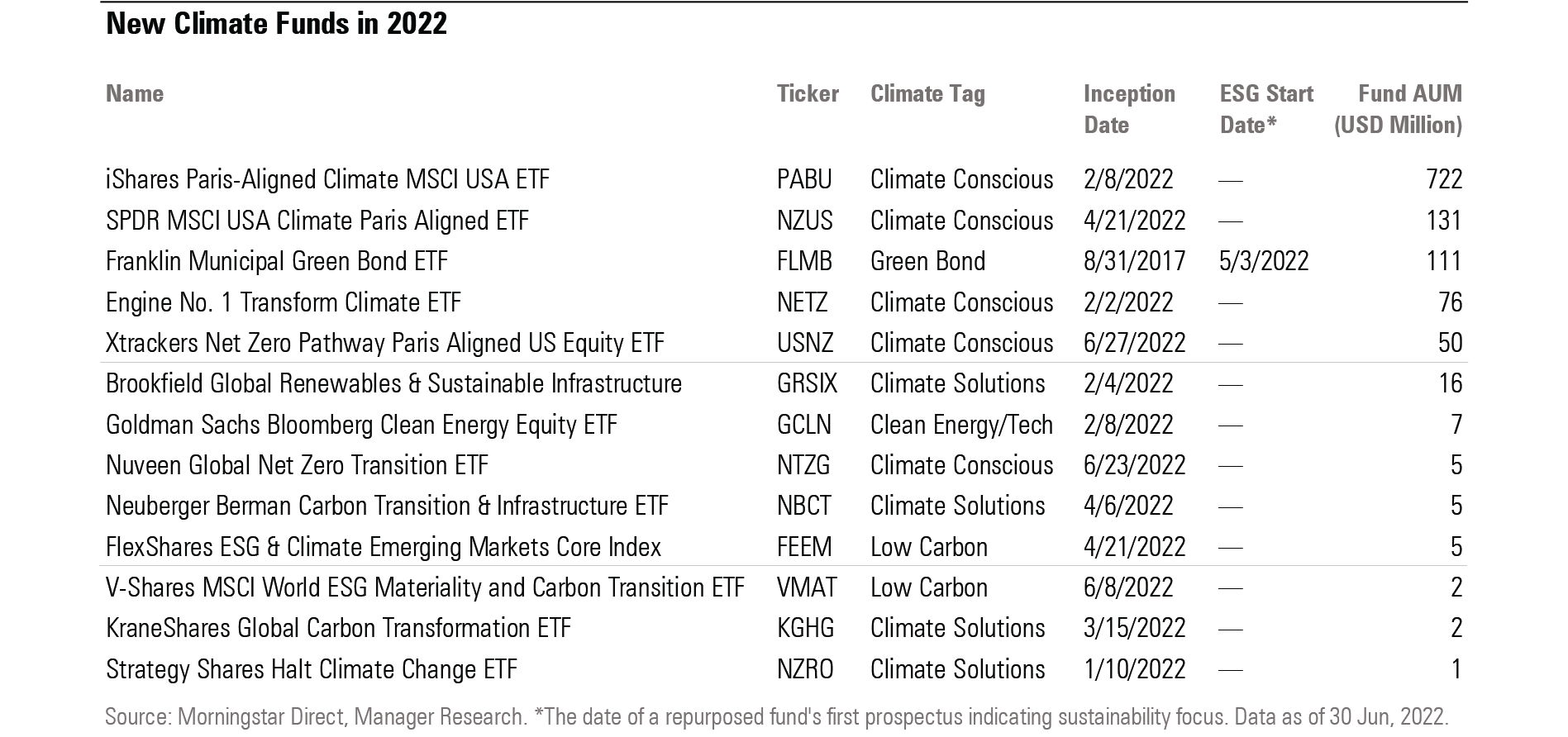

Investment options for climate-focused investors continue to grow. So far this year, 12 out of 56 new sustainable funds target climate mandates, and half of the new climate funds launched in the second quarter.

The largest new U.S. sustainable fund was SPDR MSCI USA Climate Paris Aligned ETF NZUS, the U.S.-focused sibling of NZAC. One component of the strategy is to reduce the fund’s greenhouse gas intensity by an average 10% each year relative to the parent index. This exceeds the minimum ask of Paris Aligned Benchmarks, which require a 7% year-on-year decarbonization rate (reduction in greenhouse gas emissions).

Firms Continued to Repurpose Funds for Sustainable Outcomes

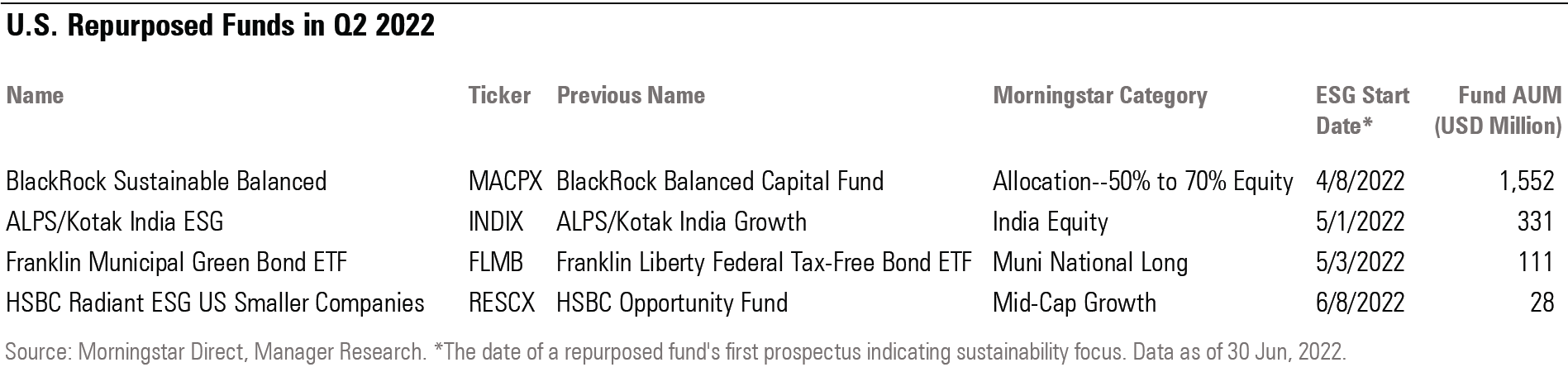

Most of the new options available to investors were launched with sustainable mandates, but firms also occasionally change the investment strategies of existing funds to target sustainable outcomes. Four funds were repurposed to adopt sustainable mandates in the second quarter of 2022.

The largest of these was BlackRock Sustainable Balanced MACPX, with $1.6 billion in assets. Along with implementing sustainability objectives such as a better aggregate ESG score and lower carbon emissions intensity versus the benchmarks, the fund opened its borders to include international equities. According to Morningstar analyst Megan Pacholok, “The expanded opportunity set should play to the management team’s strengths. Their tactical process has always had a global focus, so they may have more opportunities to implement their best ideas in this portfolio.”

The new offerings and repurposed funds brought the total number of sustainable open-end funds and ETFs in the U.S. to 588 at the end of the quarter.

Sustainable Fund Regulatory Updates

During the quarter, the SEC proposed two additional rules aimed at helping investors better identify, understand, and compare funds that feature ESG criteria in their investment process. One proposal would require funds with “ESG,” “sustainable,” or related terms in their names to commit at least 80% of assets to investments that meet their ESG criteria. The proposal would expand the existing names rule that requires a similar commitment from funds with names suggesting a focus on a particular type of investment (such as “stock,” “bond,” or “tax-exempt”).

The second proposal would require funds that use ESG criteria in their investment process to disclose more about how they do so in their prospectuses and annual reports. The proposal identifies and defines three broad types of ESG funds: ESG Integration, ESG Focused, and Impact. The first and most common cohort would be required to describe how they incorporate ESG into their process. The disclosure requirements escalate for ESG Focused funds, to describe the approaches they use in an “ESG Strategy Overview” table, as well as how the fund votes proxies and/or engages with companies about ESG issues. Impact funds would have to disclose how they measure progress toward the stated impact, the relevant time horizon, and any expected trade-off between the targeted impact and investment returns. The comment period for these proposals will conclude during the third quarter.

For a global look at sustainable fund flows for the second quarter, read the Morningstar Global Sustainable Fund Flows Report.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WYB37DY4NVDTVNZTSBDENH3GMI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JPJHXR5CGSNR4LKQF5ZKLCCVYQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)