How BlackRock, State Street, and Vanguard Cast Their ESG Proxy Votes

The “Big Three” often disagree. Here’s how to make sure their proxy voting reflects your priorities.

BlackRock, State Street, and Vanguard get a lot of attention for their similarities. All three are huge managers with trillions of dollars of mostly passive fund assets who tend to be among the very largest shareholders at most U.S. public companies.

As the volume of resolutions on social and environmental topics has increased, the three firms’ voting decisions and their control over their clients’ votes have come in for intense scrutiny. These topics may include greenhouse gas emissions reduction, workers’ rights, pay gaps, or ethical use of technology.

The firms are currently rolling out “pass-through voting,” which will enable more investors to have greater choice over how their funds are voted. However, many—perhaps most—investors are expected to continue to rely on their asset manager to make these decisions.

Investors have a wide range of views on environmental, social, and governance topics that frequently come to vote at U.S. companies. So, understanding the firms’ positions on these issues has become vitally important in ensuring that a manager’s voting decisions reflect the investor’s own values and priorities.

The Big Three Are Not a Monolith

Our latest research paper shows that the Big Three are making very different decisions on how they vote on key ESG resolutions.

We define key resolutions as shareholder resolutions that address environmental or social themes and are supported by at least 40% of a company’s independent shareholders. (This excludes company management, founders, and strategic investors, all of whom are closely connected to the companies in question, making them unlikely to support shareholder resolutions.) Specifically, we reviewed the voting decisions of the Big Three on 100 such key resolutions, which were filed at S&P 100 companies in the two years to March 31, 2023. While this time period excludes much of the ongoing 2023 proxy season, our analysis gives the best possible overview of votes at U.S. large caps that we can obtain from currently available reporting.

Here are three key findings.

- BlackRock and State Street supported twice as many key resolutions as Vanguard.

- The Big Three disagree on key voting decisions over two thirds of the time.

- Each firm has taken a unique voting stance on at least one ESG topic.

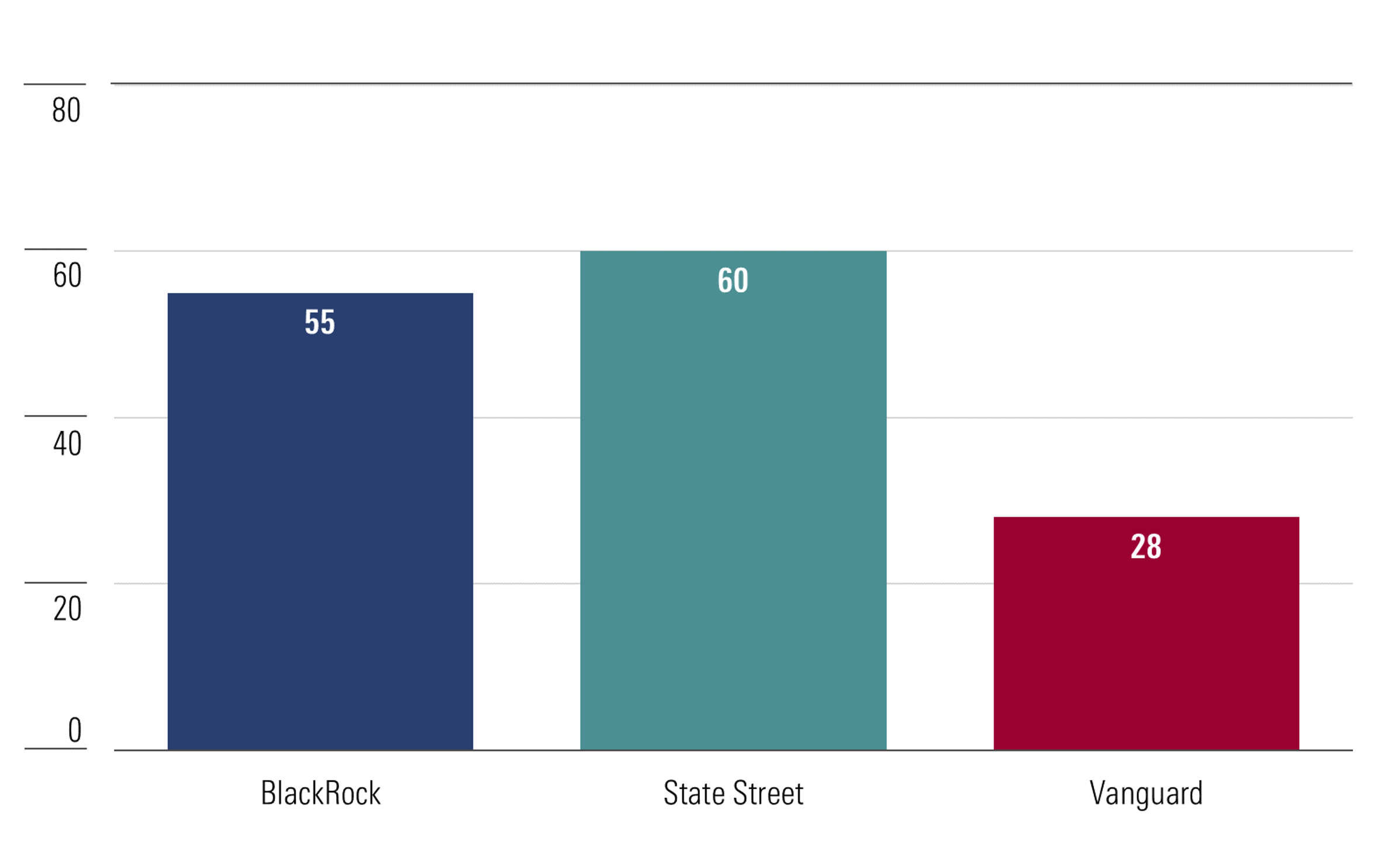

Vanguard’s ESG Support Half That of BlackRock, State Street

BlackRock and State Street supported a slight majority of the 100 proposals (55 and 60, respectively), as the chart below shows. Vanguard opposed almost three fourths (72) of them. So, investors who prefer to invest with a manager that supports a majority of key ESG resolutions would be more comfortable with BlackRock’s and State Street’s voting decisions than Vanguard’s. (It is, of course, also true that some investors would prefer the opposite.)

100 Key Resolutions: Number of Proposals Supported by Big Three Firms

This wide variation will come as no surprise to users of the Morningstar ESG Commitment Level assessment. Vanguard has a Morningstar ESG Commitment Level of Low. Analyst Mahi Roy highlights that “although the firm’s record of support for key ESG shareholder resolutions continues to be lower than comparable peers, its disclosure of the rationale behind such voting decisions is strong.”

In fact, all three firms frequently disclosed detailed rationales on their thinking behind their often-divergent decisions on these key resolutions. Such rationales have become an important aid to investors seeking to select asset managers whose views on ESG are aligned with their own—more on that later.

Support by BlackRock and State Street for the 100 key resolutions is well in line with the 59% three-year median support level for key resolutions by the top 20 U.S. asset managers. This fits well with the Morningstar ESG Commitment Level of Basic assigned to the two firms.

Most of the Time, the Big Three Disagree on ESG

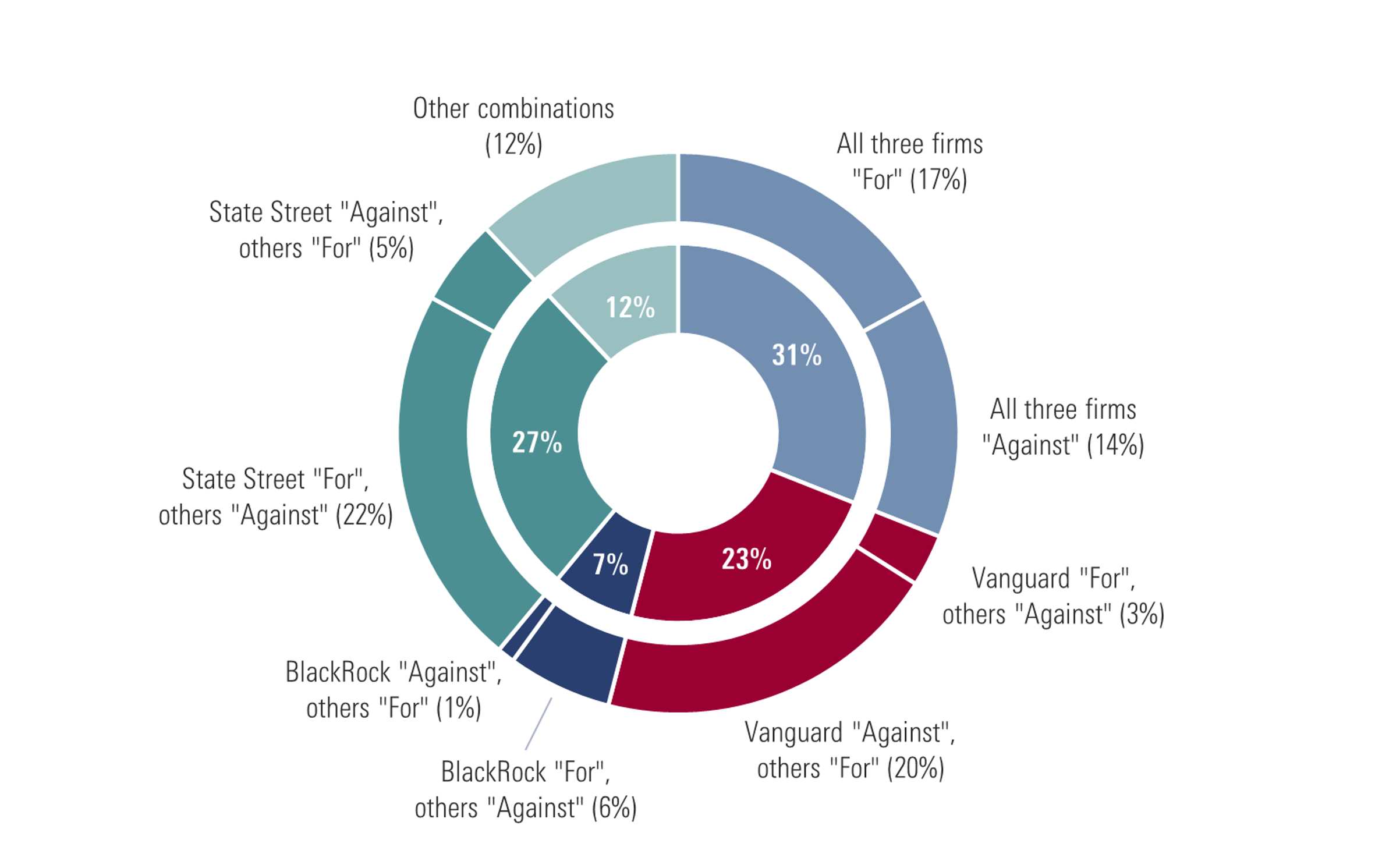

The Big Three firms voted differently on key resolutions more than two thirds of the time. On only 31 of the 100 resolutions we analyzed did the three firms make the same voting decision, as shown on the chart below.

100 Key Resolutions: Analysis of Big Three Firms' Aggregated Voting Decisions

On 57 of the 100 key resolutions, there was a 2-to-1 split in the vote. Within that, 22% of the time, State Street supported a resolution that the other two firms voted “Against”; 20% of the time Vanguard voted “Against” a resolution that BlackRock and State Street supported. BlackRock was the firm least likely to take such a minority decision, which occurred 7% of the time.

Unlike BlackRock and Vanguard, State Street is a more frequent user of the “Abstain” decision. The other two firms abstain only in very limited circumstances. State Street opted to abstain on 12 of the 100 resolutions that the other two firms voted either “For” or “Against.”

Each Firm Takes a Stand on Different Topics. Take Note, Investors.

In our research, we split the 100 resolutions into six topics. We looked at two environmental topics: climate change and “other” environment-related issues—such as water risk, use of plastics, and deforestation. The four social topics were:

- civil rights and racial equity,

- human rights and ethical use of technology,

- political influence and activity, and

- workplace equity (which includes diversity, equity, and inclusion reporting, pay-gap reporting, workers’ rights, and antiharassment and discrimination resolutions).

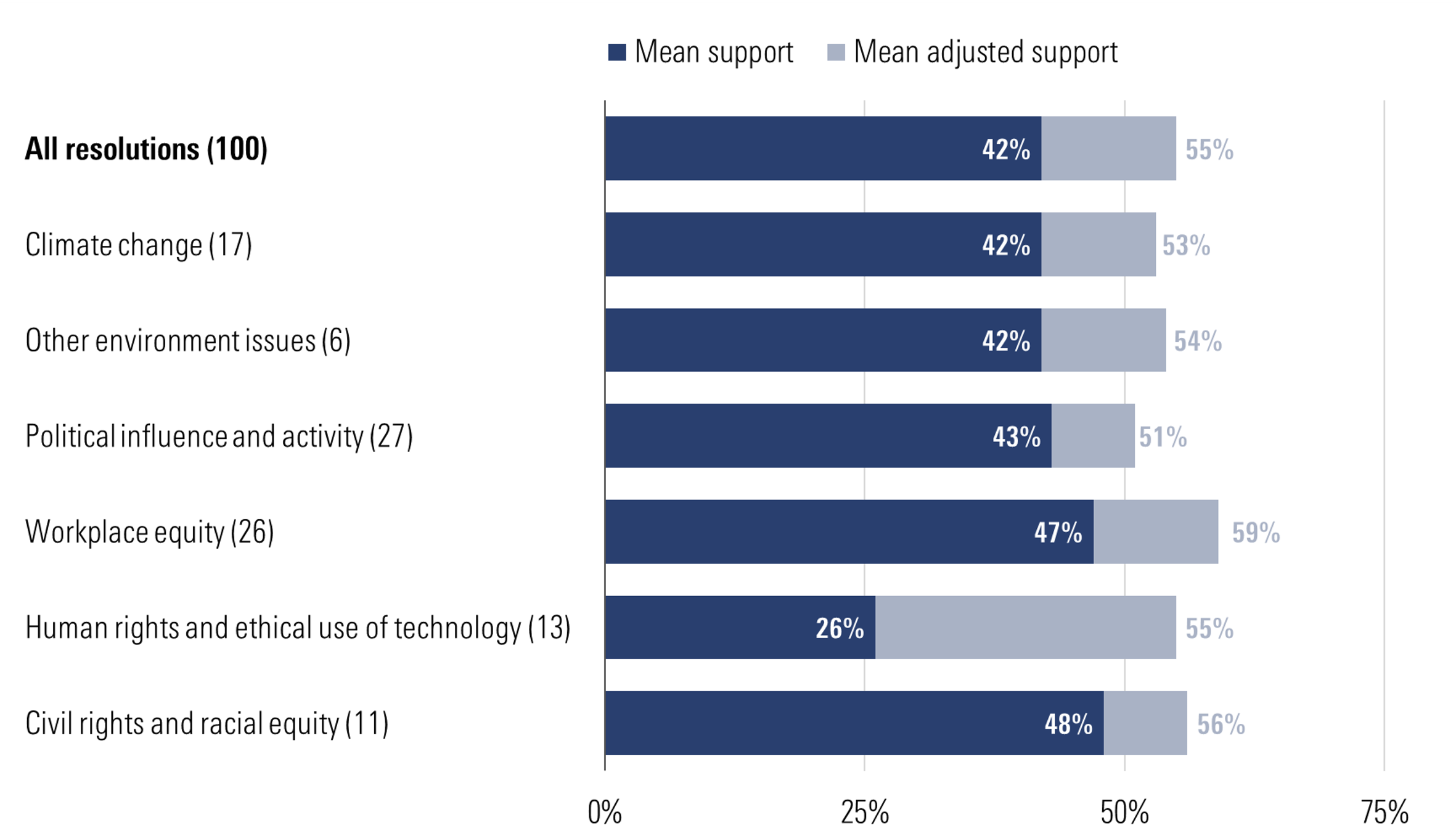

The chart below shows the number of resolutions in each topic group (in parentheses) and their average shareholder support levels.

100 Key Resolutions: Average Shareholder Support Levels by Topic

On average, the 100 resolutions were supported by 42% of shareholders. That equates to 55% of independent shareholders (shown on the chart above as adjusted support). Each group of resolutions by topic had the support of more than 50% of independent shareholders on average. The chart below shows the Big Three firms’ support for the resolutions addressing each topic.

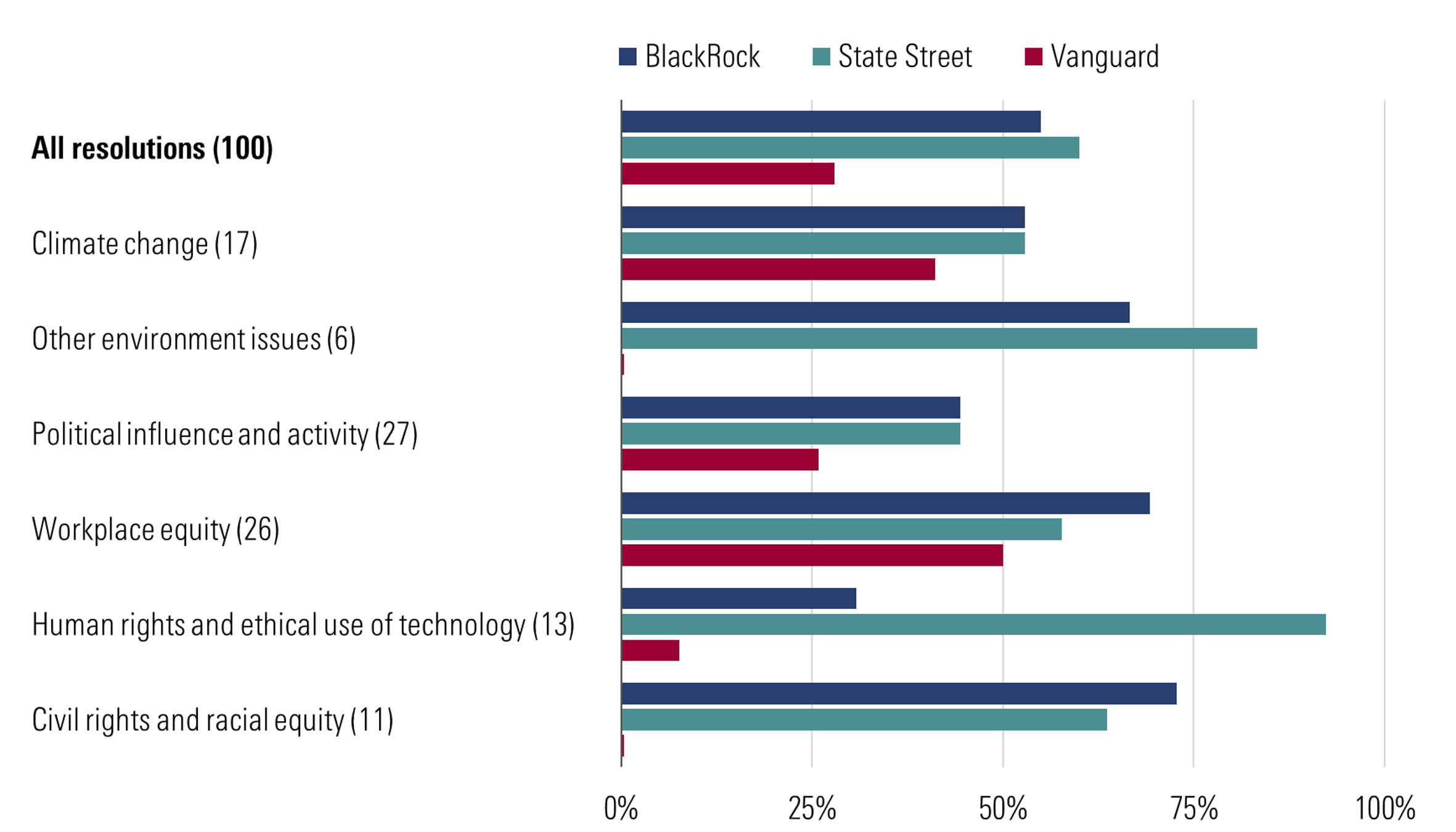

100 Key Resolutions: Percentage of Resolutions Supported by the Big Three Firms

All three firms supported at least 40% of the analyzed resolutions on two topics: climate change and workplace equity. However, we also noticed that each of the firms supported a particularly high or low proportion of resolutions on at least one topic.

For example:

- Vanguard voted “Against” all 11 resolutions requesting civil rights audits or racial equity audits. It also voted “Against” all six environment-related resolutions addressing issues other than climate. BlackRock and Vanguard supported more than two thirds of the resolutions addressing both topics.

- State Street’s support for the 13 resolutions on human rights and ethical use of technology, at 92%, was considerably higher than that of BlackRock and Vanguard (31% and 7%, respectively).

- BlackRock showed the highest support among the three firms for civil rights and racial equity resolutions (73%) and those on workplace equity (69%).

The reasons why the firms chose to support or reject certain resolutions is often more nuanced than a simple “For” or “Against” vote can tell us. That’s why it’s useful that, on many of these votes, the firms have published rationales explaining their thinking.

Let’s consider civil rights and racial equity resolutions. These have been proposed at a wide range of companies, including Apple AAPL, Chevron CVX, JPMorgan Chase JPM, and McDonald’s MCD. BlackRock frequently stated its belief that “it is in the best interests of shareholders to have access to greater disclosure on this issue,” often while recognizing a company’s ongoing efforts.

By contrast, Vanguard frequently advocates for greater board-level diversity and often backs shareholder requests for more granular DEI and workforce reporting. However, on resolutions requesting racial equity and civil rights audits, Vanguard often declared itself satisfied that ongoing efforts by the companies in question to reform DEI practices and provide additional disclosures would address the requests made in the proposals.

We also see such contrasts between firms on resolutions addressing the ethical use of technology, which focus on practices at Google-owner Alphabet GOOGL, Amazon.com AMZN, and Meta Platforms META, owner of Facebook, Instagram, and WhatsApp. In most cases, BlackRock has voted “Against” these resolutions, stating that “the company already provides sufficient disclosure and/or reporting regarding this issue, or is already enhancing its relevant disclosures,” or that “the company already has policies in place to address the request being made.” However, State Street felt that “investors would benefit from greater transparency regarding the [companies’] approach to managing risks” on all except one of the 13 resolutions addressing this topic.

There are two key lessons here for the millions of investors who hold the Big Three’s funds.

- It’s important to determine whether a manager’s proxy-voting stance on ESG issues reflects your own priorities and values. If not, it’s worth considering whether a different firm might be a better fit (particularly for products like index-tracking funds that have similar characteristics between one firm and another). Alternatively, it may also be a good opportunity to consider which type of voting policy would be the best fit when pass-through voting becomes available.

- There’s much more to a voting decision than just the vote itself. If you really want to know what a manager is thinking about a key ESG topic, it’s important to understand the policy and rationale behind the voting decisions they’re making. As this year’s proxy season comes to a close, the Morningstar team will continue publishing research to help investors gain a better understanding of these issues.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)