How Did the Top U.S. Asset Managers Vote on ESG Shareholder Resolutions?

Morningstar’s analysis reveals solid but varying support by managers.

The growing debate over sustainable investing came to a head last year. And though there’s never been a greater range of views on how environmental, social, and governance factors affect investing, everyone seems to agree on one thing: Proxy decisions matter. (For a primer on proxy voting, read this).

Asset managers believe that voting at shareholder meetings is an essential element of their fiduciary duty to clients. Yet, outside the asset-management industry, opinions are increasingly polarized. Some stakeholders think that asset managers aren’t using the influence of their voting power to address environmental and social issues at companies. Others believe managers are overprioritizing such issues to the detriment of investor returns. But, with 2022′s record number of shareholder resolutions on environmental and social issues, it’s hard to find anyone who believes that these votes are inconsequential.

In light of this, we’ve published a new research paper that looks at the top U.S. asset managers’ votes on key shareholder resolutions over the past three proxy years. Morningstar defines key resolutions as those that address environmental or social themes that were supported by 40% or more of a company’s independent shareholders—that is, excluding company insiders such as directors, founders, and strategic investors.

Asset managers have recently emphasized their reluctance to support proposals that they consider unduly prescriptive or that repeat an existing request. In light of this, analyzing key resolutions gives a clearer picture of shareholder support for proposals that asset managers with a range of approaches to sustainability are prepared to back.

Support for Key Resolutions Reveals Important Trends

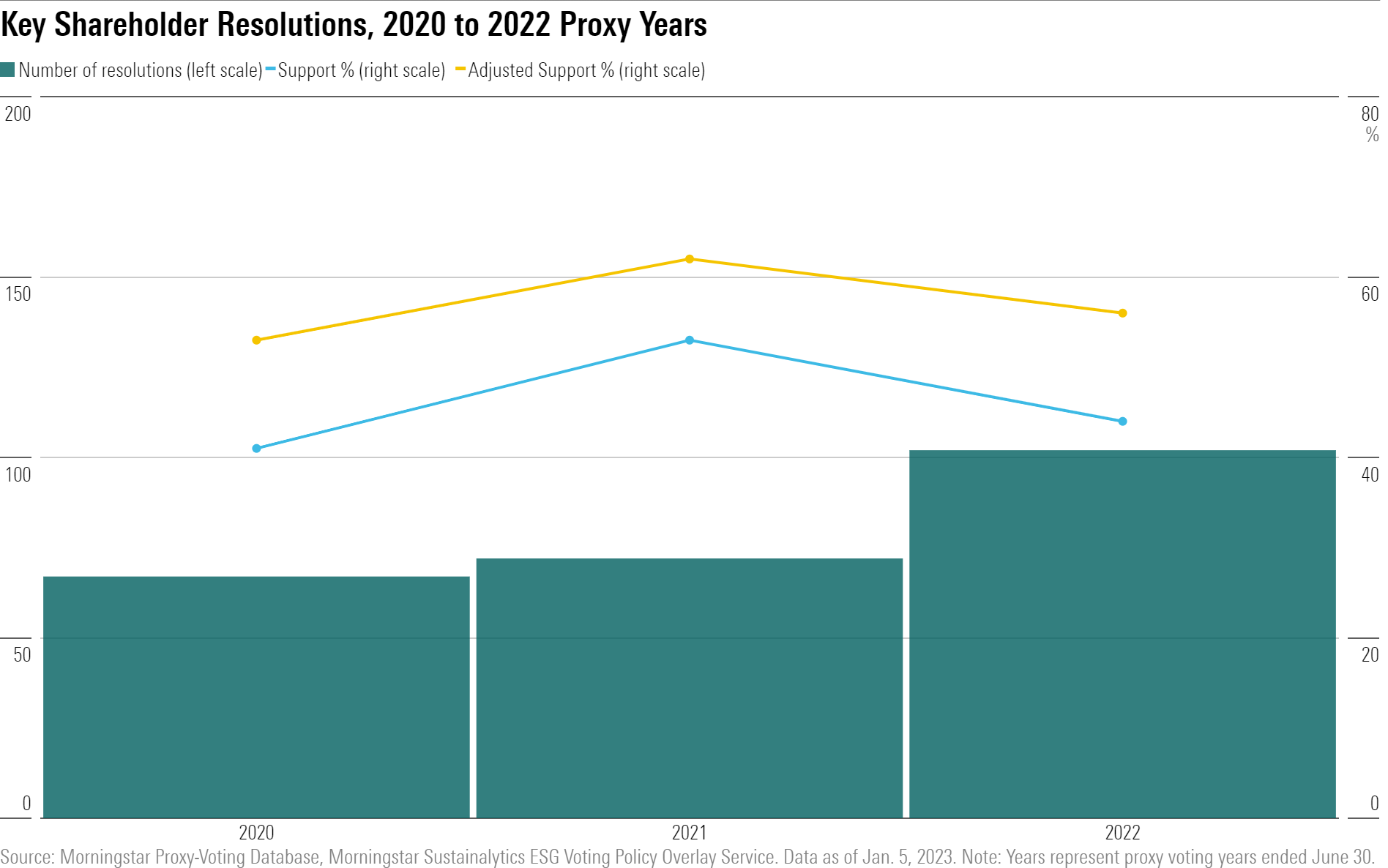

We identified 241 key resolutions in the past three proxy years: 67 in 2020, 72 in 2021, and 102 in 2022. Over that period, around two in five of all environmental and social shareholder resolutions qualified as key resolutions.

On average, a majority of independent shareholders supported key resolutions. As shown in the chart below, the average support level for these 241 resolutions (including votes by company insiders) was 46%. Average shareholder support stood at 41% in 2020, peaking at 53% in 2021, then falling back to 44% in 2022. However, the average adjusted support for these key resolutions, excluding opposition from company insiders, is 11 percentage points higher at 57%. It peaked at 62% in 2021 before falling to 56% in 2022.

This pattern—rising support in 2021 followed by a fall in support in 2022—is seen for most of the top 20 U.S. asset managers.

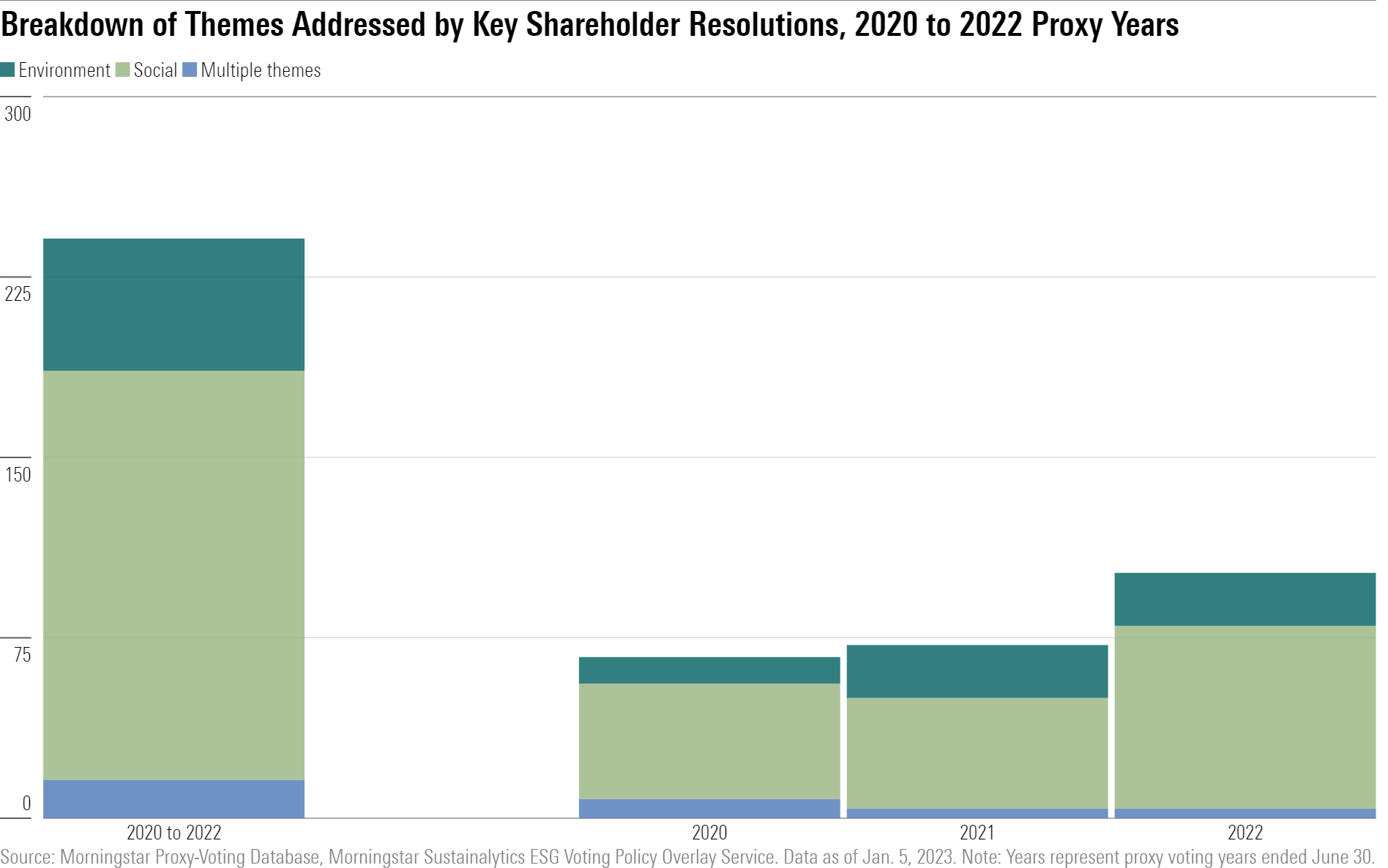

Although climate and environmental resolutions have generated plenty of headlines, they actually represent a minority of key resolutions, most of which address social themes (see chart below). Only 55 of the 241 key resolutions in the last three proxy years were related to the environment (23%).

By contrast, 170 (71%) of the 241 addressed social themes. In the 2022 proxy year, 75% of the 102 key resolutions targeted social themes (76 resolutions), with 22% addressing environmental themes (22 resolutions). We’ve also included a handful of resolutions in our analysis that cut across several ESG themes—16 in total across the three years.

How Have Asset Managers Voted on Key Resolutions?

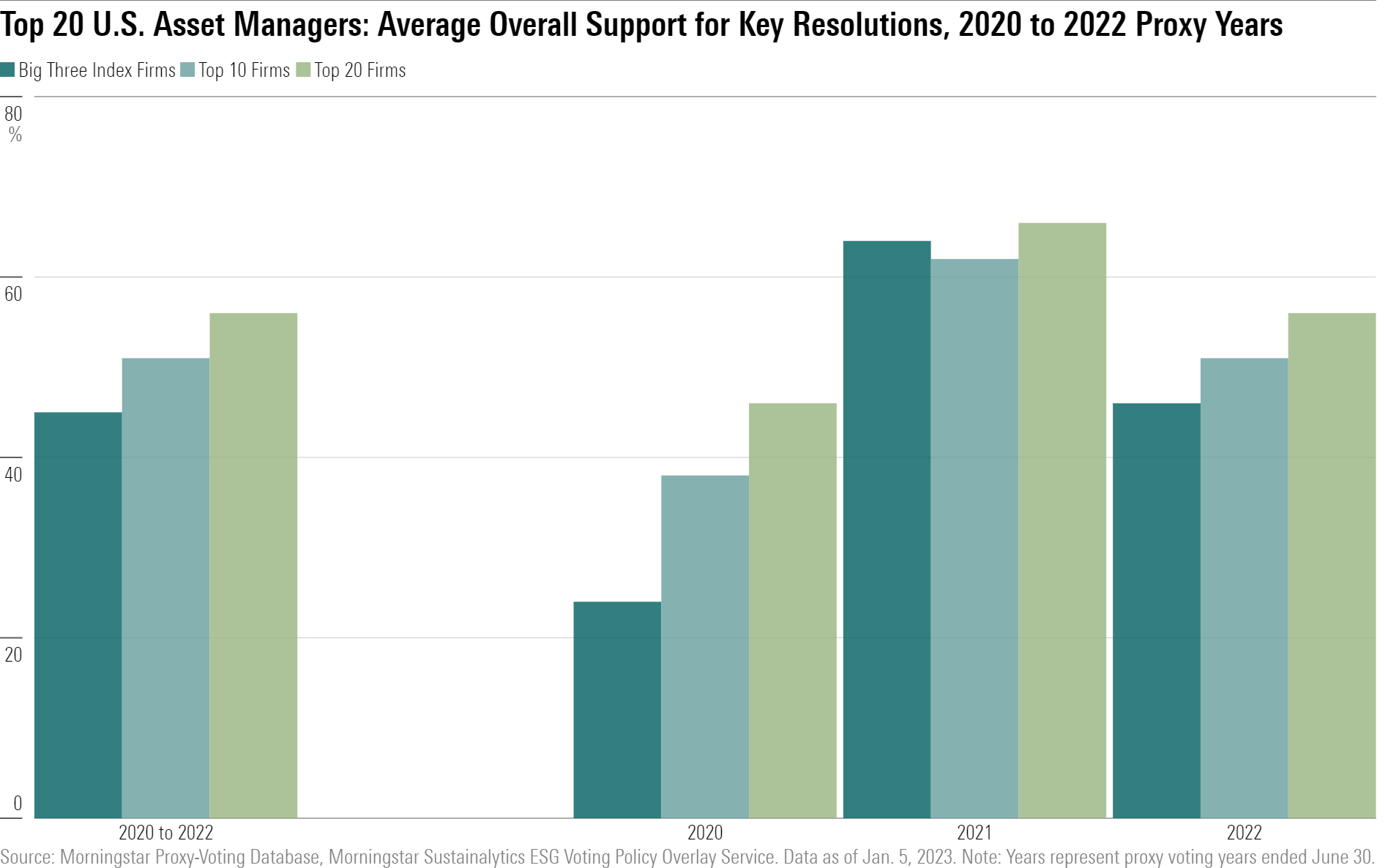

While there has been consistently solid support for key resolutions over the past three years, the top U.S. asset managers have shown varying levels of support for them. The chart below shows the level of overall support for key resolutions by the top 20 U.S. asset managers by fund assets—that is, the percentage of their fund votes cast in favor of key resolutions.

The 56% average overall support shown by the top 20 asset managers over the last three proxy years is moderate and closely matches the adjusted support level for key resolutions. Among this group of firms, there has also been a drop-off in support for key resolutions in 2022 compared with 2021, falling to 56% from 66% and reflecting the general trend we saw earlier.

Big Three Managers Support Environmental and Social Resolutions Less, Especially Vanguard

There seems to be a relationship between firm size and support for key resolutions. On average, the top 10 firms showed a lower overall support level (51%) than the next 10 firms (72%) over the past three years. Support from the Big Three index firms—Vanguard, BlackRock, and State Street—was lower still at 45%.

Even within the Big Three, we observed significant differences in voting patterns. Vanguard showed considerably lower support (36%) for key resolutions than BlackRock (43%) and State Street (59%) over the past three proxy years.

Our analysis also found that, in general, the firms’ sustainable funds showed a similar or higher level of support for key resolutions than their fund ranges as a whole, as many investors would expect. However, there were exceptions. For example, Vanguard’s and Fidelity’s sustainable funds showed noticeably lower support for such resolutions than their wider fund ranges, which may surprise investors in those funds.

A full analysis of all 20 firms’ voting records on key resolutions can be found in our paper. As attention on proxy voting continues to increase, we believe this analysis will help fund investors determine which asset managers and funds are most inclined to take a stand on the issues that are important to them.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)