Markets Brief: Hints of Softer Economy and Inflation Buoy Sentiment

Expectations for rate hikes ease. Cybersecurity stocks gain, while energy loses.

Glimmers of easing in inflationary pressures could mean a slightly less aggressive Federal Reserve in the months to come, and that's giving the markets some breathing room.

Investors will look for fresh evidence on this front when key economic indicators—including personal spending and income data—are reported during the week ahead.

“Recently released economic metrics have been coming in softer than expected and, as such, the equity market is now pricing in a lower flight path of additional rate hikes through the end of the year,” says David Sekera, chief U.S. market strategist at Morningstar.

The CME Group's FedWatch tool now shows investors ratcheting back their expectations for rate hikes in 2022. Now, 42.2% expect the target rate to be in the range of 3.25%-3.50% by December, up from 24% expecting that a week ago. Meanwhile, expectations for the federal-funds rate to be in the 3.50%-3.75% range have been declining.

The Federal Reserve raised the federal-funds rate by three fourths of a percentage point to a 1.5%-1.75% range at its last meeting and said it would consider a 0.50- to 0.75-percentage-point hike at its July meeting.

The University of Michigan Consumer Sentiment Index showed consumers' inflation expectations—a measure tracked closely by the Federal Reserve—dropped slightly from preliminary estimates released in early June. Consumers now see inflation rising at an annualized rate of 5.3% compared with earlier expectations of 5.4%.

The S&P Global Flash U.S. Composite PMI Index, a survey of purchasing managers in the manufacturing and services sector, also showed inflationary pressures were easing amid a sharply slowing economy.

As a major driver of the highest inflation to hit the nation in 40 years, lower energy prices are signaling some relief could be in sight. WTI crude settled Friday at $107.62 per barrel, down from $120.67 two weeks ago amid concerns about slower economic growth and ample supplies. The energy sector continued its lagging performance, ending the week down 1.68%, making it the worst-performing sector. Energy remains the top-performing sector this year to date with a 27.92% return and is the only sector in positive territory.

Stocks staged a broad-based rally late last week, leading to the first weekly gain for equities since May 27. A series of upbeat corporate outlooks amid easing inflation expectations lifted investor spirits. The Morningstar US Market Index rose 6.54% over the course of the past week.

“We think the market became oversold,” says Morningstar’s Sekera. “In fact, there have only been a few other instances in which the markets have traded at such a large discount to our intrinsic valuation.”

In Friday’s action, cruise line operator Carnival's CCL shares sailed 12.44% higher to $10.85 after noting occupancy rates in its second quarter were up 69% from the previous quarter and customer deposits increased to $5.1 billion as of May 31, from $3.7 billion in February. Cruise lines have been among the hardest hit groups by the coronavirus pandemic conditions the past few years.

FedEx FDX shares jumped 7.16% to $243.24 after the delivery service reported fiscal fourth-quarter earnings that matched Wall Street expectations and forecast stronger-than-expected fiscal 2023 earnings of between $22.50 and $24.50, before adjustments related to its retirement plans and certain business initiatives.

Events scheduled for the coming week include:

- Monday: Nike NKE reports earnings.

- Wednesday: General Mills GIS and Bed Bath & Beyond BBBY report earnings.

- Thursday: Walgreens Boots Alliance WBA reports earnings. Personal Consumption Expenditures Price Index May update.

For the trading week ending June 24:

- The Morningstar US Market Index rose 6.54%.

- Best-performing sectors were healthcare, up 8.35%, and consumer cyclical, up 8.06%.

- The worst-performing sector was energy, down 1.68%.

- Yields on the U.S. 10-year Treasury fell to 3.13% from 3.24%.

- WTI crude oil fell $1.94 to $107.62 per barrel.

- Of the 864 U.S.-listed companies covered by Morningstar, 777, or 90%, were up, and 87, or 10%, declined.

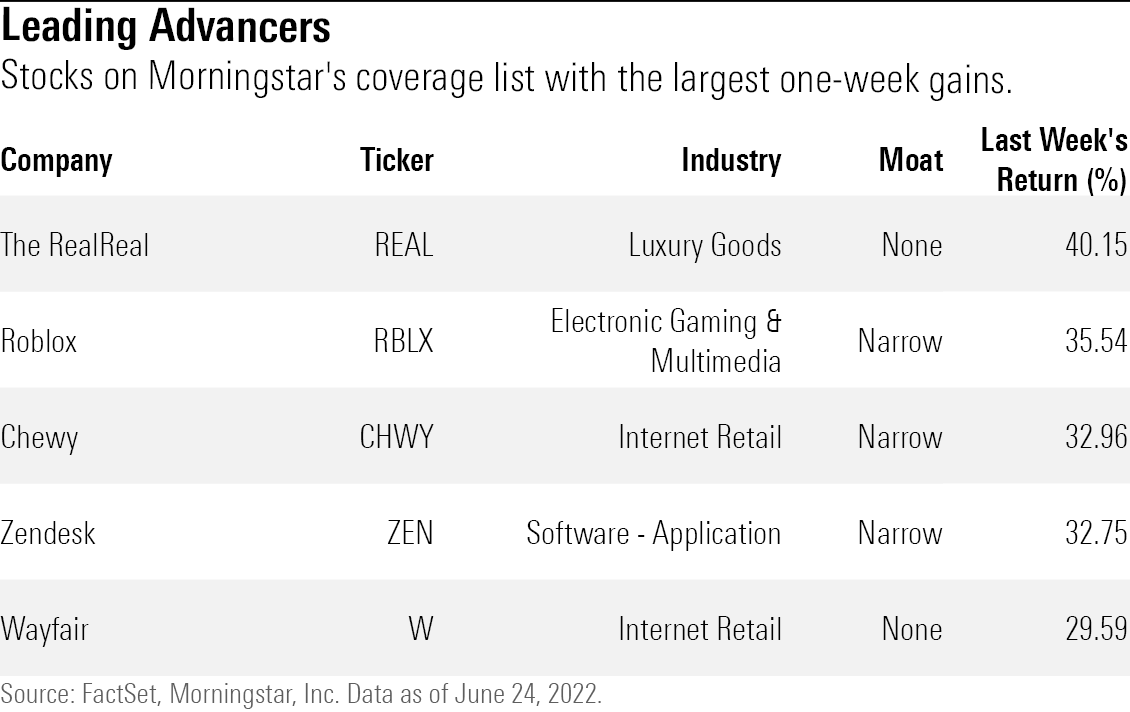

What Stocks Are Up?

The best-performing companies in the past week were The RealReal REAL, Roblox RBLX, Chewy CHWY, Zendesk ZEN, and Wayfair W.

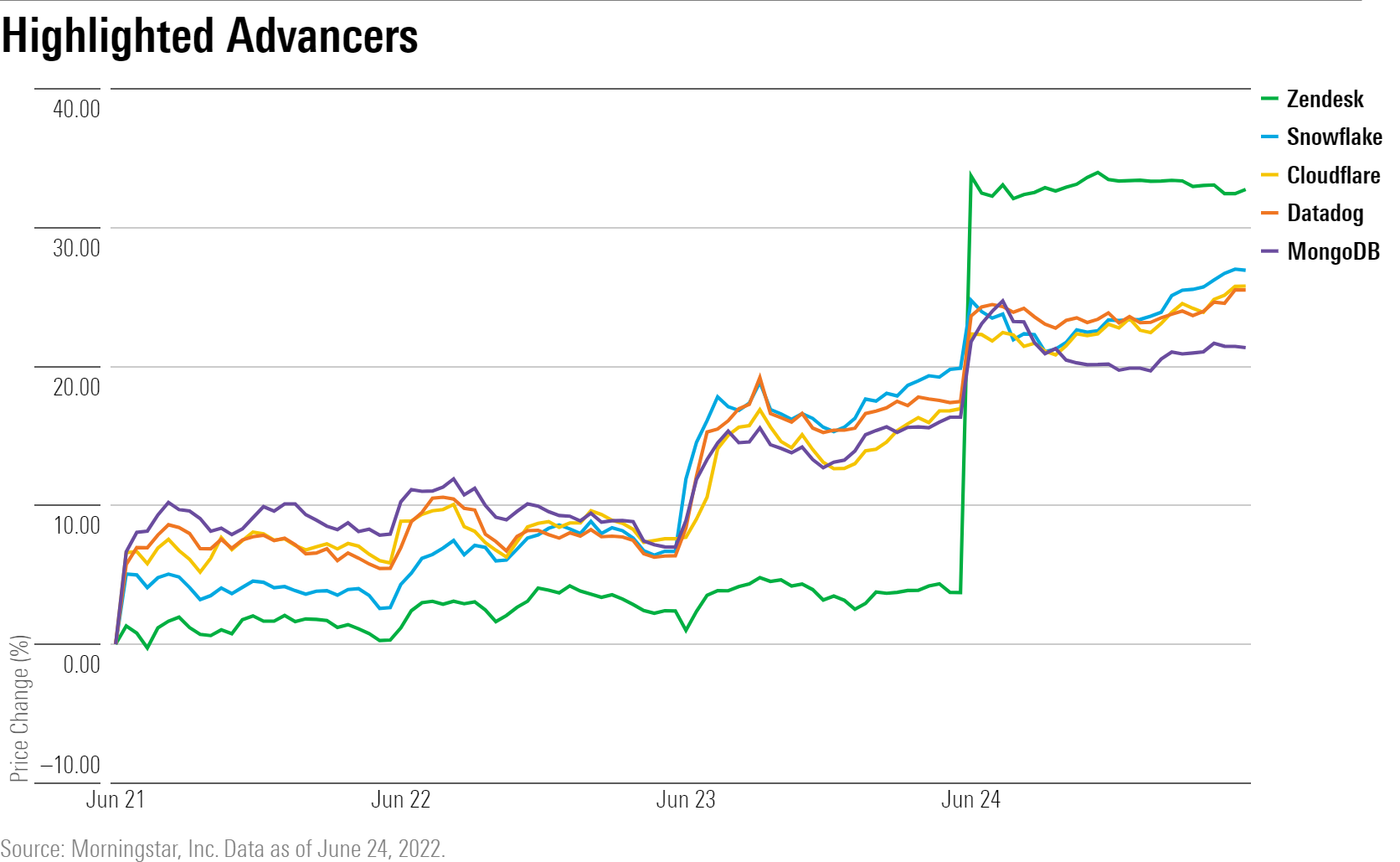

Enterprise software companies surged, with shares of Zendesk leading the group after an investor group agreed to take it private for $10.2 billion, CNBC reports. Shares of Datadog DDOG, MongoDB MDB, and Snowflake SNOW also closed the week higher.

Cybersecurity firms Cloudflare NET, Okta OKTA, and Zscaler ZS were also among the best performers.

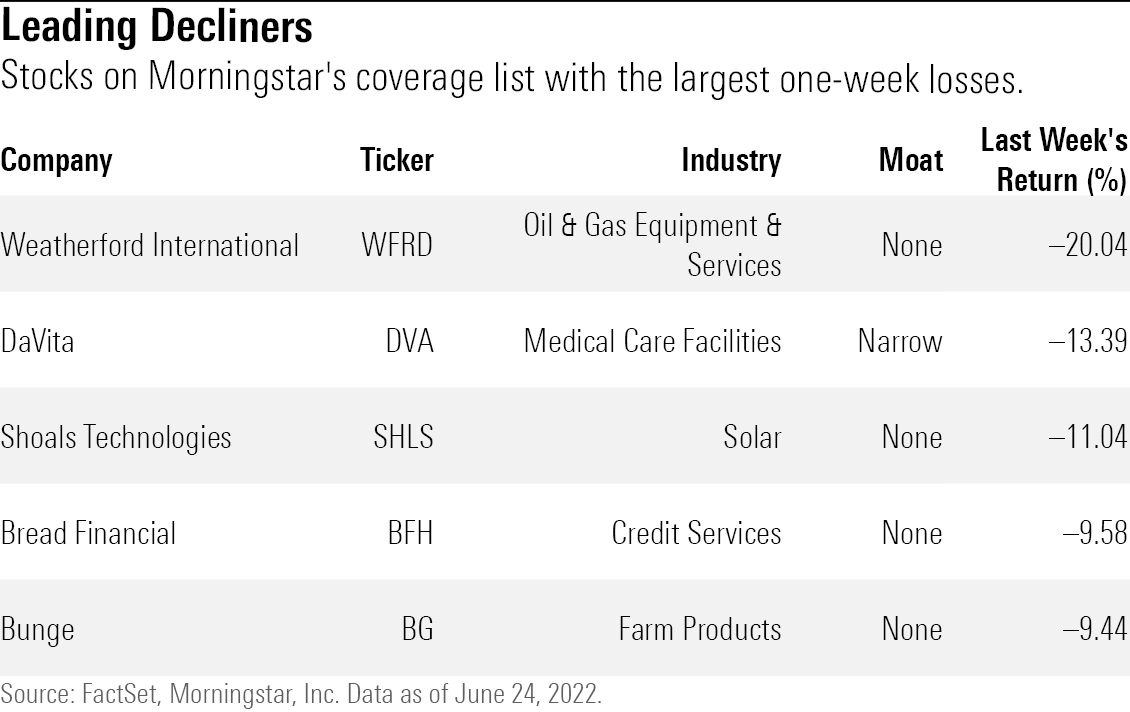

What Stocks Are Down?

The worst-performing companies in the past week were Weatherford International WFRD, DaVita DVA, Shoals Technologies SHLS, Bread Financial BFH, and Bunge BG.

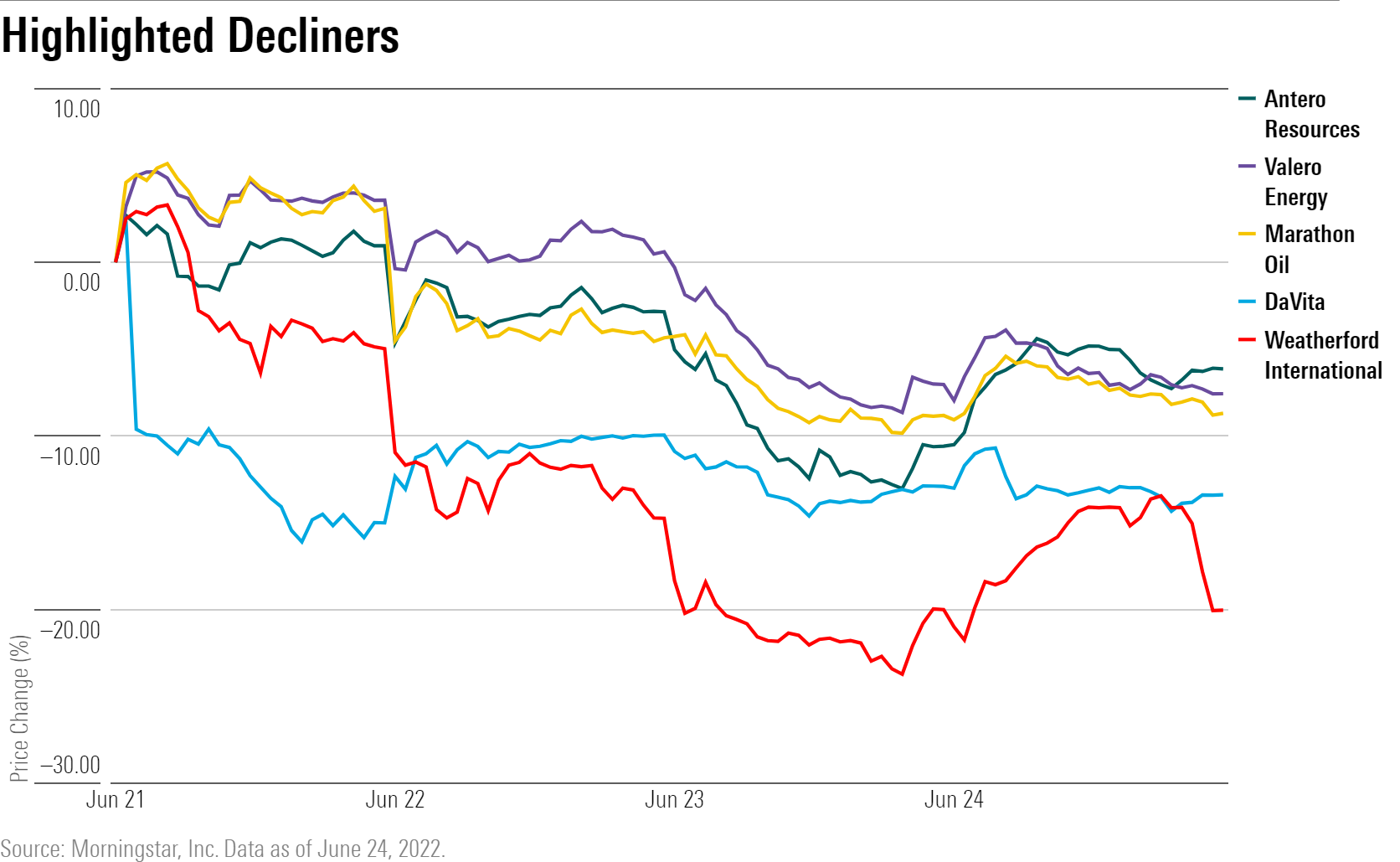

Declining oil and gas prices sent energy companies lower. Weatherford International led in losses. Shares of Antero Resources AR, Marathon Oil MRO, and Valero Energy VLO also closed the week lower.

Shares of DaVita, the largest provider of dialysis services in the United States, fell after the Supreme Court allowed Marietta Memorial Hospital to keep DaVita out-of-network. The decision could lead to insurers to push outpatient dialysis services out-of-network for all plan members, according to Morningstar senior equity analyst Julie Utterback.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)