Stock Fund Managers Are Still Playing It Safe With Cash

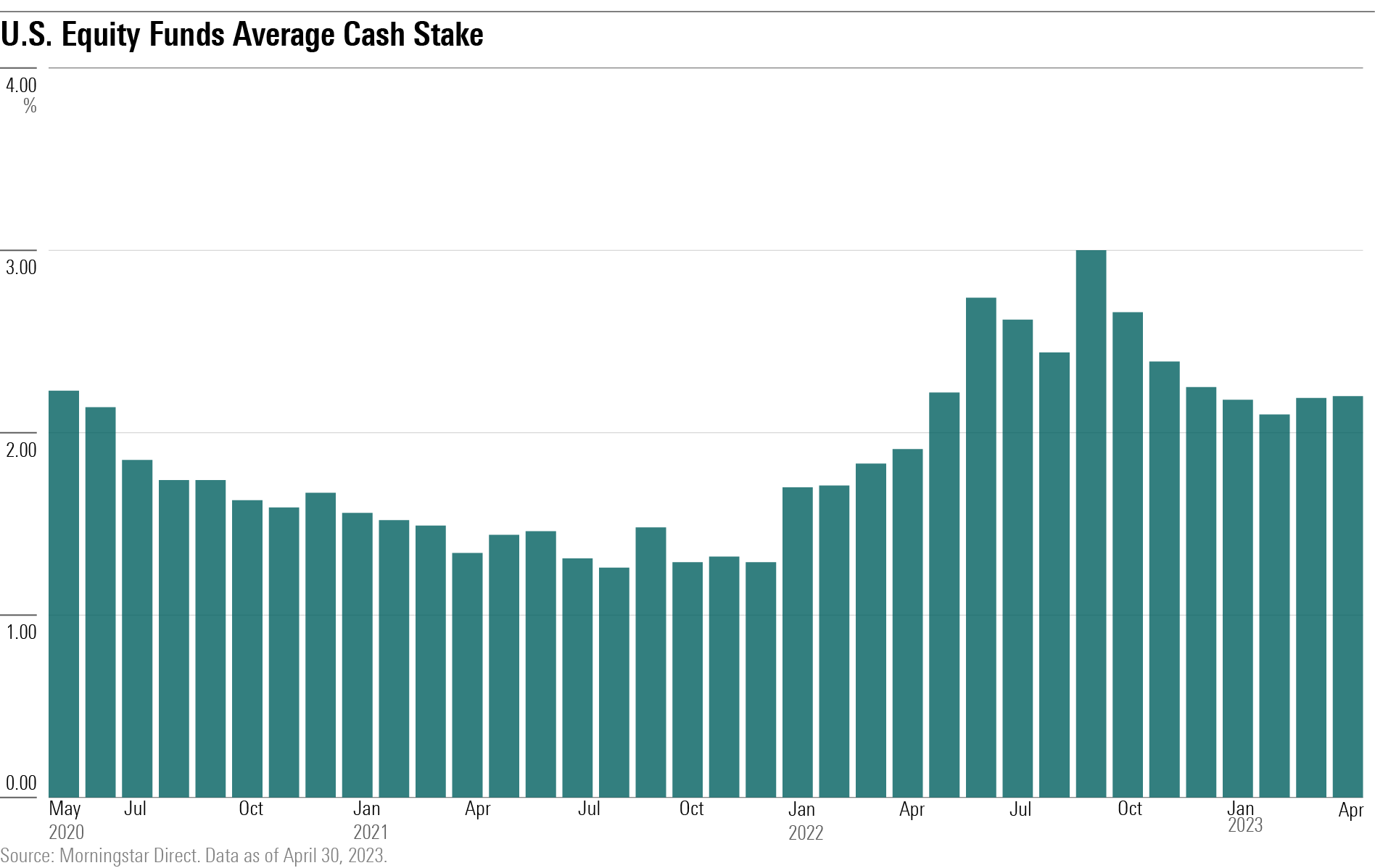

U.S. stock funds are still holding higher-than-usual cash stakes, though those stakes are down from their September peak.

While many appear to think the worst of the bear market in stocks is over, plenty of fund managers continue to play defense.

That cautious posture can be seen in the cash holdings among U.S. stock funds, which remain higher than usual, albeit down from where they were during the worst of the selloff last year.

The average weighting for cash in U.S. equity funds was 2.3%, based on the holdings data available in Morningstar Direct as of March 31, 2023. That’s down from a bear-market peak average of 3% set in September 2022 but still above the 1.9% average for the past five years. September had the highest average since March 2020, when cash levels reached a 3.1% average amid the pandemic-driven stock market collapse.

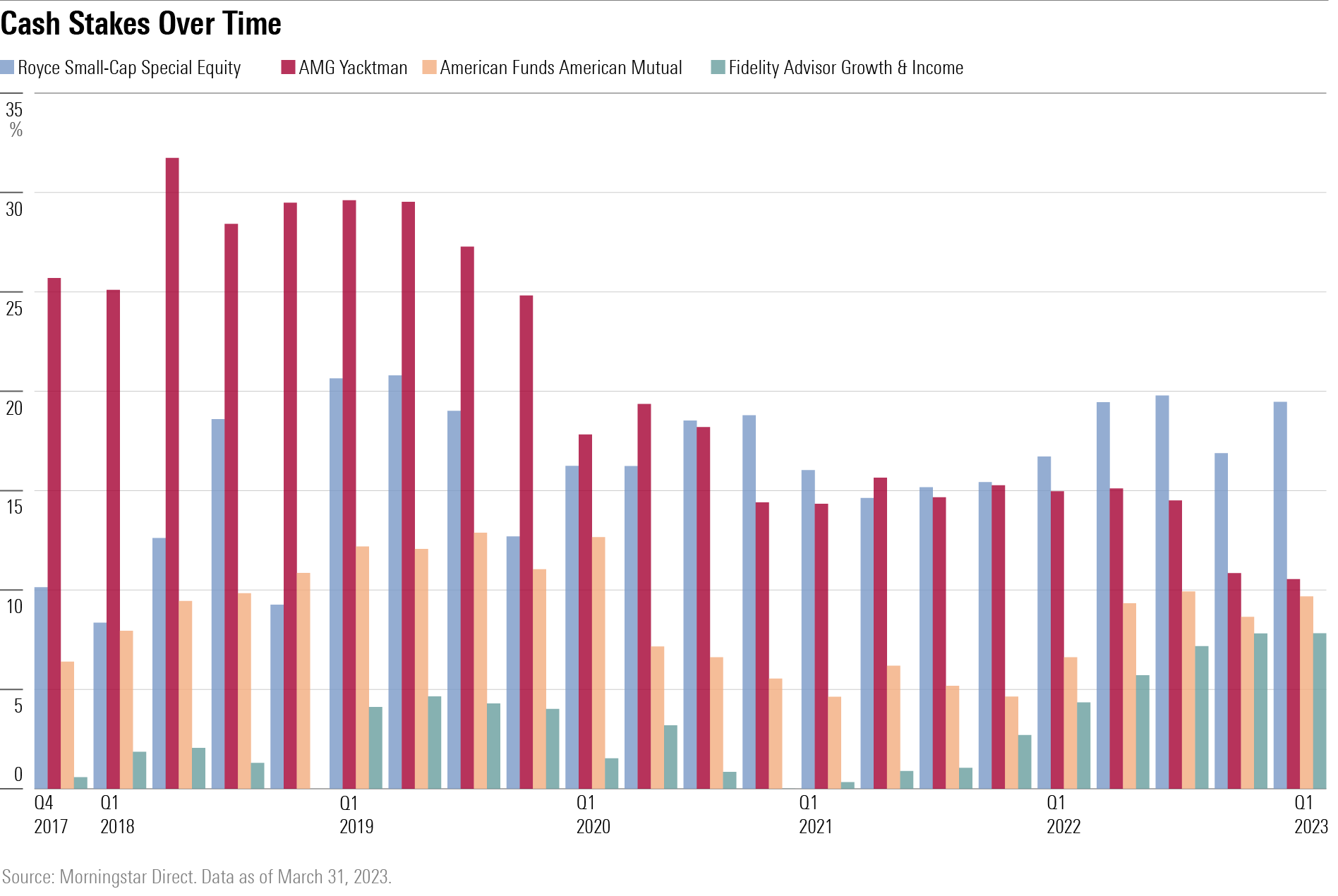

Managers have added to their cash stakes in some widely held funds, including American Funds American Mutual RMFGX and Fidelity Advisor Growth & Income FGIZX.

Holding more cash in a portfolio can help shelter investors against a downdraft, give the managers dry powder to buy beaten-down stocks, and make it easier to meet any shareholder redemptions that might come in.

Some managers are more active when raising or lowering cash levels, but many stock funds tend to hold little cash. “Many managers don’t hold a ton of cash because investors often prefer for managers to own stocks rather than pay them an active management fee to hold significant amounts of cash,” says Morningstar director of equity strategies Katie Reichart.

Another reason many managers don’t hold cash is that doing so requires trying to time the market’s ups and downs. Cash can be a ballast in down markets, but it can cause funds to lag when markets rebound.

For large-growth funds—which are up an average of 12.6% in 2023 through May 12—holding more cash has potentially hampered performance. But for small-value funds—which are down an average of 3.3%—more cash could benefit investors.

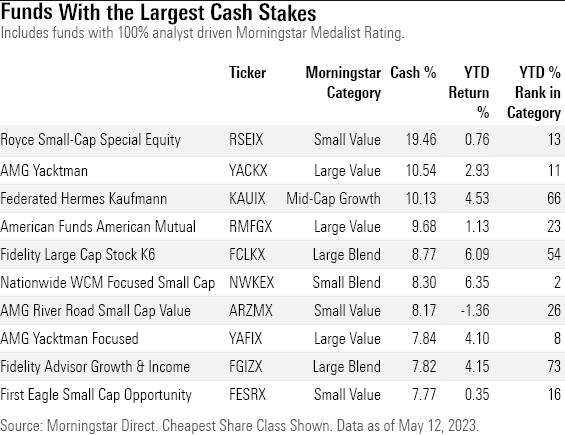

Funds With Large Cash Weightings

One of the largest value funds, $87.7 billion American Funds American Mutual, held 9.7% in cash as of March 31, 2023. Cash is its largest holding, ahead of its top equity position, which is a 3.7% weight in Microsoft MSFT.

American Mutual’s managers started increasing their cash allocation in 2022. The fund began the year with 4.6% of its portfolio in cash and ended 2022 with nearly 10% in cash. Over the past five years, the fund has held on average 8.6% of its portfolio in cash.

“It is typical for the fund to hold around 5% in cash, if not more,” says Morningstar senior analyst Stephen Welch.

American Mutual has a high bar for what gets into the fund, according to Welch. The managers look for attractively valued dividend payers. Stocks trading at stretched valuations at the beginning of 2022 and economic uncertainty later in the year could have contributed to the managers’ decision to hold more cash, he says.

The $958 billion Fidelity Advisor Growth & Income has 7.8% of its portfolio in cash. That’s up from 7.2% at the end of 2022 and just 2.7% at the beginning of last year. Cash now outweighs its stake in Exxon Mobil XOM, its largest equity holding.

For some managers, holding on to cash has been a permanent strategy. The $756 million Royce Small-Cap Special Equity’s RSEIX cash stake has hovered around 15% over the past five years. The fund recently increased its cash stake to nearly 20%.

“When [Royce’s Charlie] Dreifus and [Steven] McBoyle cannot find bargains, they are not afraid to sit on cash,” writes Morningstar editorial director Dan Culloton. “The portfolio’s cash balance often reaches double digits, creating a buffer in downturns but a drag when stocks rise.”

Royce has had one of the best down-market capture ratios (a fund’s performance measured against an index in down markets) among all U.S. equity funds since the start of the bear market on Jan. 3, 2022.

Another long-term holder of cash, $8 billion AMG Yacktman YACKX, decreased its stake in recent months. It held around 15% during 2022, but as of March 31 held only 10.5%—its lowest since 2011.

Cash can build up in the Yacktman portfolio when stocks get expensive, sometimes reaching 20%-30% of assets, writes Morningstar senior analyst Adam Sabban. “But when markets sell off and buying opportunities abound, the managers will put cash to work and increase holdings in more cyclically exposed sectors such as industrials, energy, and financials,” he explains.

Mixed Impact on Performance

For funds that invest in value stocks, holding cash may have been a bigger benefit this year. Value stocks have posted losses for the year; small-value indexes are down around 6.7%, while large-value indexes are down only 0.3% in 2023 through May 12.

The six value funds that hold the most cash all rank in the top half of their category this year. The two large-blend funds with the largest cash stakes also lag in their category, where the average fund is up 6.3% this year.

But for funds that invest in growth stocks (especially large-growth stocks, which are up around 20% in 2023), cash hasn’t had as strong a benefit, according to data from Morningstar Direct.

Federated Hermes Kaufmann KAUIX holds around 10% of its portfolio in cash and has lagged in the mid-cap growth category. It’s only advanced 4.6%, while the average fund in its category is up 5.1% this year.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)