Markets Brief: There's Good News In Fed Rate Hikes

Another rate hike is in sight, but that's good for savers. Chinese stocks Pinduoduo, JD.com bounce. Tesla, Amazon shares slide.

It’s been a very rough first four months of 2022 for investors. Stocks and bonds are posting significant losses, due in large part to the Federal Reserve shifting gears toward a much, much more aggressive path for raising interest rates to cool off the economy and get inflation under control.

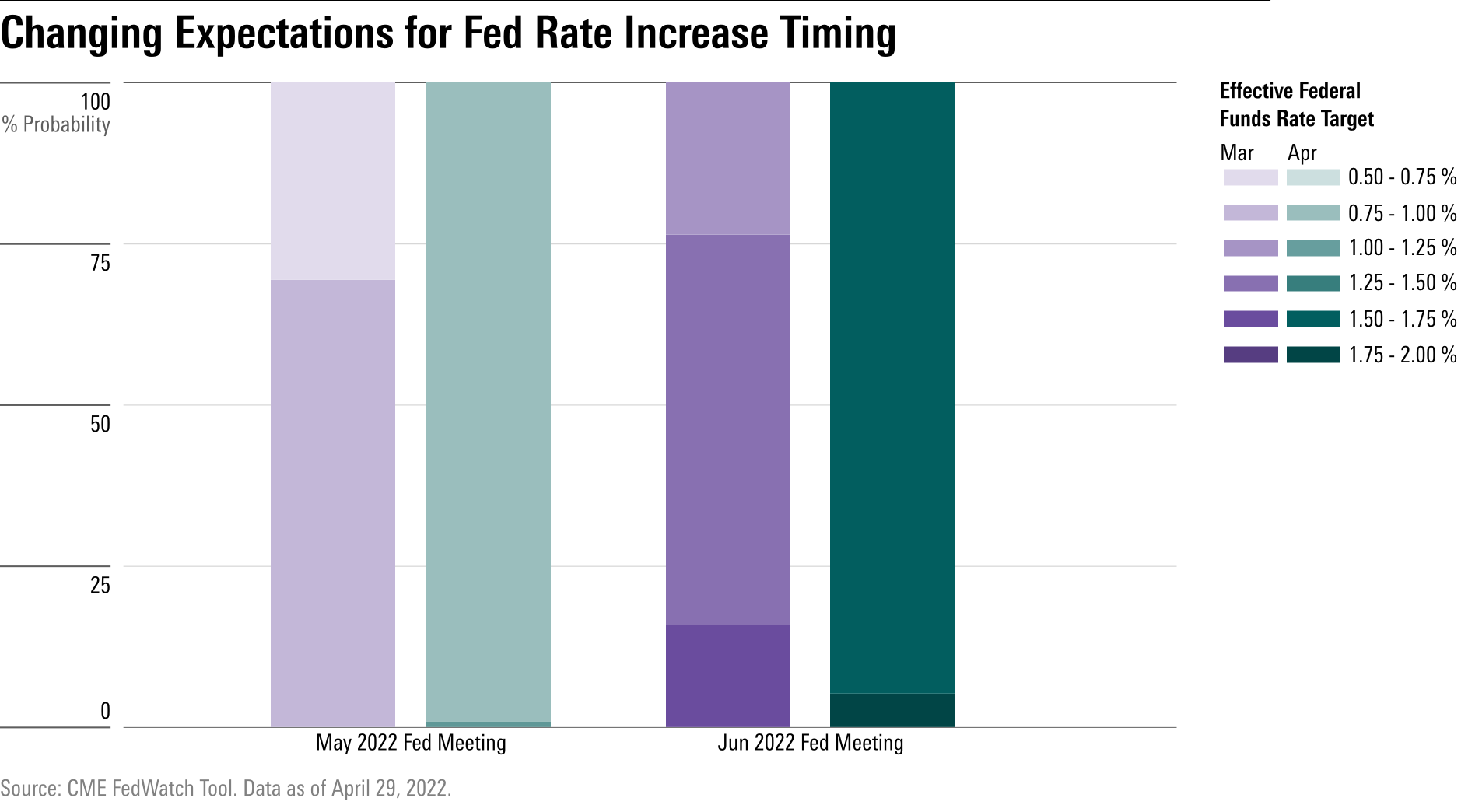

The central bank’s policy-setting Federal Open Market Committee will hold its next meeting in the coming week. Fed Chair Jerome Powell signaled that a 0.50-percentage-point increase in the federal-funds rate is a likely outcome. That kind of move is rare: It’s been 22 years since the last half-point rate hike. Bond futures are also signaling that a 0.75-percentage-point increase could be on the way in June. The last time rates were hiked that much was in 1994.

While expectations for these kinds of aggressive rate increases have been responsible for the red in investors’ portfolios, it’s not all bad, says Ashish Shah, chief investment officer for public investments at Goldman Sachs Asset Management.

“We’ve now gone two years getting paid nothing for cash, and you’re finally going to start earning money for cash in money market accounts and money market funds,” Shah says. While the talk is all about how the Fed will be raising the funds rate, financial markets have preceded the Fed by offering higher yields.

For example, U.S. Treasury 2-year notes are now yielding 2.7%, and 6-month U.S. Treasury bills are yielding 1.4%. Meanwhile, the average 7-day yield on taxable money market funds is 0.13%, according to Morningstar Direct.

And with the Fed embarking on an aggressive series of interest rate increases, even cash accounts could be yielding close to 2% in just a few months. “By the end of the summer, the rate environment is going to look completely different,” Shah says. “For people with cash around, it’s time to look at that cash and ask the question of where to get the best rates.”

For the markets, one key to this coming week’s FOMC meeting will be Powell’s assessment of the outlook for inflation. One worrisome sign came Friday with the release of the Fed’s favored inflation indicator, the Commerce Department’s personal-consumption expenditures price index. The report showed consumer prices rose 6.6% in March from a year before, and up from February’s revised 6.3% increase. The March increase was the fastest seen since January 1982.

Jan Nevruzi, a strategist at NatWest Markets, says that the 0.5-percentage-point fund rate increase appears to be set in stone, as well as details from the Fed on how it plans to wind down its holdings of bonds that were purchased as a way to keep rates low and support the economy during the pandemic-triggered recession.

But where the Fed heads in the future will depend on the confidence it has in the inflation outlook, Nevruzi says. “How confident is Powell that inflation has reached a peak?” says Nevruzi. And from there, how confident is the Fed that inflation will fall meaningfully by the end of the year? “If inflation doesn’t end up coming down, they will be increasing the pace of tightening even further.”

In addition to the FOMC meeting, the week will also bring the latest reading on the labor market, another factor in the Fed’s push to raise interest rates. The U.S. economy is forecast to have added 375,000 jobs in April, which would follow a 431,000 increase reported for March.

Events Scheduled for the Coming Week Include:

- Tuesday: Pfizer PFE and Paramount PARA report earnings. Federal Reserve meeting begins.

- Wednesday: Uber UBER and Energy Transfer ET report earnings. Federal Reserve meeting concludes.

- Thursday: Marathon Oil MRO reports earnings.

- Friday: Bureau of Labor Statistics to release April's employment data.

For the Trading Week Ending April 29:

- The Morningstar US Market Index fell 3.32%.

- The best-performing sector was basic materials, but it still fell 1.06%.

- The worst-performing sector was consumer cyclical, down 6.59%, and real estate, down 5.19%.

- Yields on the U.S. 10-year Treasury note fell slightly to 2.89% from 2.90%.

- Oil prices rose $2.62 to $104.69 per barrel.

- Of the 868 U.S.-listed companies covered by Morningstar, 155, or 18%, rose and 713, or 82%, fell.

What Stocks Are Up?

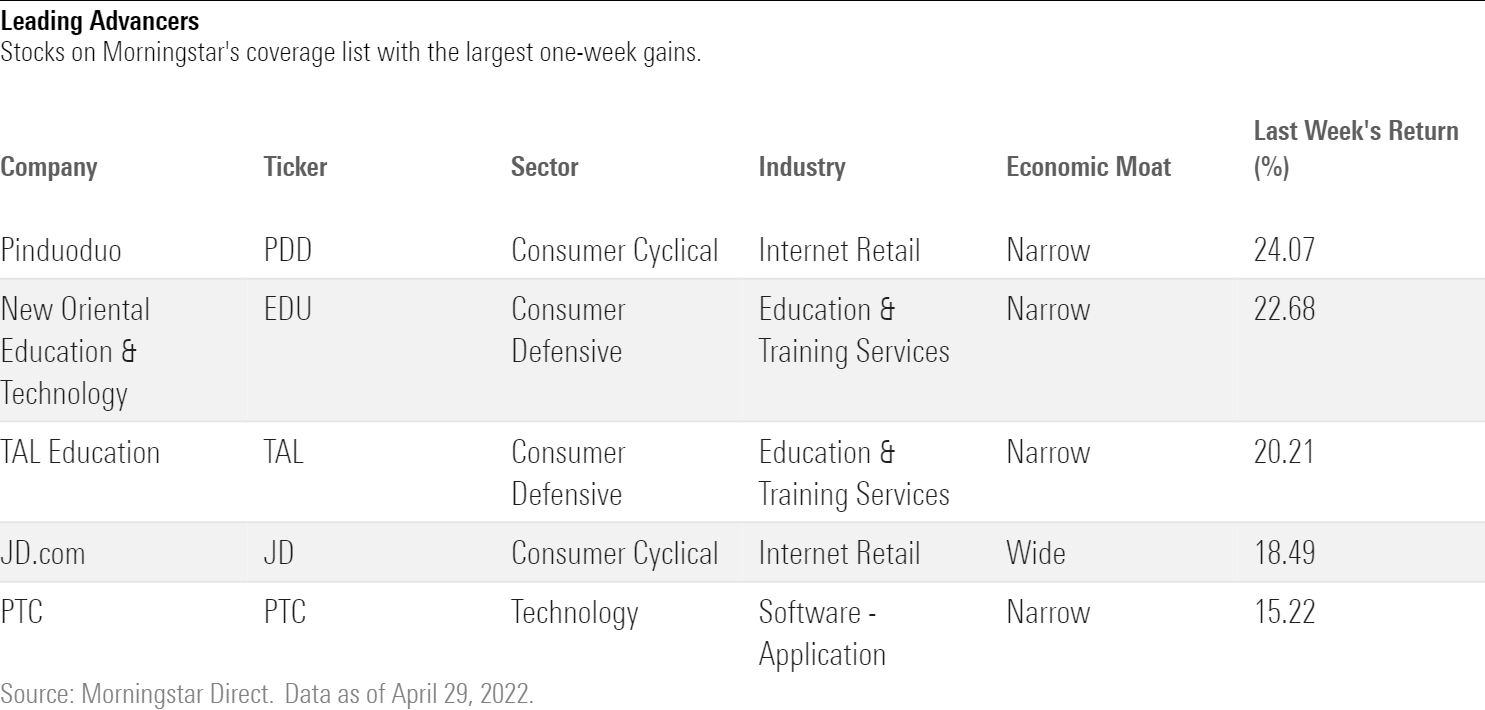

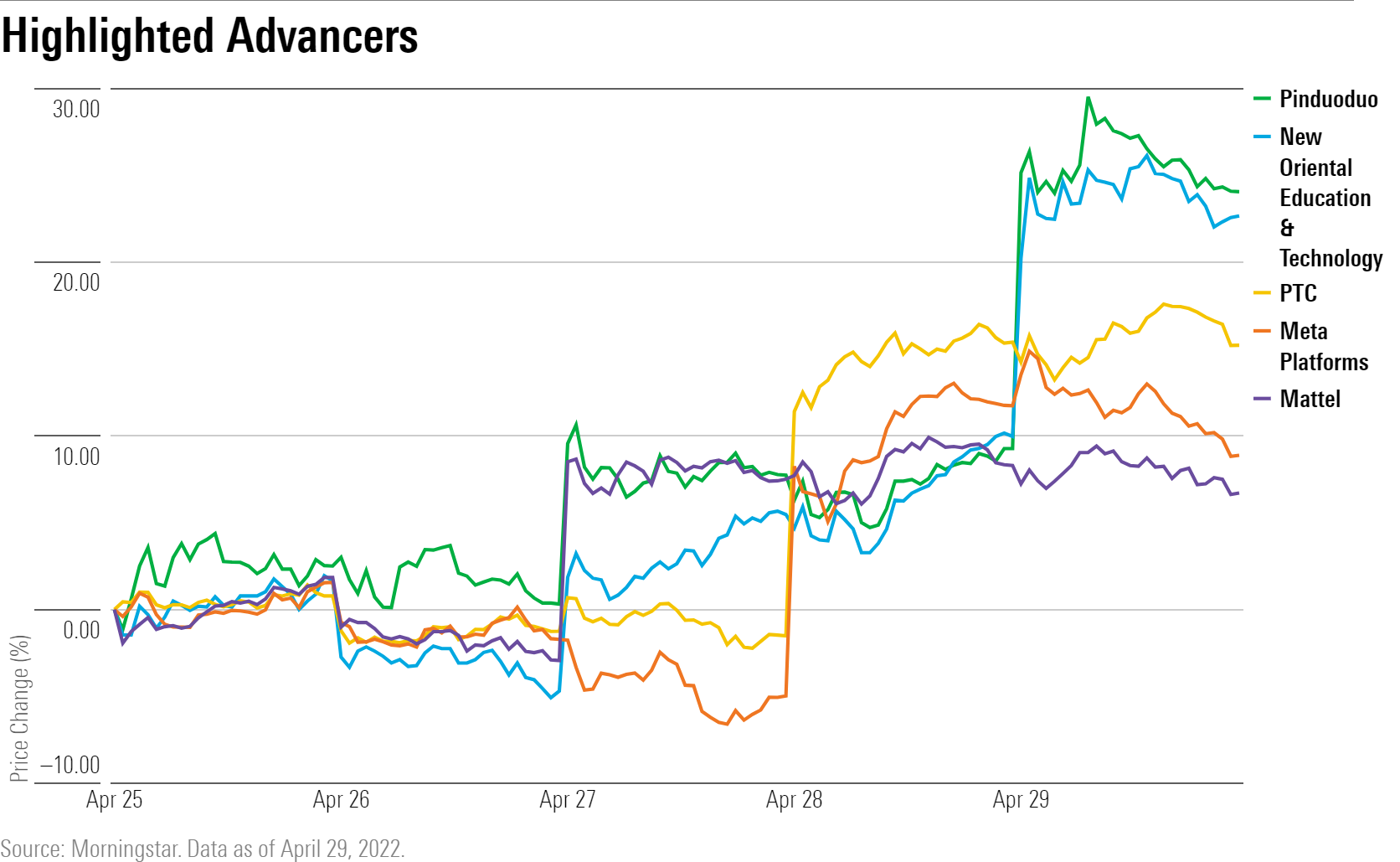

The best-performers last week were Pinduoduo PDD, New Oriental Education & Technology EDU, TAL Education TAL, JD.com JD, and PTC PTC.

Chinese ADR-listed stocks rallied after regulators prepared to slow down their campaign against technology companies, The Wall Street Journal reported. Shares of Pinduoduo, New Oriental, TAL Education, JD.com, Alibaba BABA, and Baidu BIDU rallied on Friday in response.

Strong earnings results also lifted PTC, Sherwin-Williams SHW, Avnet AVT, and Mattel MAT. Mattel has been in talks with private equity firms and may be taken private, the Journal reported.

Meta Platforms FB shares jumped despite posting mixed earnings results. The social-media company reported revenue that was lower than expected but saw an uptick in active users.

What Stocks Are Down?

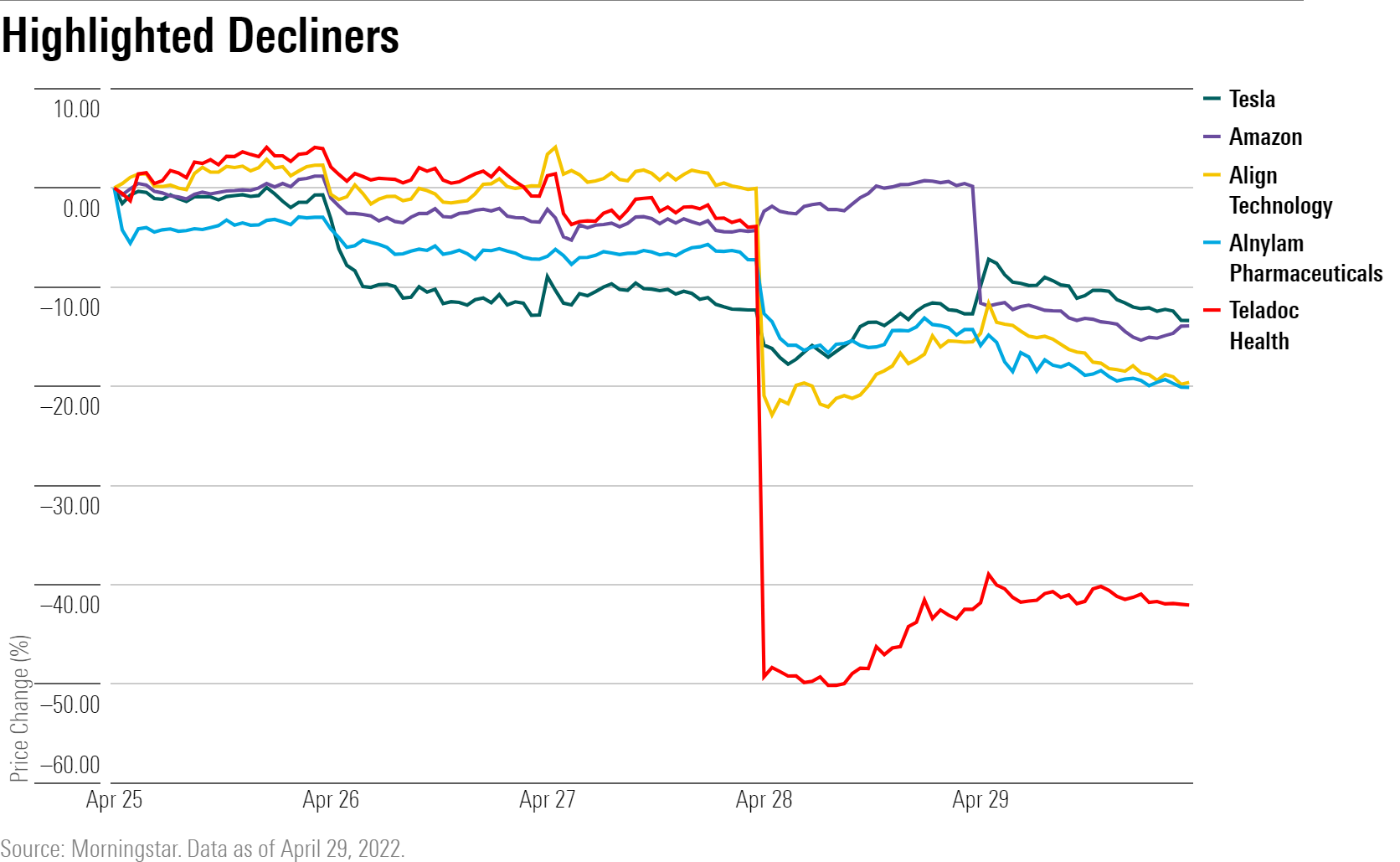

The worst performers last week were Teledoc Health TDOC, Bed Bath & Beyond BBBY, Alnylam Pharmaceuticals ALNY, Align Technology ALGN, and Altice USA ATUS.

Healthcare stocks led in losses, with Teledoc shares falling after the company cut its outlook for 2022, and both revenue and earnings per share for the first quarter missed Wall Street's estimates. Alnylam Pharmaceuticals and Align Technology also closed lower after missing revenue and EPS estimates.

Amazon.com AMZN slid after the company reported losses for the first time in seven years. The online retailing giant also released lower-than-expected guidance for the second quarter.

Tesla TSLA declined after chief executive and founder Elon Musk and Twitter TWTR reached a deal to take the social-media company private. The deal is partially financed through a margin loan, which could force Musk to sell Tesla shares should its stock price fall past a certain level.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_eae1cd6b656f43d5bf31399c8d7310a7_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)