Markets Brief: All Eyes On Inflation

Plus: are stocks rallying on sentiment or fundamentals?

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

CPI In Focus

With a busy week ahead for economic data, investors will likely focus on inflation, with the latest reading on producer prices released on Tuesday and the Consumer Price Index coming on Wednesday. Annual core CPI, which excludes volatile food and energy prices, is expected to fall from 3.8% to 3.6%. A higher number would challenge the dominant narrative among investors that inflation is falling (albeit at a slower rate than most hoped) and could lead to volatility in asset prices. However, a single data point is of little use when estimating the returns of an asset class, and therefore is more likely to be a snare than an opportunity.

Investor Sentiment to the Fore

Last week was light on data but heavy on comments by Federal Reserve officials. The Morningstar US Market Index rose 1.85% and bond yields fell as investors were reassured about future interest rates. This provides a great example of how important investor sentiment is for asset prices over short periods. Separating changes in sentiment from the fundamental attractiveness of an asset is one of the key challenges of investing, as the former can trigger behavioral biases and encourage poor decisions.

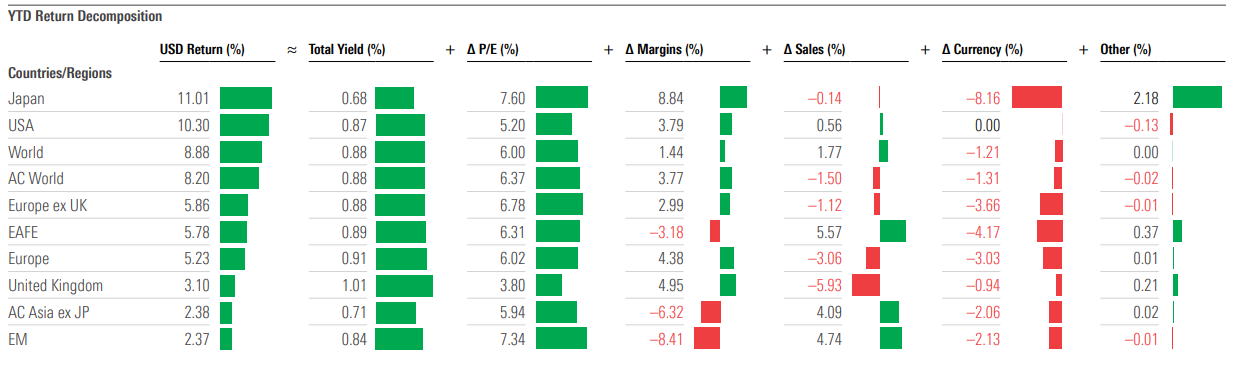

The influence of sentiment can be seen when breaking down global equity markets into their constituent components. During the first quarter of the year, 50% of the returns in US equities came from positive sentiment, as expressed by a rise in their price/earnings ratio, rather than the fundamental returns of those businesses (profit margins, sales, and the return of capital to shareholders).

Equity Return Breakdown

While sentiment may continue to improve, driving stock prices higher, this element of a portfolio’s value can disappear if investors become gloomier in their prognosis. However, this is not a reason to change investment strategy, as this value will likely be rebuilt, providing the asset’s price does not significantly exceed its fair value. To dig into this further, read our quarterly Markets Observer.

Investing In an election year

The US general election will likely be a key driver of sentiment this year. Research by Morningstar Wealth illustrates the importance of remaining focused on the long term, ignoring the politically driven forecasts that will become a bigger part of the news cycle as the year progresses.

Highlights of This Week’s Market and Investing Events

- Tuesday, May 14: April Producer Price Index report, earnings from Alibaba BABA, Home Depot HD

- Wednesday, May 15: April Consumer Price Index report

- Thursday, May 16: Earnings from Baidu BIDU, Walmart WMT

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

Stats for the Trading Week Ended May 10

- The Morningstar US Market Index rose 1.81%.

- The best-performing sectors were utilities, up 3.87%, and financial services, up 3.00%.

- The worst-performing sector was consumer cyclical, down 0.45%.

- Yields on 10-year US Treasury notes remain unchanged at 4.50%.

- West Texas Intermediate crude prices fell 1.63% to $78.35 per barrel.

- Of the 703 US-listed companies covered by Morningstar, 519, or 74%, were up, four were unchanged, and 180, or 26%, were down.

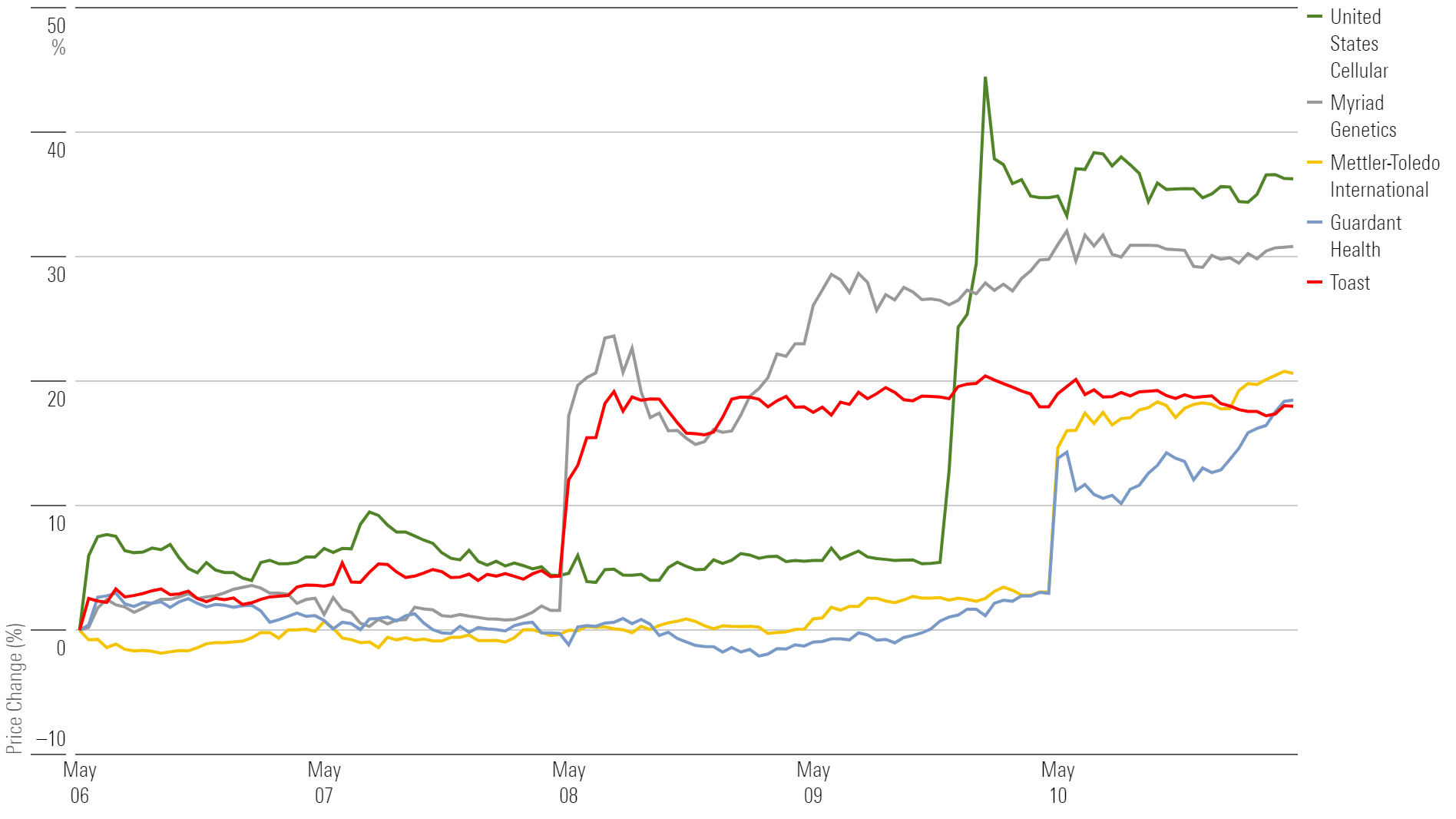

What Stocks Were Up?

United States Cellular USM, Myriad Genetics MYGN, Mettler-Toledo International MTD, Guardant Health GH, and Toast TOST.

Best-Performing Stocks of the Week

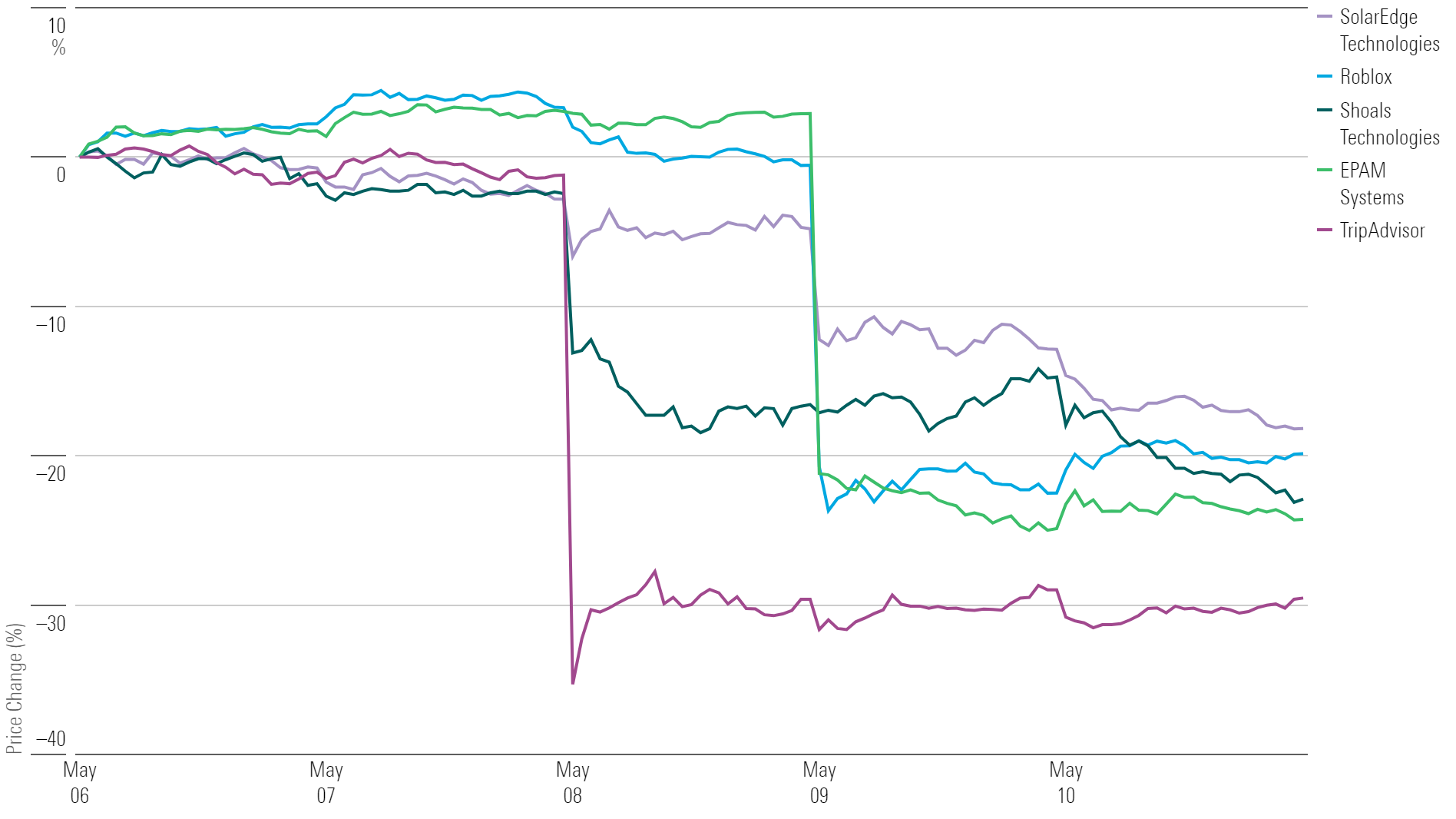

What Stocks Were Down?

TripAdvisor TRIP, EPAM Systems EPAM, Shoals Technologies SHLS, Roblox RBLX, and SolarEdge Technologies SEDG.

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K4RTVRPKCVFQBMRNMXPUOHFNLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7WLK3HWLZBFR7NKI45PXWUD6OI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JV5GNFK7INFYLNC3OMNHOPTWTI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)