5 Undervalued Stocks That Crushed Earnings for Q1 2024

Lyft, Pfizer, and Lazard are among those that are still cheap despite impressive earnings beats.

Amid an overall positive earnings picture for the first quarter, many US companies are beating estimates. Combining the results of firms in the Morningstar US Market Index that have reported earnings with the analyst expectations for those still yet to publish, earnings are on track to grow 4.7% from the fourth quarter of 2023.

At the same time, over half of the US-listed stocks covered by Morningstar that reported earnings as of May 23 beat FactSet consensus estimates by 5% or more. Even better for investors looking to put their money to work, analysts believe some of these stocks remain undervalued.

To highlight these opportunities, we ran a screen for undervalued stocks that crushed expectations for earnings and revenue for the quarter. More details on our screen and comments on the stocks from Morningstar analysts can be found later in this article.

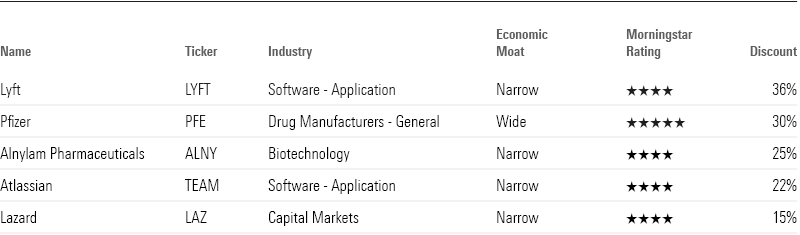

5 Undervalued Earnings Crushers

How Do First-Quarter Earnings Stack Up?

As of the time of writing, 88% of the 875 US-listed stocks covered by Morningstar analysts have reported earnings. Of those, 54% beat the FactSet mean estimates for their earnings by 5% or more—an uptick compared to the 47% that beat their mean earnings estimates by the same amount last quarter. About 16% missed earnings estimates by 5% or more—a decrease compared to the 19% that missed earnings estimates by the same amount in the fourth quarter of 2023.

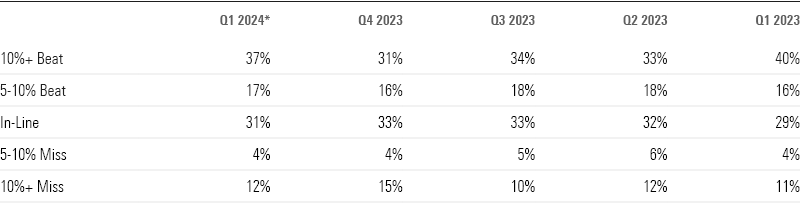

Quarterly Results for US-Listed Stocks Covered by Morningstar

More companies beat estimates by 10% or more—37%, versus 31% in the fourth quarter. About 17% surpassed expectations by 5%-10%, a slight increase from the 16% that did so in the fourth quarter.

There were also fewer earnings misses, with 12% of companies reporting earnings 10% or more below estimates—down from 15% in the fourth quarter. An additional 4% reported earnings 5%-10% below FactSet estimates, the same percentage as last quarter.

How We Did Our Stock Screen

While Morningstar analysts pay close attention to earnings, they focus on long-term results and valuations. One quarter doesn’t usually lead to a change in a stock’s fair value estimate unless new material information affects the assumptions behind that valuation. For example, new data on a drug could raise the probability of its approval, or pricing gains on a key product line could affect an analyst’s long-term thinking. Still, looking at quarterly earnings with valuations in mind can help long-term investors identify opportunities.

We screened for stocks that beat earnings expectations by 15% or more but remain undervalued. To help keep the focus on companies with truly strong results that did not beat expectations through accounting gimmicks or one-time factors, we also screened for revenue beats of 5% or higher. We filtered those results for stocks with economic moats and a Morningstar Rating of 4 or 5 stars.

Of the 875 US-listed stocks covered by Morningstar analysts, only five companies met the criteria. We’ve highlighted what our analysts had to say about their earnings below.

5 Undervalued Stocks That Beat Earnings Estimates

Lyft

- Earnings Per Share: Gain of $0.15 versus the consensus estimate of $0.07

- Revenue: $1.3 billion versus the consensus estimate of $1.2 billion

- Morningstar Rating: 4 stars

- Discount: 36%

“We are maintaining our $25 per share fair value estimate for narrow-moat Lyft, and believe shares remain undervalued. Gross bookings increased 21% year over year, ahead of guidance, while adjusted EBITDA was also impressive, coming in at $59.4 million compared with the high end of guidance of $55 million. Full-year guidance was reaffirmed, and the expected full-year percentage of EBITDA converting to free cash flow was increased to 70% from 50%. As such, Lyft remains well on track to meet our full-year expectations for 17% growth in gross bookings, and improving margins and cash flow generation. We continue to think that Lyft can achieve consistent low-teens revenue growth in the coming years and gradually improve margins and cash generation, becoming free cash flow positive this year.”

“Supporting our view of Lyft’s network effect, as gross bookings continued to grow, the average revenue per user and the net profitability per rider both improved. Lyft is translating a higher percentage of gross bookings into revenue, generating more rides per rider and increasing revenue per rider faster than sales and marketing expenses per rider. We believed the take rate (gross revenue per gross booking) would stabilize for Lyft, and it has, coming in at 35% in the quarter compared with 33% last year.”

“Lyft is seeing solid growth in both Canada and in its relatively new Lyft Media business. We think advertising-related revenue growth is particularly exciting, as it presents another—and high-margin—way to monetize the overall network Lyft is building.”

—Malik Ahmed Khan, equity analyst

Pfizer

- Earnings Per Share: Gain of $0.82 versus the consensus estimate of $0.52

- Revenue: $14.9 billion versus the consensus estimate of $13.9 billion

- Morningstar Rating: 5 stars

- Discount: 30%

“We are holding steady to our fair value estimate and wide moat rating for Pfizer following first-quarter results that largely matched our expectations. The company is tracking well to meet its goal of $4 billion in cost cuts by the end of 2024, which should improve operating margins. We believe the market is underappreciating the margin expansion based on the cost cuts, and we view Pfizer as undervalued.

“Following overinvestment during the pandemic, Pfizer is reducing costs to adapt to the slowing demand for covid products. While we still expect a tail of close to $8 billion annually for Pfizer’s covid vaccine Comirnaty and treatment Paxlovid, this is down from the over $50 billion sold in 2022. Following the cost-cutting, we expect the operating margin to return to the over-30% range more typical of Pfizer before the pandemic.

“On the top line, Pfizer posted 11% operational sales growth, excluding the impact of covid. While the Seagen acquisition accounted for close to half of the growth, we expect Pfizer to continue to post mid-single-digit growth through 2025 before patent losses increase. Importantly, the rare disease drug Vyndaqel (up 66%) is performing well. The drug’s increased entrenchment should bode well ahead of the competitive launch of BridgeBio’s acoramidis, as we expect low drug switching once a patient starts treatment. Cardiovascular drug Eliquis (up 10%) continues to gain share, but we expect intensifying generics to drive declines by 2026. Pneumococcal vaccine Prevnar (up 7%) benefited from the timing of purchases, but we expect pressure to increase as Merck launches a well-positioned competitive vaccine V116 in the adult setting (close to 30% of the market) later this year.”

—Damien Conover, director of equity strategy

Alnylam Pharmaceuticals

- Earnings Per Share: Loss of $0.52 versus the consensus estimate of $1.12

- Revenue: $494 million versus the consensus estimate of $428 million

- Morningstar Rating: 4 stars

- Discount: 25%

“Narrow-moat Alnylam’s robust first-quarter results represent a 32% increase year over year, highlighted by $365 million in net product revenue. Strong demand for its ATTR amyloidosis therapy was the primary driver of this growth. Strong uptake of the next-generation drug Amvuttra (for ATTR amyloidosis with polyneuropathy) is driving sales, accounting for $195 million of the quarter’s revenue. We forecast Alnylam will achieve net product sales of roughly $1.4 billion in 2024, representing a 15% increase from 2023. We maintain our fair value estimate of $199 per share, and we view shares as undervalued, currently trading in 4-star territory about 25% below our fair value estimate.

“Alnylam remains on track to report topline results from the HELIOS-B Phase 3 study of vutrisiran in late June or early July, which could potentially expand its leadership in ATTR amyloidosis. Management previously updated the statistical analysis plan for its HELIOS-B Phase 3 study of vutrisiran in patients with ATTR amyloidosis with cardiomyopathy. Alnylam also added three months to the primary analysis timeframe, changing it from 30 months to 33 months, which will potentially allow it to show a greater difference in cardiovascular events and mortality between its treatment and control arms. Our expected approval timeframe for vutrisiran is in 2026, and we maintain our estimated probability of approval of 45% in our base case.

“While research and development expenses increased by about 13% from the prior-year period, we think these investments will help drive long-term growth by advancing the company’s pipeline. We appreciate Alnylam’s healthy financial position, with cash, cash equivalents, and marketable securities totaling $2.37 billion as of quarter-end, which should provide Alnylam with the resources to support its growth initiatives and maintain a competitive edge.”

—Rachel Elfman, equity analyst

Atlassian

- Earnings Per Share: Gain of $0.89 versus the consensus estimate of $0.62

- Revenue: $1.2 billion versus the consensus estimate of $1.1 billion

- Morningstar Rating: 4 Stars

- Discount: 22%

“Narrow-moat Atlassian reported strong third-quarter results, including upside to both our top- and bottom-line expectations. Management also provided good guidance for the fourth quarter. That said, we are maintaining our fair value estimate of $225 per share as we await fiscal 2025 guidance with next quarter’s results. In our view, Atlassian is performing well against its migration roadmap, and we are further encouraged by positive demand trends amid an improving environment. We acknowledge demand issues from smaller customers, though. We are unconcerned about the 6% drop in share price after-hours given the firm’s strong fundamentals and view the stock as attractive.

“We continue to see softness in the smaller customer market but expect an uptick in paid seat expansions as macro conditions improve. Enterprise demand has remained more resilient, which is consistent with the rest of our enterprise software coverage. Third-quarter revenue increased 30% year over year to $1.189 billion, surpassing the high end of guidance. Subscription revenue grew 41% year over year to $1.071 billion, exceeding our expectations. Data center revenue continued to soar, growing 64% year over year to $364 million, driven by migrations from Server, as well as expansion within existing customers. Cloud revenue increased 31% year over year to $703 million, driven by paid seat expansion from enterprise customers.

“We are impressed with the firm’s ability to expand its bottom line, all while investing in its cloud, enterprise, and artificial intelligence products. Non-generally accepted accounting principles operating margin was 26.6% in the quarter, compared with 22.7% in the year-ago period.”

—Dan Romanoff, senior equity analyst

Lazard

- Earnings Per Share: Gain of $0.66 versus the consensus estimate of $0.55

- Revenue: $747 million versus the consensus estimate of $679 million

- Morningstar Rating: 4 stars

- Discount: 15%

“Narrow-moat Lazard reported record first-quarter net revenue, but most investment banking management teams have had a cautiously optimistic tone in their outlook for merger advisory. Lazard reported net income to common shareholders of $38 million, or $0.35 per diluted share, on $765 million of net revenue. Financial advisory revenue was a first-quarter record at $447 million, while asset-management revenue was its highest since the first quarter of 2022. We don’t anticipate making a material change to our $48 fair value estimate. We assess the shares as moderately undervalued.

“Lazard’s performance is unusual because other investment banks that did well in the quarter had revenue boosted by underwriting and trading results, while their financial advisory revenue was relatively muted. Potentially, Lazard by sheer chance had more merger deals close in the first quarter, or its restructuring and liability management revenue is powering results. Lazard is well known for its restructuring business, and management said restructuring revenue in the first quarter was more than 2 times higher than a year ago. If it’s restructuring that’s helping results, then current revenue levels should be more enduring. That said, Lazard’s adjusted compensation ratio in the quarter was 66% compared with a normalized target of less than 60%, which is fairly good evidence that management isn’t confident that revenue can stay near current levels.

“Asset-management revenue trended up to $276 million in the quarter, but that’s only 7% higher than a recent trough of $259 million in the fourth quarter of 2022. Lazard has a global asset-management business, so it hasn’t had as strong of a recovery as asset managers more focused on the US market; the strong US dollar can also weaken its reported results.”

—Michael Wong, director of equity research

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/a8c4d0a1-24c6-4c96-81d6-7bb13a177a1e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a8c4d0a1-24c6-4c96-81d6-7bb13a177a1e.jpg)