How the Largest Bond Funds Performed in Q2

These funds from Vanguard, iShares, and American Funds lagged as rates rose.

After a strong start, the second quarter of 2023 was tough for investors in many of the most widely held bond funds, as rising rates led to poor performance.

During the quarter, bond yields mostly rose as investors anticipated additional interest rate increases, even as the Federal Reserve elected to skip a rate hike at their June meeting. As rates rose, bond prices fell. However, funds with more exposure to lower-quality bonds, such as leveraged loans and high-yield corporate bonds, faired better, although gains were limited.

Q2 Performance for the Largest Bond Index Funds

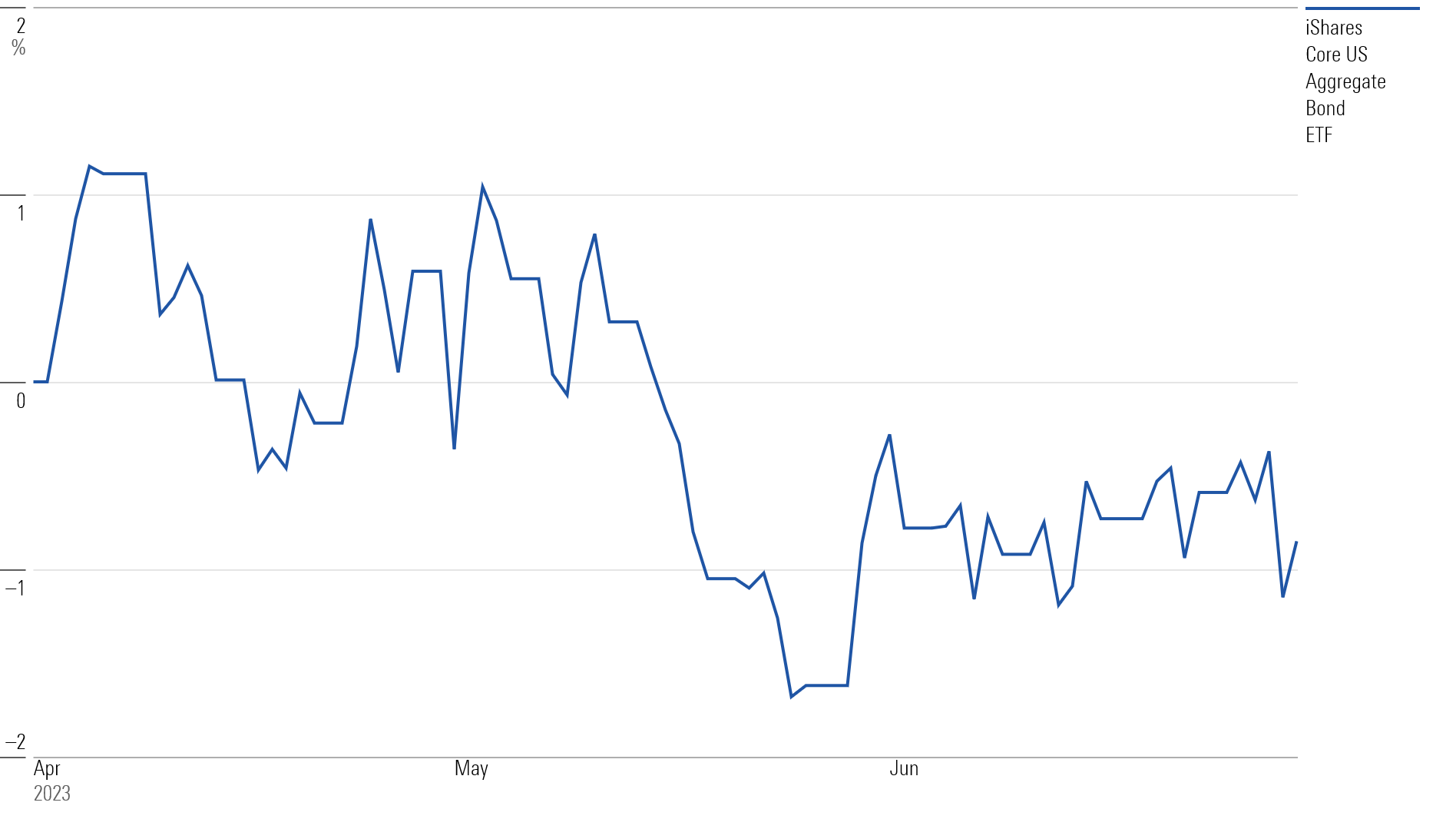

Reflecting those overall trends, the $90.8 billion iShares Core US Aggregate Bond ETF AGG, which tracks an index representing the U.S. investment-grade bond market, ended the quarter down 0.9%. The $248 billion Vanguard Total Bond Market Index VTBSX posted similar results, with a loss of 0.9% for the quarter.

iShares Core US Aggregate Bond ETF Q2 2023 Performance

Funds that promise protection from inflation also suffered. The $21.2 billion iShares TIPS Bond ETF TIP (the largest Treasury inflation-protected bond fund) declined 1.5%. “The fund has a longer duration [a measure of interest rate sensitivity] than the typical TIPS fund,” says associate research analyst Mo’ath Almahasneh. “Its high duration exposure may negate the inflation protection when interest rates rise with inflation.”

Among the largest passive funds, only Vanguard Total International Bond Index VTIFX squeezed out positive returns. The $148.4 billion fund gained 0.2% in the quarter and is up 3.7% for the year to date. As emerging-market central banks start to wrap up a credit tightening cycle, emerging-market bonds have rallied, according to associate analyst Lan Anh Tran. She also says that lower energy prices in Europe have helped bring down core inflation, and an expected end to the European Central Bank’s rate hike cycle has spurred developed market bonds.

Largest Passive Bond Funds Q2 2023 Performance

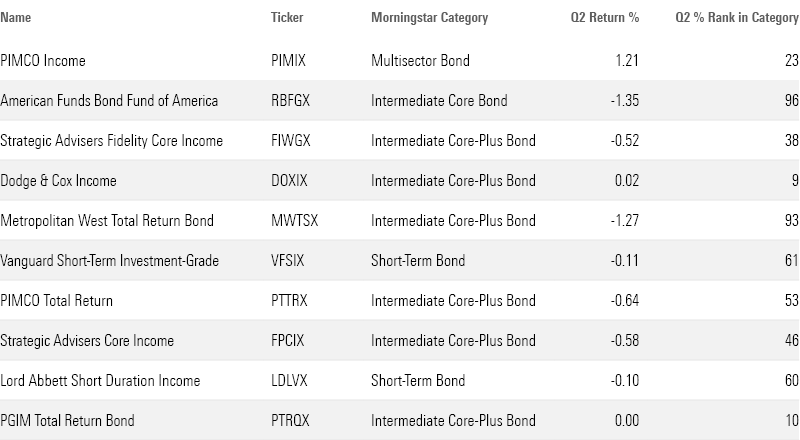

Q2 Performance for Actively Managed Bond Funds

Among the largest active funds, PIMCO Income PIMIX had the strongest quarter. The $121.9 billion fund returned 1.2%, while the average multisector bond fund advanced only 0.5%. The fund carries greater exposure to emerging market bonds than the average multisector bond fund.

Within intermediate core bonds, $75.4 billion American Funds Bond Fund of America RBFGX struggled. The fund carries a slightly longer duration profile than the average fund in its category. It lost 1.4%, putting it in the 96th percentile of intermediate core bond funds. Dodge & Cox Income DOXIX, which eked out a 0.02% gain, was one of the few funds in this group to avoid losses.

On average, short-term bond funds made small gains. The $58 billion Vanguard Short-Term Bond Index VPIPX lagged the category with a loss of 0.1% for the quarter. The fund differs from its peers due to its large stake in corporate bonds, which associate analyst Elizabeth Templeton says can explain differences in performance.

Largest Active Bond Funds Q2 2023 Performance

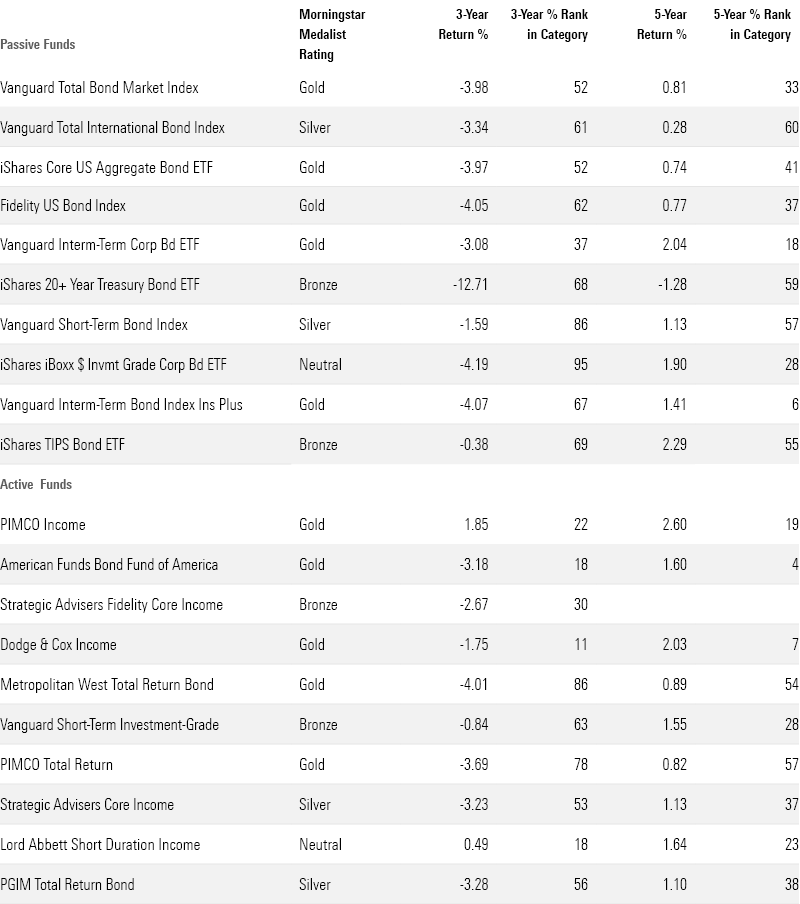

Broadly, the largest bond funds are in the red over the past three years but have had positive results over the past five years.

Among the 20 largest funds, only Pimco Income and Lord Abbett Short Duration Income LDLVX show positive returns since July 2020. Pimco Income is up 1.9% on an annualized basis over the past three years. Meanwhile, iShares 20+ Year Treasury Bond ETF TLT is still down 1.3% on an annualized basis over the past five years.

Long-term Performance of Largest Bond Funds

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)