How Funds With Hidden China Exposure Fared During the Latest Trade-War Sell-Off

Funds with the greatest business ties to China took outsize losses.

This article originally appeared in Morningstar Direct Cloud and Morningstar Office Cloud.

While the late-July stock market sell-off sparked by the latest flare-up of the U.S.-China trade war was short-lived, the depth of the decline was steep. During the downdraft, funds with the greatest business ties to China took outsize losses.

For advisors and investors, this episode highlighted the importance of understanding a portfolio's true exposure to China. The traditional method of evaluating a portfolio's asset allocation is to use a stock's "business country"--such as where the company is headquartered or where its stock is listed--to determine country allocation. However, Morningstar's revenue by region data set allows us to drill down to the revenue streams of underlying companies.

For example, Qualcomm QCOM may be based in the United States, but it derives 66.7% of its revenue from the Asia Emerging region--a revenue stream that is very much in the crosshairs of the trade tussle. Meanwhile, Parnassus Endeavor Investor PARWX has no holdings based in China, yet its revenue exposure to China is near 16%, in part because it has a heavy weighting in Qualcomm. (See this Morningstar Direct story here on hidden foreign exposure in U.S. stock funds. A recent white paper, available to Morningstar Direct clients here, and methodology documents, available here and here, provide more details on how revenue by region works.)

In this sense, revenue exposure by country gives a more bottom-up picture of how geopolitical events can affect a company's business prospects, and ultimately how those same trends can filter through to a portfolio's returns.

For this article, we took a look at the one-week market downturn from July 28 through Aug. 5 to see how returns match up to funds' revenue by region statistics. We focused on diversified emerging-markets funds, foreign large-cap stock funds, and U.S. large-cap stock funds. For all three, we screened out funds with less than a five-year track record. For emerging-markets funds and foreign stock funds, we set a minimum fund size of $225 million, and for the U.S. funds, we set a minimum asset base of $500 million.

Of course, a one-week period is too short a time frame to draw a direct connection between a portfolio's revenue sources and long-term investment returns, but it provides a framework for evaluating a fund's risks.

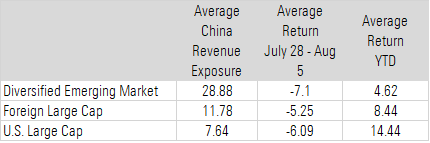

Here's how the week played out in terms of returns for funds in the screen.

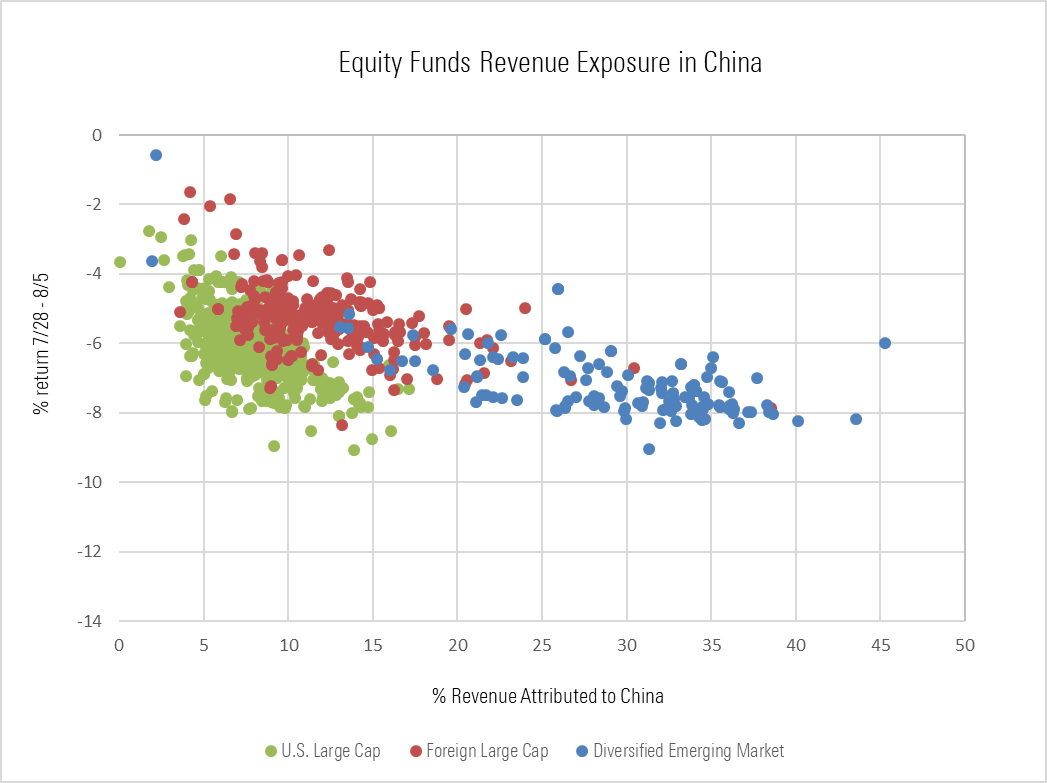

When we looked at the week in question, across all three groups, the more revenue exposure to China, the worst the fund performed during the sell-off.

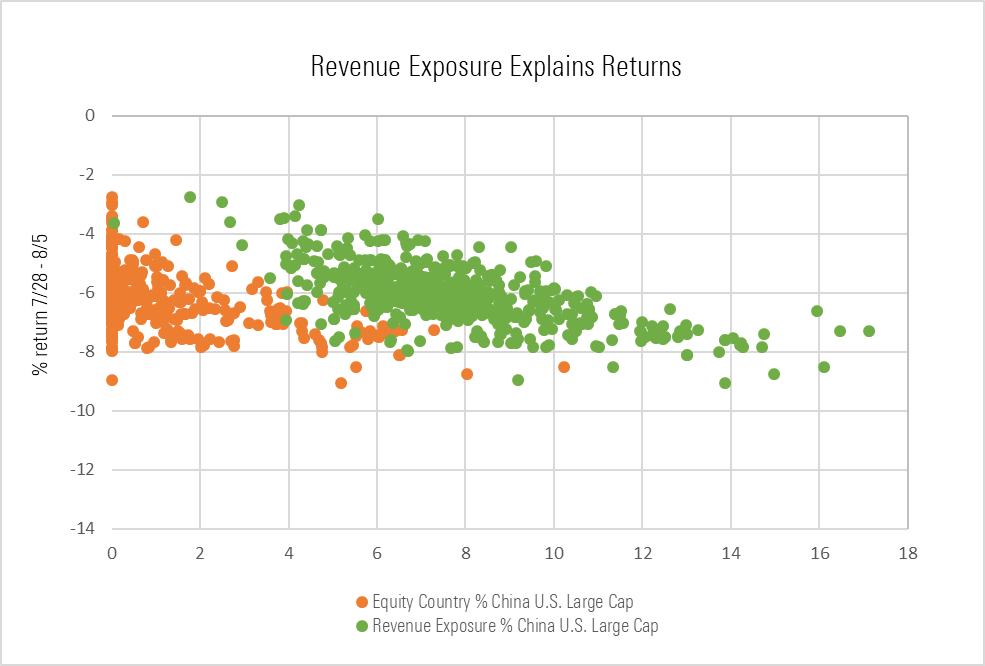

The extent of the difference between business country exposure and revenue exposure by country varies between categories. Emerging-markets stock funds tend to measure up fairly similarly between the two metrics. But foreign stock and U.S. stock funds in many cases show a wide disparity between the two readings, because they will hold mainly companies based in the U.S., but those companies can have significant economic exposure to China.

In our sample, a large number of funds in the U.S. large-cap categories report no China-based holdings. However, the average revenue exposure in China for funds that had no Chinese holdings (orange dots on y-axis) was 7%.

Here's a look at what we found within each group.

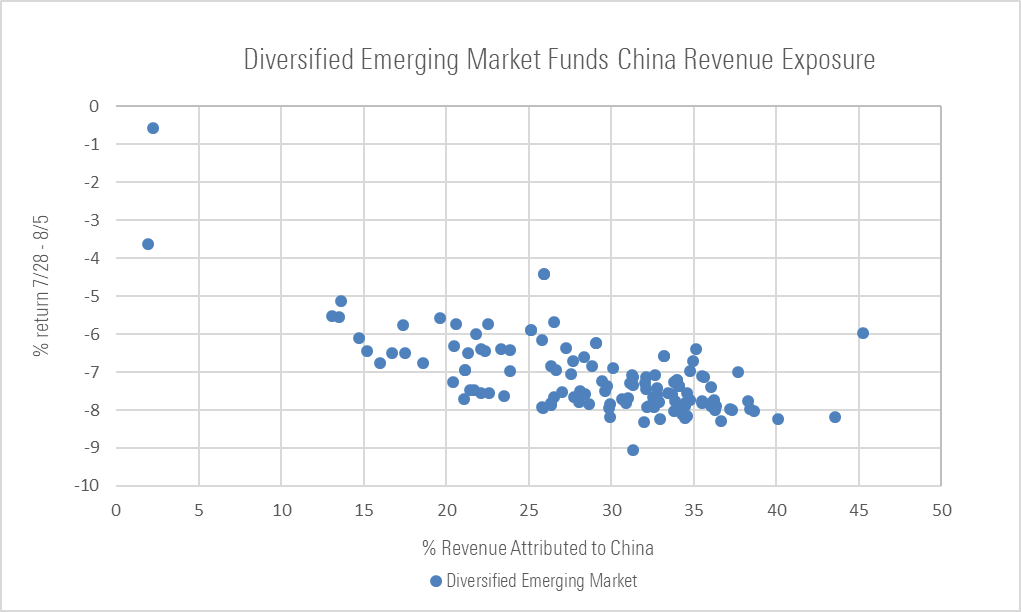

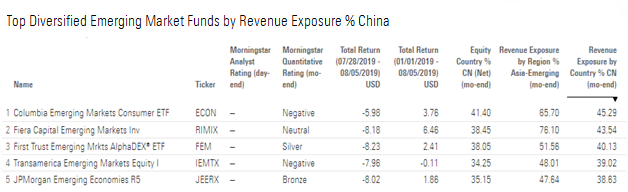

Diversified Emerging Markets Not surprisingly, diversified emerging-markets funds were hit the hardest of the three groups during the week in question, as funds in the category lost an average of 7.1% from July 28 to Aug. 5. Even though diversified emerging-markets funds tend to divide their assets among 20 or more nations, on average, funds in the category have 28.9% of revenue exposed to China. (On a business-country basis, it is 24.8%)

There is some dispersion among return within the category, but as Morningstar analyst Gregg Wolper points out, "If a fund had above 30% of revenue exposed to China, returns plateaued in the past week at around negative 8%. Past 30% the amount of revenue exposed to China didn't tend to depress returns further."

Looking at individual funds, we can see the impact that high China weightings appeared to have on portfolios. Fiera Capital Emerging Markets' RIMIX year-to-date return of 6.5% ranks in the 28th percentile of all diversified emerging-markets funds. In the last week, its 8.2% loss put it in the 95th percentile. The fund carries a revenue exposure to China of 43.5%.

Of course, there are exceptions, such as Columbia Emerging Markets Consumer ETF ECON, which did well despite its large revenue exposure to China. The fund's heavier weightings in consumer-focused stocks and lower weighting in technology stocks may have cushioned the blow.

Among other funds in the category is Causeway Emerging Markets CEMIX, which has a Morningstar Analyst Rating of Bronze. The fund's China revenue exposure has varied relative to the MSCI Emerging Markets Index over time, notes Morningstar analyst Connor Young, but it stood at 32.0% of assets as of June 2019, versus 30.5% for the index. That ranked it 13 out 132 funds. The fund lost 8% in the sell-off week, the 12th worst performance in the diversified emerging-markets category.

Young says Causeway's "quantitative model that drives portfolio decisions is positive on the region for its attractive earnings growth and valuation characteristics. Trade threats pose a risk to the market, but the team notes that it has limited exposure to Chinese firms that export to the U.S. Still, Causeway Emerging Markets Chinese picks have weighed on results during the past 12 months through July."

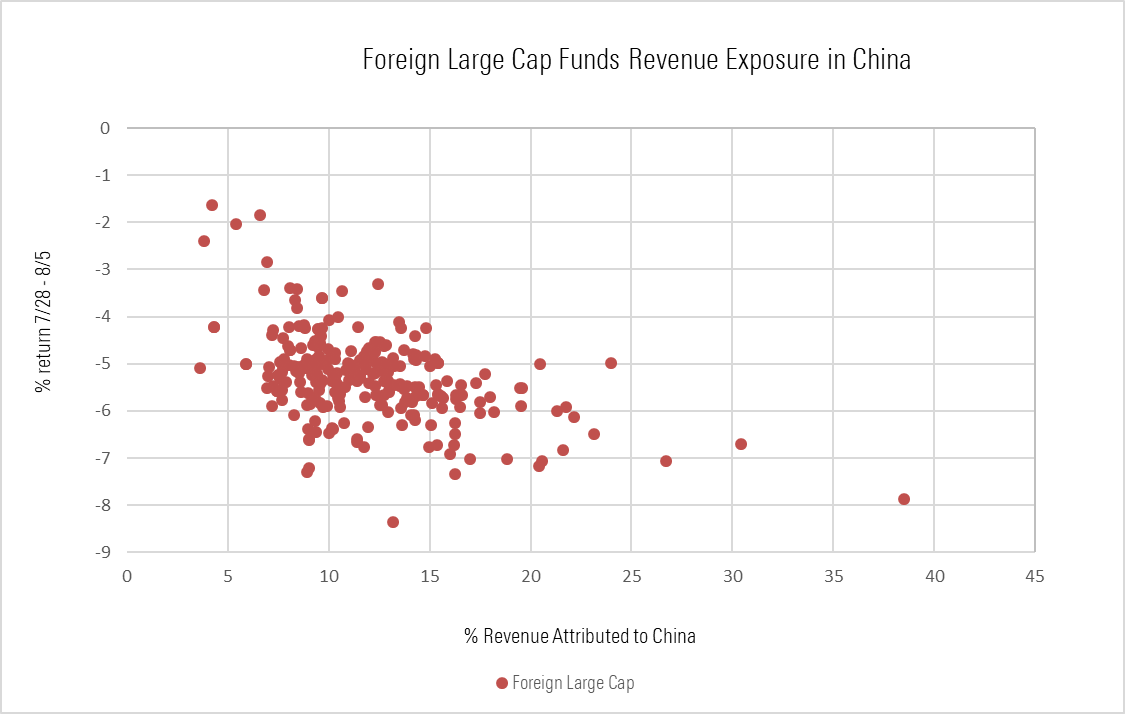

Foreign Stock Funds Foreign stocks on average had 11% exposure to China, compared with 4.4% on a business country basis. The following scatterplot again shows a solid connection between China weighting and performance.

Among funds with heavy China exposure are Davis International DILAX and Morgan Stanley International Opportunity MIOIX, with China revenue exposure of 38 and 30%. Danton Goei manages Davis International and first bought Alibaba BABA and Hollysys Automation Technologies HOLI in January 2017. Hollysys, a Chinese industrial company, is down 15.3% in the past three months, and Alibaba is down 11.1%. Overall, with a one-week loss of 7.9%, the fund had the second-worst return of all foreign large-cap equity funds. Morgan Stanley International Opportunity didn't do much better, checking in at a loss of 6.7%, almost 1.5 percentage points worse than the average of all foreign large-cap equity funds.

For Vanguard International Growth VWIGX, a foreign large-growth fund, top holdings Tencent TCTZF and Alibaba dragged down one-week returns. Morningstar analyst Kevin McDevitt rated the fund Silver in July but warned investors to beware of the fund's downside volatility. The fund had the sixth-worst return for foreign large-cap equity funds in the downdraft week.

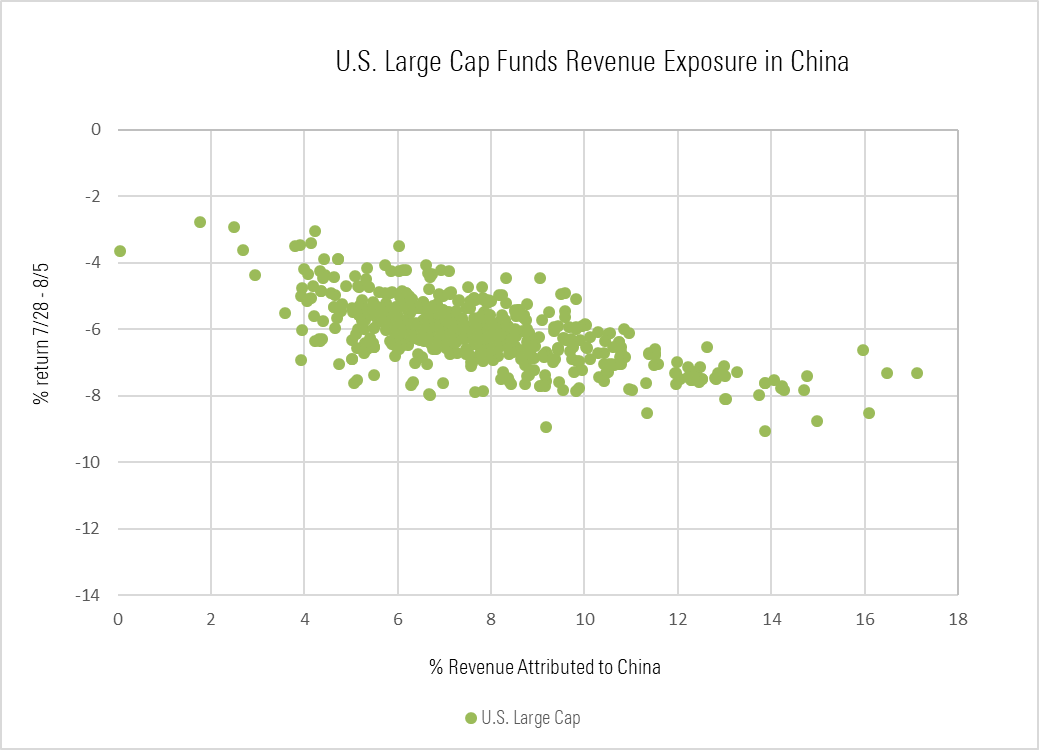

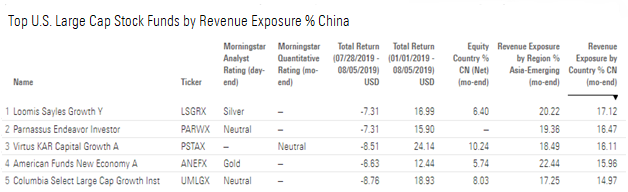

U.S. Stock Funds U.S. stock funds took a hit during the trade-driven sell-off, but their revenue exposure to China is limited. Most funds carry a revenue exposure of less than 10% to China. But again, a trend appears when plotting China exposure and performance.

The difference with U.S. stock funds is that the exposure tends to be hidden from plain view. In most cases, Chinese revenue exposure comes from large multinational conglomerates such as Micron MU and IBM IBM. Some funds, such as Loomis Sayles Growth LSGRX, do hold direct Chinese holdings, such as Alibaba. Loomis Sayles' overall revenue exposure to China is 17%, and the fund posted a loss of 7.3% during the week we surveyed.

As mentioned above, Parnassus Endeavor Investor has 17.5% revenue exposure in China, above the 7.6% average for all U.S. large-cap equity funds. In addition to Qualcomm, the fund also holds Applied Materials AMAT, which generates 33.7% of its revenue in China and only 8.9% in the U.S. The Parnassus Endeavor Investor year-to-date return of 15.9% was in the 33rd percentile for all U.S. large-cap funds as of July 28; the fund's one-week loss of 7.3% ranks in the 90% percentile.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_eae1cd6b656f43d5bf31399c8d7310a7_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)