7 Charts on U.S. Fund Flows in the First Half of 2023

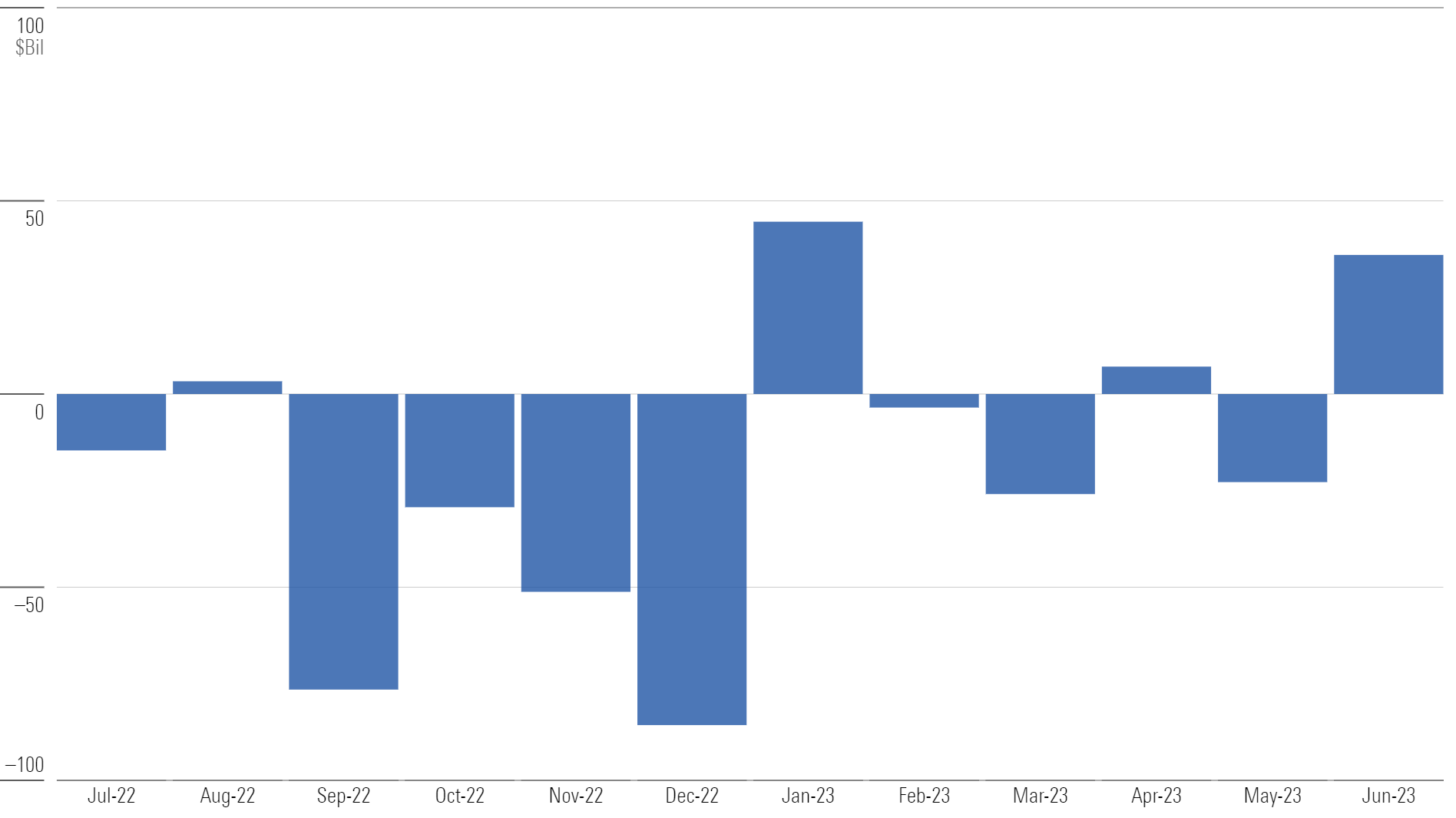

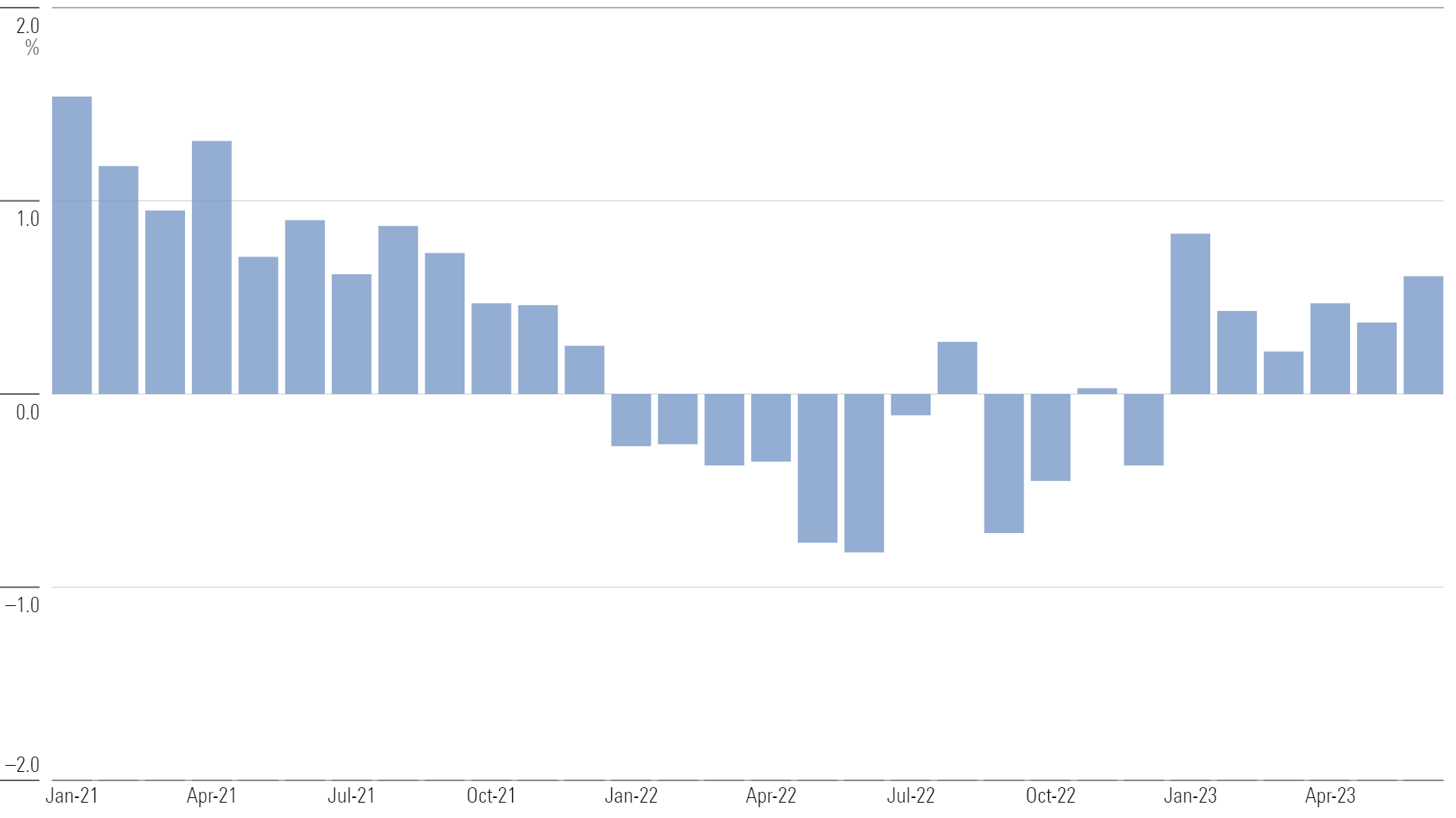

Funds seesaw back to inflows in June after a lackluster start to the year.

U.S. mutual funds and exchange-traded funds gathered about $36 billion in June, rounding off a weak first half of the year. Six out of the 10 U.S. category groups saw inflows, but none were particularly notable.

Monthly Long-Term U.S. Fund Flows

Most Category Groups Have Seen Better Days

The first half of 2023 has been weak relative to history. Long-term funds grew organically by just 0.2% through the first six months of the year, a near bottom-decile result relative to other semiannual measurements dating back to the inception of Morningstar’s data in 1993.

Organic Growth Rates by Category Group

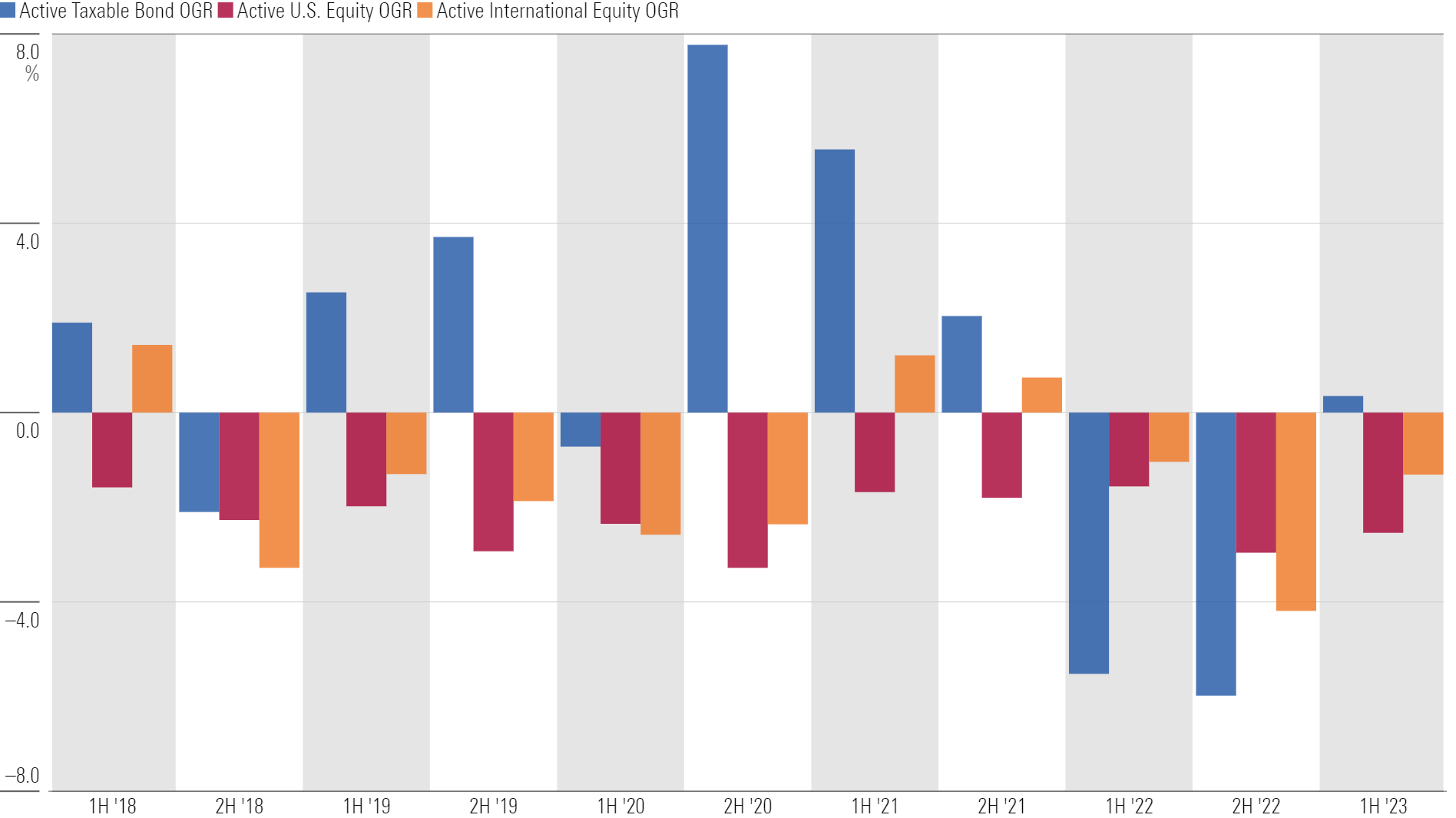

Actively Managed Funds Still Out of Favor, but Less So Than Last Year

After a calamitous 2022, actively managed funds fared better during the first half of 2023 but were still firmly in outflows overall. Active fixed-income funds returned to inflows, but active international-equity and U.S. equity funds continued to shed assets. Actively managed funds saw roughly $176 billion leave in 2023’s first half, equal to 1.5% of assets at the beginning of the year.

Active Fund Organic Growth Rates

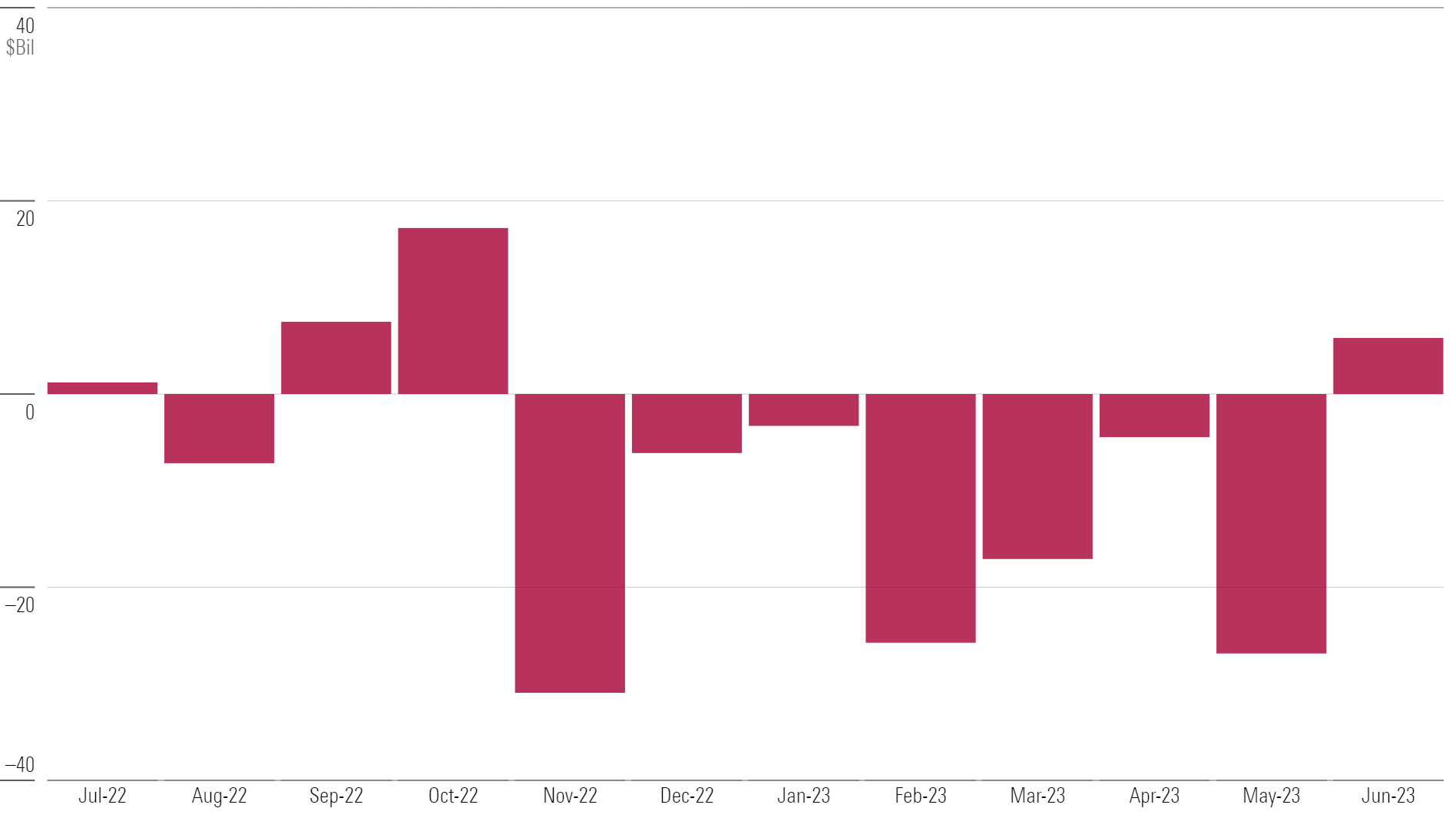

U.S. Equity Funds Rebound Behind Passive Inflows

U.S. equity funds enjoyed inflows for the first time since October 2022, collecting a modest $6 billion in June. Inflows to the largest passive funds, often found in blend Morningstar Categories, led the charge. Passive large-blend funds took in $22 billion, passive large-growth funds gathered nearly $5 billion, and passive small-blend funds collected $3.8 billion.

U.S. Equity Fund Flows

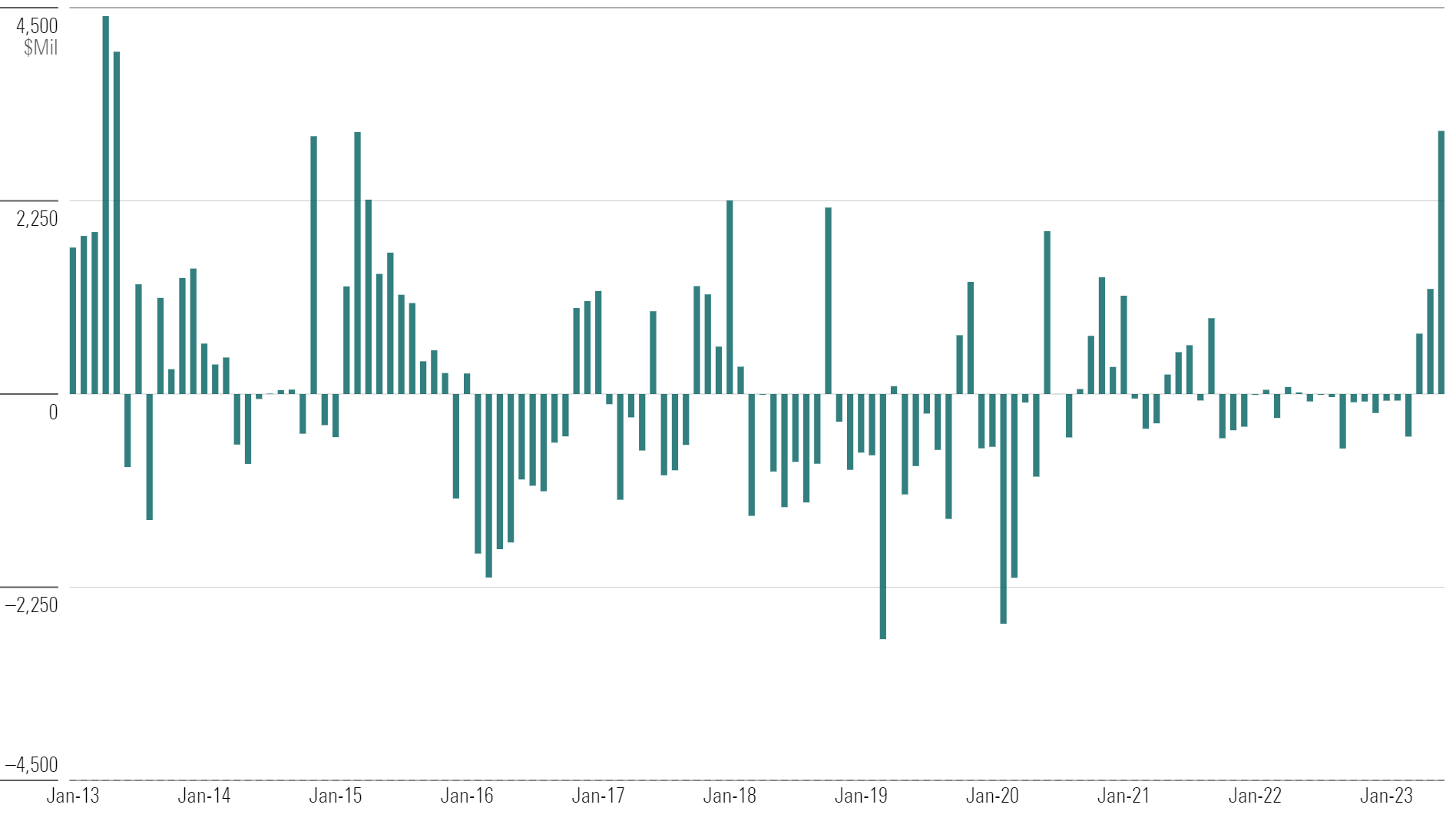

Investors Jump Into Japanese Equities

Long a slumping market, Japanese equities may be coming back into style. The Japan-stock category collected $3.1 billion in June, the largest monthly sum since 2013. However, other than passive foreign large-blend funds’ $8.2 billion intake, the international-equity category group had another sleepy month of flows. For the year to date, they’ve taken in just $20 billion.

Japan-Stock Fund Flows

Taxable-Bond Funds Continue to Claw Back

Investors looking for income have returned to bond funds. The taxable-bond category group took in over $140 billion through the first six months of 2023—easily the highest total of any category group. Staple categories such as intermediate core and intermediate core-plus enjoyed the strongest absolute flows, while long-government funds led on an organic growth basis.

Taxable-Bond Organic Growth Rate

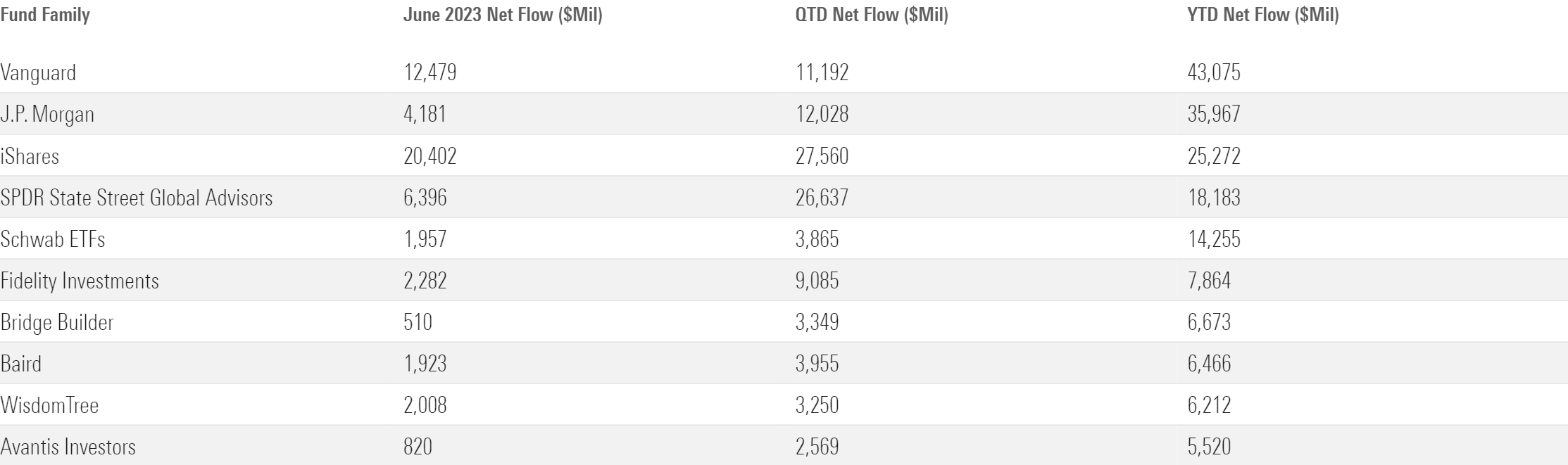

Standing Up to the Passive Titans

While passively managed funds continue to rake in assets, J.P. Morgan is defying the trend. Through the first half of 2023, the firm took in $36 billion, the second-most assets of any fund family and trailing only Vanguard. The firm’s active strategies brought in more than $26 billion—a huge achievement in today’s market—led by star strategy JPMorgan Equity Premium Income.

Top 2023 Fund Family Flows

This article is adapted from the Morningstar Direct U.S. Asset Flows Commentary for June 2023. Download the full report here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

/d10o6nnig0wrdw.cloudfront.net/05-02-2024/t_60269a175acd4eab92f9c4856587bd74_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)