DXYZ: This Closed-End Fund Is Not Destiny’s Child

What to know about the latest offering from this fund.

The latest meme sensation Destiny Tech100 DXYZ, a closed-end fund that promises everyday investors exposure to high-flying startups like SpaceX and OpenAI, has rocketed toward Mars since it began trading on the New York Stock Exchange on March 26, 2024. As it prepares to offer up to another $1 billion of shares, investors would be wise to stay on the sidelines. CEFs have unique risks; namely, their tendency to trade at premiums and discounts to the underlying portfolio’s value. Couple that with the fact that its holdings are illiquid, hard-to-price securities, and Destiny Tech100′s massive premium represents a unique opportunity for investors to enrich others at the expense of themselves.

How Are Closed-End Funds Different?

Mutual funds have unlimited supplies of shares. When their owners want to buy or sell, they transact directly with the fund company that can continuously create or redeem shares at the net asset value of the portfolio.

A fund’s NAV is the fair value of a fund’s holdings minus any liabilities, such as accrued fees, that generally account for a small fraction of the holdings’ value. For funds that own publicly traded securities only, that’s an easy calculation. You sum up the market value of each position based on the stock’s daily closing price, less any liabilities, and divide by the number of shares outstanding. The NAV represents a fair price for the current value of a share of a portfolio.

CEFs like this one operate differently. They sell a fixed number of shares to raise capital and use that money to buy securities. Those shares are the only ones available for investors to buy and sell, unless the fund issues more in a secondary offering. CEFs calculate NAV, too, but investors cannot go to the fund provider to purchase or redeem their shares at NAV. Instead, they must transact on the open market. Thus, unlike mutual funds, the price of a CEF’s shares can be disconnected from its NAV based on supply and demand.

DXYZ’s NAV Premium Is Insane

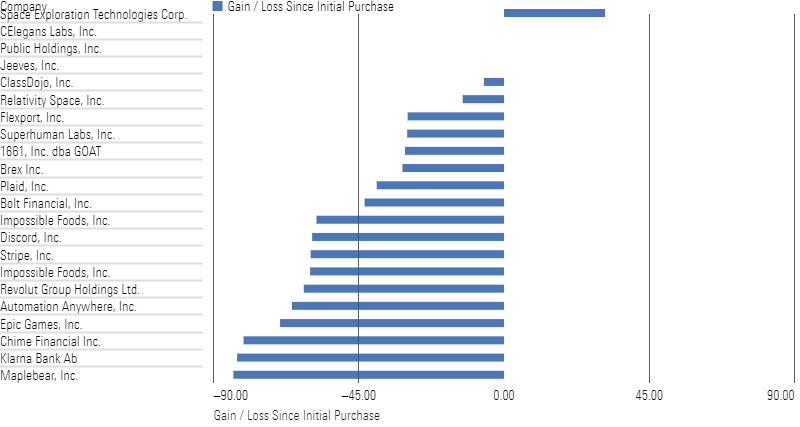

Per Destiny Tech100’s own filings, it held roughly $53 million worth of private company shares as of December 2023. Subtracting its roughly $1 million in liabilities leaves about $52 million in net assets. That corresponds to a roughly $4.84 per-share NAV. While marketed as owning 100 top technology companies, it owns fewer than 25, and most of those have seen substantial write-downs in the past three years, as shown in the chart below. Only one holding, SpaceX, has seen a gain since the fund first bought it. More than half the portfolio’s holdings are down more than 30% since they were first purchased. More than a third are down more than 50%.

Destiny Tech100 Portfolio as of December 2023

A fund with a track record like this would normally struggle to attract any assets. From its inception in May 2022 through December 2023, it lost a cumulative 23.2%, compared with a 19.5% gain for the S&P 500. Most investors aren’t beating down the doors of public equity fund managers who trailed their own index by more than 40% in less than two years. Yet that is exactly what investors are doing here.

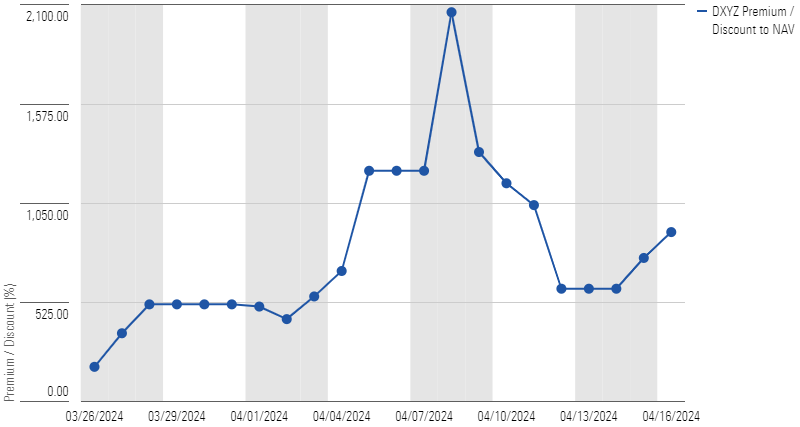

As seen in the next chart, the fund traded at $99.79 on April 8, a 2,000% premium over its $4.84 NAV, meaning that investors were willing to pay $20 for a claim on $1 worth of assets. While the market has wised up a little bit, the fund’s price closed at $43.50 on April 16, a still-whopping 900% premium. An adult can tease a child by offering to trade two $1 bills in exchange for the child’s $20 bill (after all, two bills are better than one, right?). Most kids are wise to that trick, yet when it comes to shares of private companies instead of dollar bills, adults seem to fall victim to the same gimmick.

DXYZ's Premium over NAV Peaked at 2,000%

How Reliable Is the NAV?

Am I being too cynical? Maybe the adults aren’t being tricked. Perhaps the NAV doesn’t represent the true value of the holdings. Destiny Tech100, after all, owns no publicly traded securities—just shares, or nonguaranteed promises of future shares, of privately held firms that are hard to value. The huge premium to its NAV implies that this fund is massively misvaluing its holdings.

Destiny Tech100 values its holdings once per quarter. But valuing private companies is not an exact science. First, there is virtually no active market for trading private shares. While some platforms attempt to provide a marketplace, they have little volume and are often used primarily as ways for startup employees to cash in their shares.

Private companies’ fundraising rounds provide the most reliable, observable prices, since that is when multiple, usually sophisticated, investors agree on a valuation. When fundraising rounds slow, as they have in recent years owing to higher rates, observable prices virtually disappear. Most startups do not want to raise money in a “down round,” or one that lowers their valuations, unless they are starved for cash. Without fundraising rounds, fund companies must value the holdings themselves.

None of the other means that fund companies have to do this are perfect. They may try to find recent insider transactions, apply market multiples to sales or EBTIDA, calculate their own value based on discounted cash flow analysis, or hire a third party that uses the same techniques but at least lends the process a semblance of independence.

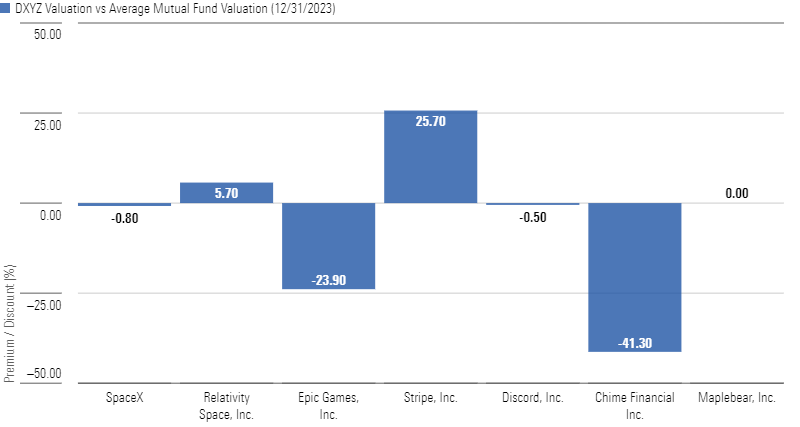

Does the NAV Represent a True Fair Value?

For the most part, Destiny Tech100’s most recent valuations are in line with those of mutual funds that own the same companies, as shown below. There are some deviations within individual holdings, but that is to be expected. Every mutual fund company that owns private equity tends to hold some shares at higher and some at lower values than their peers’. The disparity is actually a good sign. In aggregate, if these seven companies were instead marked at the average mutual fund price, that would push the fund’s NAV up about 4%. In other words, the portfolio seems fairly valued based on peer valuations.

DXYZ Valuations Versus Mutual Fund Valuations

That rules out one theory for Destiny Tech100’s huge premium: that the NAV is severely understated. Clearly, that’s not the case. Mutual funds at Fidelity, Baron Capital, and Neuberger Berman all own SpaceX—which accounts for 35% of Destiny Tech100’s assets—at roughly the same price as Destiny Tech100. In those mutual funds, though, investors aren’t paying a huge NAV premium just to get a piece of SpaceX.

For instance, SpaceX accounted for about 13% of Baron Partners’ BPTRX assets as of December 2023. Since mutual funds are priced at the fund’s NAV, an investor buying Baron Partners shares would effectively pay $97 per share for the SpaceX position, while a Destiny Tech100 investor would pay $864 for a share of SpaceX owing to the funds 900% premium to NAV.

Suppose you believe deeply in SpaceX and think Starlink will become ubiquitous and the colonization of Mars is more than a sci-fi dream. In your eyes, SpaceX could be worth 10 times what it is now (which implies a nearly $2 trillion valuation of the company, by the way, based on a recent insider sale). That would be a massive win for the Baron Partners fundholder but a paltry 11% increase for an investor in Destiny Tech100. There is one (weak) argument in favor of this fund: Mutual funds have liquidity constraints and cannot hold more than 15% of assets in illiquid securities like private equity. So if SpaceX does increase 10 times, Baron Partners would need to see the rest of its portfolio rise commensurately to keep its overall weighting below 15% to capture the full gain.

That contention doesn’t hold up to scrutiny. In Baron Partners, for example, SpaceX could increase 16% without the rest of the portfolio gaining anything before it would hit 15% of assets. That might seem like a low ceiling, but it’s still more than the Destiny Tech100 investor’s upside after paying the massive 900% premium upfront.

This Closed-End Fund Is Not Your Destiny

The single biggest determinant of an investment’s return is the price you initially pay. Even if you think an asset in a portfolio is very undervalued, when you pay an absurdly high premium for it, you’ve eliminated all your upside. It is unclear when or at what price Destiny Tech100 will offer new shares, but they will almost assuredly be priced above NAV. Investors would be wise to keep their checkbooks closed.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b0c51583-b9a2-49eb-9a8f-5f25a8bda4a3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b0c51583-b9a2-49eb-9a8f-5f25a8bda4a3.jpg)