How the Largest Bond Funds Did in the First Quarter

Vanguard Total International Bond Index and MetWest Total Return Bond were among the best performers.

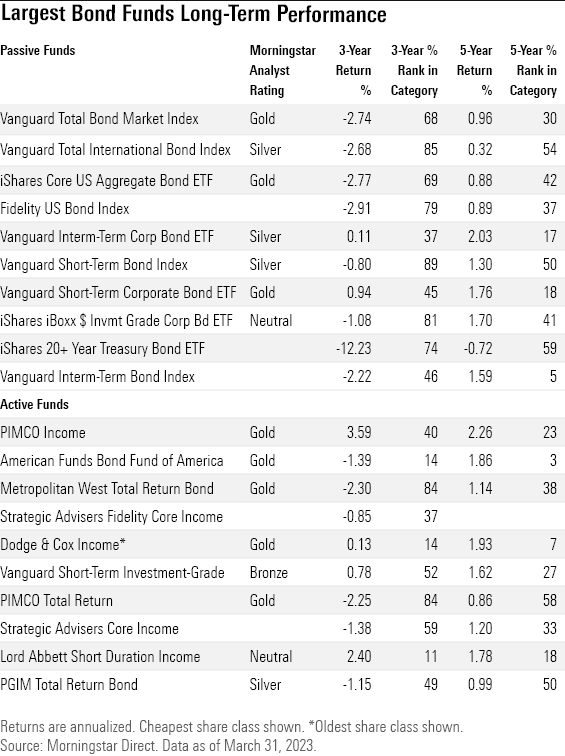

Investors in the largest bond mutual funds and exchange-traded funds found relief with solid gains in the first quarter of 2023 after suffering record losses last year.

The biggest bond strategy, the $329.2 billion Vanguard Total Bond Market Index VTBSX, advanced 3.2% for its best quarter since the first three months of 2020. However, over the past 12 months, the fund is still down 4.7%

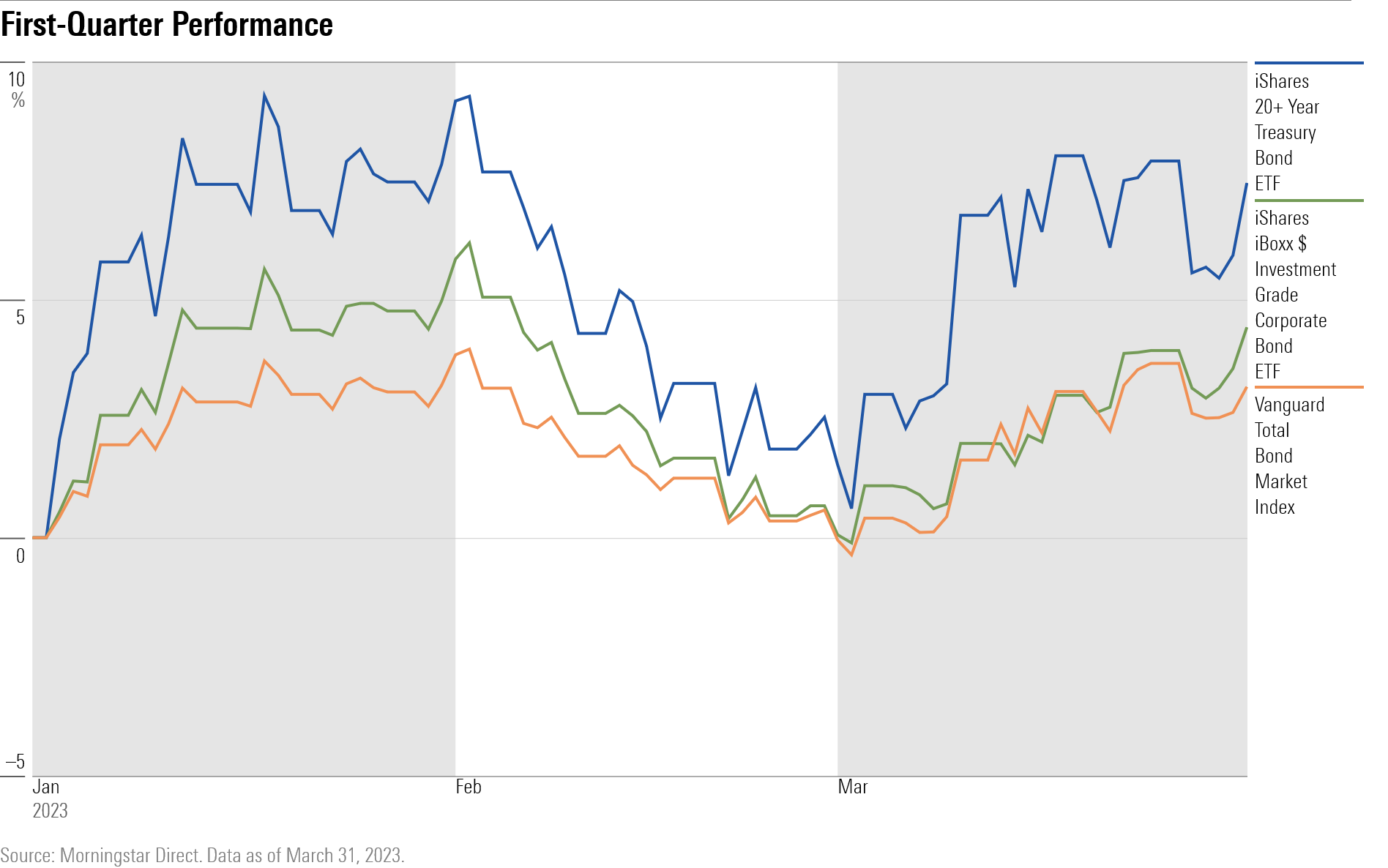

Bond-fund returns made multiple round trips in the first quarter, rallying to start the year on hopes that the Federal Reserve would soon be able to pause its rate hikes but then falling back as those hopes were dashed by stubbornly high inflation and strong economic growth. But the emergence of the regional bank crisis turned those expectations for the Fed around again, leading to a drop in yields as investors began looking for the Fed to cut rates in the second half of the year.

Q1 2023 Performance for the Largest Bond Index Funds

Long-term bond funds are more sensitive to changes in interest rates, which meant the group posted the steepest declines in 2022.

But as a result, it was iShares 20+ Year Treasury Bond ETF TLT that posted the biggest gains among the largest bond funds as yields fell. The $34.6 billion ETF gained 7.5% in the first three months of the year, its best quarter since 2019. This comes after the fund lost 31.4% last year. TLT finished the quarter still posting a 17.6% loss for the past 12 months.

The $37.5 billion Vanguard Short-Term Corporate Bond ETF VCSH advanced 1.8% in the quarter, the smallest gain among the largest bond index funds.

Among corporate-bond ETFs in the first quarter, the $35.3 billion iShares iBoxx $ Investment Grade Corporate Bond ETF LQD outperformed the $39.4 billion Vanguard Intermediate-Term Corporate Bond ETF VCIT. LQD’s higher credit quality and longer duration than is peers helped it during the quarter, according to data from Morningstar Direct. “Lower credit risk exposure has helped it to avoid the worst of major credit shocks, but the fund will also miss out on gains when credit spreads tighten,” writes Morningstar analyst Lan Anh Tran.

Vanguard Total International Bond Index VTIFX, was one of the top performers among the largest index funds. The $141.8 billion fund gained 3.6% and outperformed most U.S.-focused funds.

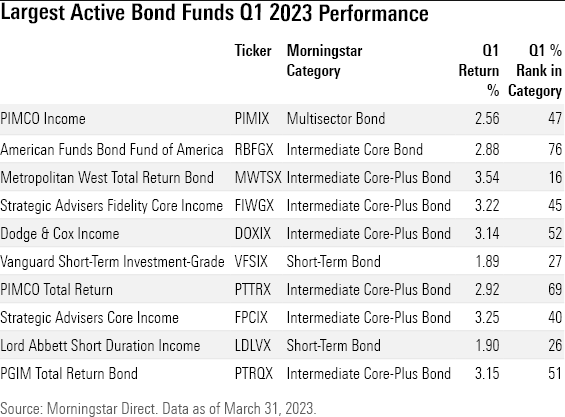

Q1 2023 Performance for the Largest Active Bond Funds

Among the largest active bond funds, the $63.9 billion Metropolitan West Total Return Bond MWTSX performed the best in the first quarter. It gained 3.6% and ranked in the 16th percentile among intermediate core-plus bond funds for the quarter. Meanwhile, the $55.2 billion Pimco Total Return PTTRX lagged in the category after advancing only 2.9%.

Despite only gaining 1.9%, the $48.7 billion Lord Abbett Short Duration Income LDLVX outperformed compared with other short-term bond funds. However, that outperformance was largely due to the low expenses on this share class. The fund’s I share class (LLDYX), its largest by assets, ranked in the 62nd percentile.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)