For Bond-Fund Investors, Credit Risk Suddenly Matters

The banking crisis has pushed the quality of funds’ bond holdings into the spotlight.

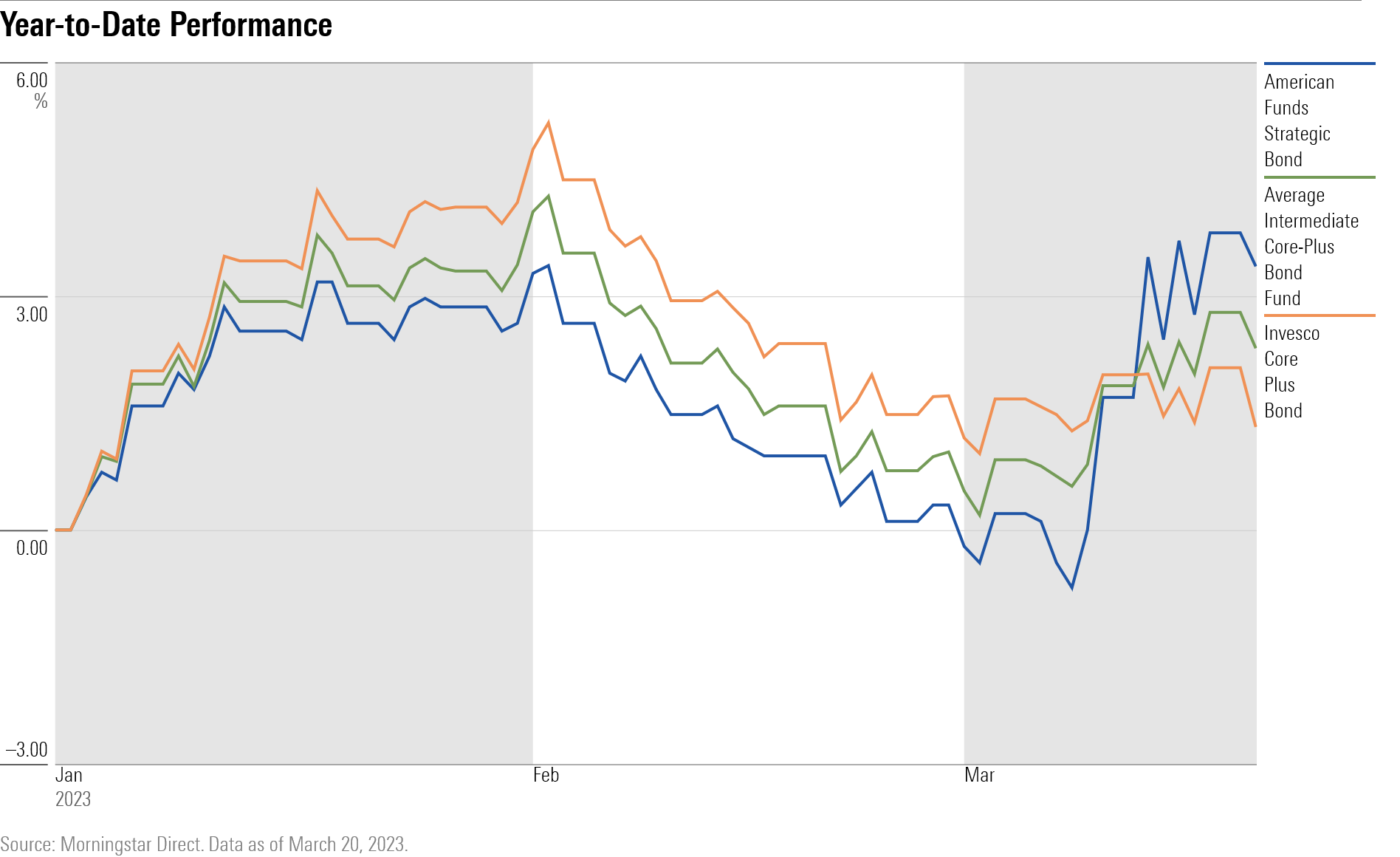

Since the emergence of the banking crisis in early March, the bond market landscape has changed dramatically, leading to big swings in performance among bond funds.

Take the $17.4 billion American Funds Strategic Bond RANGX strategy, which was lagging in its Morningstar Category to start this year, but has outperformed other comparable bond funds since the banking crisis broke. Meanwhile, the $4.6 billion Invesco Core Plus Bond CPBFX once led the category, but now ranks near the bottom for year-to-date returns.

What’s changed? Prior to early March, the dominant factor driving bond-fund returns since the start of last year was sensitivity to interest rates and the outlook for Federal Reserve policy. In 2022, funds most sensitive to the Fed rate hikes took it on the chin, a trend that reversed in early 2023 as interest-rate expectations became less bearish.

But the landscape has shifted in the past month. In the aftermath of the collapse of Silicon Valley Bank, the spotlight has turned toward the creditworthiness of bond issuers, with funds owning more bonds from low-quality borrowers performing poorly. In addition, as yields have come down, funds more sensitive to interest rates have started to do well.

This changing dynamic, compressed into just the first three months of 2023, highlights for investors the importance of understanding which factors drive a bond fund’s performance. Is it interest rates, credit quality, or both?

What is Driving Fund Performance Now?

Different kinds of funds have different levels of exposure to interest rates and credit quality. Some, such as U.S. Treasury bond funds, are highly sensitive to interest rates, but not credit quality, because the U.S. government is seen as a safe bet for repaying its debts. At the other end of the spectrum are low-quality bond issuers, such as those found in high-yield funds, where credit quality has more of a direct impact than changes in interest rates.

One category to watch for the interplay between interest rates and credit quality is intermediate-term core-plus funds. Core-plus funds have broader mandates than widely held intermediate core strategies, which own a mix of U.S. government bonds and high-quality corporate bonds.

“Core-plus funds will have big stakes in Treasuries, investment-grade credit, some mortgages, and smaller stakes in high yield and emerging market and bank loans,” says Morningstar strategist Maciej Kowara.

In 2022 and the first two months of this year, core-plus bond-fund investors essentially needed only look to one factor to understand how their bond funds were performing: changes in interest rates.

The average intermediate-term core-plus fund lost 13.3% last year, but as the Fed aggressively raised interest rates, funds with the greatest rate sensitivity—which can be measured through a statistic known as duration—posted even worse declines. The longer the duration, the more sensitive to changes in rates.

By the time 2023 got under way, investors were believing that inflation was coming under control and that the Fed could pause its rate hikes and start cutting rates sooner, rather than later. That led to a short surge in performance among funds with longer-duration holdings.

But during February, the tide reversed, as economic data showed inflation was still raging and investors once again believed the Fed would need to take rates higher and keep them there longer. During the month, the average intermediate core-plus fund lost 2.3%, but funds with shorter durations fared better.

That didn’t last long, however. The emergence of the banking crisis is seen as meaning the Fed will be raising interest rates by less than expected, and could be cutting rates during the third quarter. This was good news for bonds. The average intermediate core-plus bond is up 1.6% since March 8.

However, within the category, there emerged a new reason for a dispersion of returns: worries about a credit crunch and how that would affect lower-quality borrowers.

Funds that invest in safer assets, including mortgages backed by the government, started to lead the category along with some funds that carry longer durations, which are more sensitive to changes in interest rates. At the same time, credit-sensitive bonds have come under pressure.

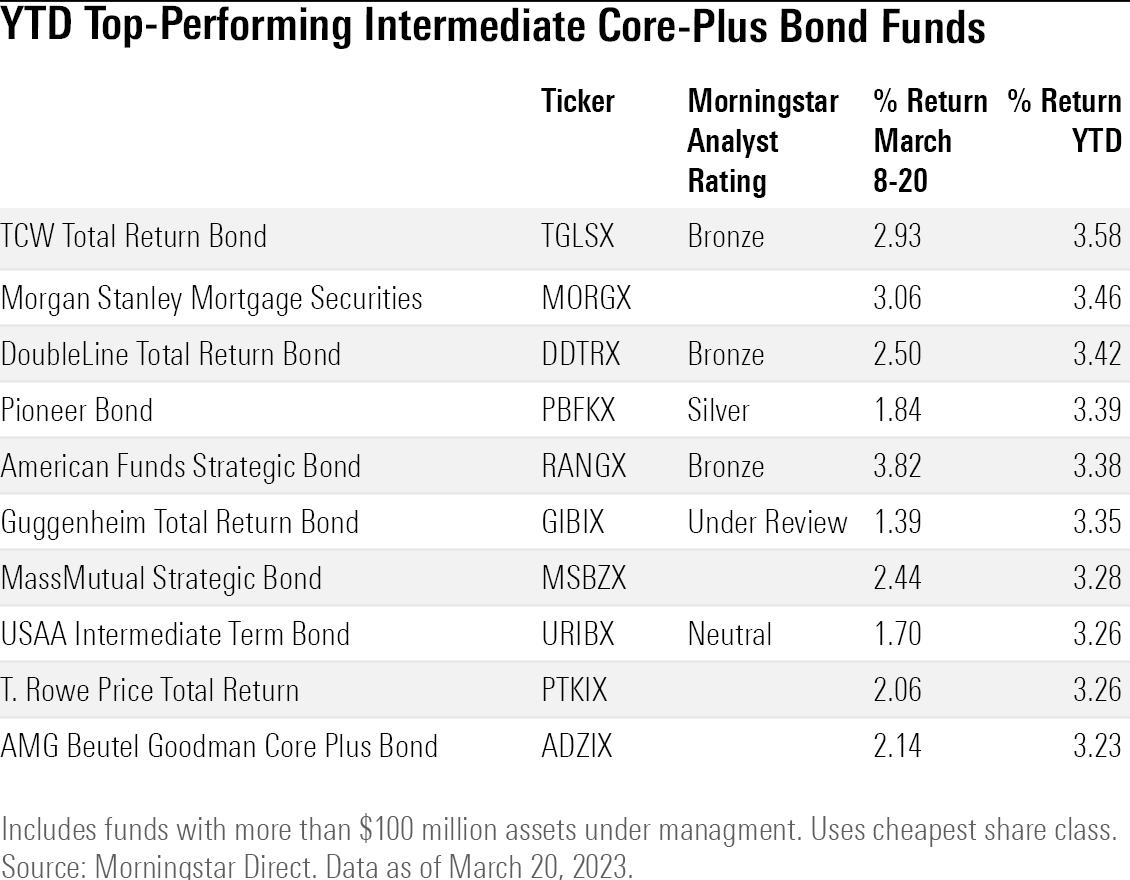

Best-Performing Core-Plus Bond Funds

Prior to the banking turmoil, the American Funds Strategic Bond Fund was underperforming in the intermediate core-plus category. It was up only 0.32% as of February 28, while the average fund was up 1%.

Since March 8, the fund has gained 3.8% and now ranks as one of the best funds in the category for the year to date. The fund likely benefited from owning positions that would do well if investment-grade or high-yield indexes performed poorly, says senior analyst Sam Kulahan. “When credit sold off and spreads started widening out substantially, these positions would have gained,” Kulahan says.

Some funds which invest in mortgages backed by the government have also done well as investors seek safer holdings. The $189.4 million Morgan Stanley Mortgage Securities MORGX is up 3.1% since March 8. Funds that invest in mortgages backed by the U.S. government carry minimal credit risk says, Kowara.

The $3 billion TCW Total Return Bond TGLSX also invests primarily in mortgage securities backed by the government, and carries a longer duration than the average intermediate core-plus fund. “The firm has a penchant for incrementally raising duration as interest rates sell off,” wrote associate director Brian Moriarty.

As yields have fallen following the collapse of SVB, funds with longer durations have nevertheless benefited. TCW Total Return Bond is up 2.9% since March 8 and has gained 3.6% this year to date, making it the top-performing fund among intermediate term core-plus funds with more than $100 million in assets.

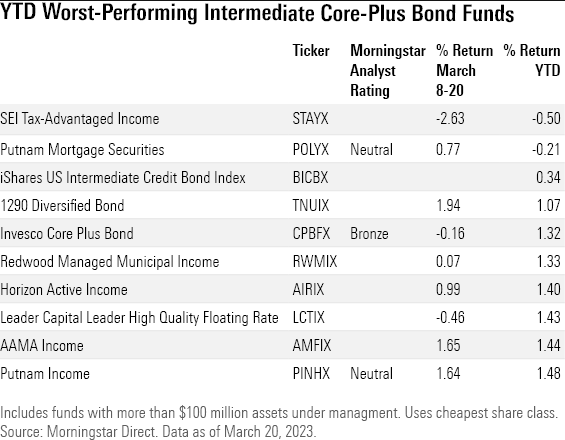

Worst-Performing Core-Plus Bond Funds

Some funds that were outperforming prior to SVB’s collapse have fallen back in the rankings. Invesco Core Plus Bond was near the top of the category as of February 28 with a 1.7% return.

However, since then its fortunes have lagged and it ranks 92nd in the category this year to date. Invesco Core Plus Bond likely suffered from exposure to Credit Suisse’s AT1 bonds, says Morningstar analyst Tom Murphy. Owners of the company’s AT1 bonds are being wiped out following the takeover of Credit Suisse by UBS.

Not all mortgage funds have done well thanks to holdings of non-agency mortgages which carry credit risk because they are not backed by the U.S. government. That includes $453 million Putnam Mortgage Securities POLYX, down 0.21% this year.

Funds that invest in floating-rate debt have lagged as yields fell. “Interest rates going down are not good for bank loans,” says Kowara. The $180 million Leader Capital Leader High Quality Floating Rate LCTIX is down 0.5% since March 8.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)