How Bond Funds Fared in 2023

Credit strategies prevail in another volatile year for bonds.

Bond funds staged a fourth-quarter comeback in 2023. Through late October, the Morningstar US Core Bond Index, a proxy for the broad fixed-income market, was on pace for a third-consecutive year of losses as uncertainty around a hard or soft landing lingered and interest-rate volatility persisted. By year-end, however, the bond market rewarded those who stayed the course. The Morningstar US Core Bond Index rallied 6.6% in the fourth quarter and gained 5.3% for the full year.

Credit-sensitive sectors, like bank loans and high-yield bonds, even provided equitylike returns, as a relatively healthy and stable economy supported them. In 2023, the average fund in the bank loan and high-yield bond Morningstar Categories gained 12.1% each.

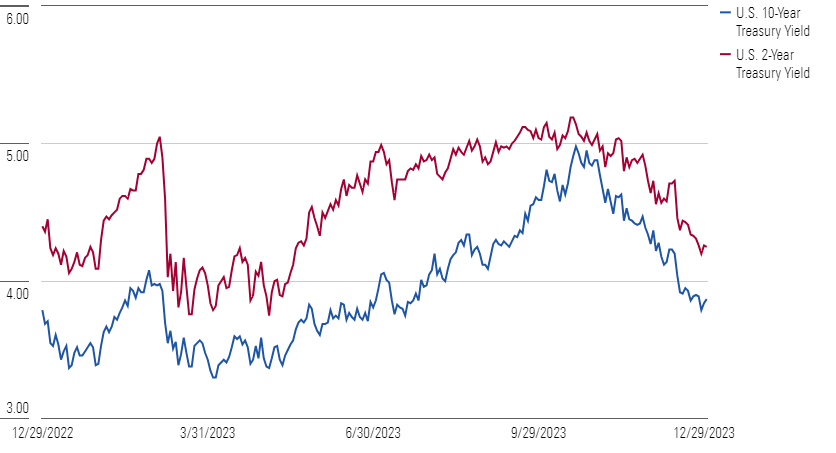

On the other hand, investors who accepted more duration risk, or sensitivity to shifting yields, stomached an uneasy ride over the past 12 months. But even long government strategies, which bear significant interest-rate risks, eked out gains in 2023 thanks to a strong finish. Bond yields plunged during the year’s final quarter as market observers received additional clarity on a path for rate cuts in 2024. As such, the typical long government fund soared 11.9% during the quarter but only gained 3.0% for the full year as yields crept higher over the first nine months.

Interest-Rate Volatility Persists in 2023

Here’s a closer look at how some of the more prominent bond-fund managers fared during another eventful year and quarter.

High-Yield Bonds Soar

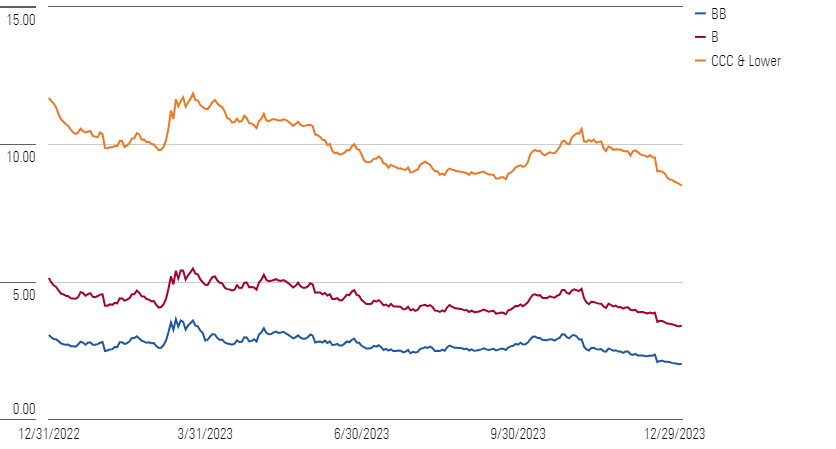

High-yield bond managers grappled with market uncertainty and a looming recession all year. But as credit markets remained resilient, managers who cut exposures to riskier pockets of the market in anticipation of a recession lagged rivals who either maintained or leaned into dicey credits. These bonds, represented by the Bloomberg US High Yield CCC Index, climbed almost 20% during the year, while the Bloomberg US High Yield BB Index, a proxy for the highest-quality segment of the high-yield market, rose 11.6%. High-yield credit spreads across ratings buckets tightened over the year.

High Yield Corporate Bond Spreads Tighten in 2023

Artisan High Income ARTFX, whose retail share class has a Morningstar Medalist Rating of Silver, was well positioned to benefit. Known for its concentrated portfolio and elevated allocation to CCC rated debt, the retail shares’ 15.1% rise beat the typical high-yield peer’s 12.1% gain. Bronze-rated Lord Abbett High Yield’s LAHYX historically aggressive portfolio cut back CCC exposure to 6% from 15% in 2022 and fared worse as a result. Its 10.9% gain in 2023 trailed almost 80% of its peers.

Longer-Duration Strategies Finish Strong

Funds with shorter durations edged those with longer durations during the year. But as yields plummeted during the final quarter, the intermediate core bond category—consisting of funds with durations typically ranging between 75% and 125% of the Morningstar Core Bond Index’s 6.0-year duration—generally performed better than its shorter-duration counterparts, such as the ultrashort bond and short-term bond Morningstar Categories. For the quarter, the typical intermediate core bond fund gained 6.5%, while the typical ultrashort bond and short-term bond funds increased 1.8% and 3.4%, respectively.

Strategies that suffered the most in 2022 and 2023′s first nine months because of their longer durations finally saw their fortunes change during the fourth quarter of 2023. For instance, Western Asset Core Bond WATFX climbed 8% during the fourth quarter and beat over 95% of its intermediate core bond rivals because its duration is longer than most peers. Its strong fourth-quarter showing helped the fund best 65% of rivals in 2023.

One of our favorite picks among core bond managers, Gold-rated Baird Aggregate Bond BAGIX, had another winning year. The fund outpaced its median peer by 82 basis points and beat over 80% of its competitors. The team’s duration-neutral approach proved effective during a year when yields whipped around. Consistent outperformance continues to be the fund’s hallmark.

Tailwinds Help Emerging-Markets Bonds

After a dreadful 2022 and ongoing concerns in China, investors who ventured into emerging-markets bonds could finally rejoice by 2023′s end. The Morningstar Emerging Markets Composite Bond Index gained 9% in 2023, though the bulk of that performance came during the last quarter, mostly due to declining inflation rates and a weakening dollar.

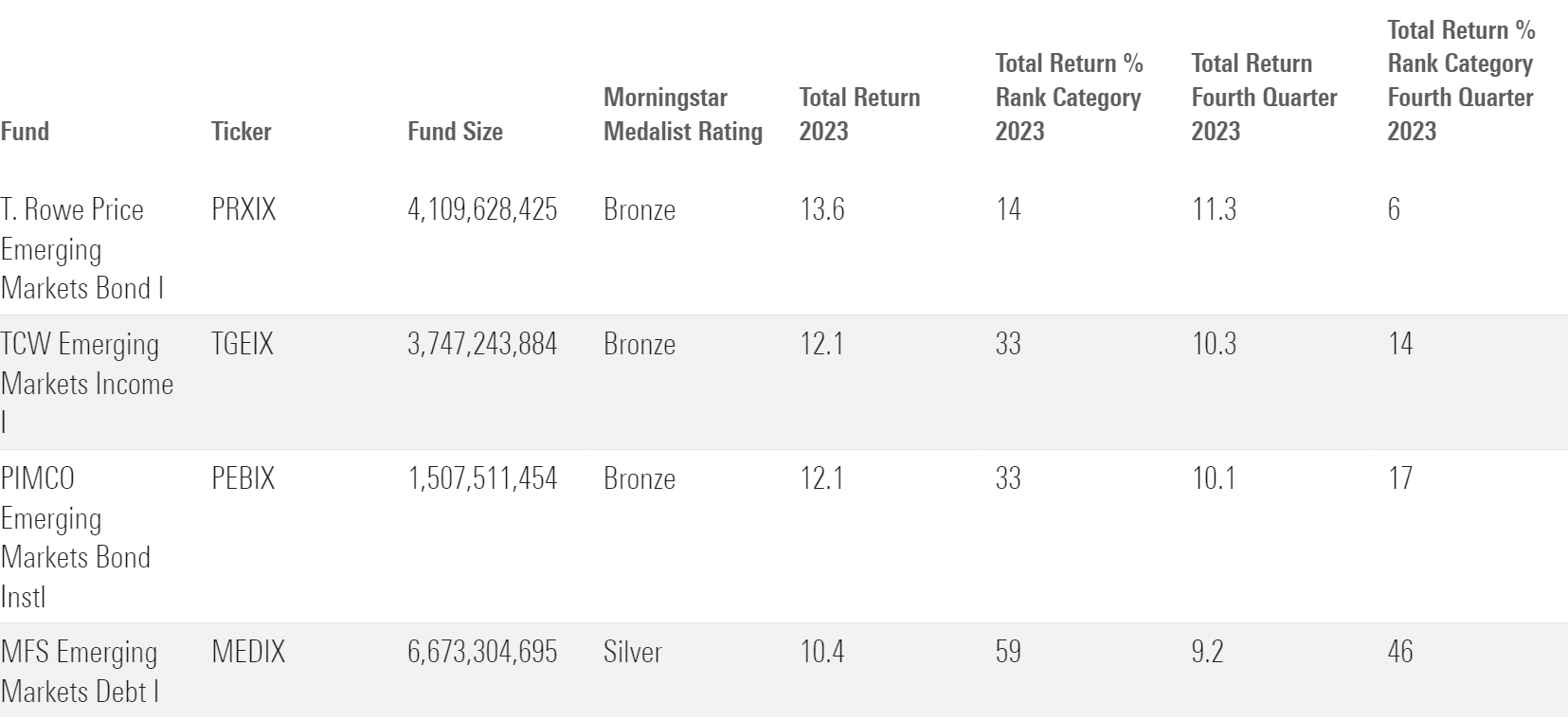

Some top developing-markets managers enjoyed continued success in 2023. Those that stood out include Bronze-rated T. Rowe Price Emerging Markets Bond PRXIX, TCW Emerging Markets Income TGEIX, and Pimco Emerging Markets Bond PEBIX. They all posted returns above the typical peer’s 10.7% return. One of the largest funds in the category, Silver-rated MFS Emerging Markets Debt MEDIX, failed to keep pace with those peers and posted below-median returns of 10.4%, mostly due to the portfolio’s underweight stance in some lower-rated segments of the market that rallied over the year.

Emerging-Markets Bond Funds Performance Highlights

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)