Bond Funds Post Mixed Results in Q2

Lingering bond market volatility in the second quarter rewarded investors who took risk.

This article is part of Morningstar’s Q2 market review and outlook.

It was a mixed second quarter for bond fund investors. Funds sensitive to interest rates, like long government and intermediate core bonds, were once again beaten down. These funds, which invest sizable stakes in U.S. Treasuries, saw bond prices slip while U.S. Treasury yields rose during the period.

For the quarter, long government funds—the worst-performing Morningstar Category—fell 2.1% on average. In a similar fashion, the typical intermediate core bond manager lost 0.8%.

Credit-sensitive funds also felt some pain, mostly in May. Still, lower-quality fixed-income assets, such as leveraged loans and high-yield corporate bonds, eked out gains for the full quarter amid interest-rate volatility thanks to their shorter-duration profiles. As such, the average bank loan and high-yield bond funds posted solid returns of 2.7% and 1.5%, respectively.

Regardless of asset class, bond fund managers fought through another volatile and noisy period in the markets. As concerns about the banking sector faded, the Federal Reserve continued to grapple with inflation, while fears about a hard economic landing remained. Uncertainty around the debt ceiling only fueled the fire.

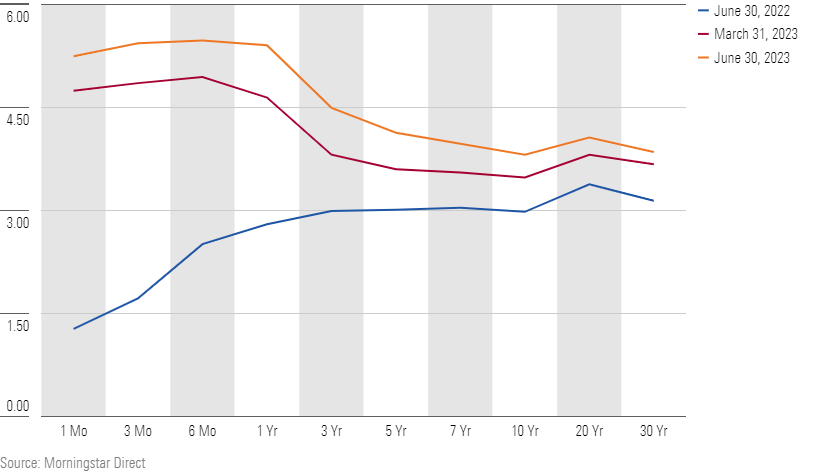

After a relatively tame April, yields steadily climbed in May and June as the debt ceiling debate affected the Treasury bills market, while strong economic data persisted and the Fed’s signals caused investors to shift to expect additional rate hikes rather than cuts later in the year. As these events unfolded, the yield on the 10-year U.S. Treasury crept 37 basis points higher, while the two-year U.S. Treasury note rose 81 basis points.

Yield-Curve Changes

High-Quality Bonds Underperform

For the year to date through June, investors have piled $90 billion into intermediate core bond and intermediate core-plus bond Morningstar Categories, which invest in a mix of high-quality and longer-duration securities like U.S. Treasuries, agency mortgages, and investment-grade corporates. However, as interest rates increased during the quarter, these categories fared poorly. The Morningstar US Core Bond Index and the Morningstar US Core Plus Bond Index, proxies for these strategies, lost 0.8% and 0.7%, respectively.

Fidelity Intermediate Bond’s FTHRX shorter-than-average duration within the intermediate core bond category limited the portfolio’s drawdown. While the fund, which has a Morningstar Medalist Rating of Bronze, lost 0.6% for the period, it beat over 75% of its peers. On the other hand, Bronze-rated Western Asset Core Bond WATFX, which carries one of the peer group’s longest durations, dropped 1.0% and lagged 80% of peers. Last year’s interest-rate volatility has seeped into 2023, and managers taking less interest-rate risk continued to provide more downside protection than their longer counterparts.

Taking Credit Risks Rewarded

Investors retreated from credit-sensitive sectors, such as leveraged loans and high-yield bonds, despite ripping performance in 2023. These securities posted strong returns in the second quarter, tacking onto their solid first three months. For the first half of the year, the Morningstar LSTA US Leveraged Loan Index gained 6.5%, while the Morningstar US High Yield Bond Index followed suit and returned 5.4%. Through June, outflows from the bank-loan and high-yield bond categories totaled approximately $17 billion and $10 billion in assets, respectively, as many investors braced for a recession.

Amid the uncertainty, the more risk managers accepted within the credit space, the better they fared. Within the high-yield bond Morningstar Category, funds with big helpings of lower-rated credits performed best, as they did in the prior quarter. The Bloomberg U.S. High Yield Caa Index led the way, gaining 4.2% in the second quarter, while the Bloomberg US High Yield Ba Index, which represents the highest-quality bucket in the high-yield market, returned just 0.9%.

As such, conservative strategies like Neutral-rated Pimco High Yield PHIYX failed to keep pace during the risk-on environment. The portfolio’s 4% CCC debt stake remained below the typical peer’s 8%, and the fund trailed the typical peer by 42 basis points during the period.

Mixed Results in Munis

The general fixed-income theme of lower-quality bonds outperforming their higher-quality counterparts extended to municipal bonds. The high-yield corner of the muni market posted the strongest results in the quarter as the Bloomberg High Yield Muni Index returned 1.7% while the Bloomberg Municipal Bond Index, a proxy for the broad investment-grade-rated muni market, ended the quarter flat. Therefore, managers taking more credit risks reaped the benefits over the period. As municipal-bond yields followed U.S. Treasury yields higher, managers who accepted more interest-rate risks most likely trailed their peers as well.

For instance, Silver-rated American High-Income Municipal Bond HIMFX, which tends to take on less interest-rate risk than most category rivals, was one of the high-yield muni category’s top-performing strategies, in part because of its 8.4-year duration. It posted a 1.2% gain during the period, while the typical peer returned 0.9%.

Neutral-rated Nuveen High Yield Municipal Bond NHMRX, with its 13.1-year duration, produced one of the category’s worst showings. Its 0.2% second-quarter loss trailed the typical peer by 110 basis points.

Emerging-Markets-Debt Rally Continues

As the inflation outlook in most emerging-markets countries improved, so has the performance in the asset class. After a crushing year in 2022 for these bonds, investors who ventured into the higher-yielding emerging-markets-debt space reaped rewards in the second quarter. The JPMorgan EMBI Global Index gained 1.5% for the quarter, bringing year-to-date returns up to 3.8%.

Silver-rated TCW Emerging Markets Income TGEIX struggled to keep pace with its emerging-markets-bond peers, though. Its 1.7% return trailed the typical rival’s 2.0% return, in part because of underweight positions in some dicey issuers that rallied on the back of improved sentiment in the United States and decreasing concerns about a global banking crisis.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)