An Up and Down First Quarter for Bond Funds

Fixed-income investors sought refuge in high-quality assets amid heightened market uncertainty.

At the close of 2023′s first quarter, all major fixed-income Morningstar Categories eked out gains, but it was a choppy ride to get there.

It was smooth sailing early on. In January, results were positive across the fixed-income landscape. Those who benefited the most took more risk on less creditworthy borrowers and on bonds with greater sensitivity to rising interest rates, or longer duration.

The market changed in February, however. Interest-rate volatility from 2022 returned, thanks to stronger-than-expected inflation and growth data. Almost all fixed-income sectors promptly gave back their January gains.

Then, Silicon Valley Bank’s early March collapse and Signature Bank’s subsequent failure roiled financial markets, not the least already-jittery bond investors. Renewed concerns over the banking system during the rest of March caused those investors to pour into high-quality assets, especially money markets.

In what proved to be a volatile quarter for both interest rates and credit markets, investors who stayed the course during the quarter probably fared better. High-quality assets, like U.S. Treasuries, trailed lower-quality securities, like high-yield corporate bonds. The Morningstar US Treasury Bond Index gained 3.0%, while the Morningstar US High-Yield Bond Index rose 3.7%.

Corporate Credit Cracks

Despite rising for the quarter, the broad credit market felt pain in the wake of regional bank failures. In March, bank loans and high-yield corporate bonds fared worse than investment-grade corporate bonds. The Morningstar LSTA US Leveraged Loan Index lost 0.1%, while the Morningstar US High-Yield Bond Index and the investment-grade Morningstar US Corporate Bond Index rose 1.1% and 3.0%, respectively.

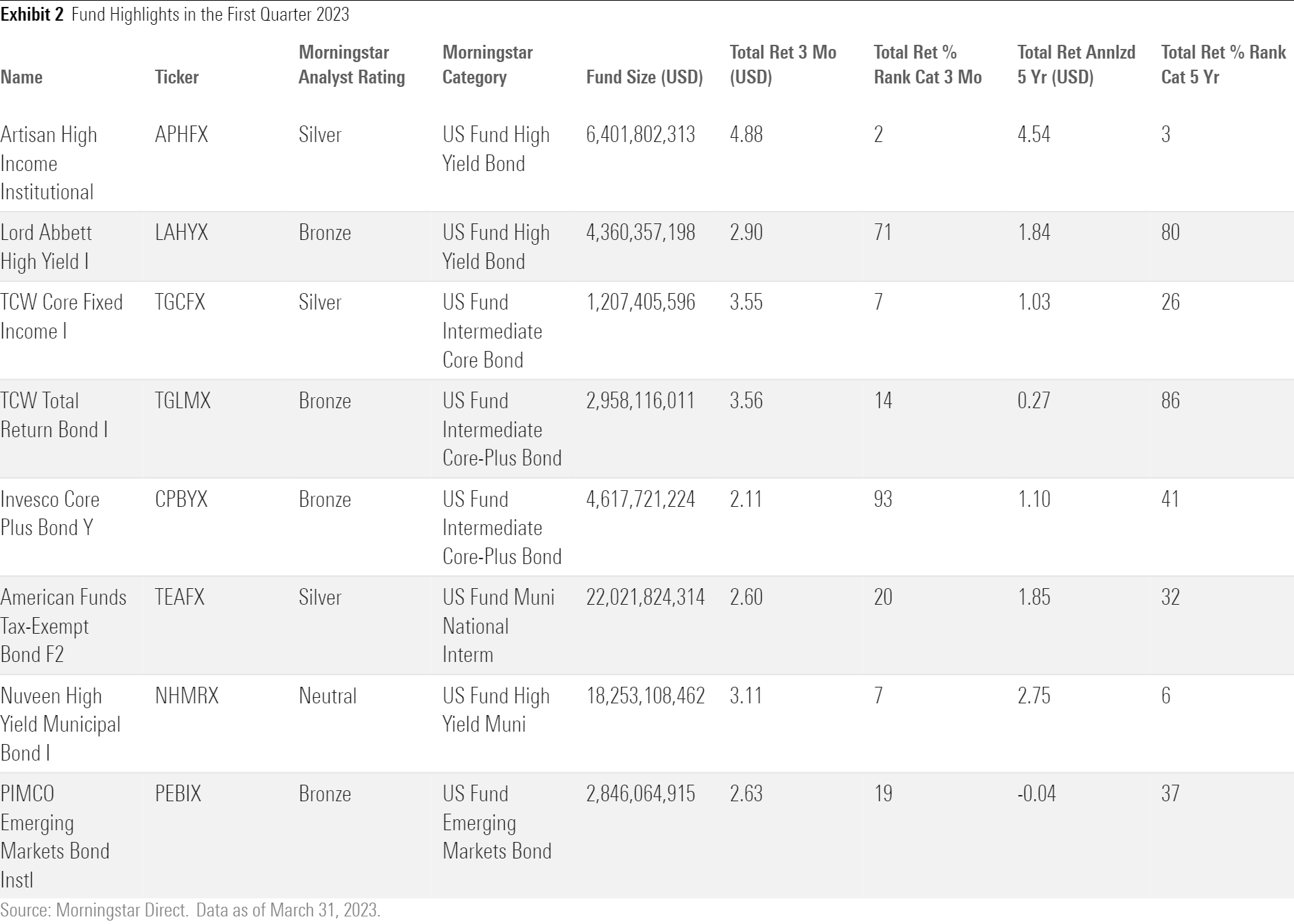

Within the high-yield bond Morningstar Category, funds with big helpings of lower-rated credits performed best but were also the most volatile. In the first quarter, the Bloomberg U.S. High Yield Caa Index gained 4.2%, despite losses of 2.1% in March, while the Bloomberg U.S. High Yield B Index advanced 2.6%. Artisan High Income APHFX, one of the more aggressive category funds with about 25% of assets tied up in issuers rated CCC, rose 4.9% for the quarter.

Meanwhile, Lord Abbett High Yield LAHYX, whose managers had cut back on credit risk and slashed the portfolio’s CCC exposure to about 6% by December 2022 from 15% one year prior, gained 2.9%—just off the typical high-yield bond peer’s 3.2% pace for the quarter.

Security selection was important. Managers with little to no exposure to hard-hit credits like Silicon Valley Bank, Signature Bank, and Credit Suisse CSGN were less volatile than those who owned these names.

Longer Duration Rewarded

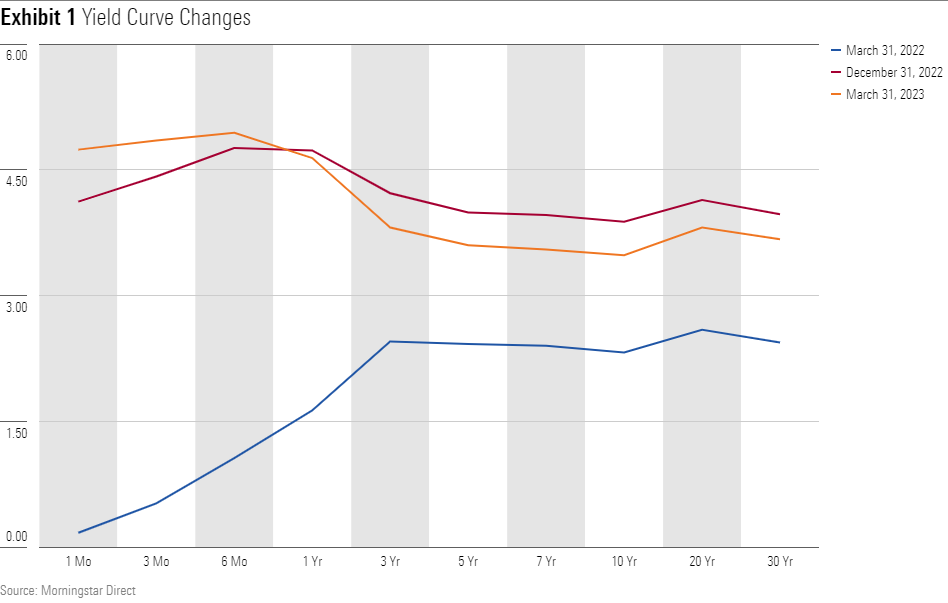

Intermediate core bond and intermediate core-plus bond categories—which comprise interest-rate-sensitive strategies that invest in a mix of longer-duration securities like U.S. Treasuries, agency mortgages, and investment-grade corporates—fared well during the first quarter amid a downward shift in the yield curve, a point-in-time plot of interest rates running from the shortest to longest maturities of a given issuer. As interest rates fell, the market bid up the prices of bonds held by the funds in these two categories. The Morningstar Core Bond Index, a proxy for the strategies, returned 2.9%.

TCW Core Fixed Income TGCFX, which has a Morningstar Analyst Rating of Silver, gained 3.6%, beating most of its intermediate core bond Morningstar Category peers. Its longer duration relative to the category boosted performance. Bronze-rated TCW Total Return Bond TGLMX had similar success because of its longer duration within the intermediate core-plus bond Morningstar Category. Its 3.6% gain beat the average peer’s 3.0%.

Bronze-rated Invesco Core Plus Bond CPBYX struggled to keep pace with most intermediate core-plus bond peers. Its 2.1% first-quarter gain ranked toward the bottom of that group. The portfolio had exposure to Credit Suisse additional Tier 1 instruments, which were wiped out during the broader banking crisis.

Investor Appetite for Munis Is Back

Municipal-bond yields followed U.S. Treasury yields, in this case lower, during the quarter. After 2022′s historic outflows, investors piled back into the asset class in early 2023. Strong demand for and relatively low supply of issues helped support strong absolute performance of most municipal-bond funds. The Bloomberg Municipal Bond Index rose 2.8% in the first quarter.

Funds with heightened interest-rate and credit risks benefited more than conservatively positioned funds, as longer-dated bonds and lower-quality credits outperformed during the quarter. Silver-rated American Funds Tax-Exempt Bond’s TEAFX 2.6% rise was one of the muni national intermediate’s best, thanks to its longer duration. Within the high-yield muni category, Nuveen High Yield Municipal Bond NHMRX, one of the peer group’s riskiest, had strong relative results during the risk-on period and outperformed its typical rival by 73 basis points. Its abundance of lower- and nonrated credits and longer duration contributed to that outperformance.

Volatility in Global Fixed-Income

After an historically strong run relative to a basket of currencies, the U.S. dollar started to weaken at the end of 2022 and the first month of 2023, which in turn boosted performance for most emerging-markets debt and unhedged strategies. These strategies lost their steam in February, however, when the U.S. dollar strengthened in tandem with rising yields.

Despite the volatility, emerging-markets debt strategies still did well in the quarter. The JPMorgan EMBI Global Index gained 2.3%. Bronze-rated Pimco Emerging Markets Bond’s PEBIX 2.6% gain beat the emerging-markets debt Morningstar Category norm by 81 basis points. Developed markets fared even better as measured by the Bloomberg Global Aggregate Index’s 3.0% increase. The U.S. dollar-hedged version of that benchmark didn’t quite keep up, rising 2.9% for the quarter.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)