2 Prominent Core Bond Funds Head in Different Directions

A look at these ratings changes and other November highlights.

Rising interest rates, heavy fund outflows, and geopolitical tensions have tested bond managers’ mettle in 2022. These challenges have accentuated one management team’s strengths and another’s weaknesses, leading to two noteworthy Morningstar Analyst Ratings changes in November.

American Funds Bond Fund of America’s BFFAX People Pillar rating increased to High from Above Average, resulting in the fund’s cheapest share classes being upgraded to an Analyst Rating of Gold, while its pricier shares now range from Silver to Neutral. Western Asset Core Bond’s WATFX People and Process Pillar ratings dropped to Above Average from High, leading to an Analyst Rating downgrade to Bronze from Gold, with its more expensive share classes carrying Neutral to Negative ratings.

Here’s a closer look at the reasons behind these two ratings changes, as well as other ratings activity from November.

This Fixed-Income Team Is on the Upswing

Increased confidence in American Funds Bond Fund of America’s team and resources drove its People Pillar rating upgrade. The firm enhanced its leadership at year-end 2019, when Pramod Atluri took over as principal investment officer of the fund’s now four-person management team. Meanwhile, experience and stability have been hallmarks on the fund’s 40-plus analyst bench.

Improvements in data and resources across the firm’s fixed-income platform have been years in the making. In May 2018, for example, the firm completed a multiyear process of adopting the analytics platform Aladdin. Proprietary risk dashboards have also become more integrated into managers’ workflows, and that has led to better coordination across research groups.

As is the norm at American Funds, the managers align their interests with investors’ through fund ownership. Three managers invest more than $1 million each, and the fourth invests at least $100,000.

But what really separates this team from other core bond managers are its strong execution, decision-making, and focus on building a straightforward, risk-conscious portfolio that has delivered solid results for investors. That’s been evident in 2022 thus far, as the strategy’s muted interest-rate sensitivity and allocation to Treasury Inflation-Protected Securities has helped it lose less than most peers.

Since Atluri’s January 2016 start on the team through October 2022, the fund posted top-decile risk-adjusted returns in the intermediate core bond Morningstar Category. American Funds Bond Fund of America is a compelling long-term option for investors seeking core fixed-income exposure.

People and Process Concerns for Western Asset

Thanks to its capable managers, Western Asset Core Bond’s penchant for courting volatility has seldom proved costly in the end, but the degree of underperformance in 2022 raises concern that some of the supporting sector teams have lost their edge. Risk management practices could also be better, even if the team’s relative value approach remains thoughtful.

The supporting sector teams include Ryan Brist’s standout investment-grade corporate group, but other groups aren’t as impressive. The high-yield credit team has a history of taking on more risk than one would expect from a high-yield mutual fund and appears to have been reactive rather than proactive with risk management. The securitized team has seen several manager departures in recent years from an already moderately sized team, and the emerging-markets debt team hasn’t distinguished itself from the competition.

The Western Asset Core Bond team’s willingness to push the strategy’s limits at the expense of heightened volatility can test the purpose of a reliable core bond allocation, and this can lead to painful experiences for investors. The team’s decision to maintain a significant duration overweight has decimated results this year and now overshadows the fund’s trailing three- and five-year performance as well.

To be sure, the fund’s 10- and 15-year record remains attractive, thanks to its ability to bounce back. But this strategy requires investor patience over the long haul.

New to Coverage

Dimensional International Core Equity Market ETF DFAI debuted with an Analyst Rating of Gold. Launched in late 2020, the exchange-traded fund’s track record is brief, but long-term performance can be informed by its open-end sibling DFA International Core Equity DFIEX, which follows the same strategy. The broadly diversified low-turnover ETF leans into factors that should provide a long-term edge. Low fees only heighten the appeal of this fund.

Ratings Roundup

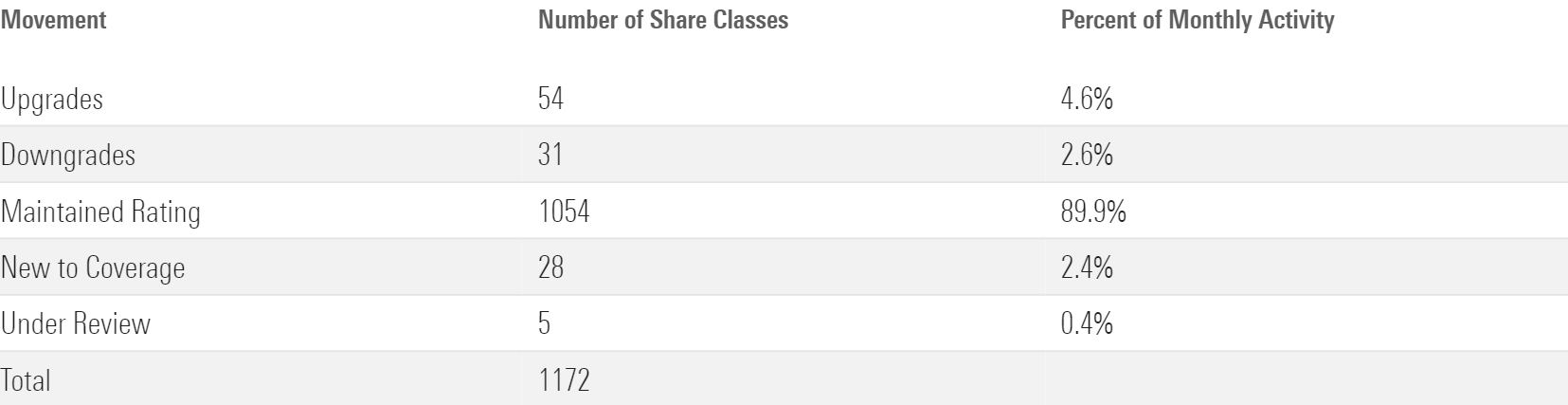

Morningstar updated the Analyst Ratings for 1,172 fund share classes, exchange-traded funds, separately managed accounts, collective investment trusts, and model portfolios last month. Of these, 1,054 maintained their previous rating, 54 earned upgrades, 31 received downgrades, 28 were new to coverage, and five went under review owing to material changes, such as manager departures. Looking through share classes and vehicles to their underlying strategies, Morningstar issued 226 Analyst Ratings during November. Of these, two were new to coverage and one is Under Review. While nine strategies saw an upgrade and eight had a downgrade, the majority (206) maintained their previous ratings.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)