Are You Making Less Than You Did Last Year Because of Inflation?

Your salary may be going up, but your purchasing power could be dropping.

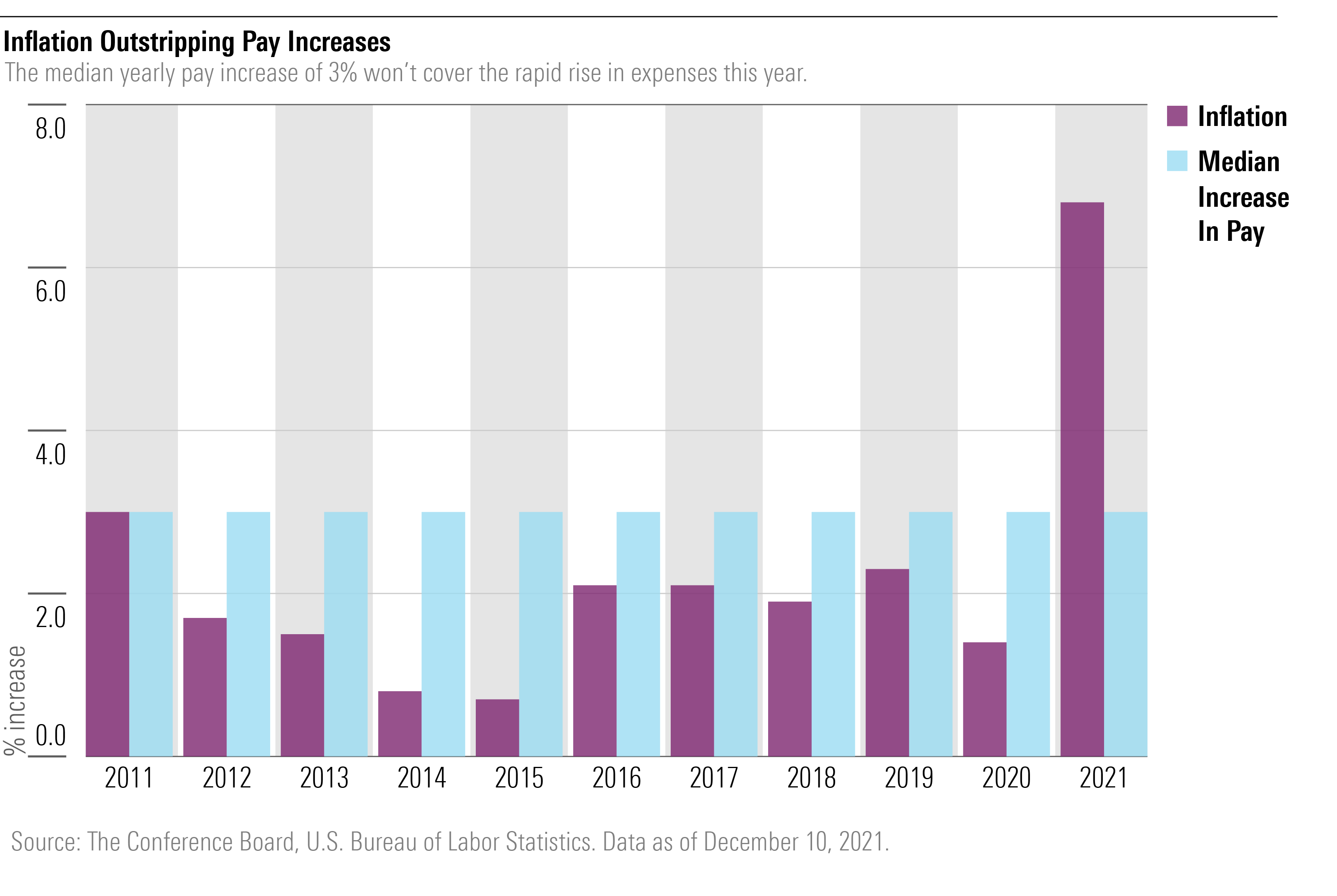

Your year-end bonus or annual pay bump might not be enough to cover the jump in expenses seen this year.

Across the board, prices are 6.8% higher from a year ago. This sharp intake in prices prompted the Social Security Administration to raise its cost-of-living adjustment by 5.9%, the largest increase the organization has made in nearly 40 years.

If it feels like your dollars aren't stretching as far, they likely aren't. For example, $100 might have covered weekly grocery store bill last year. But with grocery prices 6.4% higher this year, that money might not cover all seven days. And if you had $40,000 in your pocket in 2019, you could outright purchase a new vehicle. Today, you couldn't.

How Inflation Can Affect Your Earnings

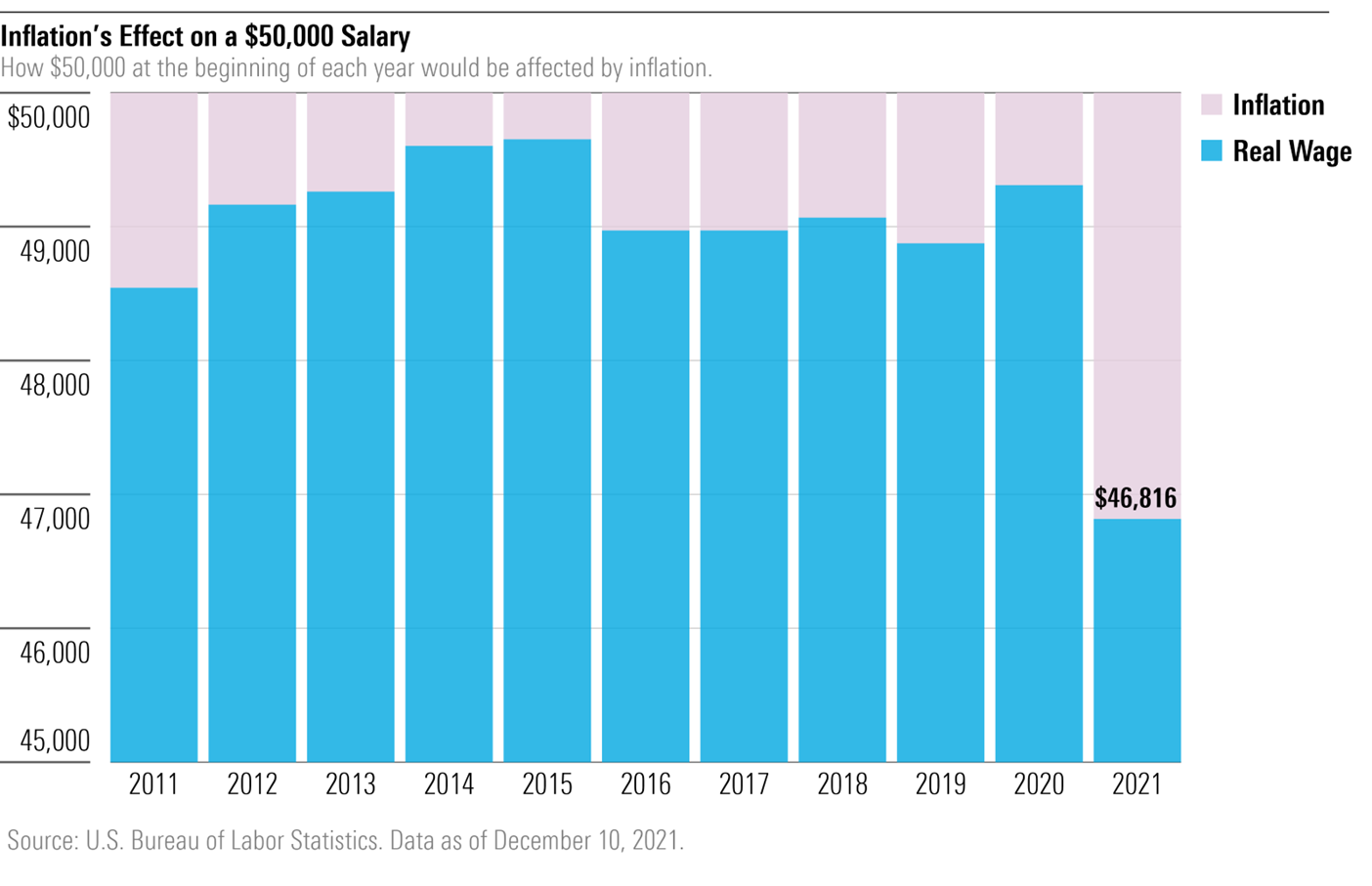

The dollar amount you see on your paystub each month, also called your nominal wage, could have increased, but your purchasing power still declined because of inflation. That’s because this broad increase in prices, from groceries to transportation, has cut into your purchasing power as a consumer. To understand how inflation affects you and what you can buy, you can calculate your real wage.

Your real wage is your take-home pay after accounting for inflation. This calculator from the U.S. Bureau of Labor Statistics provides an easy way to see how inflation has cut into your purchasing power. Let's say you were earning $50,000 at the beginning of the year and didn't see a pay increase. With inflation at 6.8%, your real wage is close to $46,816 ($50,000 / (1+0.068)). Your $2,000 paycheck now feels like only $1,872.

How to Find Your Personal Rate of Inflation

The BLS calculator uses the inflation numbers in the Consumer Price Index, which measures changes in the retail prices of a constant basket of goods. But finding your personal rate of inflation gives a more accurate picture of how inflation affects you.

Inflation's impact on you depends on how and where you spend your money. Tools like this can help you understand the differences. For example, you may be experiencing higher inflation if you drive to work and buy more from grocery stores than someone who takes public transportation and eats out more. A large purchase like a new car or high healthcare or travel spending could cause a bigger dent on your purchasing power. Keeping track of your personal rate of inflation can help you see how your real wage is affected.

Without a pay increase this year, you are likely facing a decline in purchasing power. Workers tend to see a 3% increase in pay every year, according to the Conference Board, a labor market research group that also tracks consumer confidence. With annual inflation hovering around 2% since 2011, this would have easily compensated for rising prices. However, this year, a 3% pay increase still results in a 3.8% reduction in purchasing power.

Inflation could prove to be temporary. But, after facing one year of rising prices and no sign of it abating, it’s important to understand inflation’s effect on you.

Related Links:

How to Protect Your Portfolio From Inflation

What Are TIPS, and How Do They Help Protect Against Inflation?

Your Inflation Tool Kit

The '-flations' in Finance

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)