Rethinking Sustainability Through a Sovereignty Lens

Amid rising geopolitical tensions, rapid tech disruption, and growing energy challenges, security, autonomy, and resilience have emerged this year as new priorities for governments.

To reflect today's complex reality, responsible investors have been compelled to rethink their ESG frameworks and reevaluate investment strategies to align with critical sustainability goals.

This article explores four key investment themes at the intersection of sustainability and sovereignty. We highlight the strategic role that responsible investors can play in fostering a safer, more resilient, and sustainable world.

Defense: Expanding the Responsibility Lens

Geopolitical tensions have resurged since the Russia-Ukraine War began in 2022 and have become even more pronounced following Donald Trump’s return to the US presidency this year. Defense and security have moved to the forefront of political and strategic discussions worldwide. And as a result, over 100 countries have ramped up their military spending.

Though defense was traditionally excluded from sustainability discussions due to its perceived harmful implications, it's now increasingly viewed as integral to national stability and the protection of democracy and fundamental freedoms.

As a result, sentiment among responsible investors has shifted, leading to increased exposure to the sector. According to Morningstar data, exposure to defense stocks within ESG European equity funds has tripled in the past three years—up to nearly 2% in June from just 0.6% at the start of 2022, on average.

The renewed focus on defense has also triggered a shift in how asset managers approach weapons exclusions.

For example, Allianz Global Investors removed exclusions for its Article 8 mutual funds in two specific areas: military equipment and services and nuclear weapons permitted under the Non-Proliferation Treaty.

Similarly, UBS Asset Management withdrew its policy prohibiting its sustainable funds from investing in companies that generated more than 10% of their revenues from producing conventional military weapons.

Even as they broaden their defense investment universe, responsible investors remain committed to ensuring that any support for a nation’s defense sector is grounded in rigorous ESG due diligence.

This is especially critical given that most firms directly involved in weapons manufacturing are assessed as having high to severe ESG risks, while firms providing supporting products and services—such as logistics, technology, or infrastructure—typically have a Sustainalytics ESG Risk Rating of Medium.

The most material ESG risks in the industry arise from business ethics, product governance, and environmental impact. Responsible investors should demand greater transparency from companies to assess these risks effectively and balance expected returns with sustainability and ethical considerations.

AI Governance: A New Frontier for Sovereigns

Artificial intelligence is rapidly becoming a defining feature of sovereign power. Nations are racing to develop and deploy AI technologies for economic competitiveness, defense, and independence.

This AI arms race has introduced new ESG considerations. It is essential for nations to establish their own responsible standards for AI deployment, including transparency requirements and human rights safeguards, while also securing their digital sovereignty, defined as the ability to control and govern their own digital infrastructure, data, and technologies.

Digital sovereignty is becoming increasingly important as AI and other technologies are being used more strategically to shape global power dynamics, influence public opinions, and secure national interests.

This shift has brought new risks to the forefront, particularly around information integrity and public trust.

In January, for the second consecutive year, the World Economic Forum’s Global Risks Report ranked misinformation and disinformation as the leading short-term risks due to their persistent threat to societal cohesion, governance, and trust. These risks are particularly destabilizing in the context of rising geopolitical tensions.

This growing concern over AI and digital sovereignty was underscored recently when the EU reaffirmed its commitment to advancing landmark digital rules, including its AI Act, emphasizing its sovereign right to govern economic activities within its territory in line with its democratic values.

Responsible investors have an important opportunity to help shape the future of responsible AI.

By assessing national AI strategies, supporting sovereigns engaged in international ethical frameworks, and encouraging thoughtful regulation, they can contribute to ensuring that AI and technological progress reinforce—rather than undermine—safety, stability, and trust.

Meanwhile, investors are increasingly scrutinizing how company boards oversee and manage risk related to AI.

According to Morningstar research, shareholder resolutions on AI have garnered significantly stronger support than those on environmental and social issues. In the 2024 proxy season, the average support for 15 reviewed US shareholder proposals on AI was almost double that of the 400 environmental and social proposals (30% versus 16%, respectively).

Energy Independence: A Pillar of Sovereign Resilience

The ongoing Russia-Ukraine war and the resulting energy crisis have highlighted the strategic importance of energy independence.

Today, national security and economic stability are inseparable from a country’s ability to secure reliable, affordable, and clean energy. Without energy, there is no economy, no industry—and increasingly, no digital infrastructure either, as data centers and other technologies become major energy consumers.

Europe remains significantly dependent on external sources. According to Eurostat, 58% of the continent’s energy, including oil, gas, enriched uranium, was still imported as of 2023, a level unchanged from before the war.

While Russian gas imports have declined, the gap has been filled elsewhere, mainly by the US. In 2024, the US was the largest supplier of liquified natural gas to the EU, accounting for almost 45% of total LNG imports.

This dynamic is unlikely to change soon as the EU recently pledged, under a broader trade negotiation, to purchase $750 billion worth of U.S. energy products over the next three years in exchange for tariff concessions on EU exports.

In the meantime, the EU is trying hard to pivot toward clean energy. According to the International Energy Agency, the EU invested over $10 in clean energy for every $1 in fossil fuels in 2023, one of the highest clean-to-fossil investment ratios globally.

Also, investments in grid upgrades, which need to keep pace with the rapid expansion of low-emissions electricity generation, is set to exceed $70 billion this year. Yet the challenge ahead remains steep: The EU estimates that over $600 billion will be needed to modernize grids by 2030 for renewable integration.

Investors have a critical role to play in strengthening energy sovereignty, both in Europe and globally. This includes financing renewable energy projects and the modernization of infrastructure, including smart grids, interconnectivity, and energy storage. They can also engage with policymakers to promote coherence between short-term energy needs and long-term climate commitments.

Climate Change: The Ultimate Sovereign Stress Test

Climate change is no longer a distant threat. Record high temperatures, more frequent and severe weather events, and biodiversity loss are already materially impacting national economies, social stability, and governance structures.

Total global economic losses from natural catastrophe rose to $162 billion in the first half of 2025, up from $156 billion the previous year, according to the World Economic Forum. The US alone accounted for a staggering $126 billion of that total—marking the costliest first half for the US on record.

Investors are increasingly evaluating sovereigns, alongside companies, through three dimensions of climate risk: physical, transition, and adaptation.

Of these, adaptation risk remains the most overlooked. For sovereigns, it encompasses institutional strength, disaster preparedness, and the resilience of critical infrastructure.

Investors can reinforce a country’s sustainable future by investing in climate-resilient infrastructure, renewable energy, and biodiversity protection.

But their influence goes further: Investors can also advocate for ambitious climate policies and champion transparency by urging policymakers to mandate corporate disclosure of emissions targets, transition and adaptation plans, and broader sustainability metrics.

A Strategic Role for Investors

This year's complex geopolitical environment signals an evolution in how responsible investors approach investing.

As global challenges evolve and new risks emerge, investors are forced to rethink their ESG frameworks, review their investment policies, and adjust their capital allocation to reflect shifting priorities and capture new opportunities.

Beyond capital allocation, investors have a critical role to play in engaging with policymakers to promote transparency, responsible governance, and climate ambition.

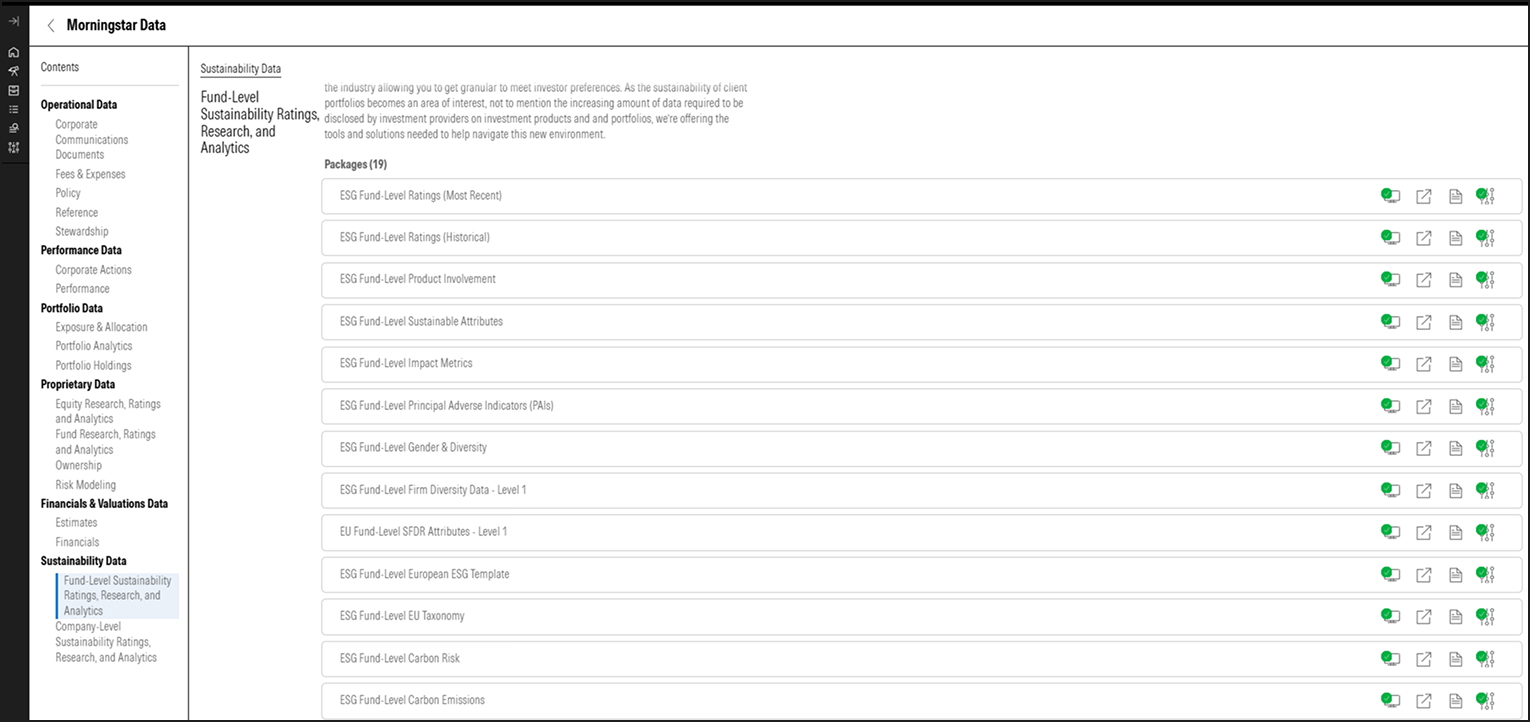

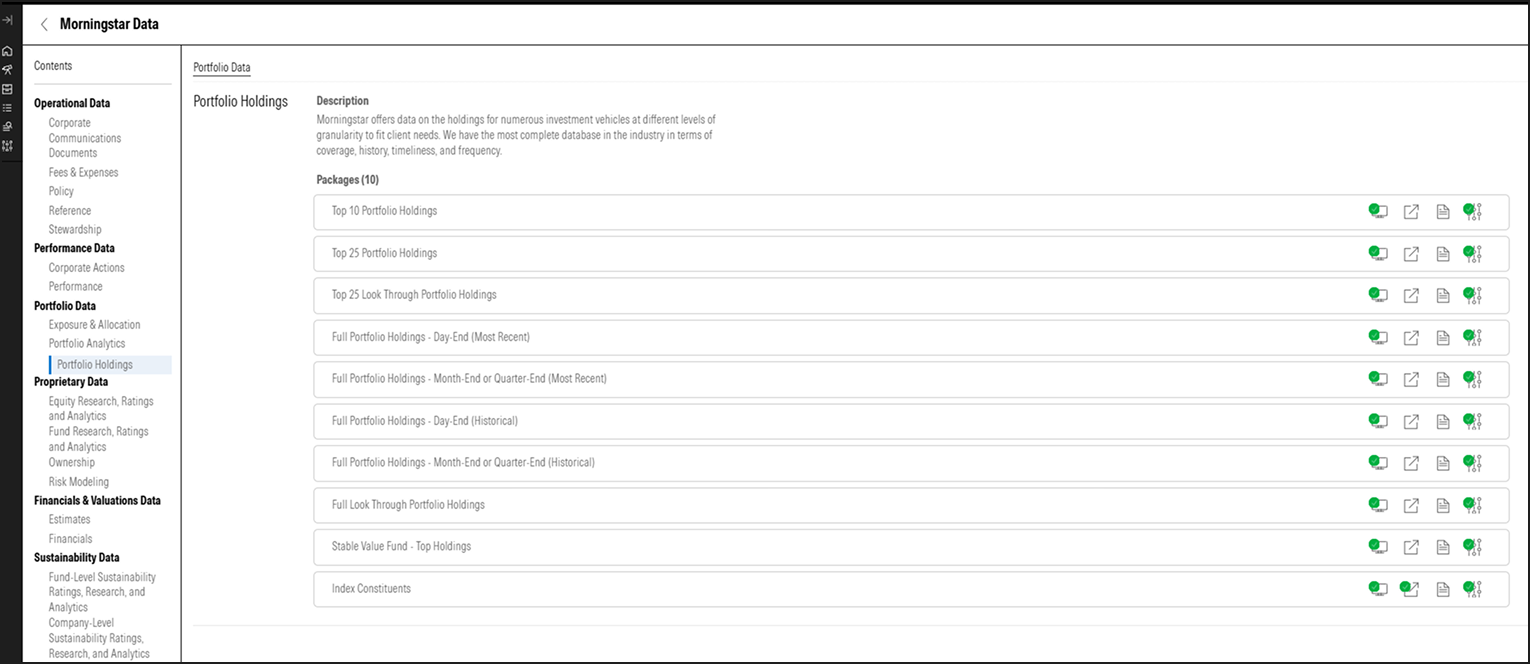

To support this, investors are increasingly relying on new datasets, analytics, and forward-looking metrics to inform decision-making. These tools help refine ESG frameworks, enhance risk assessment, and guide more effective engagement activities—all of which contribute to aligning investment practices with broader sustainability goals.

Leveraging robust ESG data empowers investors to adapt to global challenges and lead in responsible investing.

Prioritizing sustainability and governance helps build resilience and drive meaningful change for investors.