Fund Ranking Flip-Flops

The market turmoil has some funds seeing big moves in category ranks.

This article originally appeared in Morningstar Direct Cloud and Morningstar Office Cloud.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

With financial markets hit by turmoil of a level not seen since the global financial crisis, fund strategies are seeing a significant change in fortunes, either for the worse or for the better.

We dove into Morningstar Direct to screen for diversified U.S. stock funds and international stock funds that have had notable moves up or down in their Morningstar Category ratings as a result of the market collapse between Feb. 19 and Feb. 27. To do so, we compared the category rankings for the one-year period ended Feb. 19 against the one-year period ended Feb. 27. To create a more relevant sample for investors, we screened among funds that have at least a three-year track record and fund assets of at least $100 million.

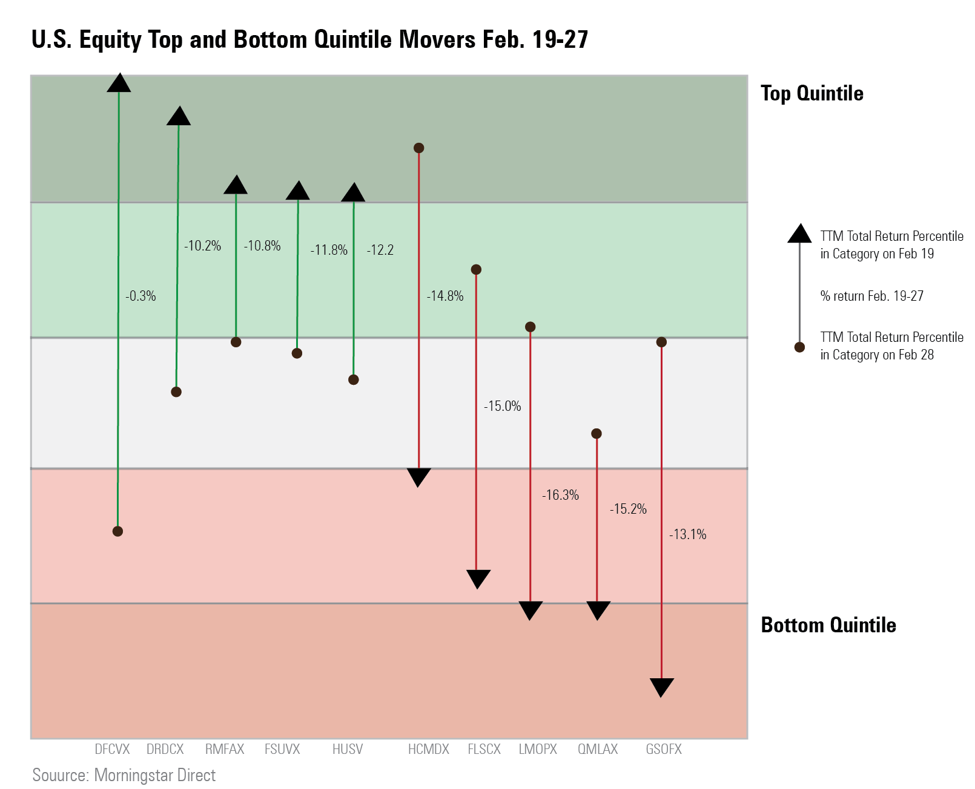

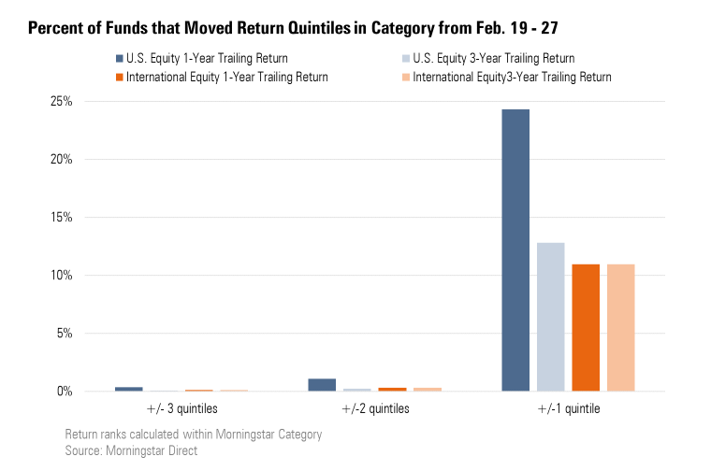

During this time frame, fund rankings within U.S. equity categories saw more movement than among international equity categories. Close to 25% of U.S. equity funds moved up or down a quintile, while only 11% of foreign stock funds did. Some of these swings were substantial: 1.5% of U.S. equity funds and 0.44% of international equity funds moved two or more quintiles.

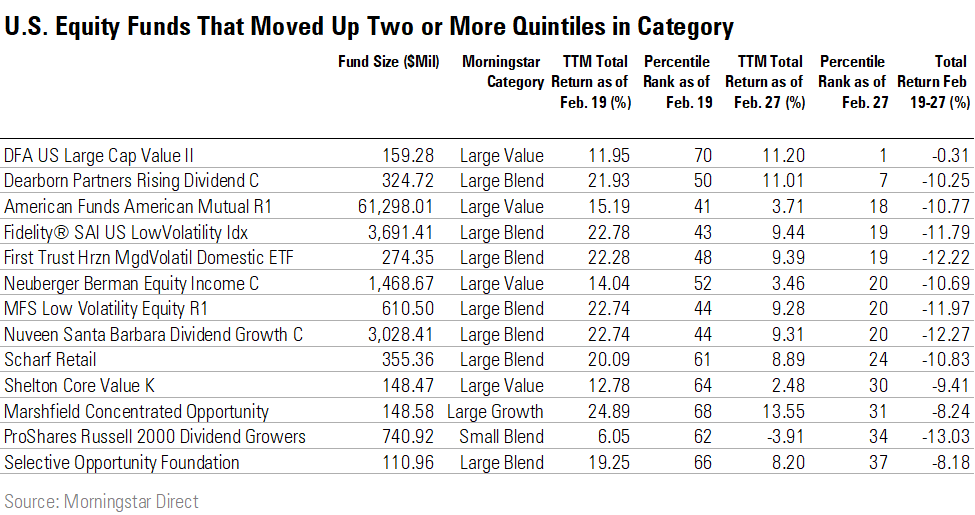

Eighteen U.S. equity funds moved more than one return quintile when one-year rankings were looked at just eight days apart. Thirteen funds moved up more than one quintile--meaning they moved more than 20 percentiles (the 1st percentile = best fund return in Morningstar Category).

For example, DFA U.S. Large Cap Value DFLVX lost only 0.3% over the eight days, and its one-year return of 11.2% as of Feb. 27 put it in the first percentile of large-value funds. The week before, it had ranked in the 70th percentile.

Neuberger Berman Equity Income NBHCX, a large-growth fund with a Morningstar Analyst Rating of Silver, ranked 52nd as of Feb. 19; it moved up two quintiles to seventh. The fund still lost 10.2% but did better than the average loss of 11.5% for large-growth funds for the period.

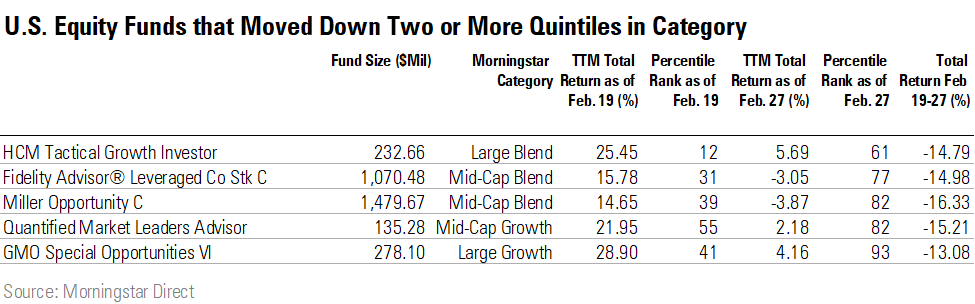

Five U.S. equity funds moved substantially down in rankings. Prior to the market collapse, HCM Tactical Growth Investor HCMDX ranked in the top quintile for large-blend funds; it moved two quintiles to 61st percentile after losing 14.8%. As stated in the prospectus, the fund attempts to mitigate losses during market declines by moving from equity securities into money markets and short-term bonds.

Miller Opportunity LMOPX, managed by veteran stock-picker Bill Miller, has a Morningstar Analyst Rating of Neutral. It took a loss of 16.3% in the sell-off, and the fund’s one-year return went from 14.6% to a loss of 3.9%. That, in turn, caused the fund to fall from the 39th percentile to the 82nd.

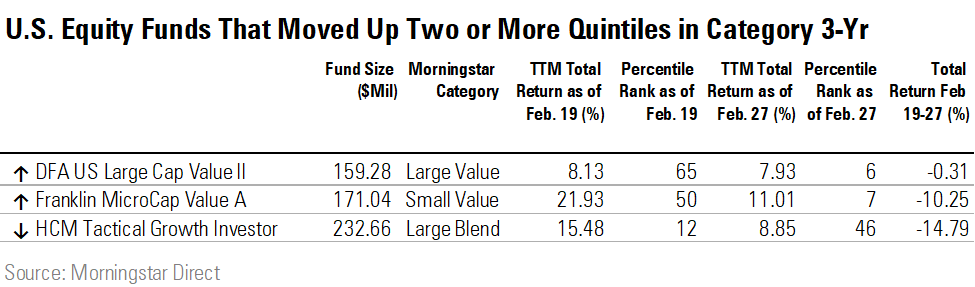

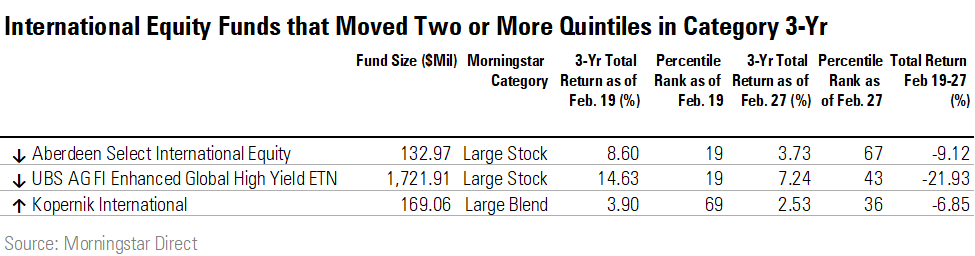

Some funds even saw changes in their three-year fund quintile ranks.

DFA U.S. Large Cap Value lost only 0.3% over the eight days, and its three-year return of 7.9% as of Feb. 27 put it in the first percentile of large-value funds. The week before, it had ranked in the 65th percentile.

Franklin MicroCap Value FRMCX also moved up. It had ranked in the 50th percentile for three-year returns as of Feb. 19; it moved up to seventh as of Feb. 27. The $171 million fund lost 10.3% during the eight days, less than the category average of 11.5%.

HCM Tactical Growth Investor moved down in one-year rankings as well as three-year. The $262 million fund ranked in the 12th percentile for the three-year period but then fell to the 46th.

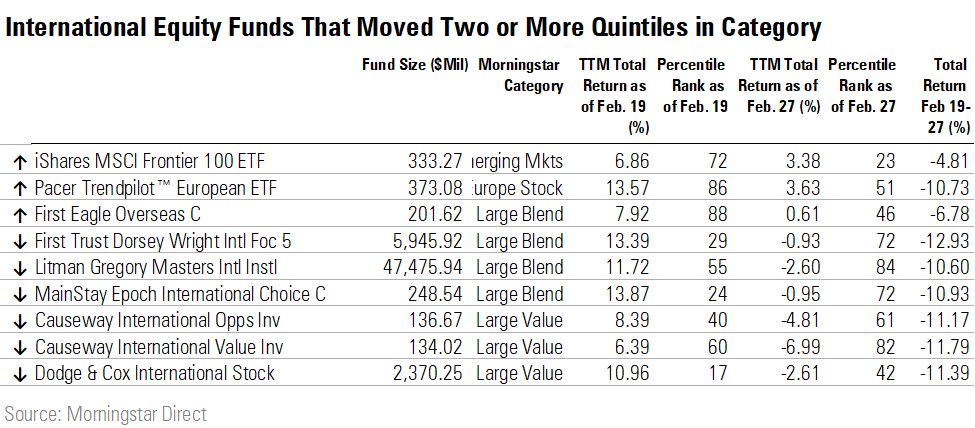

International equity funds also saw some shuffling of the deck, though not to the extent that U.S. equity funds did.

In terms of three-year returns, three funds moved more than two quintiles. UBS AG FI Enhanced Global High Yield ETN FIHD lost 21.93% and moved down to 43rd percentile from the 19th percentile. The average three-year return for world large-stock funds was 7.1% as of Feb. 27.

Within the diversified emerging-markets category, iShares MSCI Frontier 100 ETF FM moved two quintiles up to 23rd percentile from the 72nd percentile for a one-year time period. The fund lost only 4.8% from Feb. 19 to 27, while the average diversified emerging-markets fund lost 6.8%.

Seven funds moved down more than two quintiles. Causeway International Value CIVVX, which is rated Gold by our analysts, had a one-year return of 6.39% as of Feb. 19. The fund went on to lose 11.8%, putting its one-year return at negative 6.9% for the trailing 12 months.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)