Putting the Stock Market Wipeout Into Perspective

Clients can be reminded where the market has been, not get caught up in the market headlines, and stay focused on their goals.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

Note: This article was originally published March 10, 2020. We have updated the data through March 13.

The headlines read like Armageddon is here, with the Dow plunging and oil prices collapsing against the scary and uncertain backdrop of the novel coronavirus. There's no question this is a challenging time, and it's easy for investors to think they are on the verge of seeing their savings wiped out.

It's here that advisors can offer their clients important perspective.

Advisors can do this from three vantage points: where the markets have been, how their clients' portfolios are made up of more than just stocks, and what it all means for meeting their goals.

First, where we've been.

It Has Been a Nasty Sell-Off There is no reason to sugar-coat the severity of the stock market's decline. (In fact, it's a teaching moment for clients.)

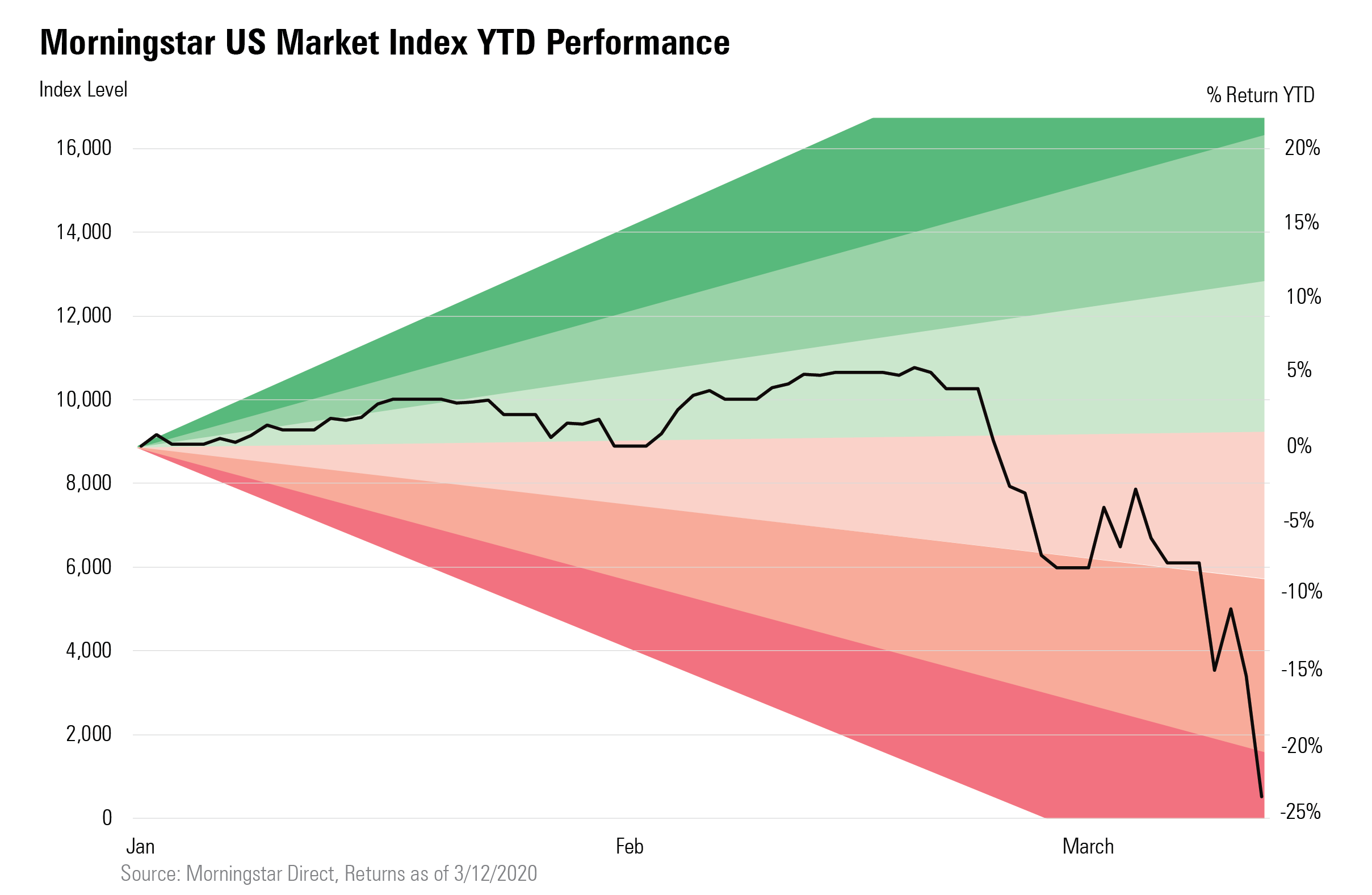

For the year to date through the close on trading on March 13, 2020, the Morningstar US Market Index was down nearly 24%, having suffered a 27% loss since Feb. 19―entering a full-fledged bear market. In the following chart, the color spectrum reflects the cumulative return range for the index trend line within each band.

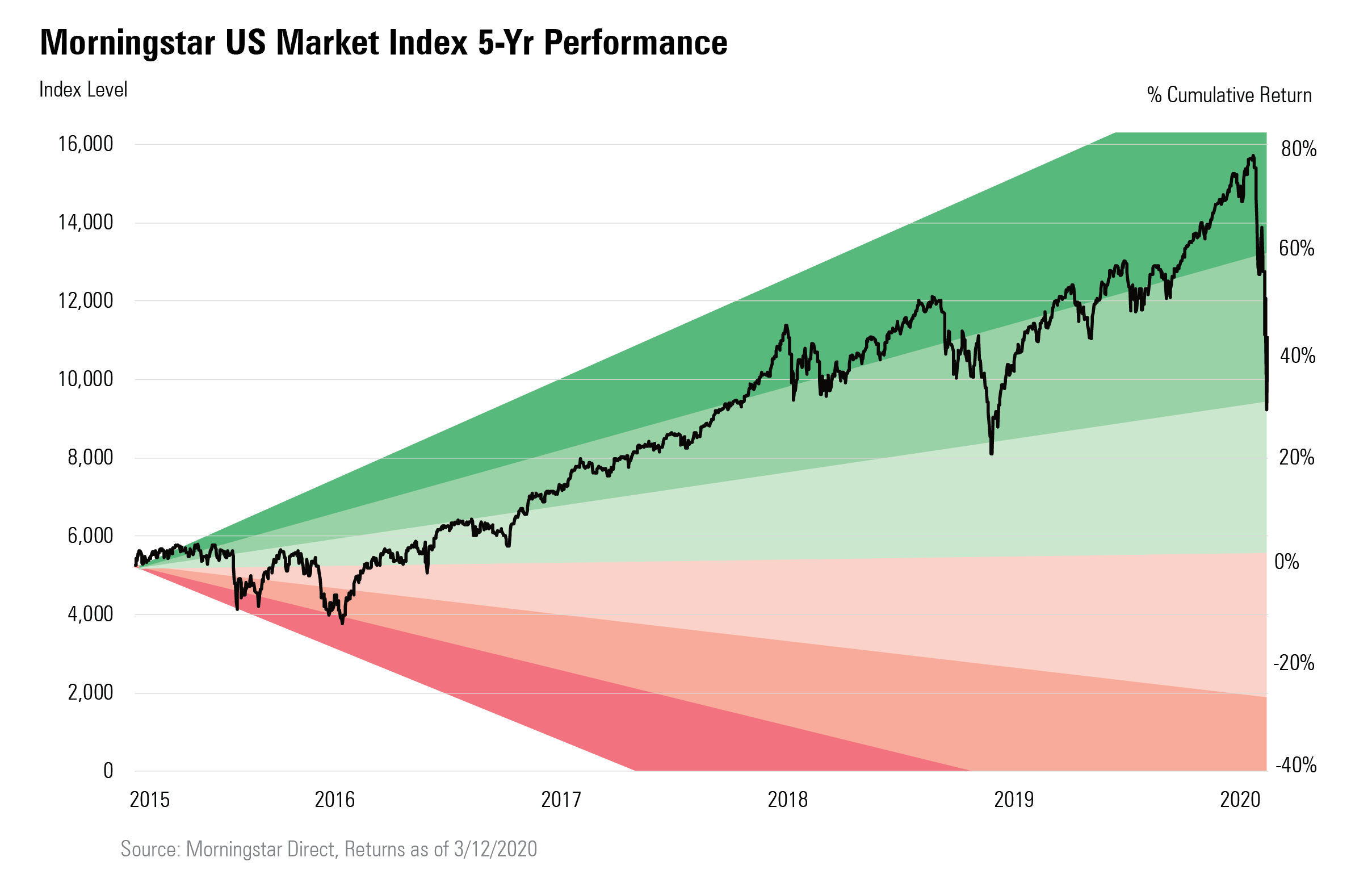

But It's Been a BIG Bull Market When the stock market closed on Feb. 19, it had hit yet another new record high in a bull market that stretched back all the way to back to 2009 when markets were emerging from the global financial crisis.

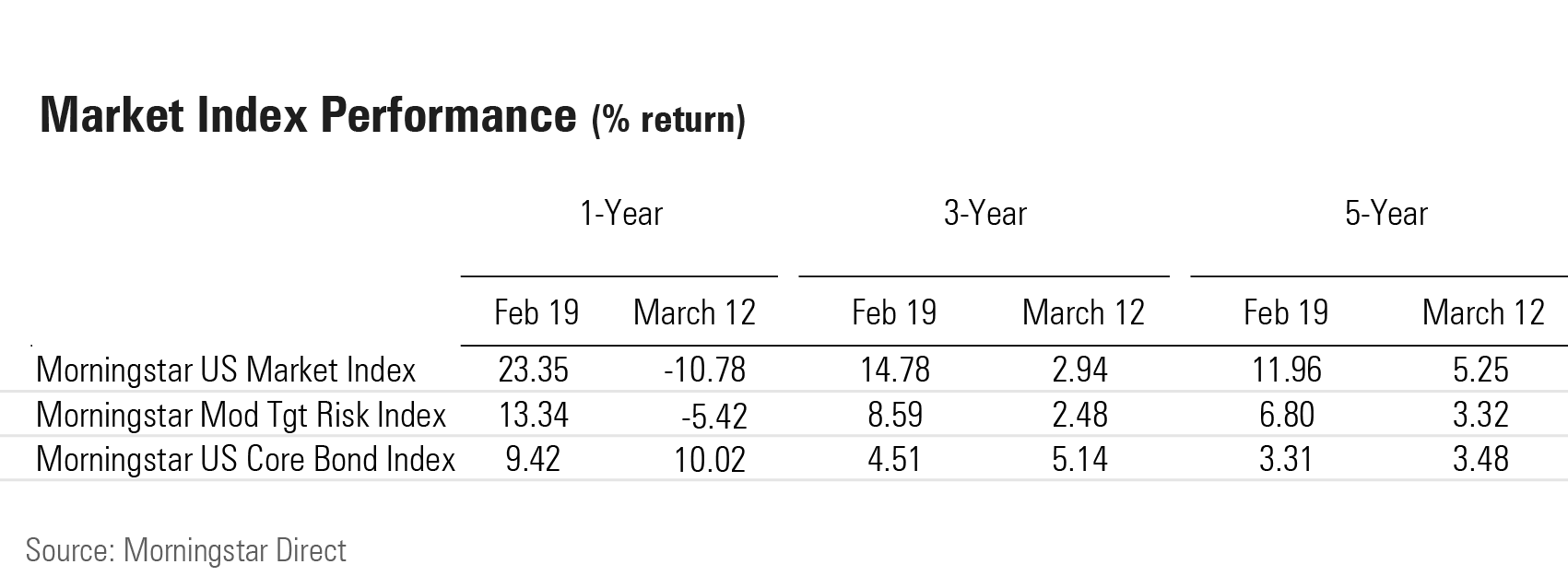

As of Feb. 19, the Morningstar US Market Index had risen 23% over the previous 12 months and was up nearly 15% a year for the past three years and 12% a year for the past five years. Those returns were all well above the long-term averages for equities. In other words, investors made a lot of money in stocks.

Here's how those same stats looked after the March 12 market plunge: The Morningstar US Market Index was down 10.8% from 12 months earlier. Three-year average annual returns were 2.90% and 5.25% over the past five years. Those numbers are weak but still positive and above an extremely low inflation rate.

Clients can also consider that in March 2019, in the wake of a nasty sell-off in the fourth quarter of 2018, stocks were only up 0.3% for the prior 12 months. (Although at that time the three-year average annual return was 13.7% and five-year returns were 9.7%.)

Clients Need to Know the Dow Is Not the Same as Their Portfolio While it's been a bloodbath in the stock market, the panic has translated into a roaring bull market for bonds. That means to whatever degree a portfolio is in diversified bond funds, the headlines on the stock market are overstating the damage that they're experiencing.

As a broad measure of the bond market, we can turn to the Morningstar US Core Bond index. It's up 2.3% in 2020, and up 10% over the past 12 months. On Feb. 19, the index had been 9.4% for the prior 12 months. (Many long-term bond funds are up above 20% this year, but credit-sensitive bonds have taken a hit.)

Now consider how this plays out in a diversified portfolio. Take a standard mix of 60% stocks and 40% bonds as represented by the Morningstar Moderate Target Risk Index. Even after the stock market crumbled last Monday, this portfolio was down just 5.4% for the past year.

Meanwhile, that 60/40 portfolio was up an average of 5.2% per year for the past three years and a hair under 5.0% for the past five years. While that's nothing to write home about, it still leaves an investor ahead of inflation.

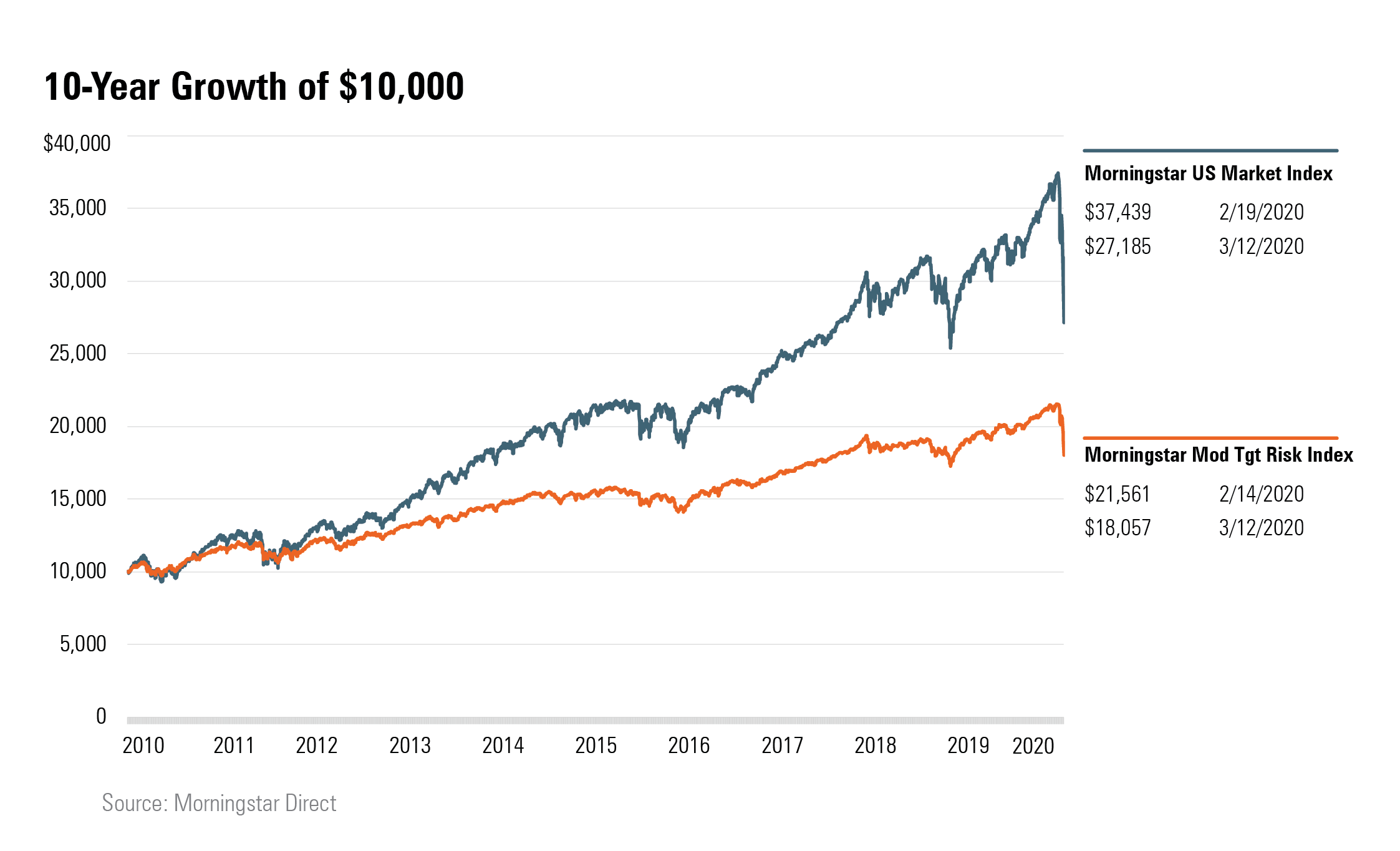

Here's another way to look at the numbers, using a growth of $10,000 calculation. On Feb. 19, $10,000 invested in that 60/40 portfolio a decade earlier was worth about $21,550. After the market collapse, as of March 12, it was worth around $18,000, roughly a 16% decline. (Remember, that decline compares with the nearly 25% drop in the stock market.)

This Sell-Off Is a Good Thing … for Your Clients' Planning Mike Tyson famously said, "Everyone has a plan until they get punched in the mouth." This is the opportunity to help clients see whether their financial plan―and their comfort with the risk of their strategy―can take a punch.

Putting the market drop into the perspective of long-term trends and client goals also helps clients see the value of advice. And as our columnist Sheryl Rowling wrote, advisors can use this market turmoil as an opportunity to assess how well they are serving their clients when it comes to assessing risk capacity and client communications.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)