How Exposed Is Your Domestic Portfolio to Overseas Revenue?

From domicile to revenue.

An Evolution in Investing Investing at home and abroad has changed considerably within the lifetime of most Morningstar readers. The U.S. asset manager Capital Group, which helped pioneer international investing, did not make its first overseas investment until 1954, and only a few others had done the same by the mid-1970s.[1] Holding stocks of companies domiciled outside of North America has since become commonplace. At year-end 2017, for instance, the large-growth Morningstar Category median for actively managed funds' non-U.S. exposure was 4.6%, and nearly 70 funds out of 350-plus had at least 10% of their assets in non-U.S. stocks.

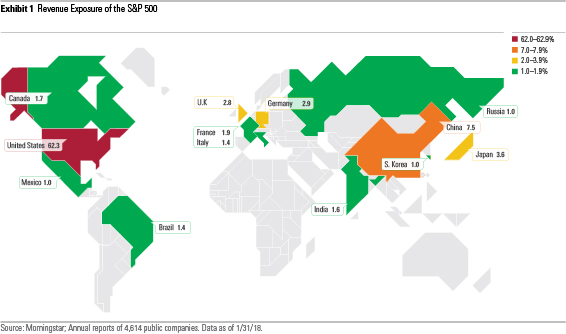

Yet, the significance of where a company’s headquarters are located has changed, too. In the past, a company’s revenue sources had closer geographic ties to its domicile, both nation and region. In that respect, a U.S. investor could use the percentage of assets held in foreign firms and their location to gauge a fund’s country-risk exposures. With many businesses’ operations now spanning the globe, the link between domicile and revenue is less prominent. Indeed, companies within the S&P 500--a popular bellwether for U.S. stocks--receive in total about 38% of their revenue outside the United States, including 14% from Europe and roughly 8% from China.

Looking at Portfolios Through the Revenue Lens

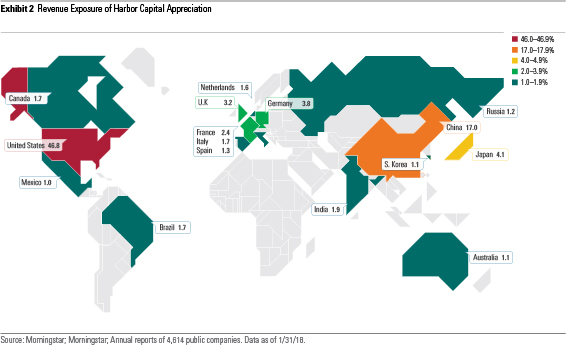

Diversified portfolios in today’s world are inevitably global. To help investors understand the extent to which a domestic fund they own provides exposure to non-U.S. revenue sources or an international fund to money made in America, Morningstar has undertaken a geosegmenting project that will allow analysis of funds from the standpoint of revenue sources. This capability will not become fully operational until later in 2018, but an example here might help.

Even funds whose home-country bias remains strong after accounting for revenue sources can have substantial overseas exposure. Among all large-cap Morningstar Medalists, three value funds own firms that in total receive the lowest percentage of their revenues from outside the U.S. Yet, those percentages are still significant.

Don’t Count Out Domicile

Domicile still matters, though. Aside from renewed concerns about tariffs and trade wars, not every country has laws in place to protect investors to the same extent as the most shareholder-friendly developed markets. Moreover, some companies’ revenue sources still prove to be quite provincial despite their size and prominence. China’s Internet goliaths

Three Domestic Funds With Big Bets on China's Tencent and Alibaba Investors who hold domestic offerings with significant weightings in Tencent and Alibaba might be interested to know the degree to which their fortunes are leveraged to those companies and the country-specific risk associated with them. To that end, here are the three U.S. funds that had the largest combined weightings in Tencent and Alibaba as 2017 came to a close. Each falls into the large-growth category and has a Gold rating.

Harbor Capital Appreciation leads the way. As of year-end 2017, the fund had a 7.2% combined stake in Alibaba and Tencent, both top-10 holdings. Comanagers Sig Segalas and Kathleen McCarragher of subadvisor Jennison Associates focus on dominant businesses they expect to grow at a significantly faster clip than the broader market. That has long led them to tech stocks, a preference that has become even more pronounced of late with just more than half of the fund’s assets in tech, 12 percentage points more than the Russell 1000 Growth Index. They built the fund’s positions in Alibaba and Tencent years ago, though, and this is their second go-around with Alibaba. They first bought the stock following its September 2014 IPO and sold it at a loss in third-quarter 2015 before buying it back in 2015’s fourth quarter. Meanwhile, they had added Tencent in early 2015. Both stocks have subsequently become winners for the fund.

In late 2017,

Unlike the previous two funds mentioned,

The three domestic funds highlighted here, as well as the broader geographic evolution of investing, are yet further reminders that investors should know and understand what they own. Newfound insight provided by aggregating the revenue sources of fund holdings is crucial, but one shouldn’t neglect domicile either.

[1] Ellis, C.D. 2004. Capital: The Story of Long-Term Investment Excellence (Hoboken: John Wiley & Sons), P. 167-168.

/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)