6 New Stocks in the Wide Moat Focus Index

The Morningstar Wide Moat Focus Index scoops up some asset managers and jettisons some real estate stocks.

In June, the Morningstar Wide Moat Focus Index swapped out six stock positions.

To be included in the Wide Moat Focus strategy, a company must have an economic moat rating of wide (which means we think they have advantages that will fend off competitors for at least 20 years), and its shares must be among those trading at the steepest discount to their fair value estimates. (Our fair value estimates are determined through independent research by the Morningstar Equity Research team.) Only U.S. stocks are included in the index.

The index consists of two subportfolios with 40 stocks each. The subportfolios are reconstituted semiannually in alternating quarters, and stocks are equally weighted within each subportfolio. After the June reconstitution, half of the portfolio swapped out six positions. The net result is that the index now holds 50 positions.

Two asset managers,

On the flip side, six stocks were removed because their price/fair values rose beyond our buy range. Notably, two real estate stocks are looking expensive after their prices have run up this year;

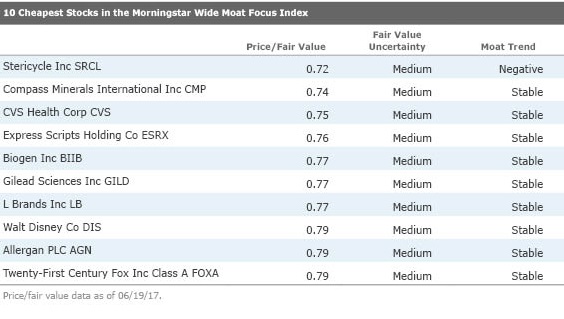

The table below lists the 10 cheapest stocks in the index, ranked by price/fair value. The median stock in the Wide Moat Focus Index is trading at a price fair/value of 0.91. By comparison, the broad Morningstar US Market Index is overvalued, trading at a median price/fair value ratio of 1.06.

Digging Into First-Half Performance

Over the first half of 2017 through June 19, the Wide Moat Focus Index returned 12.2%, beating its benchmark, the Morningstar US Market Index, by 274 basis points. It also outpaced the S&P 500 by 250 basis points. Consumer cyclical stocks were the main performance driver during the quarter, comprising more than a fifth of the portfolio and rising 14.3%. Among consumer cyclicals,

Healthcare and technology were big contributors to performance, with medical device and software firm

The Wide Moat Focus' zero weighting in energy continued to pay off, helping it outperform broader market indexes. Though we have not identified any competitively advantaged companies selling at a discount in the energy space for quite a while, that could change if stock prices continue to slide. The energy sector has fallen 12.6% for the year to date through June 19 due to sagging oil prices. The median energy stock under our coverage is trading at a 7% discount to fair value, at a price/fair value of 0.93%.

Basic materials hurt performance worse than any other sector so far this year. Among individual stocks, rock-salt producer

And although the healthcare weighting has been a positive contributor in aggregate this year, not all bets in the sector paid off. Biotech

Click

to see the top 25 positions in the index. (Premium members can see

.)

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)