Investor Flight to Money Market Funds Slows Dramatically in April

Bank exodus levels off as worries cool over regional bank crisis.

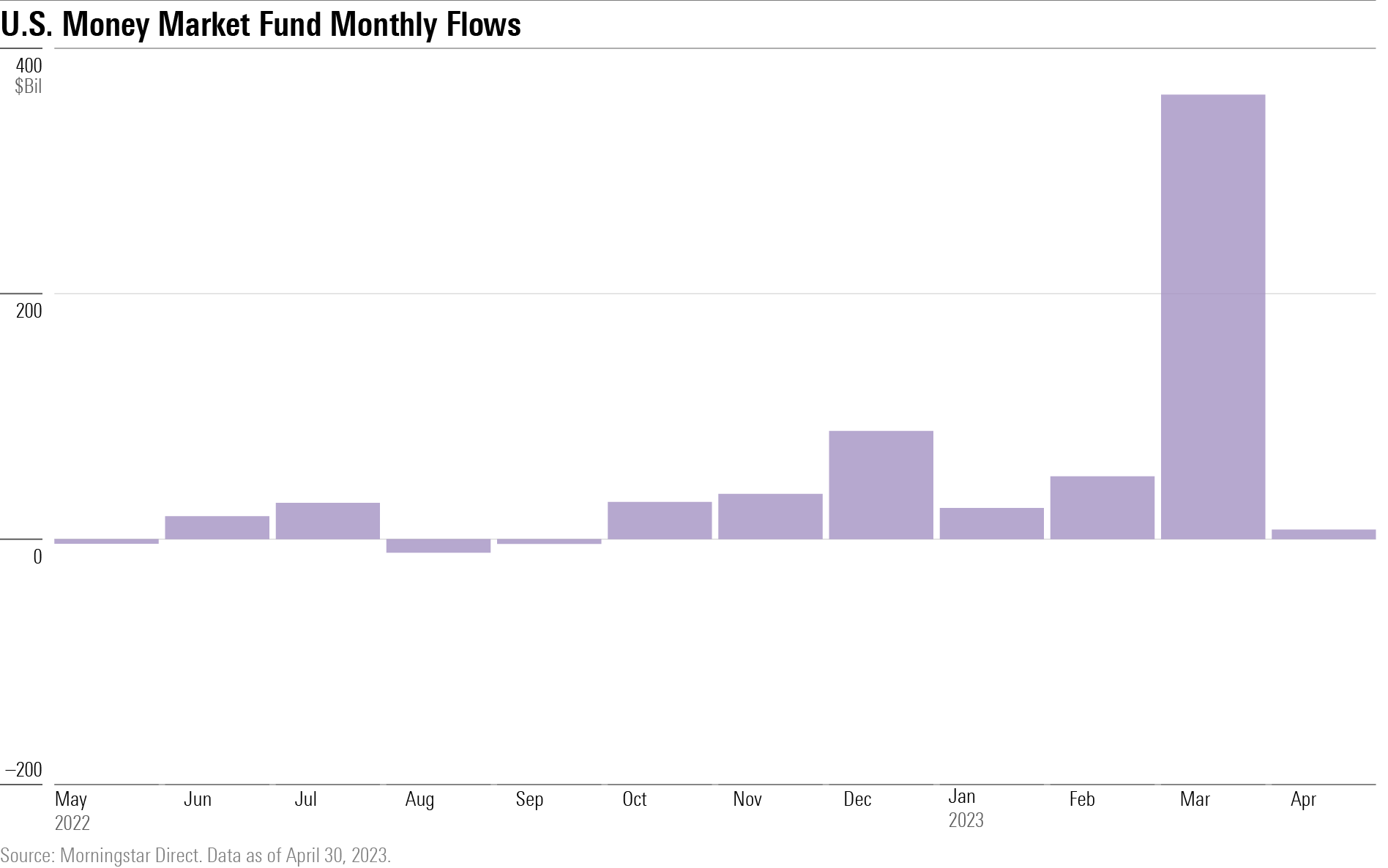

After investors poured into money market funds in March, their appetite subsided in April.

Money market funds collected just $7.8 billion during April—a trickle compared with the $362.2 billion the month before—and experienced their largest week of outflows since 2020.

Still, such funds have grown this year by $514.3 billion, to $5.3 trillion.

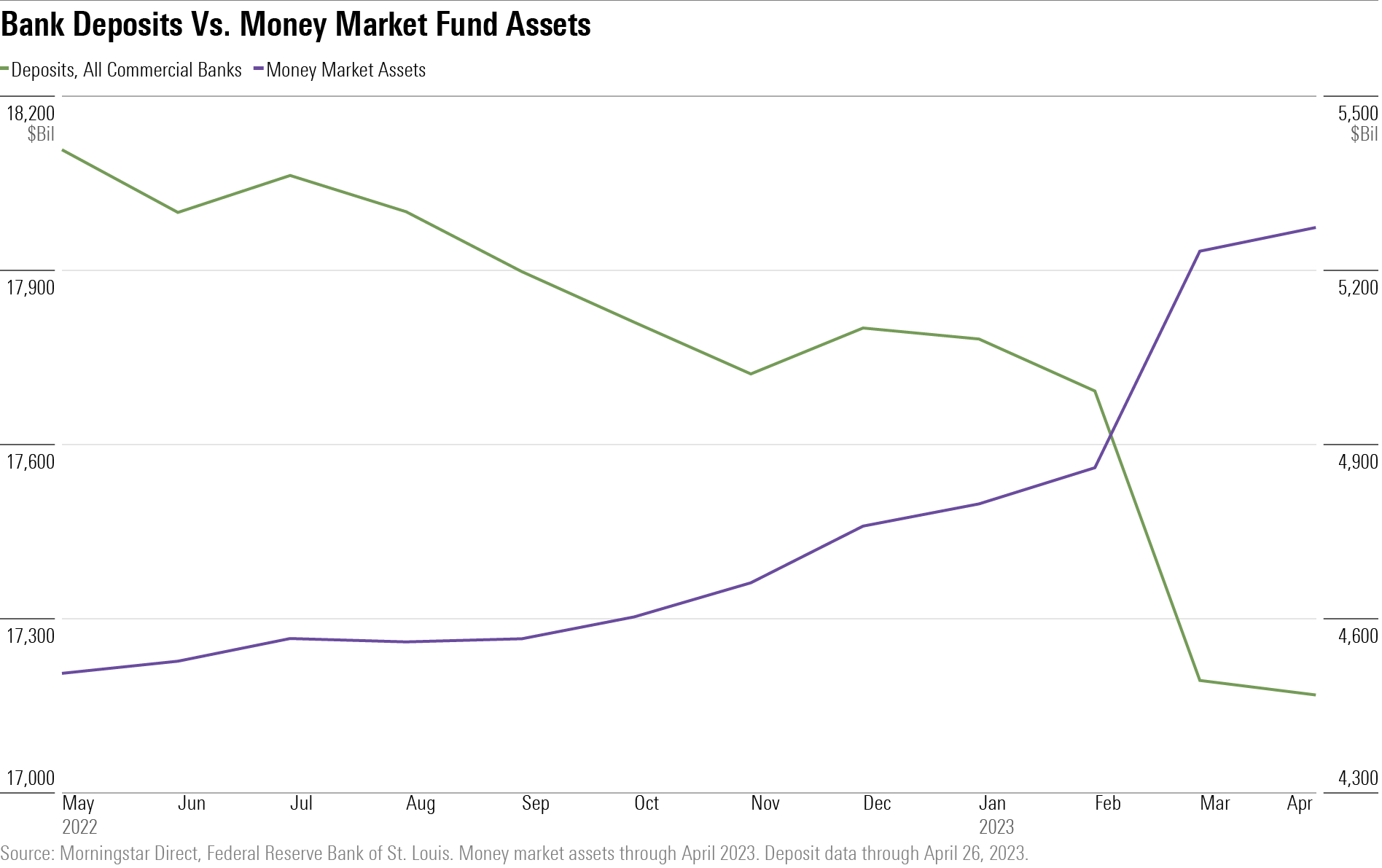

That flood of cash was the product of two factors: higher yields on money market funds as a result of the Federal Reserve’s aggressive interest-rate increases, and worries about the safety of bank deposits following the recent failures of three regional banks, beginning with Silicon Valley Bank in early March. Investors have pulled $632 billion in deposits from commercial banks since the start of the year through April 26.

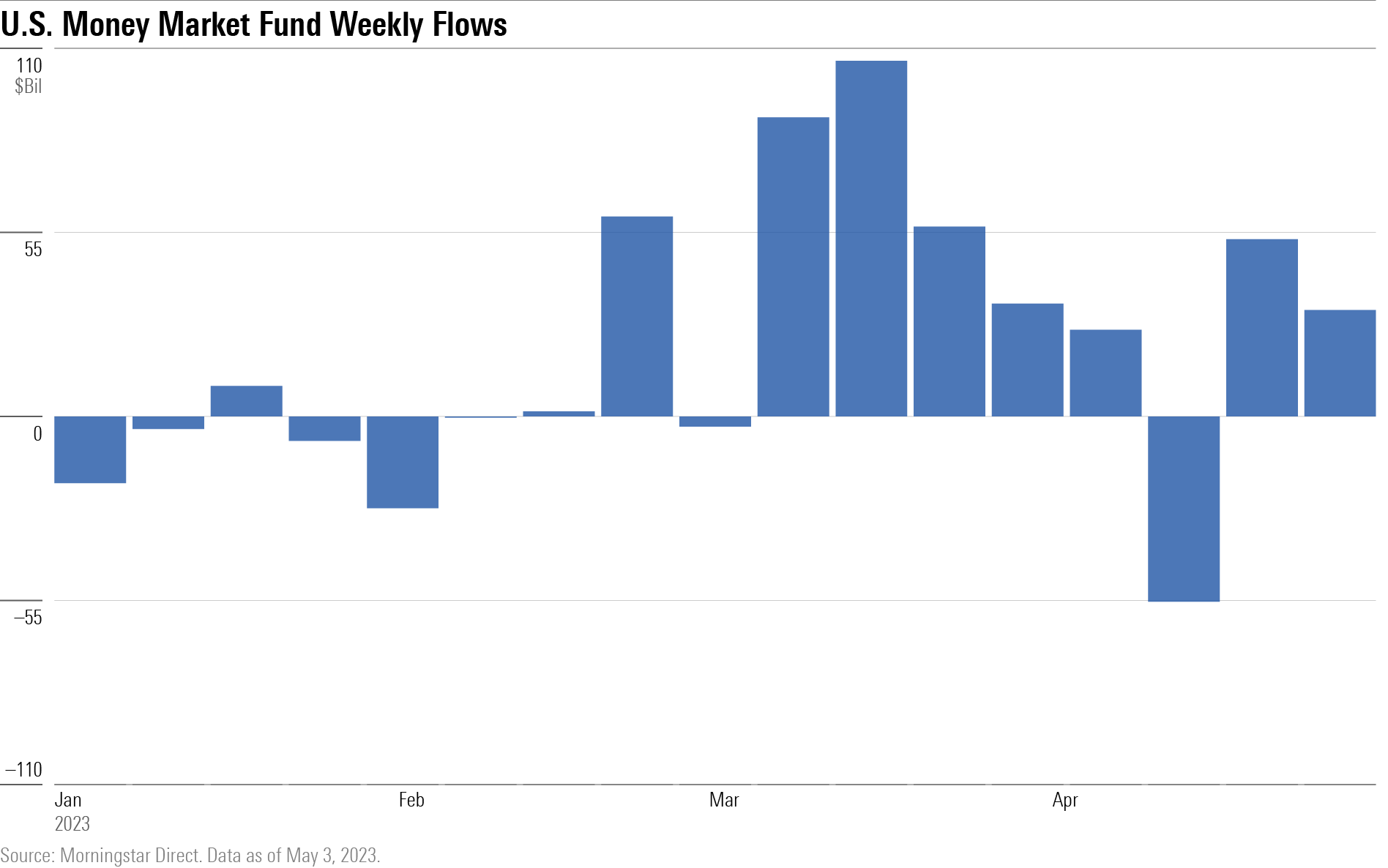

Money market funds recorded outflows of $55.4 billion in the third week of April—the largest weekly outflow since July 2020.

(The weekly money market flows graph captures roughly three-quarters of the assets of the month’s data. It does not include information from Fidelity Investments, which only reports monthly.)

Flight From Banks

While money market funds are generally considered low risk, they aren’t insured by the FDIC the way that certificates of deposit and bank deposits up to $250,000 are.

However, when Silicon Valley Bank collapsed, a large number of depositors—including technology company startups—were threatened with losing their money on deposits in excess of the FDIC cap. That sparked a wave of concerns about the safety of deposits at regional banks.

Those concerns seem to have eased after regulators stepped in to backstop bank deposits. The failure of another major regional bank in May, First Republic, did not generate a panic and a move to money market funds the way the initial bank failure did.

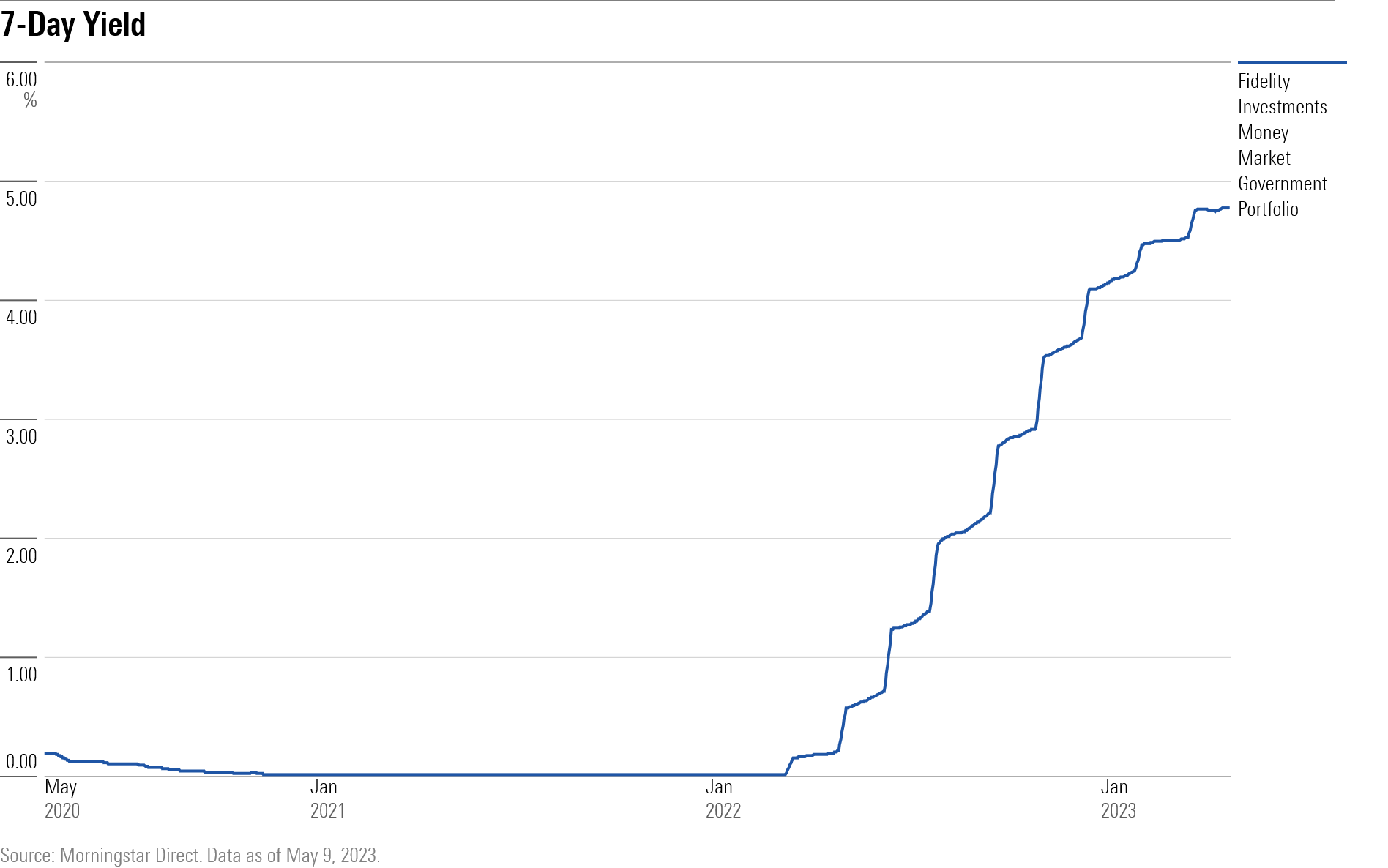

The Allure of Money Market Fund Yields

Additionally, the more attractive yields available on money market funds have magnified the shift from bank deposits.

Two years ago, investors received next to nothing for putting their cash in a money market fund; today they can receive 4.7% on an annualized basis in a Fidelity government money market fund. Interest rates on savings deposits generally rise at a much slower pace.

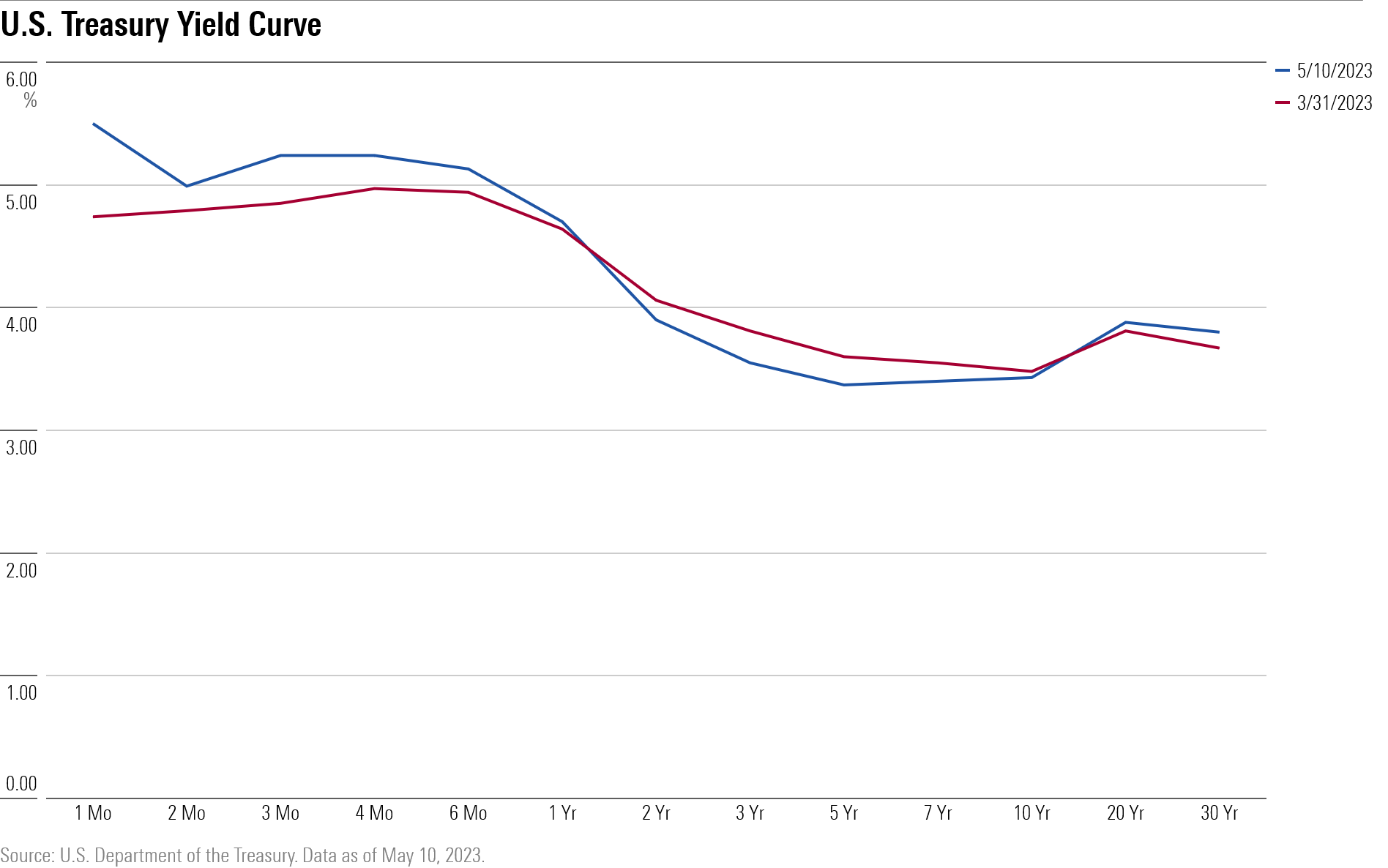

One potential problem for money market funds is the uncertainty around the debt ceiling in Washington. While experts deem a default unlikely, if the U.S. did run out of money, one result would be a failure to pay interest and principal on its debt, which could include the kinds of short-term Treasury securities held by money market funds.

Still, concerns about disruptions from the U.S. government hitting the debt ceiling are showing up in the bond market, where short-term Treasury yields have spiked recently. One-month Treasury yields have risen to 5.5% as of May 10—up from 4.7% at the end of March.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)