Markets Brief: March CPI Report Forecasts Show Inflation Still Running High

Slowing economic growth expected to bring down inflation this year.

Check out our weekly markets recap at the bottom of this article.

For over a year, red-hot inflation has often made the monthly Consumer Price Index report a make-or-break moment for the markets. However, it could be a different story with the March CPI report.

In the wake of the regional banking crisis that broke out a month ago, the focus has shifted to the degree to which the economy will slow in coming months as bank lending slows, and from there, the degree to which that will help reduce inflation. That should take some of the pressure off the March CPI to show significant improvement in terms of falling inflation rates.

Forecasts for the March CPI report show inflation is expected to post a 5.2% increase from a year ago, according to FactSet’s consensus forecasts. That would be well above the Federal Reserve’s target, but an improvement from the 6% increase shown in the February CPI report.

For the month, the CPI is forecast to rise 0.3%, while core CPI is expected to rise 0.4%.

Of course, a March CPI report that comes in well above forecasts could mean that the job facing the Fed in reducing inflation will continue to prove difficult.

CPI May Take a Back Seat to Data on Economic Growth

But many investors are now expecting a slowdown to ripple through the economy as banks make it harder to borrow money, which in turn should help cool off inflation later this year. Already, key reports on the manufacturing sector of the economy are showing signs of significant weakening.

Bond markets are now expecting the Fed to cut rates as soon as the third quarter, even as Fed officials have signaled that after one more quarter-point increase in the federal-funds rate, they expect to hold policy steady through the end of the year.

For now, however, forecasts for the March CPI report call for inflation to once again come in at stubbornly high levels. That’s especially the case for so-called core inflation, which excludes volatile food and energy costs.

“Headline inflation still continues to trend down, but progress on core inflation seems to be stalled,” says Alan Detmeister, senior economist and executive director at UBS.

When it comes to inflation getting down toward the Fed’s 2% target, “It’s going to take time, at least a year away from that,” he says. “But once you start getting more toward the summer, we expect to see monthlies start to ease on the core side.”

March CPI Report Forecasts

Forecasts for the March CPI report show a slight slowdown in price increases, according to FactSet.

- The CPI is forecast to rise 0.3% for the month after rising 0.4% in February, according to FactSet.

- Core CPI is forecast to rise 0.4% for the month versus 0.5% in February.

- The CPI, year over year, is forecast to rise 5.2% versus 6.0% in February.

- Core CPI, year over year, is forecast to rise 5.6% versus 5.5% in February.

Detmeister maintains a March CPI forecast that falls in line with consensus for core CPI, but he’s expecting headline CPI numbers to come in below consensus. He foresees headline CPI rising just 0.1% month over month and 5.1% year over year. For core CPI, Detmeister expects a consensus-matching rise of 0.4% for March from month-ago levels and a rise of either 5.6% or 5.7% from year-ago levels.

Erik Weisman, chief economist and portfolio manager at MFS Investment Management, does not produce month-to-month CPI forecasts. But for the longer term, he says that inflation won’t be embedded the way it was in the 1970s. “Fiscal policy was very loose leading up to that time, for three or four years in a row,” Weisman says. “And this time, fiscal policy was loose after the onset of the pandemic, but that really only lasted one year. It takes longer for the effects of loose fiscal policy to really become embedded.” That said, Weisman thinks that inflation could get stuck at levels above 2% after the economy makes its way out of any upcoming recession.

Morningstar’s chief economist Preston Caldwell forecasts inflation numbers for the PCE index, the Fed’s preferred inflation indicator. Caldwell foresees overall PCE inflation to fall to 3.0% year over year by mid-2023 and 2% by the end of the year, down from 5.0% as of February. That’s consistent with a core CPI number between 0.3% and 0.4% for the March CPI report.

What to Watch in the March CPI Report

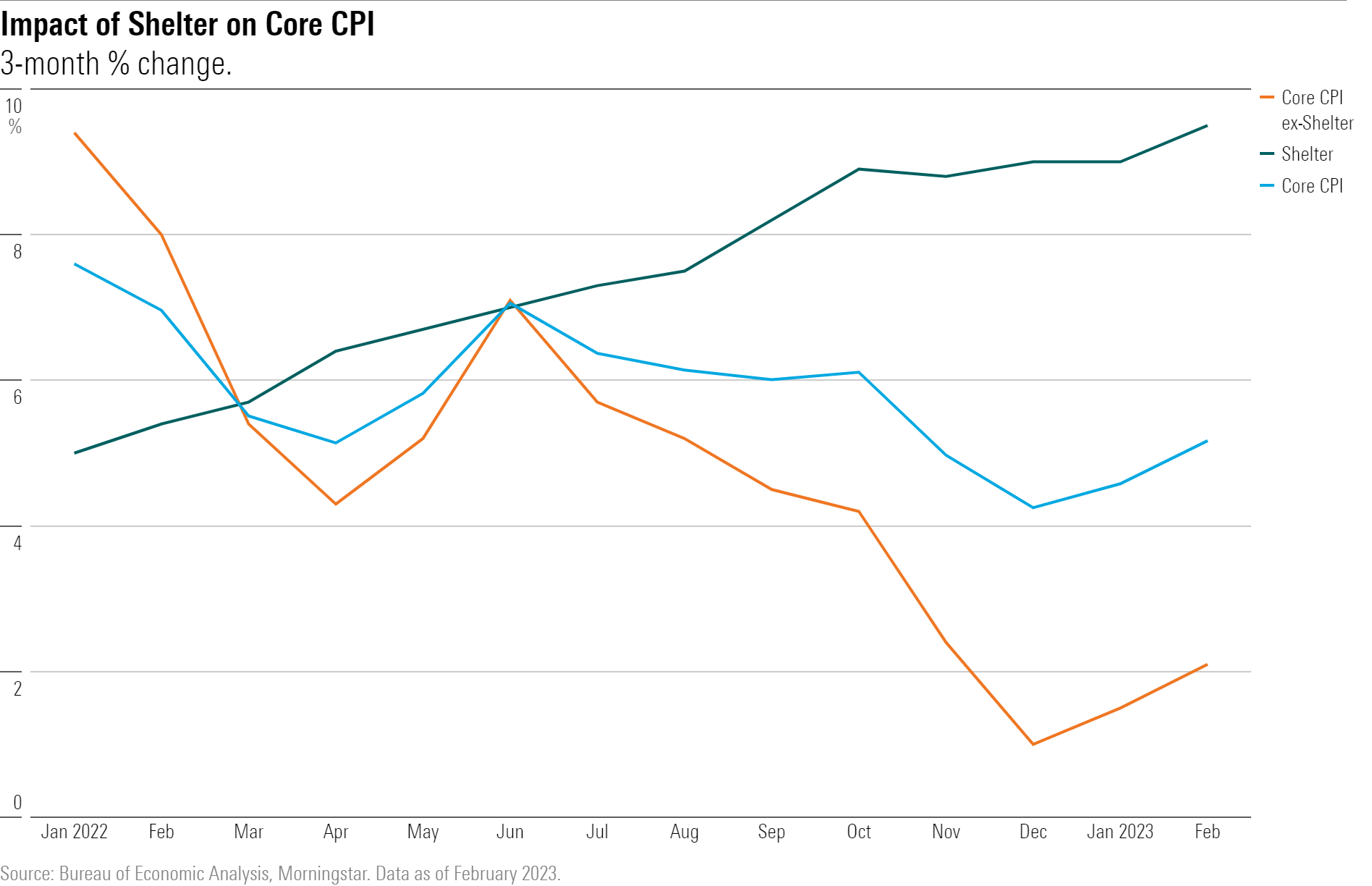

“For now, CPI rents are still increasing very close to their fastest pace,” UBS’ Detmeister says, adding that rental prices make up 40% of the core CPI. “Once we start to see the market rents slowing down in the CPI, we will see dramatic slowing in the core CPI.”

Rental prices are an important indicator of longer-term inflation trends, according to Detmeister.

“Other measures of market rents (rentals to new tenants, not renewals of existing properties) have all started to slow pretty dramatically since October, but we haven’t seen that in the CPI yet.” Detmeister says it’s only a matter of time before slowdowns in market rents and other rental prices start to appear in the CPI reports.

“Super Core” Services Inflation

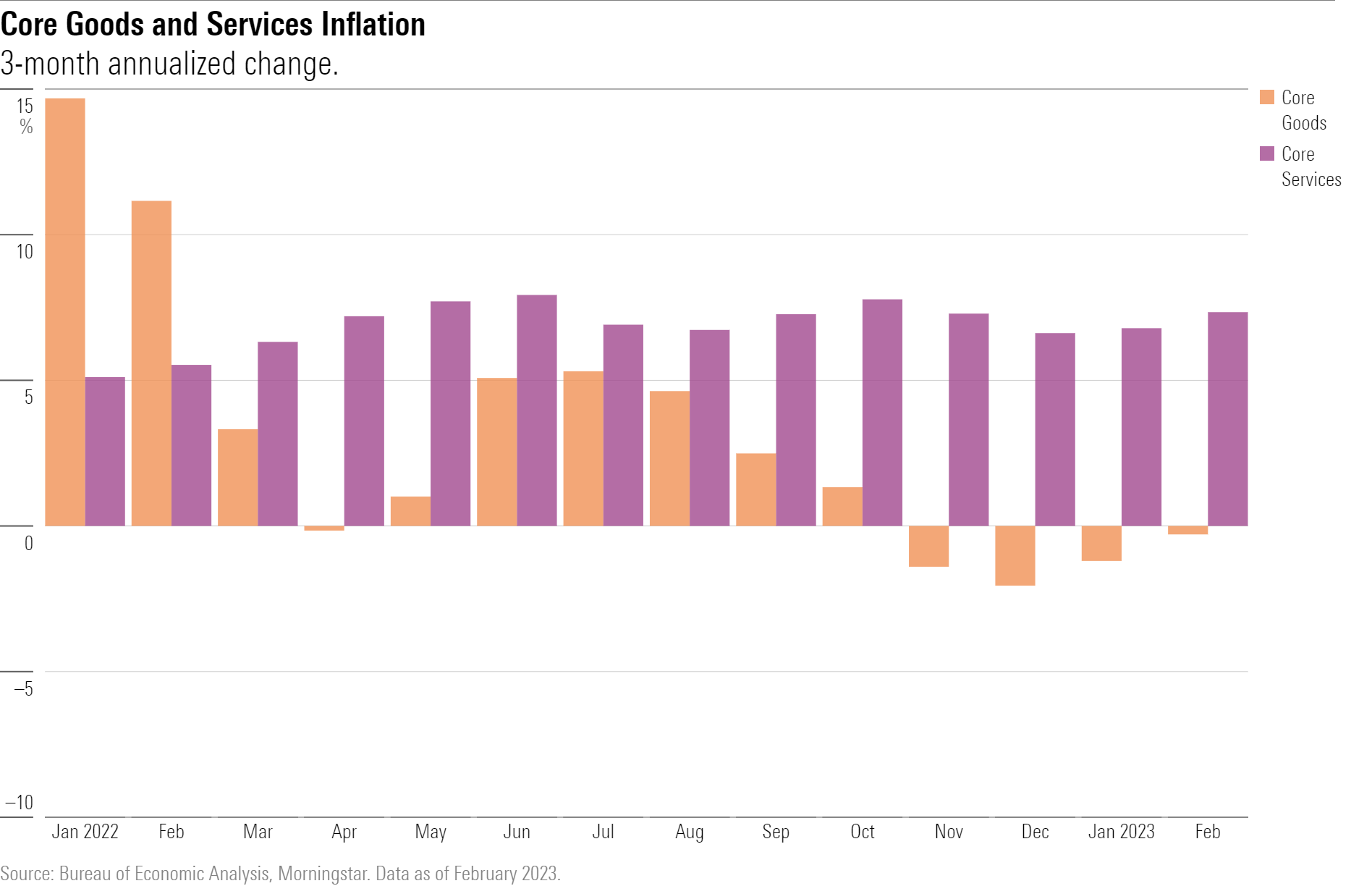

“One area of inflation that remains a key question mark is core services excluding housing—often referred to as ‘super core’ inflation,” Morningstar’s Caldwell says.

“Super core inflation in the CPI report has shown no signs of abating yet,” he says, “But falling wage growth would suggest that inflation in this category should moderate.”

MFS’ Weisman echoes the sentiment, saying that this type of inflation rhymes with much of the labor market. “Core services—outside of rents, medical services, and transportation—makes up the broad basket of what many people think of as wage-driven components. Their correlation with wages is actually a lot lower than you’d expect, but they tend to be more persistent components.” Weisman recommends watching these so-called super core components for clues on the Fed’s next move.

Fed Policy Moves Will Depend on All the Latest Economic Data, not Just CPI

UBS’ Detmeister doesn’t see the Fed changing its decision based on the results of the March CPI report. “We’re still expecting a quarter-point rate hike, a pause after that, and then some rate cuts late this year as the economy goes into recession and as inflation continues to ease.”

The Fed looks at economic data holistically, and it would take more than just one strong or weak inflation reading to get the policymaker to change its tune. “It would take not just the CPI but also wage growth, payroll growth, and more broadly what’s happening in the macroeconomy—if they all come in really low or really high, that could easily change the Fed’s plans. But monetary policy won’t be driven off one print.”

Events Scheduled for the Coming Week:

- Thursday: March Consumer Price Index Report.

- Friday: JPMorgan Chase JPM, Wells Fargo WFC, Citigroup C, BlackRock BLK, and UnitedHealth Group UNH report earnings.

For the Trading Week Ended April 6

- The Morningstar US Market Index fell 0.5%.

- The best-performing sectors were utilities, up 3.0% and healthcare, up 2.9%.

- The worst-performing sectors were industrial, down 3.8%, and consumer cyclical, down 3.1%.

- Yields on 10-year U.S. Treasuries fell to 3.29% from 3.50%.

- West Texas Intermediate crude prices rose 6.5% to $80.61 per barrel.

- Of the 844 U.S.-listed companies covered by Morningstar, only 335, or about 40%, were up, and 508, or about 60%, declined.

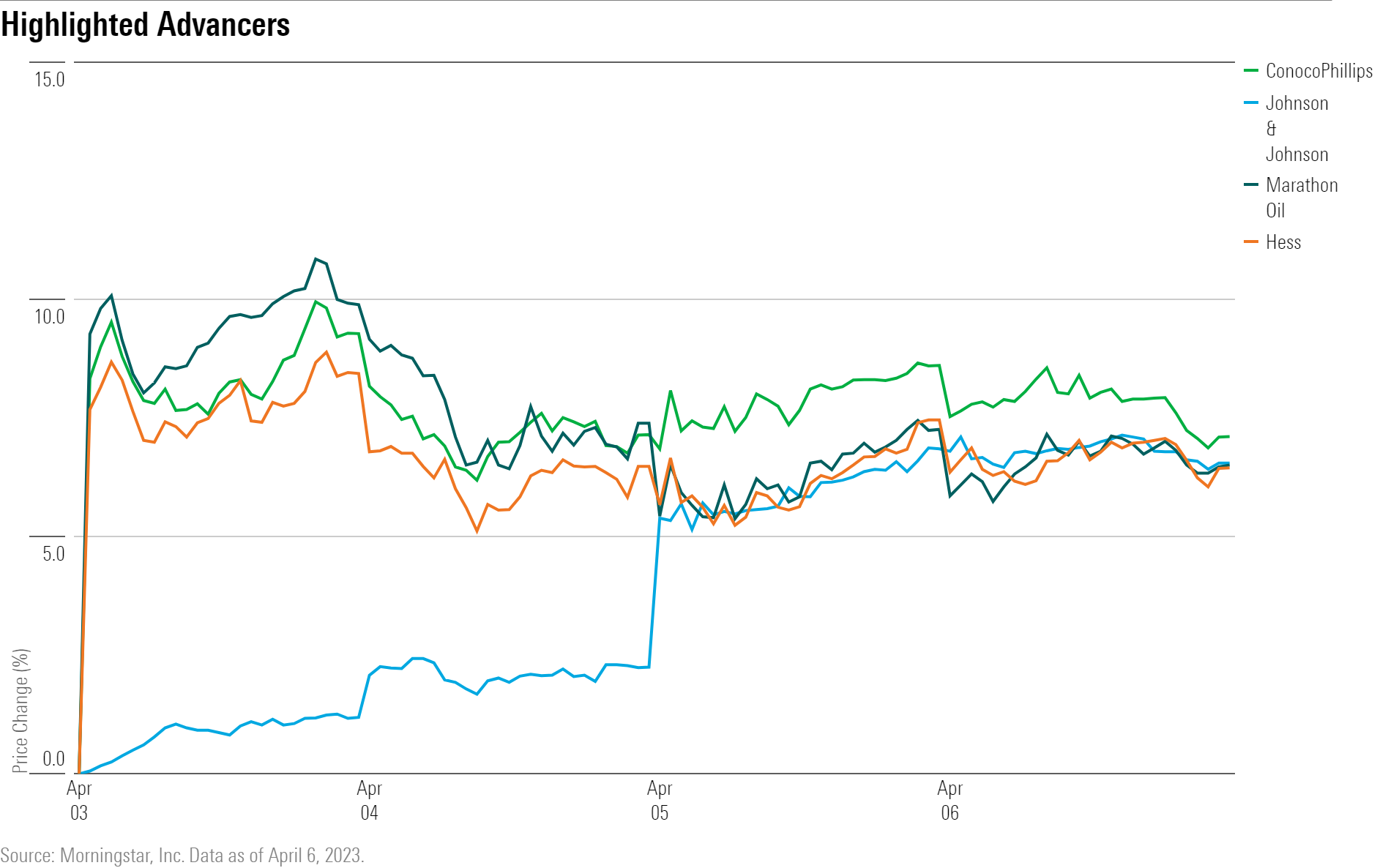

What Stocks Are Up?

Oil & gas companies jumped over news that the Organization of Petroleum Exporting Countries would cut production, leading to a spike in oil prices. Shares of ConocoPhillips COP, Hess HES, and Marathon Oil MRO were among the best performers in the industry.

Johnson & Johnson JNJ stock rallied after the firm proposed to pay $8.9 billion over the next 25 years to settle lawsuits over claims that its talcum powder products caused cancer. The proposal “looks likely to remove the litigation risk overhang,” says Damien Conover, Morningstar’s director of equity research, healthcare.

“Even though we believe there seems to be very little link between talc usage and cancer, J&J appears to prefer this settlement rather than pursuing litigation that could take decades and end up costing several billion dollars in legal fees,” he says.

What Stocks Are Down?

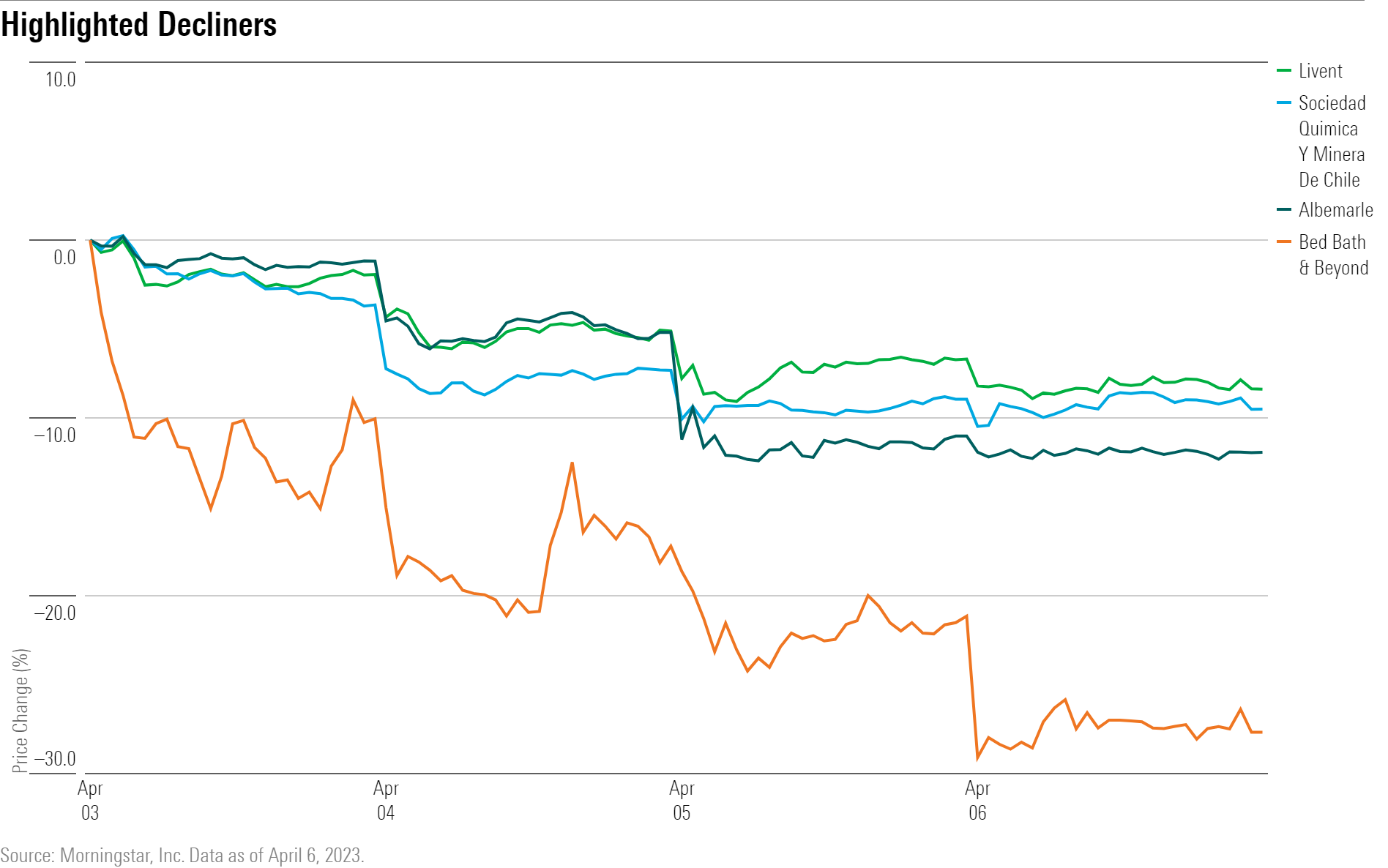

Bed Bath & Beyond BBBY shares continue to slump as the firm struggles to stay afloat. The firm announced that it entered a vendor consignment program with ReStore Capital. Under this deal, ReStore will buy up to $120 million in merchandise, which will allow Bed Bath & Beyond to stock up on merchandise without having to pay for it upfront, which should help the firm manage its cash flow.

Lithium miners producers Albemarle ALB, Livent LTHM, and Sociedad Quimica Y Minera De Chile SQM all fell as lithium carbonate prices continued to slip. The metal is down roughly 60% from the start of the year.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)