Markets Brief: Why Investors Are Rushing to Quality in the Bond Market

In the wake of the banking crisis, the highest-quality bonds have gained while low-quality bonds suffer.

Check out our weekly markets recap at the bottom of this article.

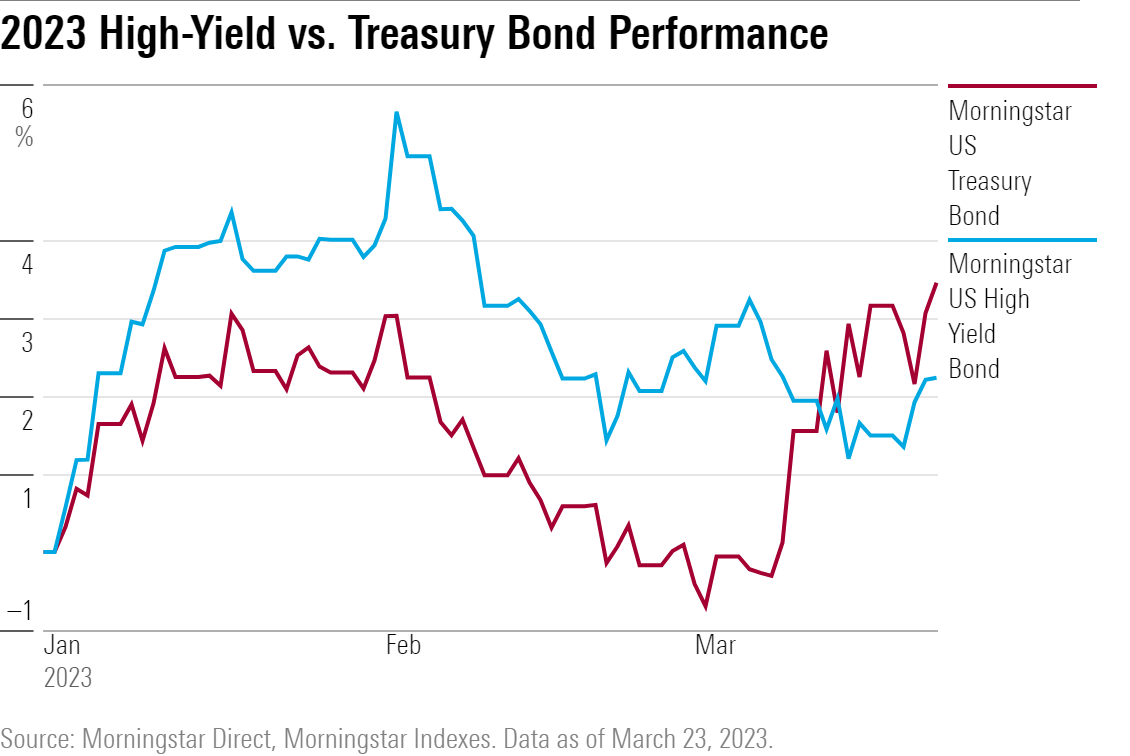

With the collapse of Silicon Valley Bank SIVB sparking fears of a broader banking industry crisis, there’s been a sudden divergence in performance within the bond market.

High-quality bonds, including U.S. Treasuries, have surged in price while lower-quality, higher-yielding assets are falling.

“There’s a credit event on the horizon, and people are worried about what’s ahead,” says Alfonzo Bruno, associate portfolio manager for Morningstar Investment Management.

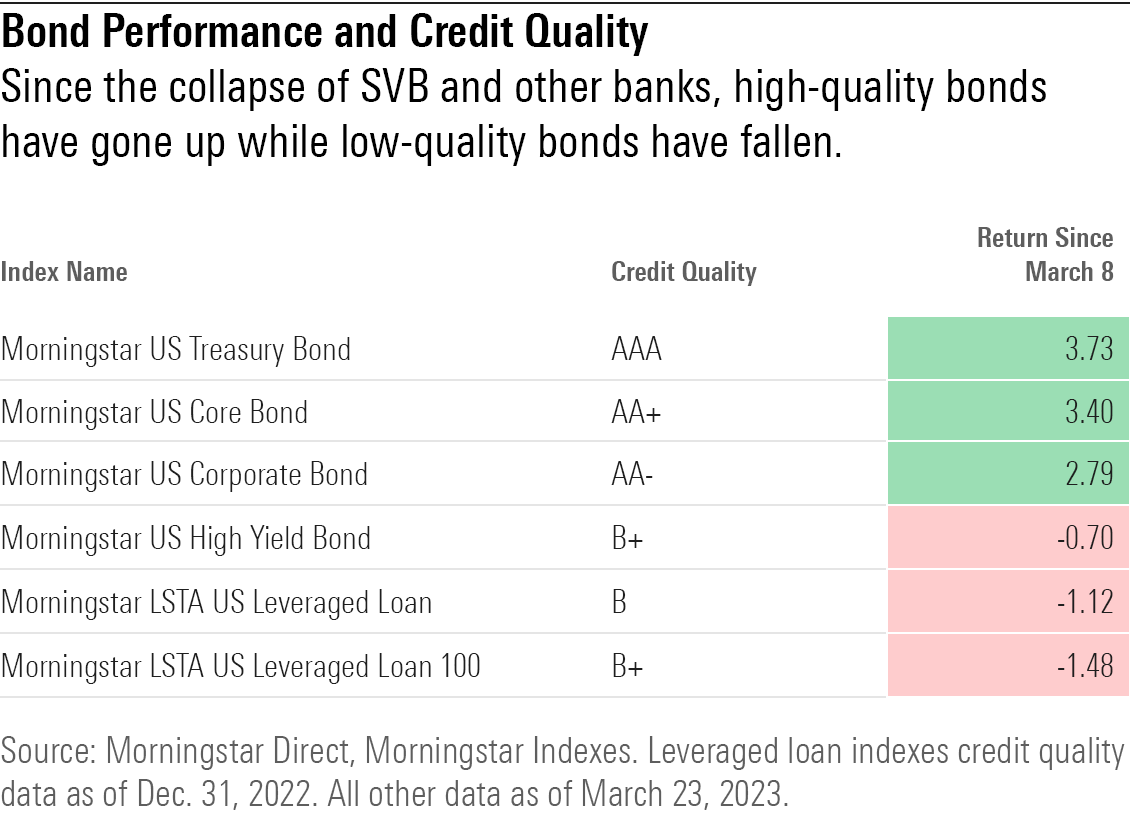

For example, since March 8, as the news from Silicon Valley Bank began to emerge, the Morningstar US Treasury Bond Index has gained 3.7% while the Morningstar US High Yield Index—which tracks riskier corporate bonds—has fallen 0.7%.

The rally in Treasury bond prices has led to a significant drop in yields. On the U.S. Treasury 2-year note, the yield has fallen to 3.76% from 5.05% on March 8, hitting its lowest level since September 2022.

Adding to the complexity around the concerns about the banking system is the fact that the Federal Reserve is still fighting inflation, which means interest rates could go even higher, or stay high for longer. Either way, there’s a lot of uncertainty.

“With all this happening, that increases the idea that there’s hardship ahead for the economy,” says Bruno.

Why Credit Quality Matters

Full-fledged recessions can come on quickly with little advanced warning, Bruno warns. “All of a sudden, things extrapolate quickly. If you are on the wrong side of the risk spectrum, performance can be pretty bad, pretty fast.”

Credit quality is an industry-standard measure used to gauge the risk of bonds. Specifically, it’s an assessment of how well an entity can consistently pay off its debts. Bonds with high credit quality—those issued by reliable organizations such as the U.S. government or large blue-chip corporations—consistently meet their debt obligations.

Bonds with low credit quality are riskier debts issued by companies with challenged outlooks or are smaller, untested companies. As a result, they with a higher likelihood of default. Credit scores range from AAA for the highest-quality bond issuers like the U.S. government; B+ for riskier bonds, which often come with higher yields; all the way down to C or even D for the riskiest junk bonds.

Since the troubles at Silicon Valley and other banks in the U.S. and Europe, Morningstar’s high-quality bond indexes have seen strong performance, while lower-quality indexes have suffered.

“The flight to Treasuries and higher-quality assets is driven by perceptions of safety,” he adds. “When investors are worried about credit deterioration or potential defaults, they rotate out of corporate bonds and into Treasuries.”

U.S. government Treasuries are considered risk-free assets, according to Bruno, as the government is extremely likely to repay its debts in any economic conditions. “And with short-term Treasuries yielding what they are right now, investors can stay risk-free and still make 4.5% over the next couple of months.”

The Morningstar US Treasury Bond Index—which measures the performance of fixed-rate, investment-grade U.S. Treasury bonds with maturities greater than one year—carries an average credit quality of AAA, the highest-possible credit quality rating. Since March 8, the Treasury bond index has gained 3.7%.

Meanwhile, the lower-rated Morningstar LSTA US Leveraged Loan Index, which provides a comprehensive view of the U.S. leveraged-loan market and carries a credit quality of B, fell 1.1% during the same period.

Leveraged loans are loans made to companies that generally have low credit quality and have often high levels of existing debt. They are similar to high-yield bonds in terms of credit quality, but they come with added benefits that result in higher recovery rates in the event of default and make them less sensitive to interest rates.

What’s Next for the Bond Market?

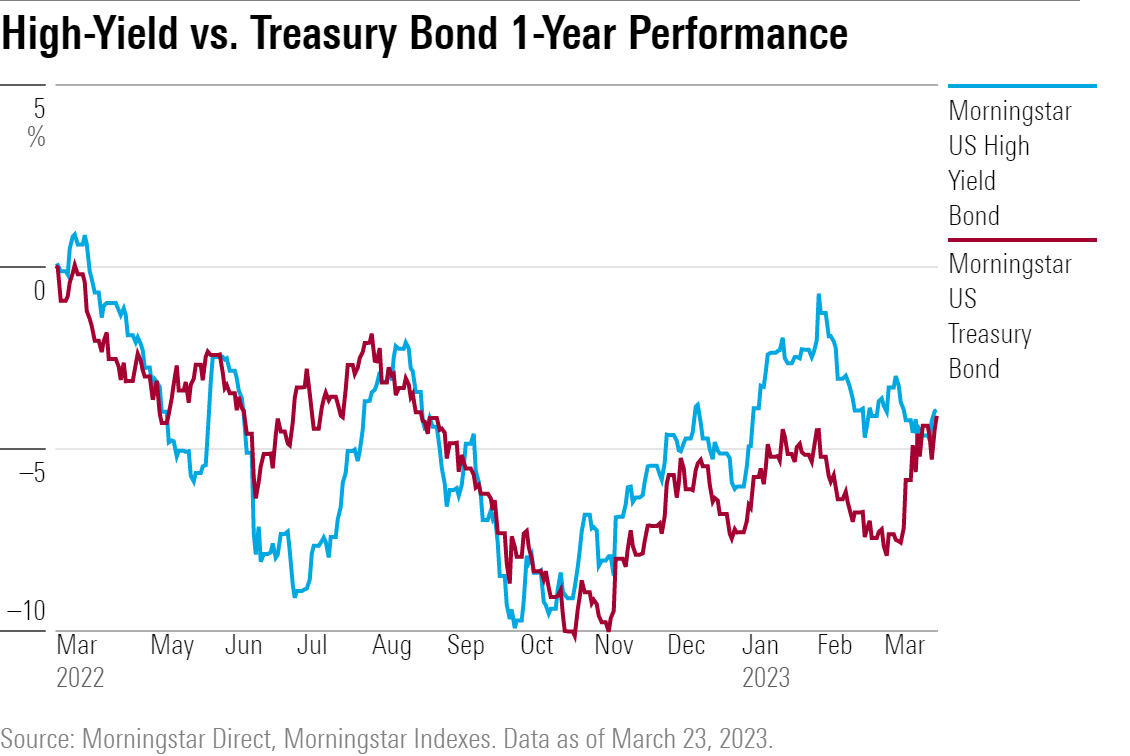

The rally in interest-rate-sensitive U.S. Treasuries and the lagging performance of bonds driven by credit concerns marks something of a reversal of trends seen in the bond market since the start of 2022. Last year, interest-rate-sensitive bonds suffered big losses as the Fed raised interest rates, while credit-sensitive bonds were more buoyant.

The question for investors is how this new dynamic plays out from here.

“The wild card continues to be the stability of the banking system,” Bruno says. “Banking crises are not something to take lightly: Any further indication of more stress within these mid- to small-sized banks can alter investment sentiment rather quickly.”

If banks tighten their lending standards or stop lending in general, says Bruno, “that has pretty severe economic implications.” When businesses struggle to borrow money, hiring slows down and new projects stall. “Anything that can result in a tightening of credit conditions isn’t good for businesses in any way.”

In such uncertain times, Bruno says investors will benefit from taking a methodical approach to adding risk. “We don’t want to get too excited when lower-quality bond spreads widen out, especially when they are still at long-term averages,” he states. “For now, with short-term Treasury yields where they are, investors can stay risk-free and still make 4.5% over the next couple months.” Bruno says investors are seeing that sticking with Treasuries offers the best risk-return profile at this point, “while we wait for more clarity from the Fed and wait to see how the situation turns out.”

In times like these, “Credit quality really starts to matter,” says Bruno. “You have to be selective on where you’re taking risk.”

Events Scheduled for the Coming Week:

- Monday: Carnival CCL reports earnings

- Tuesday: Lululemon Athletica LULU and Walgreens Boots Alliance WBA report earnings.

For the Trading Week Ended March 24

- The Morningstar US Market Index rose 1.3%.

- The best-performing sectors were communication services, up 3.0%, and basic materials, up 2.0%.

- The worst-performing sectors were utilities and real estate, both down 1.2%.

- Yields on 10-year U.S. Treasuries fell to 3.38% from 3.39%.

- West Texas Intermediate crude prices rose 3.8% to $69.26 per barrel.

- Of the 844 U.S.-listed companies covered by Morningstar, only 521, or about 62%, were up, and 323, or about 38%, declined.

What Stocks Are Up?

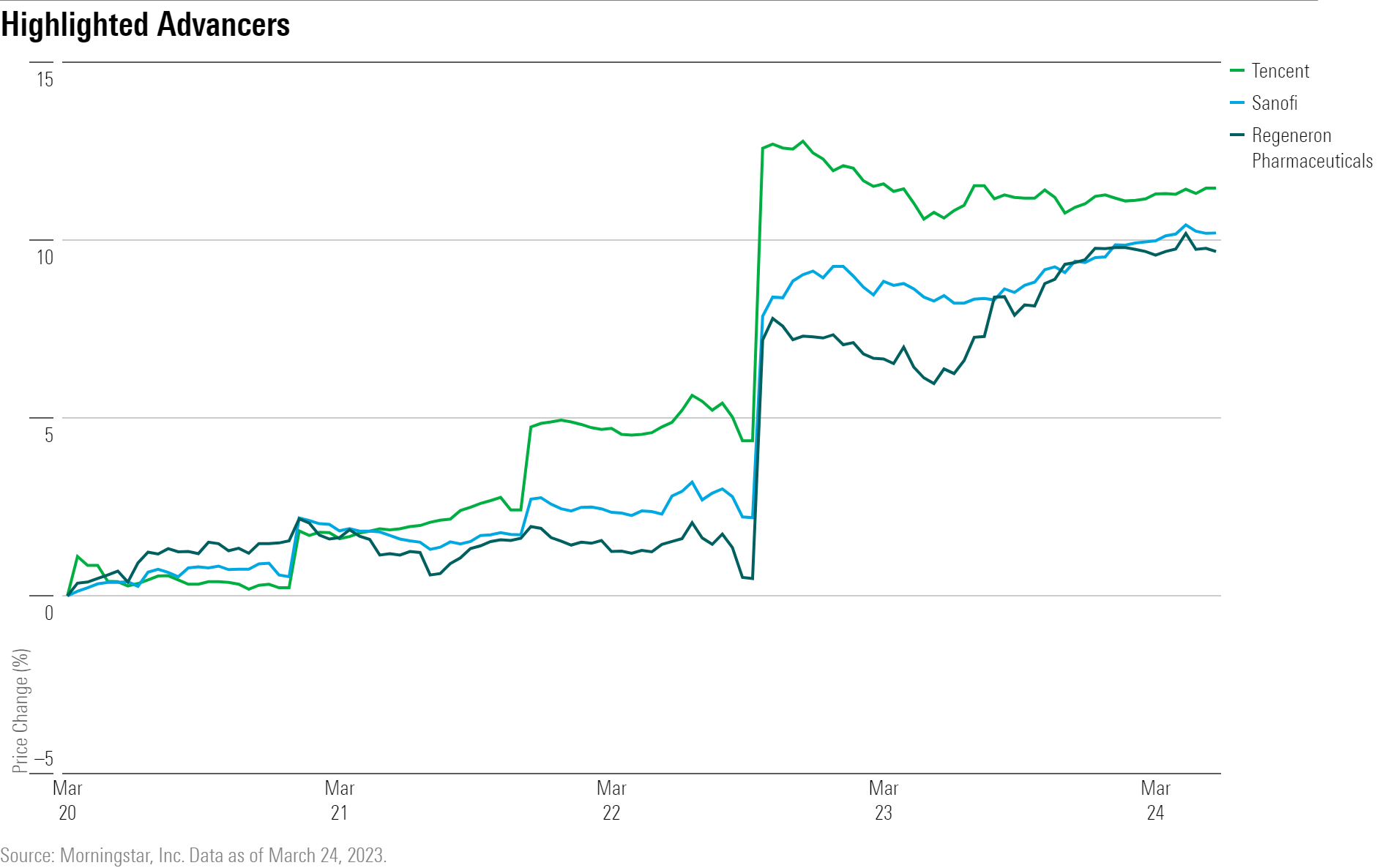

Chinese internet giant Tencent TCEHY rallied as “management’s comments during the earnings call suggest the firm is now pivoting from cost-cutting to fostering growth,” says Ivan Su, Morningstar senior equity analyst. The firm also reported solid fourth-quarter earnings results that met FactSet consensus estimates, with the highlight being 15% year-over-year growth in advertising revenue in spite of tougher macroeconomic conditions.

Shares of both Regeneron REGN and Sanofi SNY rose on news that their jointly developed drug Dupixent showed positive signs of being able to treat chronic obstructive pulmonary disease, which would make it the first antibody to improve symptoms. Morningstar healthcare strategist Karen Andersen raised her fair value estimate for Sanofi to $61 from $57 as a result.

Regeneron was due for a slight increase as well, but the positive news from Dupixent was offset by downward adjustments in revenue assumptions of Eylea, a Regeneron drug used to treat retinal diseases.

What Stocks Are Down?

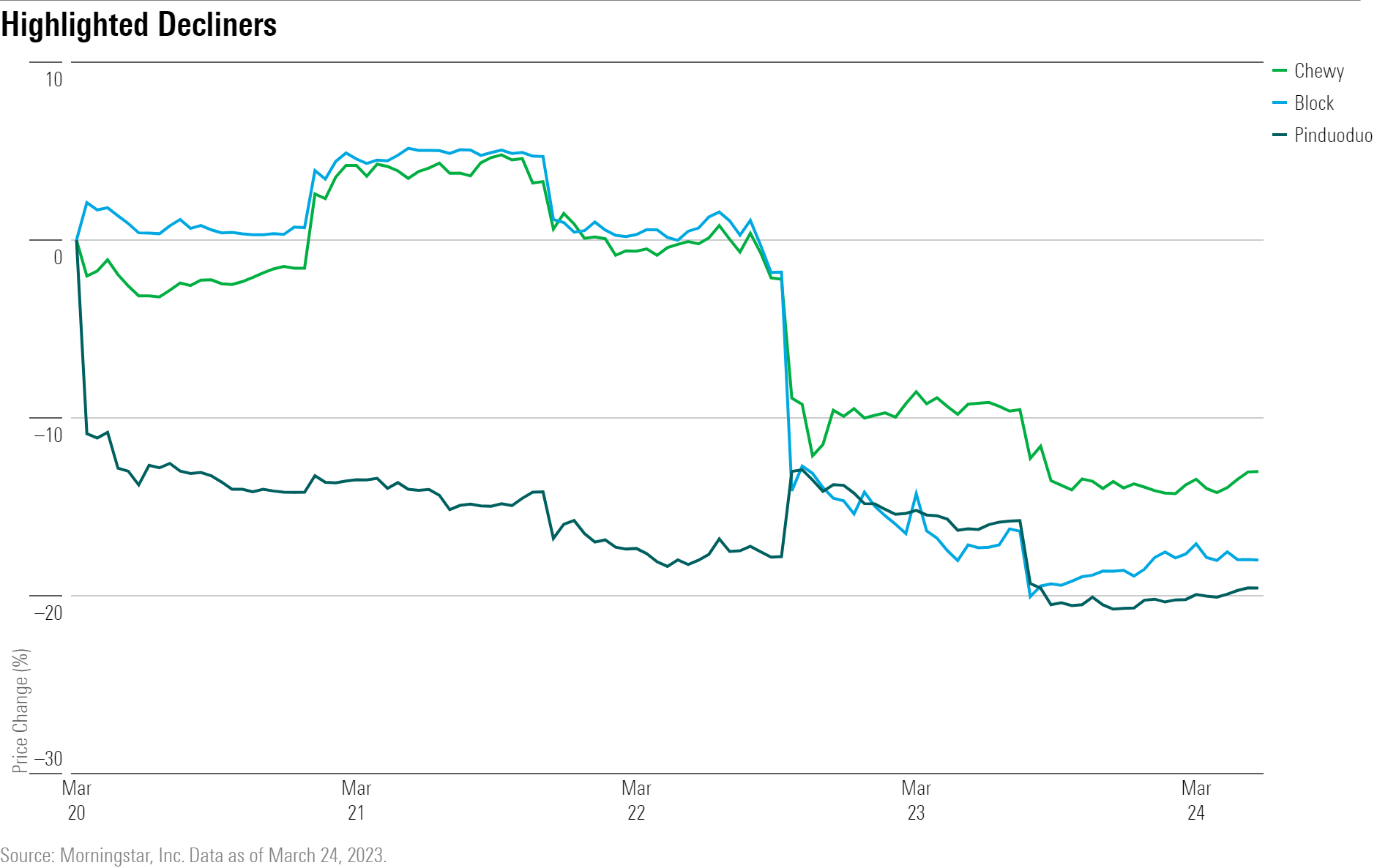

Payment software firm Block’s SQ shares tumbled over claims from Hindenburg, a notable short-seller, that Block’s Cash App business was built on fraud, and that 40%-75% of the accounts were fake. Morningstar senior equity analyst Brett Horn says he finds the evidence of the claims to be “largely anecdotal,” and reaffirms his $104 fair value estimate for the company. However, Horn notes that the claims could prompt a regulatory response.

Chinese internet retail platform Pinduoduo’s PDD shares slid after the company missed fourth-quarter revenue FactSet consensus estimates. Revenue came in at $5.78 billion, versus estimates of $6.05 billion. Dragging sales lower was a deceleration in its online marketing services revenue, which represents 78% of the company’s total revenue. Online marketing services sales in the fourth quarter only grew 38% from a year prior, compared with 58% growth in the third quarter.

Pet product retailer Chewy CHWY saw its stock slide after reporting fourth-quarter earnings. While the results themselves were solid, Morningstar equity analyst Sean Dunlop says, “Weakness in discretionary pet product spending and soft 2023 profit guidance sent narrow-moat Chewy’s shares tumbling.” Management noted they were expecting EBITDA margins to either remain flat or decline up to about 50 basis points in 2023.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)