Where Are Stocks Looking Cheap or Expensive?

7 charts on valuations as the stock market heads into 2023.

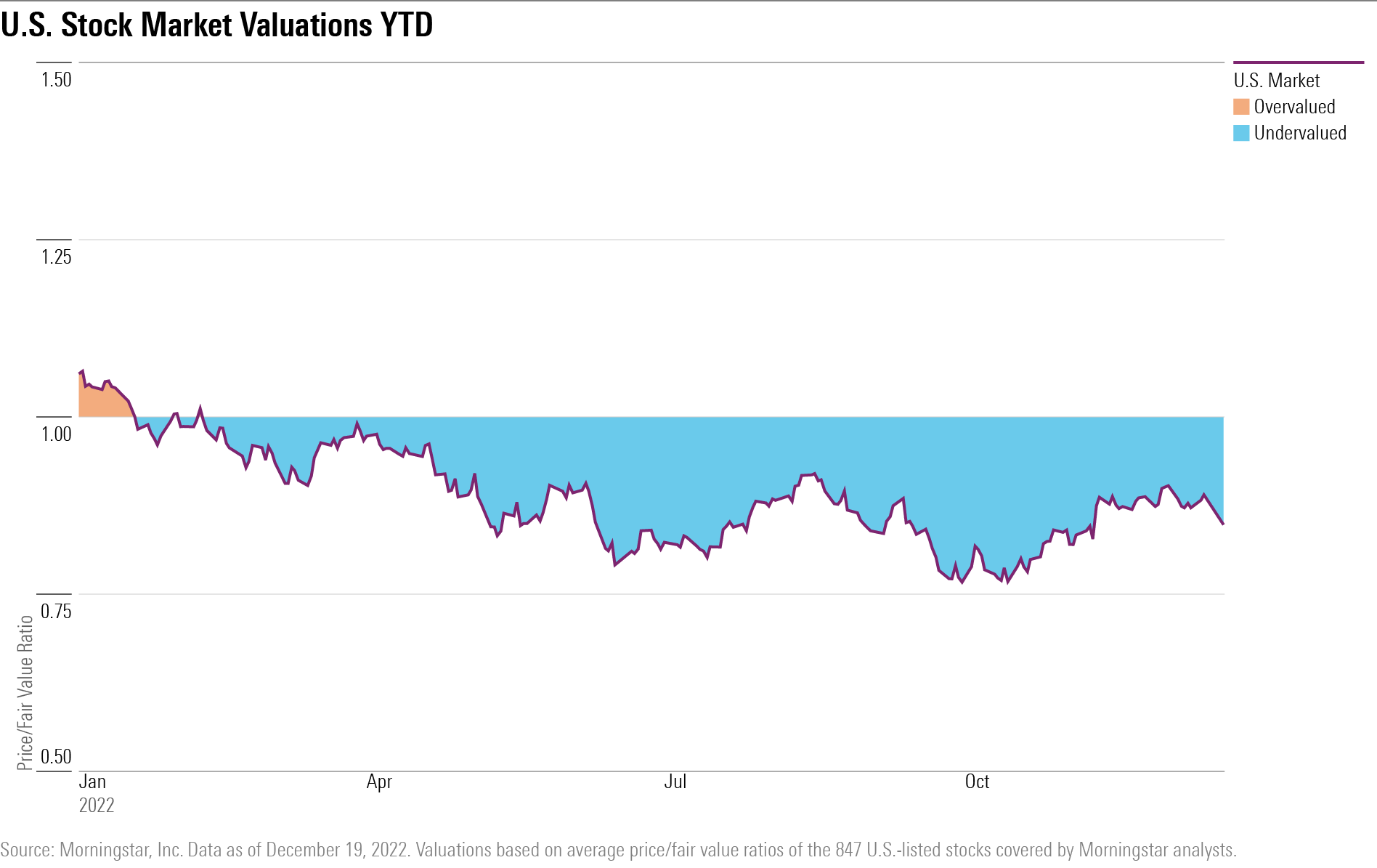

Over the course of 2022, stocks have undergone a significant valuation reset thanks to the bear market.

At the start of the year, Morningstar analysts saw many of the stocks they cover as overvalued. But after a more than 20% decline in the broad market year to date, analysts think valuations have swung too far in the opposite direction, even after cutting back on their growth assumptions.

As the stock market heads into 2023, here are some of the main valuation stories for investors to consider:

- Overall, U.S. stocks are off their cheapest levels, but are finishing 2022 at their most undervalued since March 2020.

- Stocks covered by Morningstar analysts have been this cheap for only 5% of the time in the last two decades.

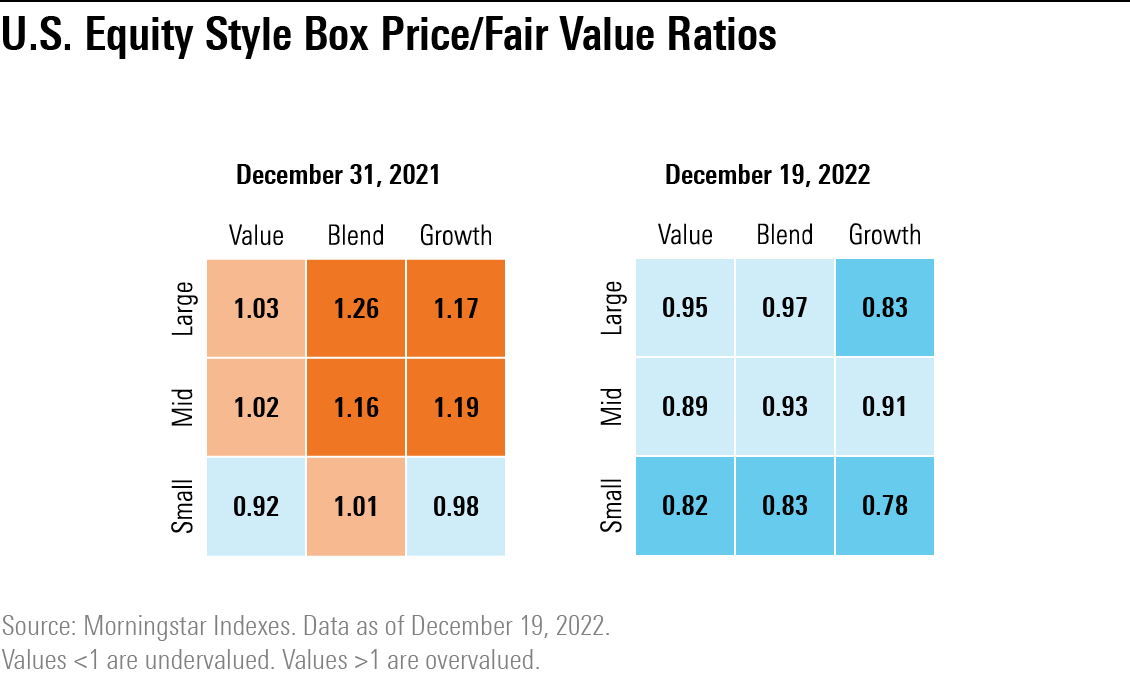

- Small-cap and large-cap growth stocks are the most undervalued among equity style categories.

- Stocks without economic moats are cheaper than their wide- and narrow-moat counterparts.

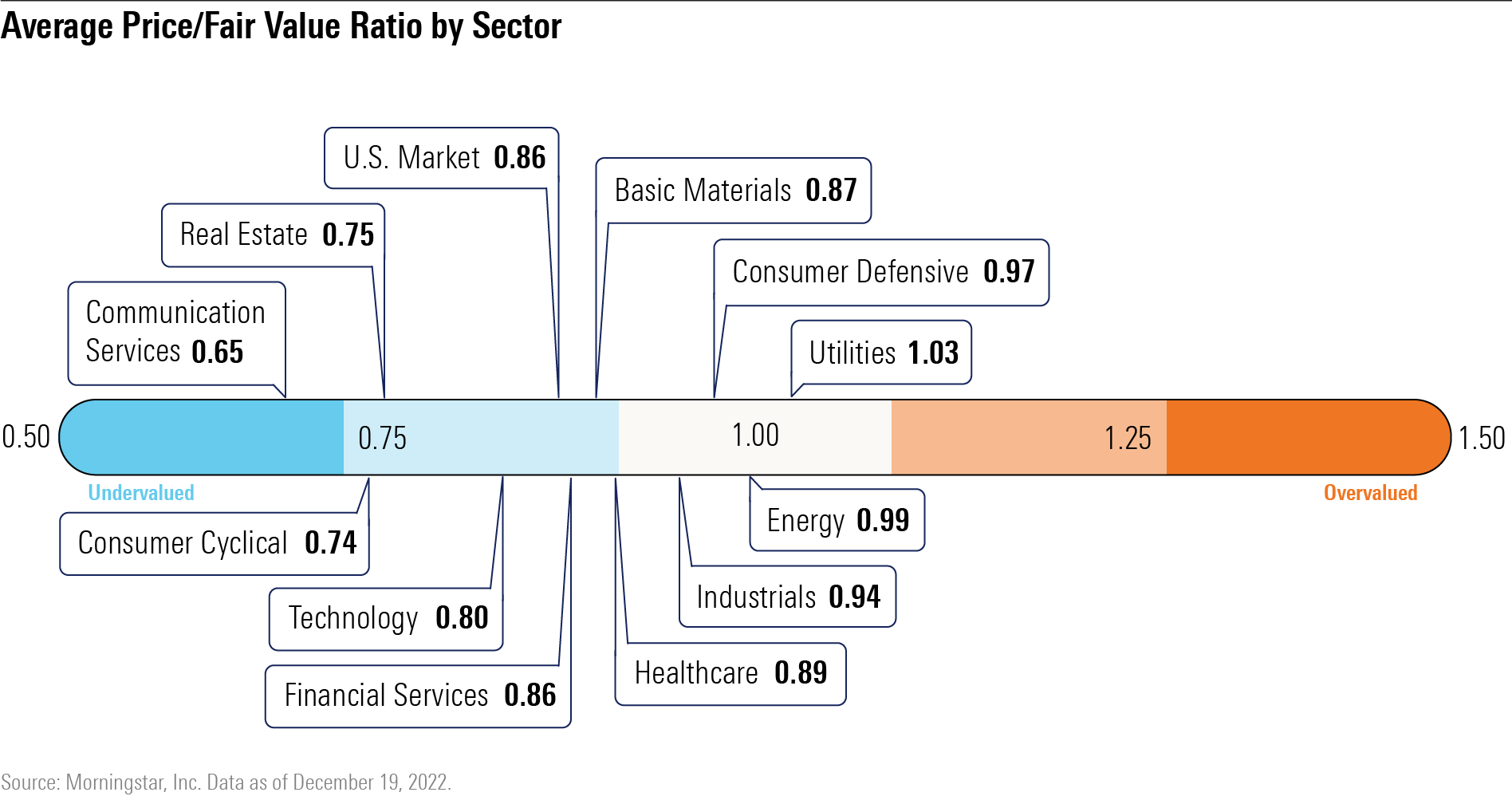

- Communication services and consumer cyclicals are significantly undervalued, while utilities are slightly overvalued.

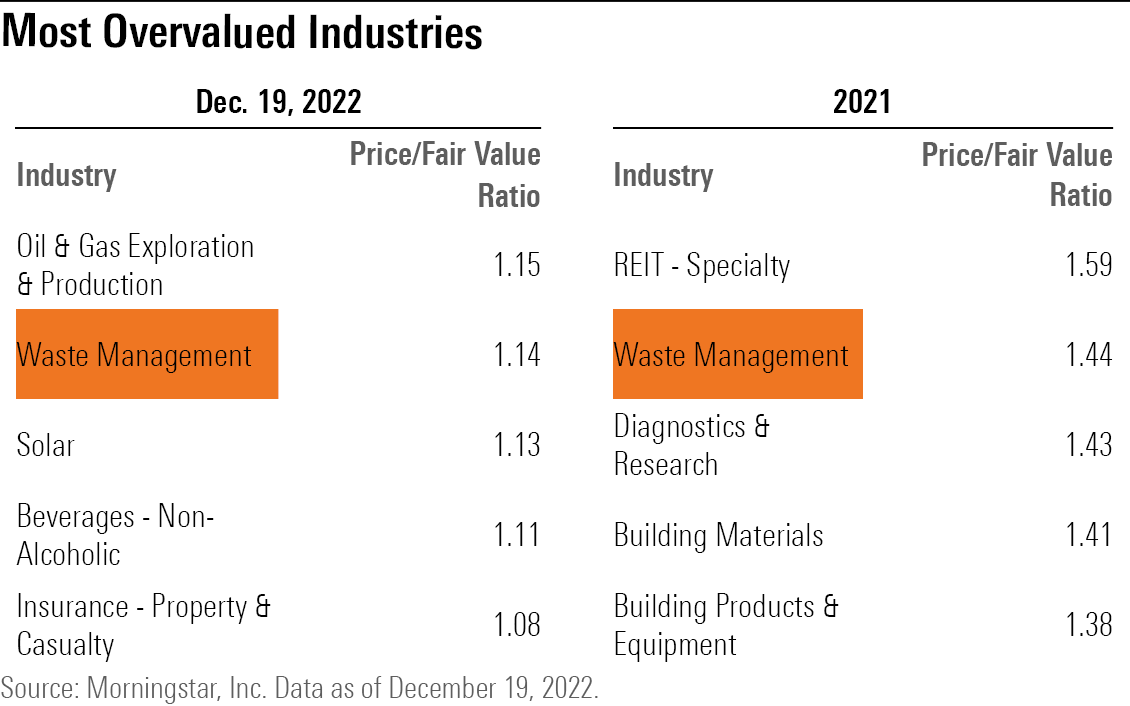

- Oil and gas companies, waste management stocks, and solar are the most overvalued industries.

How Cheap Is the Stock Market?

Morningstar analysts measure valuations in terms of the price/fair value ratio, which divides a stock’s price by their Morningstar fair value estimate, a measure of what analysts believe a company’s shares are worth. Stocks with a price/fair value ratio greater than 1.0 are considered overvalued, while those under 1.0 are undervalued.

As of Dec. 19, U.S. stocks covered by Morningstar analysts had an average price/fair value ratio of 0.85—meaning stocks are trading at an average discount of 15%.

At the start of the year, Morningstar analysts had pegged the market to be 6% overvalued—a 21-percentage-point difference. In October, as the stock market hit its most recent bear-market bottom, the average price/fair value ratio fell to as low as 0.77, or a 23% discount.

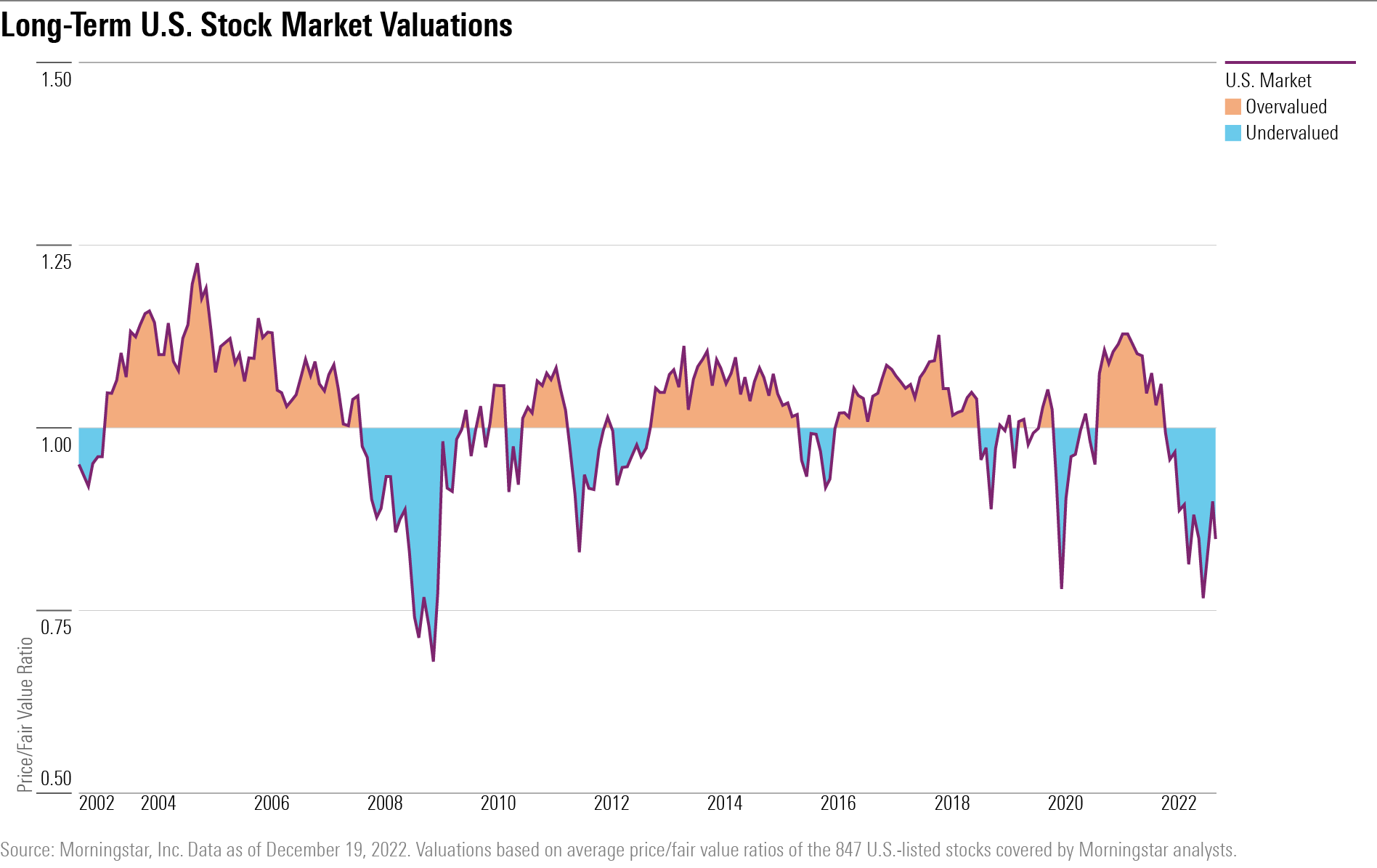

Over the last 20 years, Morningstar analysts have seen U.S. stocks as undervalued during only 10 distinct periods, or about 36% of the time.

However, there’s only been three times when valuations were as low as they are now: The pandemic crash of 2020, 2011′s eurozone crisis, and the global financial crisis of 2008.

Small Caps, Large Growth Look Cheap

In terms of stock style, Morningstar’s equity analysts say the most undervalued opportunities can be found in small caps, namely small-cap growth stocks, which trade at an average discount of 22%. By some measures, small-cap stocks are trading at their cheapest levels since the 2008 financial crisis.

Large-cap growth stocks also land among the cheapest stocks in the market, having suffered some of the biggest losses. That’s especially the case among the Big Tech stocks that had been market leaders in recent years.

As share prices declined, large-cap growth stocks saw big swings in valuations. Large-cap growth stocks now trade at an average discount of 17%, a complete reversal from the end of 2021, when they were considered 17% overvalued.

Moat Valuations

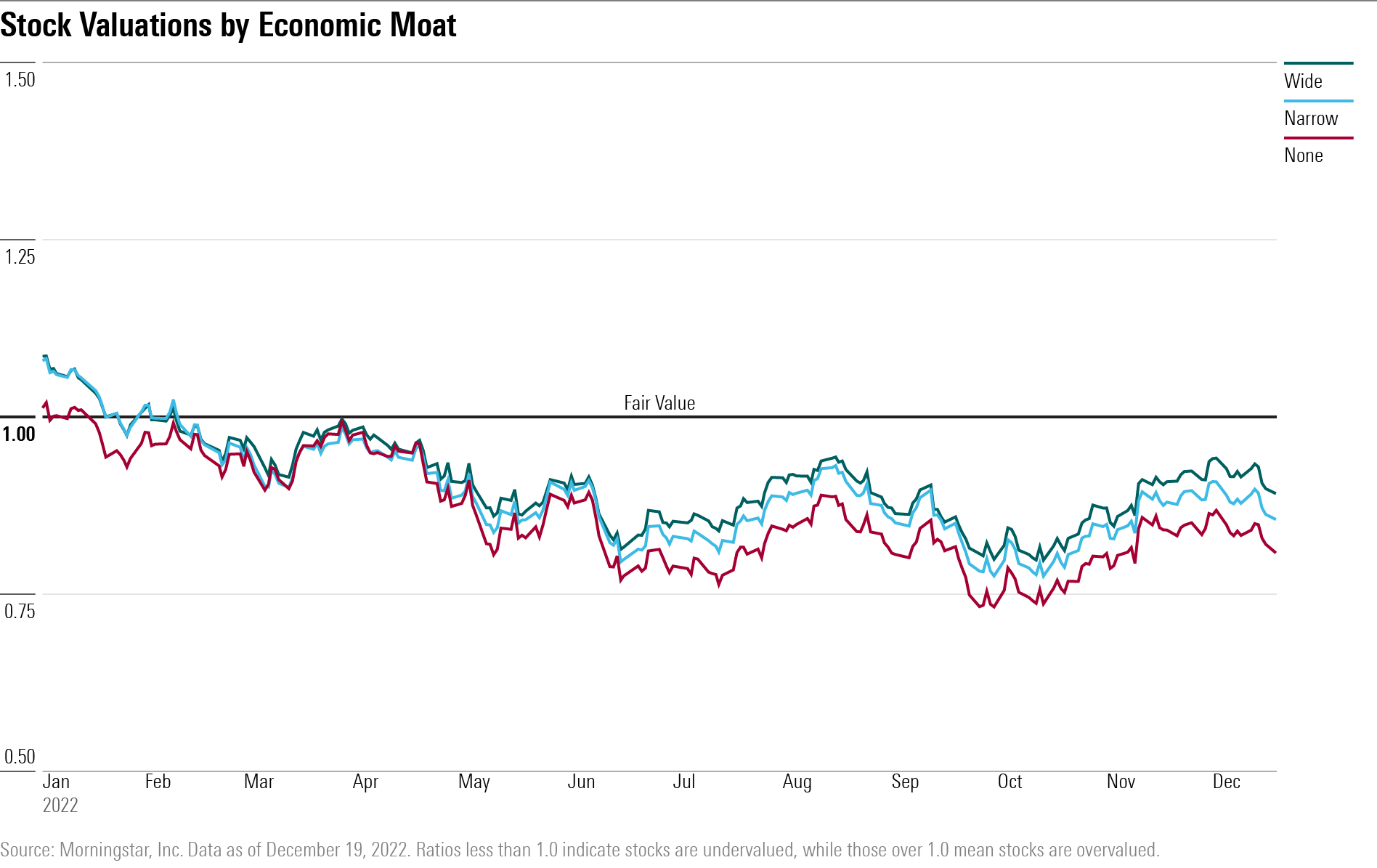

In terms of Morningstar Economic Moat Ratings, which designates if Morningstar analysts believe a company has a durable competitive advantage over its peers, valuations have also gotten cheaper across the board.

Stocks with a wide moat are those that analysts believe can ward off competition for 20 or more years, whereas narrow moats are expected to fend off competition for 10 years. No-moat stocks face immense competition.

Stocks of wide-moat companies, which also tend to consist of high-quality names, were less cheap than narrow-moat stocks, which were less cheap than stocks without a moat.

Wide-moat stocks now trade at an average discount of 11%, narrow-moat stocks 15%, and stocks without a moat 19%.

Most Stock Sectors Undervalued

Nearly all sectors are considered by Morningstar’s stock analysts to be undervalued as of Dec. 19. The communication services sector is trading at the greatest discount to fair value at a 35% discount. Next cheapest is consumer cyclicals, trading at a 26% discount, and real estate at 25%.

Utility and energy stocks trade on the relatively more overvalued side compared with the rest of the market. Utility stocks trade at an average 3% premium to their fair value estimates, with stock prices in the sector kept buoyant by the group’s defensive appeal during the bear market. Energy stocks are considered fairly valued by Morningstar analysts, with an average 1% discount. Energy stocks have performed strongly during the market downturn on the back of the strength in oil prices.

At the industry level, stocks of oil and gas exploration and production companies are considered the most overvalued group overall, trading at an average 15% premium to their fair value estimates. A year ago, these stocks were considered some of the most undervalued, at a 29% discount.

Only waste management stocks, such as Waste Connections (WCN) and Republic Services (RSG), have remained one of the most overvalued industries throughout the year.

Even so, these stocks were not impervious to the broad market selloff, losing 21.1% in 2022. As a result, while the industry is still considered overvalued by about 14%, valuations have become more reasonable than what they were at the end of 2021, when the group traded at an average premium of 44%.

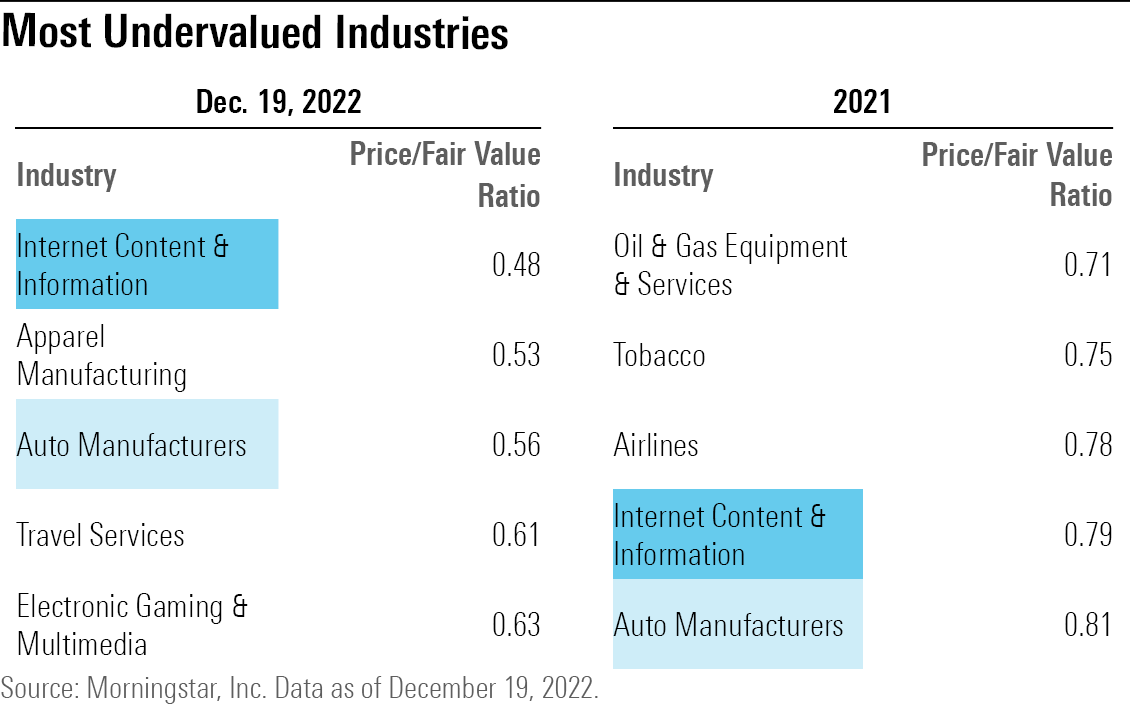

Among the most undervalued industries now is internet content and information, which includes stocks such as Alphabet (GOOGL), the parent company of Google, and Meta Platforms (META), the parent company of Facebook. It is now the most undervalued industry, at an average discount of 52%. A year ago, this industry ranked as the fourth-most undervalued, with the group viewed as 21% undervalued on average at the time.

Auto manufacturers remained among the most undervalued, moving up to the third-most undervalued industry from fifth a year ago. Auto manufacturer stocks trade at an average discount of 54%.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)