5 Charts on Big Tech Stocks’ Collapse

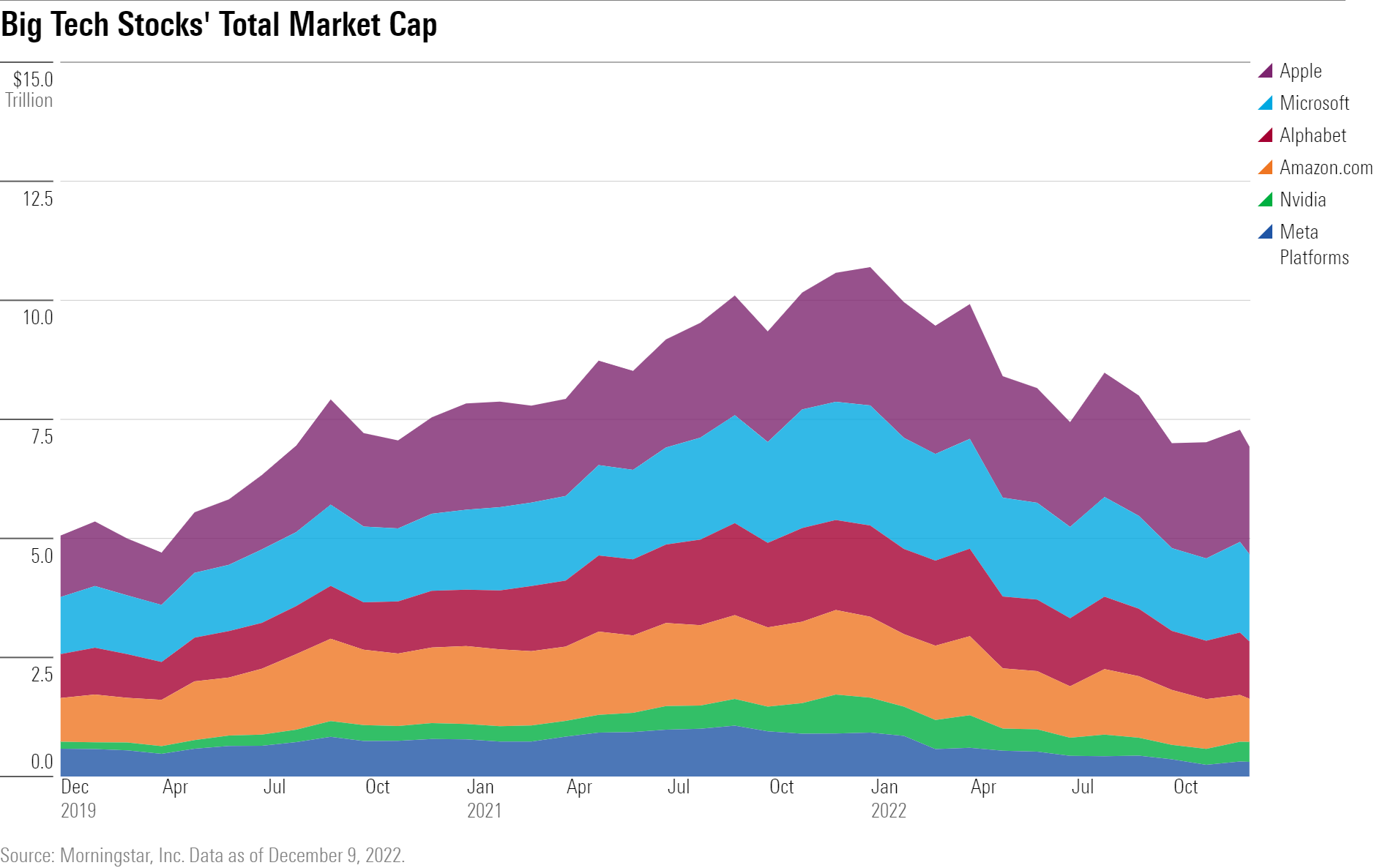

Big Tech stocks collectively lost nearly $4 trillion in market value in 2022.

In 2020 and 2021, one of the best places for stock investors to have their money was in mega-cap technology stocks. In 2022, it was one of the worst.

Tech has been one of the worst-performing sectors of the year, largely pulled down by the poor performance of software companies. As of Dec. 9, the Morningstar US Technology Index was down 28.7% for the year, underperforming the Morningstar US Market Index, which is down 18.7%.

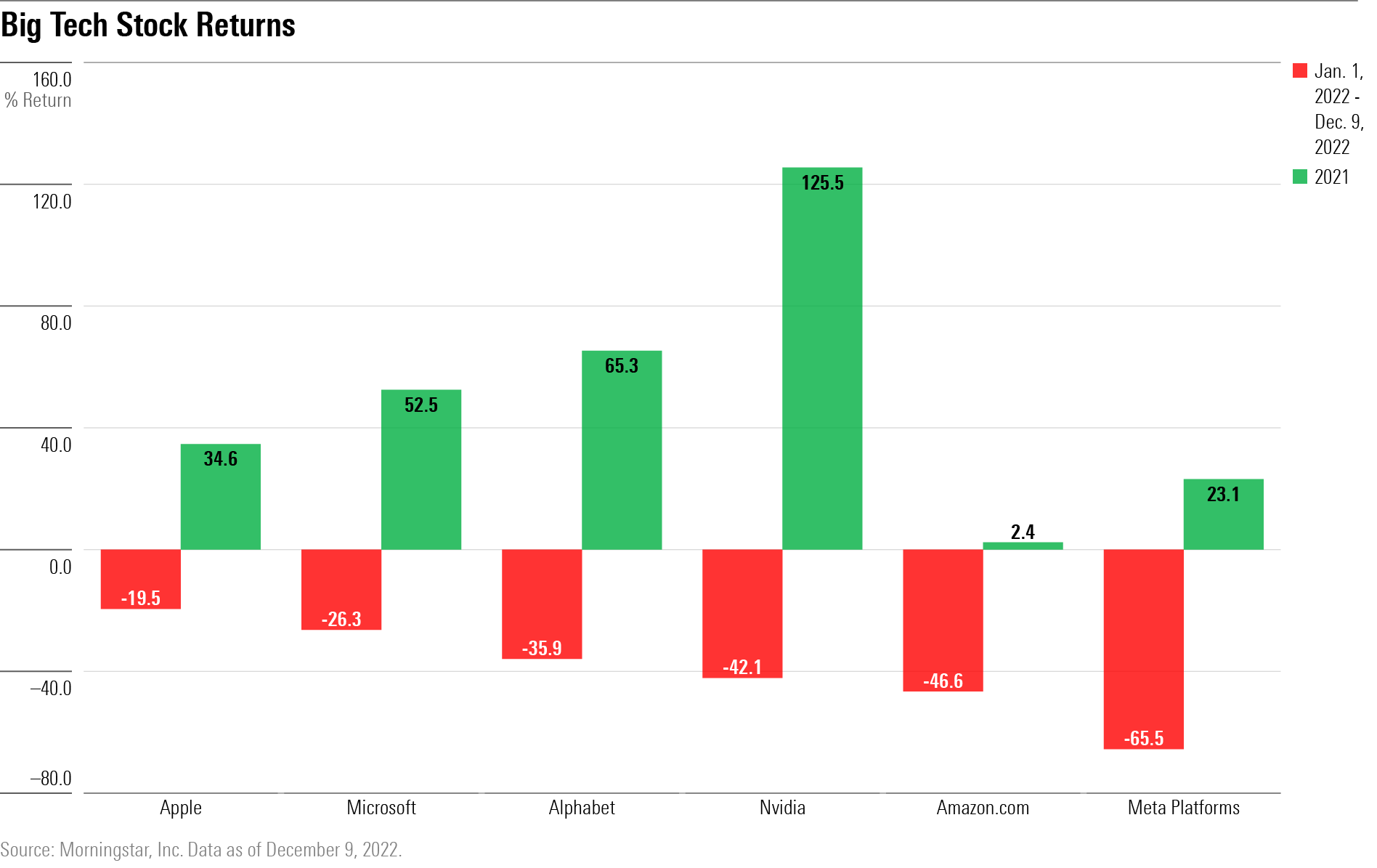

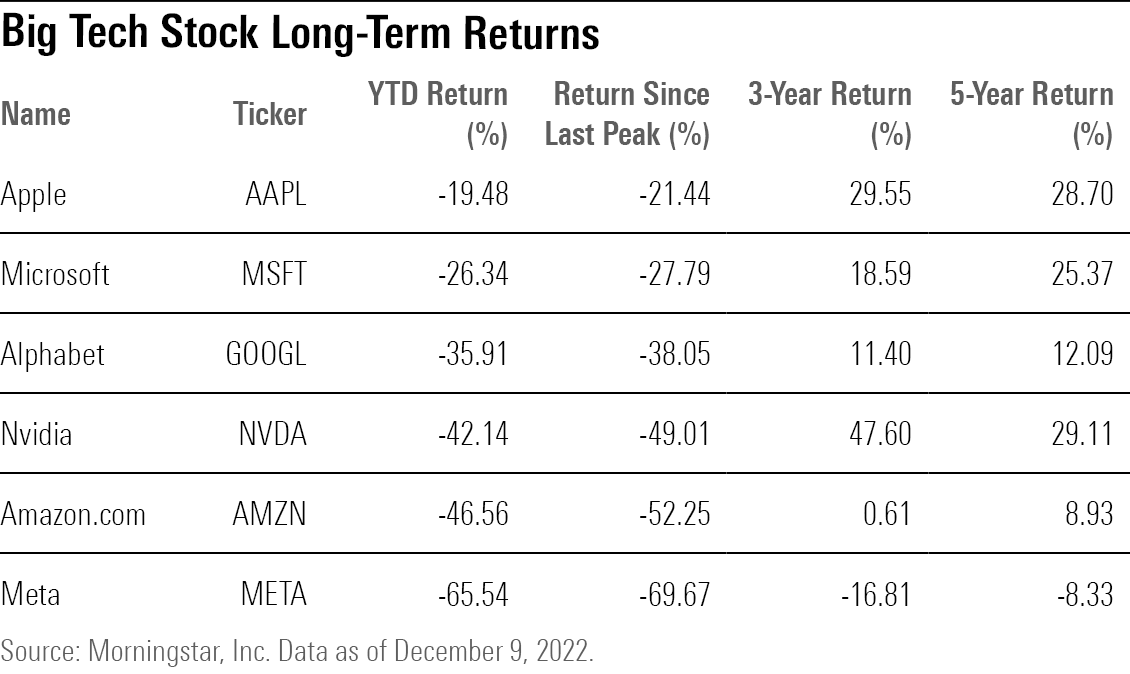

But it’s the collapse of so-called Big Tech that has attracted attention, as recession fears and macroeconomic pressures battered their shares as the year unfolded. Among the large technology stocks that had been big winners in recent years, Meta Platforms (META), the parent company of Facebook, has lost 65.5% this year, semiconductor manufacturer Nvidia (NVDA) lost 42.1%, and Microsoft (MSFT) fell 26.3%.

Even Apple (AAPL), which has remained relatively buoyant, is still on track to finish the year with worse losses than the overall market.

As losses piled up, Big Tech stocks’ total market capitalization sank. The six largest U.S. tech stocks were worth about $10.7 trillion at the end of 2021 altogether. Over the course of 2022, they lost nearly $3.8 trillion in market cap and are now collectively worth about $6.9 trillion—back to July 2020 levels.

In terms of total dollar value, Amazon.com (AMZN) lost the most in the group during the year, about $788 billion, followed by Alphabet, which lost $714 billion.

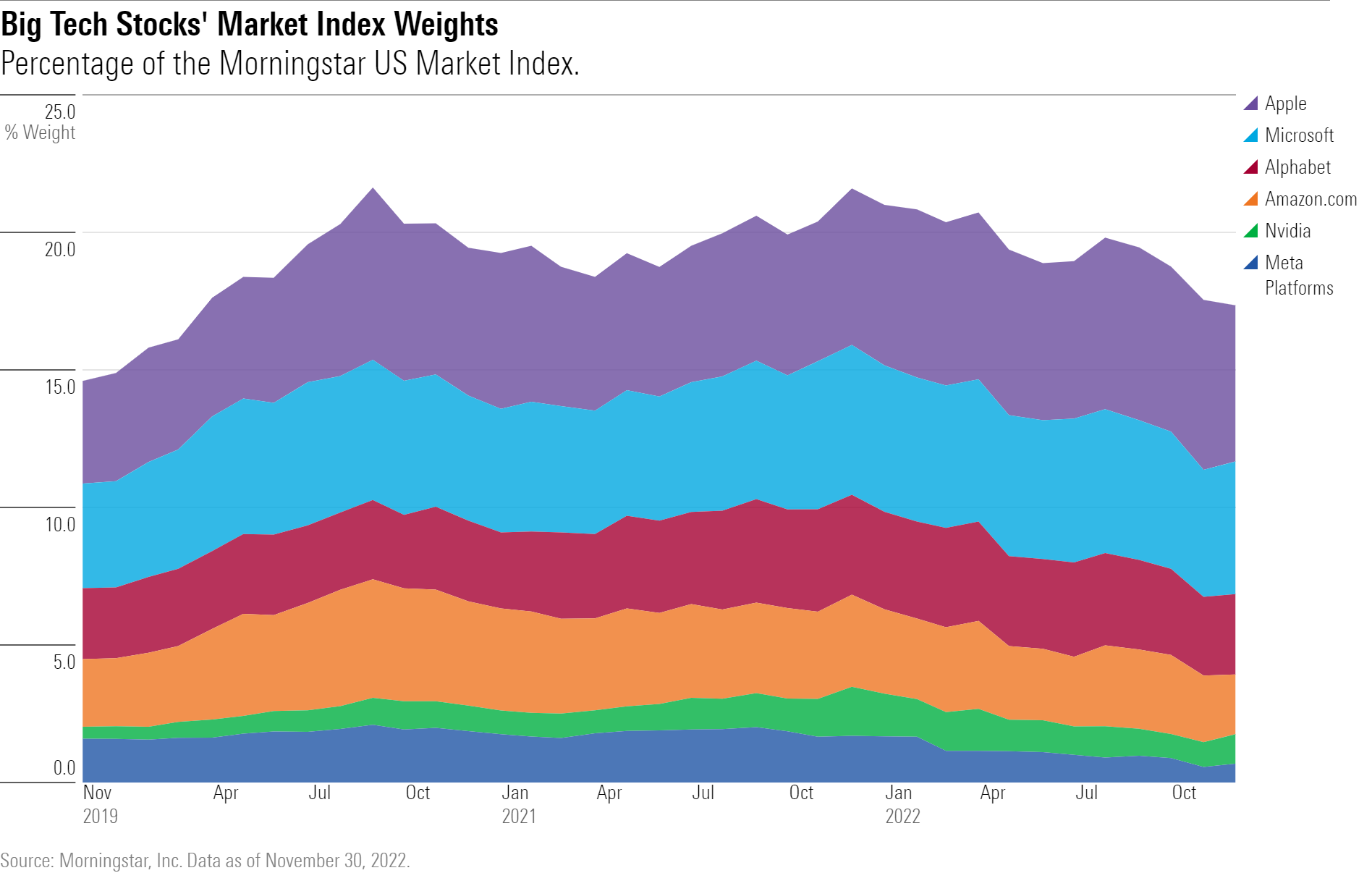

The declining market caps rippled through to Big Tech’s weightings in market indexes.

Overall, the six Big Tech stocks’ influence has fallen to 17.4% of the Morningstar US Market Index from 21% at the start of the year. Still, Big Tech’s influence is still greater than what it was three years ago. As of Dec. 31, 2019, it represented about 15% of the index.

The largest change in weighting in the broad market index among the group during 2022 was Meta Platforms. The stock is now the 22nd-largest weighting in the Morningstar US Market Index as of Nov. 30, down from the seventh largest at the start of the year.

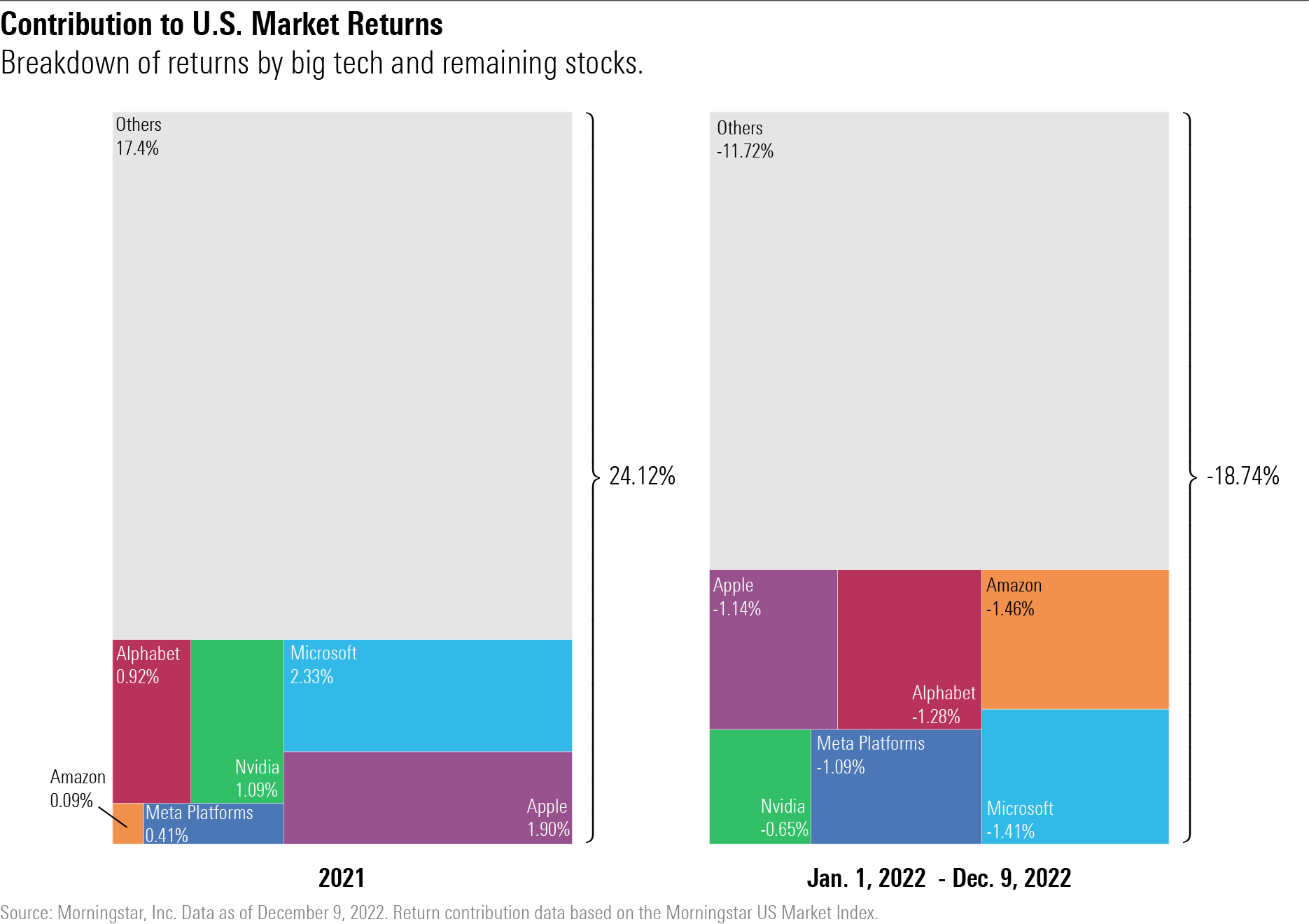

While Big Tech’s influence on the market index has fallen, these stocks still had an outsize impact on returns over the past year. Having started the year with a 21% weighting, and given the scope of the losses, Big Tech’s collapse has had a larger effect on the market’s returns in 2022 than in 2021.

According to return contribution data from Morningstar Direct, of the U.S. market index’s 18.7% loss between Jan. 1 and Dec. 9, about 7 percentage points of that decline came from Big Tech stocks. That represents about 37% of the market’s total loss for the year.

Moving forward, Big Tech’s influence on the market may be closer to what it was in 2021, when the Morningstar US Market Index was weighted about 19.3% toward Big Tech stocks given its current weight of 17.4%

In 2021, of the 24.12% US Market Index gain that year, Big Tech stocks contributed 6.7 percentage points, which represented about 28% of the return.

Why Did Big Tech Stocks Perform Badly?

Even Apple, which was generally more buoyant than many other tech companies, is down more than the overall market in 2022, losing 19.5%. Apple’s stock stayed afloat due to strong iPhone 14 and Mac computer sales. Heading into the fourth quarter, the company anticipated iPhone demand to accelerate and started to boost production. However, those plans were scrapped after the projected demand failed to materialize.

Worst off among the group was Meta Platforms, whose stock was pummeled amid concerns about its cash-intensive strategy to become a metaverse leader in 2022. Recession fears compounded Meta’s problems, as a major source of revenue—advertising—showed signs of slowing down during the third quarter. The company also potentially faces up to $13 billion in fines for failing to comply with data privacy rules set by the European Union in the General Data Protection Regulation of 2018.

About 66.5% of Meta Platforms’ stock market value was wiped out during 2022, and it now trades in a price range last seen toward the end of 2016. It’s also the only Big Tech stock that has negative annualized three- and five-year returns.

Alphabet (GOOGL), the parent company of Google, saw its stock also take a hit from economic worries, especially changing spending habits from advertisers concerned about future consumer spending.

Changing consumer spending behavior also spelled trouble for Amazon.com shares, which have declined 46.6% year to date, and subsequently lost its status as a trillion-dollar company. Investors were caught off guard when the company revealed a much more conservative guidance for revenue in the fourth quarter of $140 billion to $148 billion, below the analyst consensus of $156 billion at the time, according to FactSet.

Microsoft, meanwhile, showed signs of weakness after the software giant disappointed investors with revenue guidance of $52.35 billion to $53.35 billion for the fourth quarter, compared with previous analyst estimates of $56.22 billion. Shares are down 26.3% for the year so far.

Nvidia’s stock slide came on the heels of huge gains in 2021. The semiconductor manufacturing leader surged 125.5% in 2021, only to collapse 42.1% in 2022. Driving the reversal: Tailwinds from the work-from-home transition and computer shortages both abated much sooner than anticipated. In addition, new restrictions from the U.S. on the sale of advanced chips to China also hurt investors’ confidence in the company’s growth prospects.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)