Small-Cap Stocks Are Really Cheap

Valuations on small caps are at their lowest in decades, and a recession looks priced in.

While many investors are wondering whether it’s safe to start buying those mega-size companies that led the last bull market, it’s actually small-cap stocks that may be the biggest bargains.

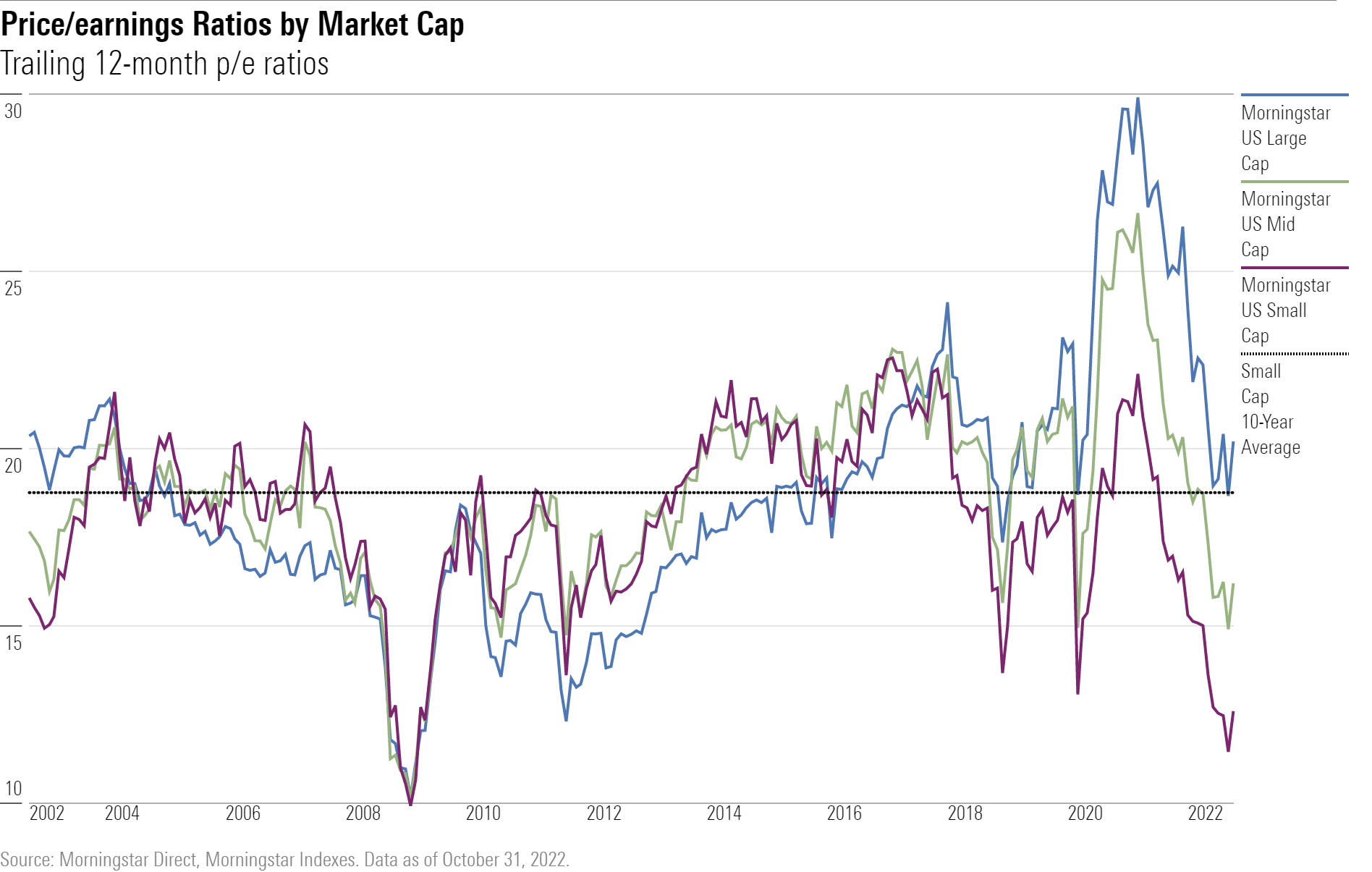

For smaller-company stocks, price/earnings ratios—a widely used measure for determining the value of a stock relative to its earnings—have reached their lowest levels in two decades. Lower ratios generally represent more attractive values and with a greater potential for price gains.

“Across the equity landscape, the small-cap trade is the most interesting thing I’m seeing right now,” says Lori Calvasina, managing director and head of U.S. equity strategy at RBC Capital Markets.

Calvasina, who spent seven years analyzing small-cap companies before taking on her current role, says that small-cap stocks are very undervalued relative to their historical levels as well as compared to large-cap stocks.

“Relative to large caps, small-cap stocks are the cheapest we’ve seen since the tech bubble,” Calvasina says.

The trailing 12-month price/earnings ratio for the Morningstar US Small Cap Index—a collection of the smallest 7% of U.S. stocks, each with current market caps of no more than $18.7 million—currently lies at 12.6, while the large-cap index’s price/earnings ratio is 20.2. A gap this wide between large- and small-cap valuations hasn’t been seen since 2002.

A key reason for lower valuations in small caps is that they’re generally more sensitive to the ups and downs of the U.S. economy, and as a result, rising expectations for a recession have hit the group especially hard.

But Calvasina says that at current levels, small-cap stocks are already priced at valuations that would account for “the worst that you’d expect to see in the middle of a recession.”

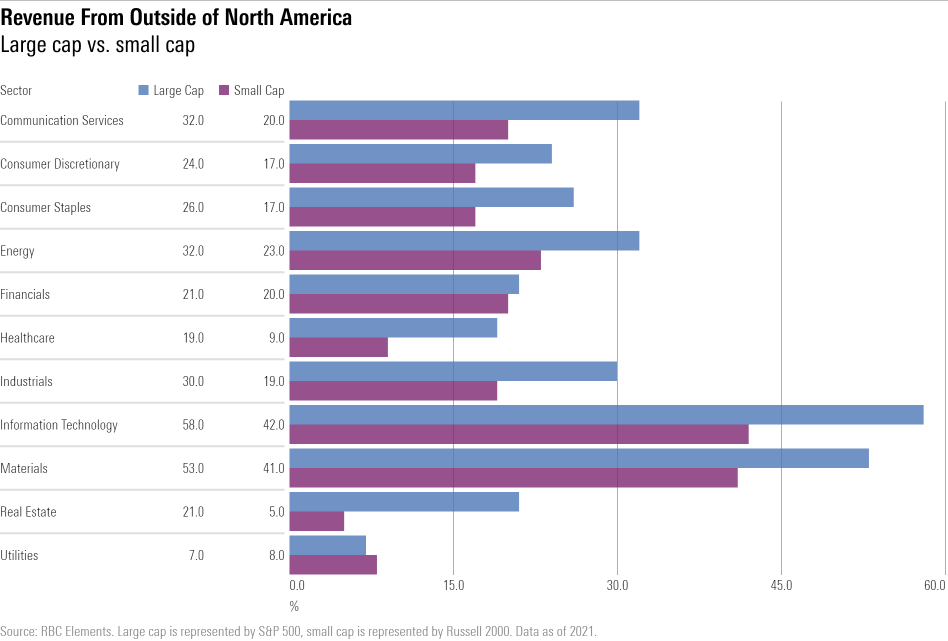

At the same time, there are factors working in favor of small caps that remain headwinds for larger company stocks. In particular, small-cap stocks tend to generate higher portions of their revenue within the U.S. compared to large caps, rendering them less vulnerable to a strong U.S. dollar.

Of course, there are risks. Calvasina says the main potential stumbling blocks for small caps are a severe recession or interest rates that stay higher for longer than expected.

Within the small-cap space, higher-quality companies across sectors are best poised to do well, Calvasina says, with financial services and consumer defensive small caps as some of the most undervalued.

Small-Cap Stocks Are Trading at Rare Discounts

In September, the price/earnings ratio of the Morningstar US Small Cap Index reached 11.4, its lowest reading since 2009. Its current value of 12.6 as of October 2022 is still well below the small-cap index’s 10-year average price/earnings ratio of 18.7. Meanwhile, the Morningstar US Large Cap Index’s price/earnings ratio of 20.2 is roughly in line with its long-term average of 20.6.

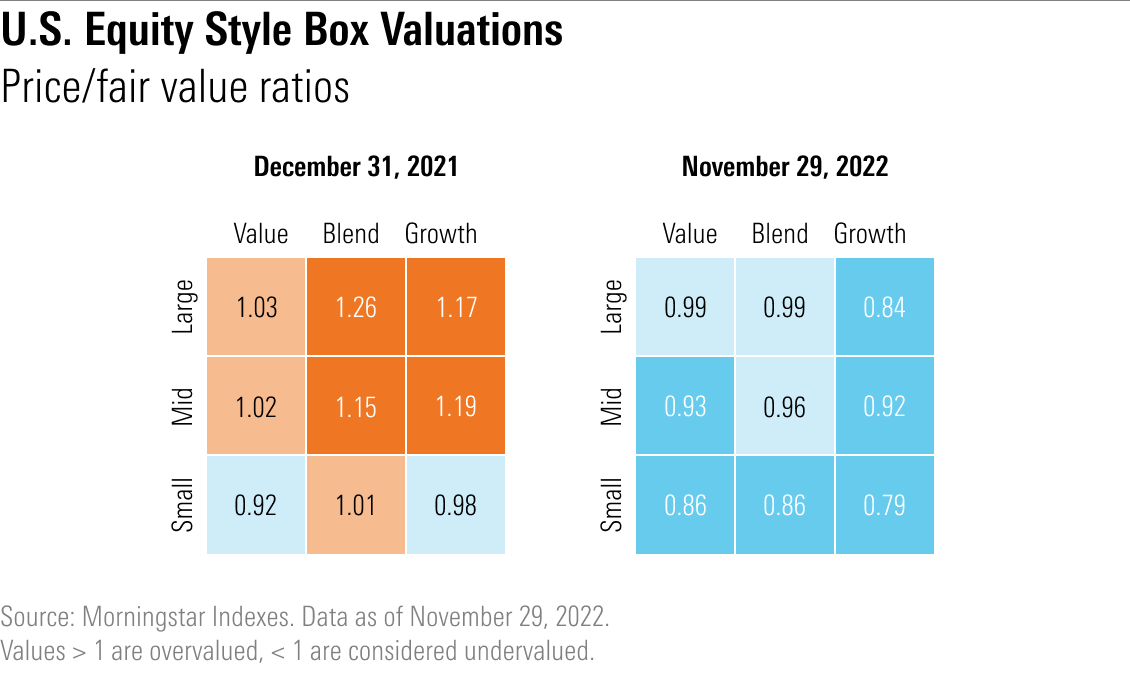

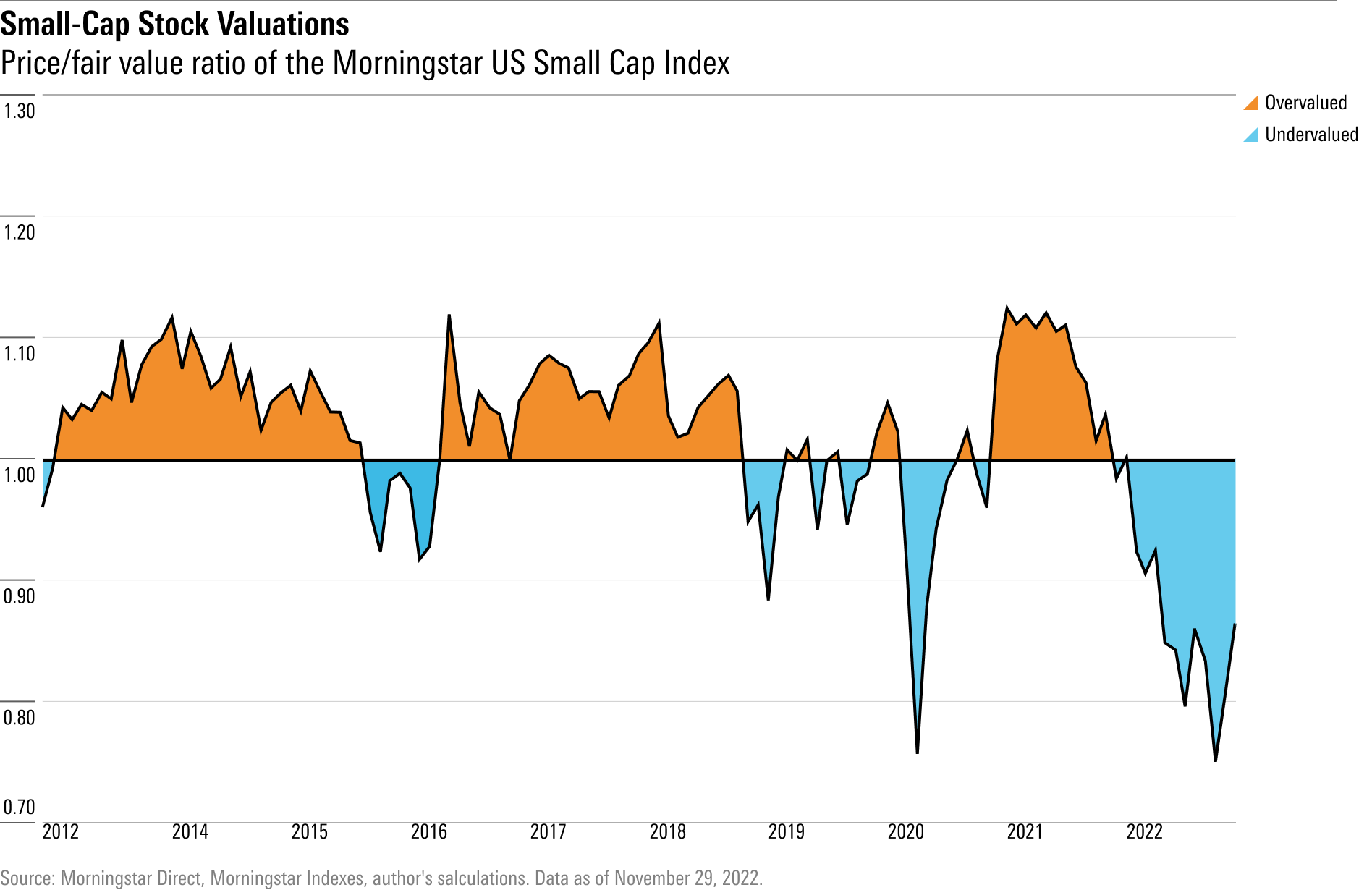

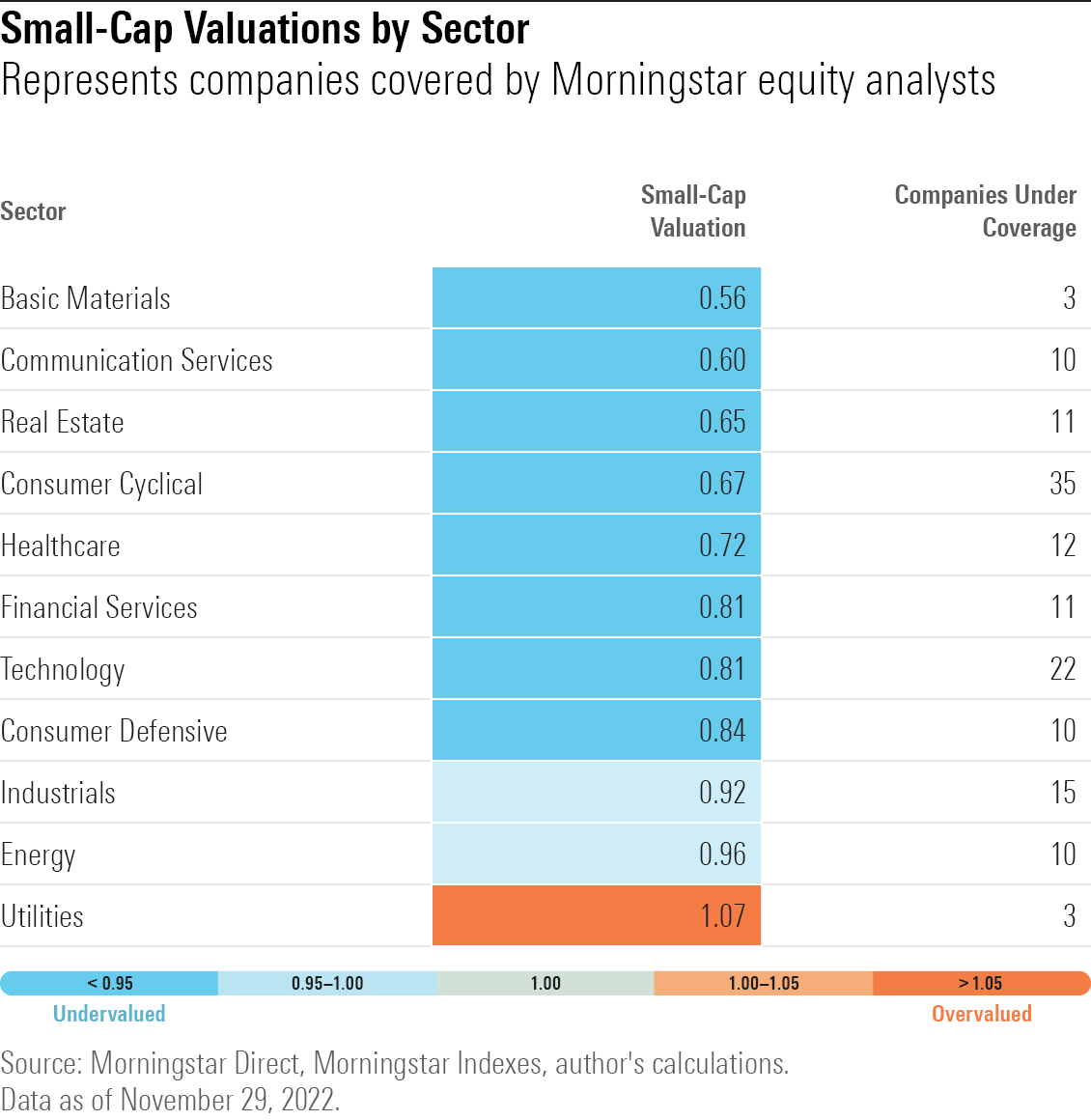

Small-cap stocks are also looking cheap according to Morningstar analysts’ price/fair value estimates.

The Morningstar US Small Cap Index currently has a weighted-average price/fair value ratio of 0.84. That’s meaningfully lower than the valuations for mid-cap and large-cap stocks, which both post index-level price/fair value ratios of 0.94.

Small-cap valuations are also cheap relative to where they were at the end of 2021, when the Morningstar US Small Cap Index’s average valuation stood at 0.96, signaling that small-cap stocks looked fairly valued as a group.

Why Are Small-Cap Stocks So Cheap?

A major driver behind low small-cap valuations is that they are already priced for an impending recession, Calvasina says. “We feel pretty strongly that small caps have already baked in the recession, and large caps are still in the process of pricing it in,” she says.

It may seem counterintuitive. Large-company stocks have fallen more than small-company stocks this year. The Morningstar US Large Cap Index is down 18% in 2022, while the US Small Cap Index is off 15.3%. At the same time, the iShares Russell 2000 ETF IWM—one of the largest small-cap blend funds with over $55 billion in assets under management—has fallen 17.2%.

But valuations on large stocks were much higher by historical standards heading into the bear market than on small-cap stocks, and their price/earnings ratios still haven’t hit historical lows. In addition, small caps lagged far behind big-company stocks during the 2021 rally and headed into the bear market with lower valuations.

Calvasina also points to fundamental reasons for the bigger drop in valuations. Many large-cap companies have been better able to manage recent macroeconomic headwinds such as supply-chain snarls and the labor market shortage relatively well.

Small caps, on the other hand, have had a much tougher time, she says. Smaller companies often don’t have as much scale, bargaining power, or negotiating power compared to larger companies. “So anything bad that happens out there, small caps absorb that a lot more directly,” Calvasina says.

Is It Time to Buy Small-Cap Stocks?

Historically, small caps tend to underperform before a recession hits, start to outperform midway through a recession, then finally outperform strongly coming out of the recession, according to Calvasina. “A recession is usually the point at which you want to be thinking about adding small caps to your shopping list,” Calvasina says.

That process may have been accelerated this time around. And many of the factors that have been headwinds for small caps may be turning, Calvasina says. In particular, supply chains and the labor backdrop for small companies are improving.

Those factors have “really weighed down small-cap companies over the past few years, and now, they’re starting to get better,” Calvasina says.

Another potential positive, according to Calvasina, is that as a group, small caps are carrying less earnings risk relative to large caps. That’s mainly due to the current strength of the U.S. dollar, she says.

On average, small-cap companies generate about 20% of their revenue outside the U.S., while large-cap companies make about a third of their revenue overseas.

“The growing value of the dollar is a headwind to earnings, it forces earnings to come down” she says. “It’s a much, much bigger problem for” large-cap stocks.

Overall, she says, “earnings estimates are safer in small caps rather than large caps right now,” Calvasina says. “You can rely on them a little bit better.”

What Kinds of Small-Cap Companies Are the Most Undervalued?

Calvasina says that small-cap stocks with positive earnings, bigger market caps, lower debts, and higher return on equity have held up better than the rest and are likeliest to outperform over the long term. “Higher-quality companies do better within small caps,” she says.

And at the sector level, small-cap financial services stocks look attractive to Calvasina, as the sector is very undervalued by her metrics. They’re the only sector within small caps seeing positive earnings revision trends right now, she says. “With financials, you’ve [currently] got a nice combination of resilient earnings and attractive valuations.” Additionally, Calvasina says that consumer defensive stocks are undervalued within small caps, even as large-cap names look overpriced for the sector.

Morningstar’s equity analysts currently see small-cap companies of all sectors as undervalued, with the exception of utilities stocks—currently overvalued by 7%—and energy, which is currently at 0.96, just shy of its aggregate analyst-assessed fair value estimate. Small-cap stocks in basic materials, communication services, and real estate look the cheapest according to analyst estimates. Morningstar analysts cover only three small-cap companies from the basic materials sector, and three from utilities.

Among some of the undervalued small-cap names, according to Morningstar analysts, are biotech company CRISPR Therapeutics AG (CRSP), which is trading at a 54% discount to Morningstar’s fair value estimate, apparel manufacturer Hanesbrands (HBI), which is trading at a 69% discount to its fair value estimate, and the travel services company Sabre (SABR), which is undervalued by 60%.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)