2 Sectors With the Largest Fair Value Estimate Cuts After Third-Quarter Earnings

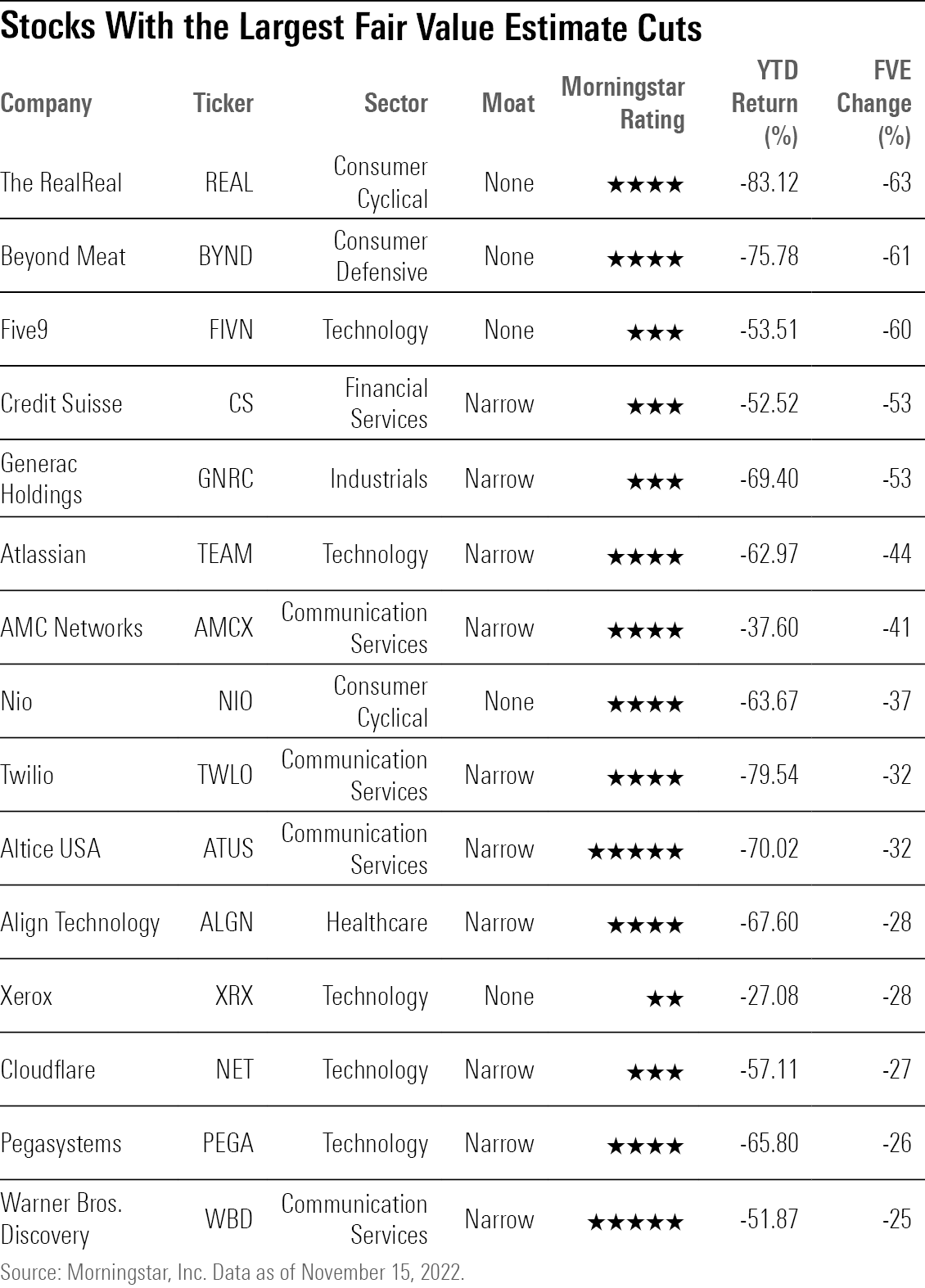

Software, semiconductors, and television network stocks such as AMC, Altice and Twilio saw significant downward revisions.

An increasingly difficult economic backdrop is resulting in a diminished outlook for many stocks in the eyes of Morningstar stock analysts.

Fair value estimates, Morningstar’s measure of a stock’s intrinsic value, were cut by a greater degree following third-quarter results than in the previous quarter as companies reported third-quarter earnings results that, for the most part, were weaker than what the market was expecting.

Results were often paired with negative commentary on near-term performance from company management, such as slashing guidance outlooks, continuing struggles with supply chain issues, and high inflation.

Unsurprisingly, fewer companies made the case that fundamentals were improving enough for Morningstar analysts to increase their fair value estimates. Instead, the bulk of fair value estimate changes in the weeks succeeding the end of the third quarter were cuts.

Between Sept. 30 and Nov. 11, Morningstar analysts reduced their fair value estimates for U.S.-listed stocks by an average of 1.85%. That’s a greater decrease than the average 0.53% reduction last quarter, and the 10-year quarterly average fair value estimate increase of 1.74%. The third quarter 2022 earnings season now has the largest fair value estimate average cut since the first quarter of 2020.

Only 130 companies out of the 843 U.S.-listed stocks covered by Morningstar analysts earned a fair value estimate increase during third-quarter earnings season, the fewest since the first quarter 2020 earnings season. Furthermore, only 16 stocks earned a notable fair value estimate increase of 10% or more, compared to the 10-year average of 50. Conversely, 201 stocks had their fair value estimate cut, with 71 of them reduced by 10% or more, compared to the 10-year average of 51.

Morningstar analysts conduct a fundamental review and create models to determine a fair value estimate of a company’s shares. While Morningstar analysts take a long-term approach to investment analysis, they monitor quarterly earnings results to update their assumptions and, potentially, their fair value estimates.

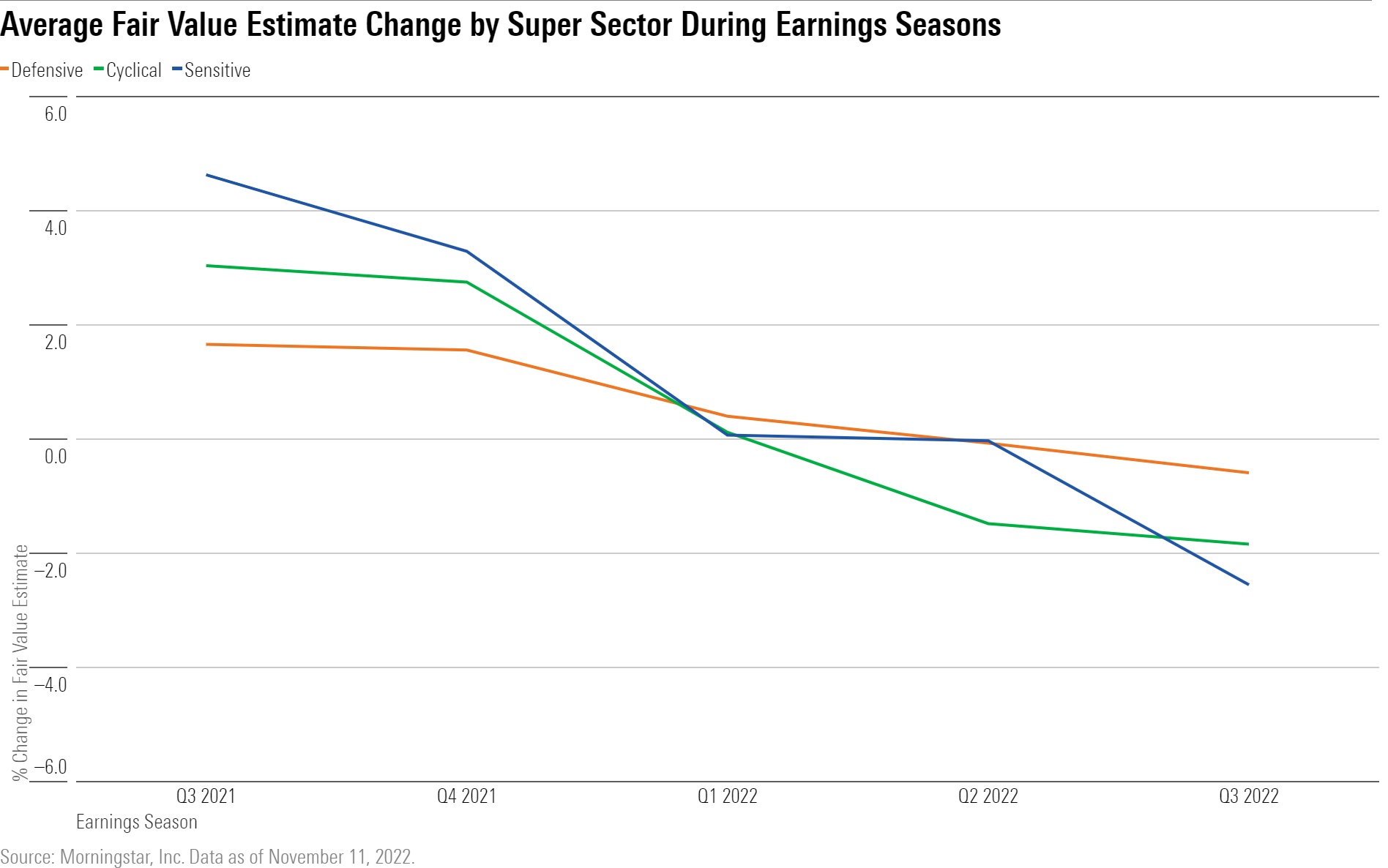

The chart below shows the average percentage change in fair value estimates following and during earnings for the past five earnings seasons. The estimates were pulled from Morningstar Direct for the end dates of each quarter and compared against the estimates six weeks after each quarter ended to capture changes during each earnings season. More details on the methodology can be found at the end of this article.

We’ve sorted data by what Morningstar calls Super Sectors: Companies that fall into cyclical, defensive, and sensitive categories.

Cyclical sectors are those that are heavily correlated with the business cycle. As the economy expands or contracts, cyclical sectors follow.

The defensive sector includes industries that are relatively immune to economic cycles.

Sensitive sector industries ebb and flow with the overall economy, albeit with more volatility than defensive, but less than cyclical.

Fair value estimates dropped across all three Super Sectors during third-quarter earnings season, with the more severe fair value estimate cuts occurring in the sensitive sector. Fair value estimates for sensitive stocks were reduced by 2.55% between Oct 1. and Nov. 11, up from the 0.03% decline for the second-quarter earnings season, and is the worst earnings season drop for the group since 2015′s fourth-quarter earnings season, when sensitive sector stocks’ fair value estimates were cut by 3.11%.

The intensity of fair value estimate changes for defensive and cyclical sectors also stepped up, with fair value estimates in the defensive sector reduced by 0.59% from a decline of 0.07% last earnings season, and cyclical sectors by 1.84% from a 1.48% fall in the period prior. Both reductions were the worst for the two Super Sectors since the first quarter 2020 earnings season.

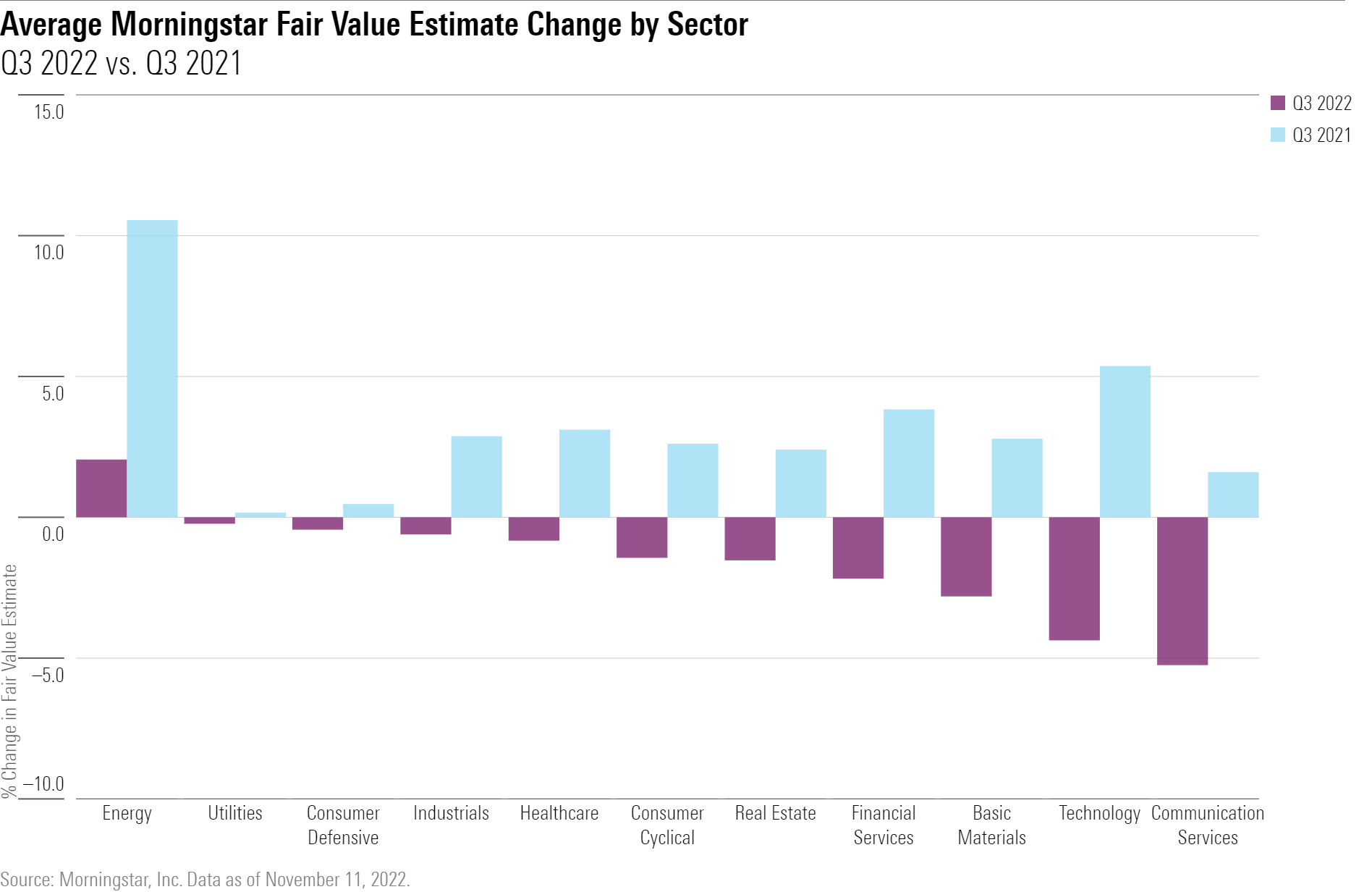

Drilling down to the sector level, the bulk of the reductions was in communication services, where fair value estimates were cut by an average of 5.25%, and technology where the average reduction was 4.37%. Meanwhile, the only sector that had an average fair value estimate increase was the energy sector, where they increased by 2.05% on average.

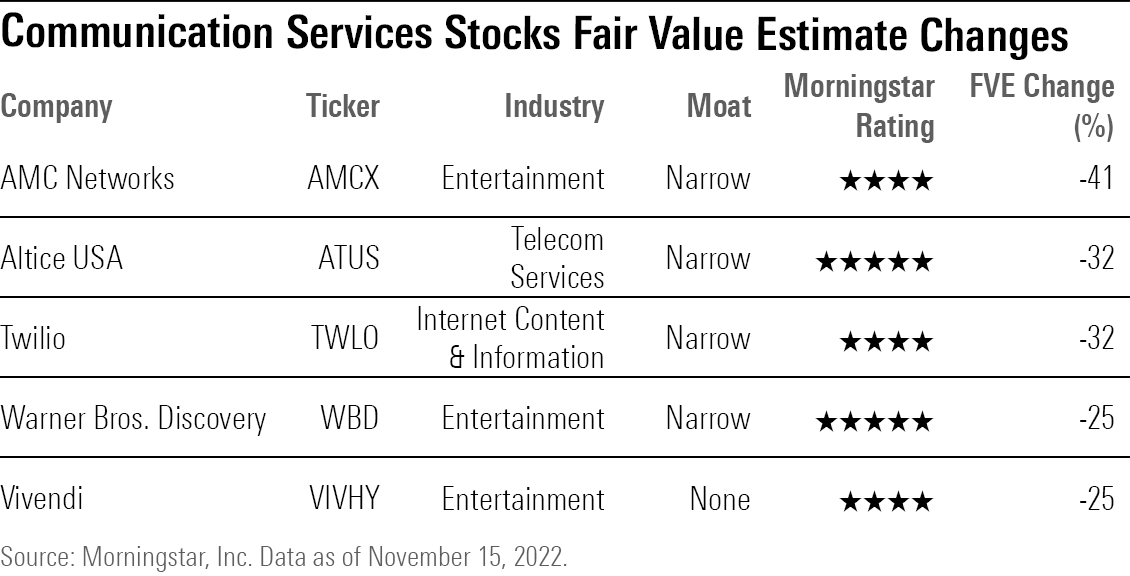

Communication Services

Stocks in the communication services sector are facing growing headwinds, which has caused the group to become the worst-performing sector in 2022 so far. One of the most significant factors hurting communication services stocks has been a decline in spending from advertisers, which are a major revenue source for many companies in the sector.

The communication services stock with the largest fair value estimate cut this earnings season was AMC Networks (AMCX), which reported revenue of $682 million in the third quarter, down from $738 million in the second quarter.

“Ongoing streaming growth in the U.S. was overwhelmed by lower affiliate, licensing, and ad revenue as well as unfavorable currency movements,” says Neil Macker, a senior equity analyst at Morningstar. AMC Networks also reduced its full-year revenue guidance to flat to low-single-digit growth versus low-single-digit previously. Macker cut his fair value estimate to $30 per share from $51 after incorporating the results, however, the stock remains undervalued despite the cut, with a Morningstar Rating of 4 stars.

Likewise, other TV network companies faced pressure from declining revenue from advertising spending, such as Warner Bros. Discovery (WBD), which Macker also cut his fair value estimate on to $30 from $40. The French media firm Vivendi’s (VIVHY) fair value estimate was reduced to $11.25 from $15.

Macker says about Warner Bros. Discovery that, “we expect all linear TV networks to feel the pain from the ad market slowdown over the next few quarters.” Both stocks remain undervalued following their fair value estimate adjustments, with Warner Bros. Discovery rated as a 5-star stock, and Vivendi at 4 stars.

Other major fair value estimate reductions in the communication services sector include Altice USA (ATUS), which Michael Hodel, Morningstar’s director of equity research, media and telecom, reduced to $19 from $28 after the firm reported results that showed “poor customer losses, weak revenue per customer, and soft margins.” Altice USA stock remains undervalued, and has a rating of 5 stars despite the cut.

Twilio (TWLO), which provides tools to help companies build communications infrastructure, saw its fair value estimate decrease by 32%. “Between macro pressures and lower-than-expected guidance, we are cutting our fair value estimate to $95 per share, from $140 previously,” says Dan Romanoff, senior equity analyst at Morningstar. Twilio’s stock now has a rating of 4 stars and is viewed as undervalued by Romanoff.

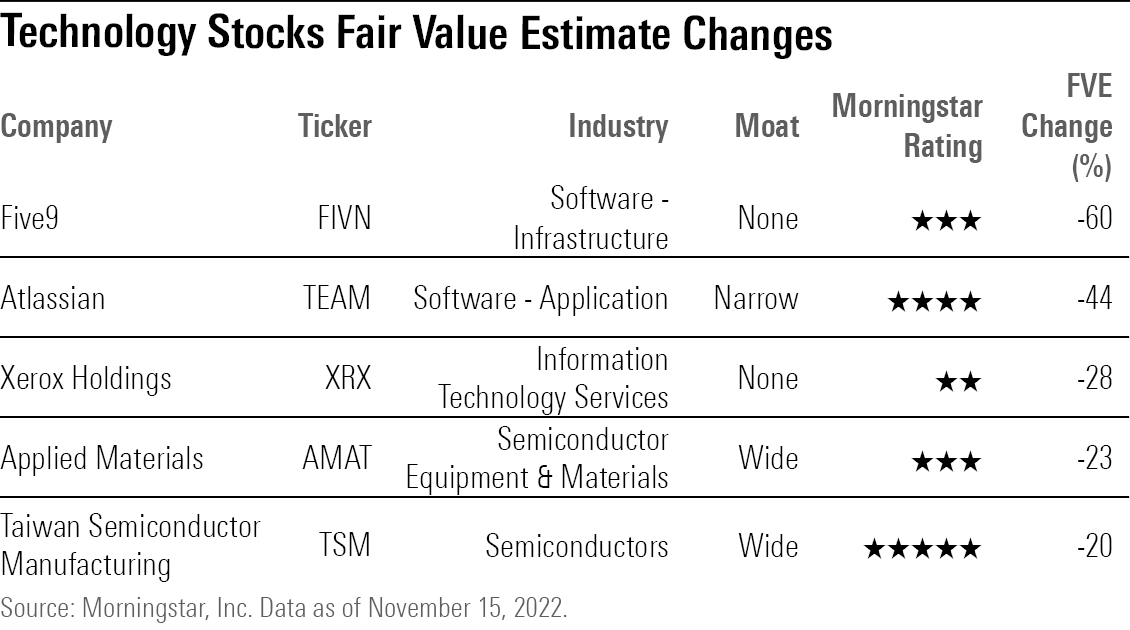

Technology

A deluge of guidance cuts from technology companies brought down valuations for a number of firms in the sector.

Five9 (FIVN) had one of the largest fair value estimate reductions among tech stocks during third-quarter earnings season after Morningstar’s Romanoff cut his fair value estimate for the stock to $52 from $130, a 60% decrease.

The company reported a lackluster outlook for the fourth quarter and fiscal 2023, which Romanoff sees as “well short of our model, and likely the rest of Wall Street as well.” Romanoff slashed his growth and earnings expectations sharply following the news, leading to the fair value estimate decrease. Five9 stock is considered fairly valued, and now has a rating of 3 stars.

Atlassian (TEAM) share’s fair value estimate was cut to $210 from $375 after the company released lower guidance than anticipated. The software company now expects its fiscal 2023 second-quarter revenue to be $835 million to $855 million, versus former consensus estimates of about $879 million, according to FactSet. Fewer free users of the company’s software converted to a paid subscription during Atlassian’s fiscal first quarter of 2023, and paid user growth declined. Atlassian stock now has a rating of 4 stars.

Morningstar equity analyst Malik Ahmed Khan reduced his fair value estimate for Xerox (XRX) to $13 from $18 after the company cut its full-year 2022 guidance for free cash flow generation to “at least $125 million” from $400 million when their third-quarter earnings were released. The company attributed its lower free cash flow generation guidance to, “slower-than-expected improvements, and persistent higher rates of inflation.” Khan notes that the bleaker guidance outlook is not the firm’s only concern as, “we remain concerned about the long-term structural decline in the printing landscape as consumers and companies wean off paper usage.” After the fair value estimate reduction, Xerox stock is considered fairly valued and is rated 2 stars.

Semiconductor stocks faced a wave of cuts as global demand for advanced chips took a hit, especially as U.S.-China tensions led to a ban on U.S. companies selling semiconductors past a certain performance threshold to China. Applied Materials (AMAT), a supplier of equipment used in semiconductor manufacturing, had one of the largest cuts to its fair value estimate as a result of the dampened outlook for semiconductors.

“After taking into account these new export restrictions and a weaker outlook for 2023 equipment spending, we are reducing our fair value estimate to $110 per share from $142 per share for wide-moat Applied Materials,” says Abhinav Davuluri, a Morningstar technology sector strategist. Davuluri sees Applied Materials’ stock as fairly valued and it has a 3-star rating

Expectations for more sluggish personal computer demand in 2023 and 2024, on top of the China restrictions, also contributed to Taiwan Semiconductor Manufacturing Co.’s (TSM) recent fair value estimate cut to $133 per share from $166. The company has a Morningstar Rating of 5 stars

Data notes: Fair value estimates were sourced from Morningstar Direct for the end dates of each quarter. Fair value estimate percentage changes were then calculated between their value at the end of each quarter, and any new fair value estimates as of six weeks after the quarter ended, which we define as earnings seasons for the purpose of this article. For example, for Q3 2022, fair value estimate percentage changes were calculated between Sept. 30 and Nov. 11. For the fourth quarter only, we expand our earnings season period to eight weeks to adjust for the holiday season. In some cases, fair value estimate adjustments may have also been made outside of these date ranges and would not be captured in this review.

Stocks without a fair value estimate at the beginning and/or end of the six-week period were excluded from data aggregation to account for any changes in our equity coverage list. Stocks portrayed in sector tables may not necessarily reflect those that had the largest fair value moves within the sector. The stocks mentioned in this story were selected to emphasize sector-wide trends and/or at the recommendation of Morningstar analysts.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-06-2024/t_bd32499d257a40fe9a757102874ba6c4_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)