How Did the Largest Bond Funds Do in Q3?

Some funds saw a fourth consecutive quarter of losses.

The largest bond funds extended losses in the third quarter, as hopes that inflation would fall off quickly and the Federal Reserve could slow down its rate increases were once again dashed.

For some of the most widely-held bond funds, the past three months marked the fourth consecutive quarter of losses. That includes the largest bond strategy for U.S. investors, the Vanguard Total Bond Market Index VBMFX, which has never had four straight quarters of losses in its 34-year history.

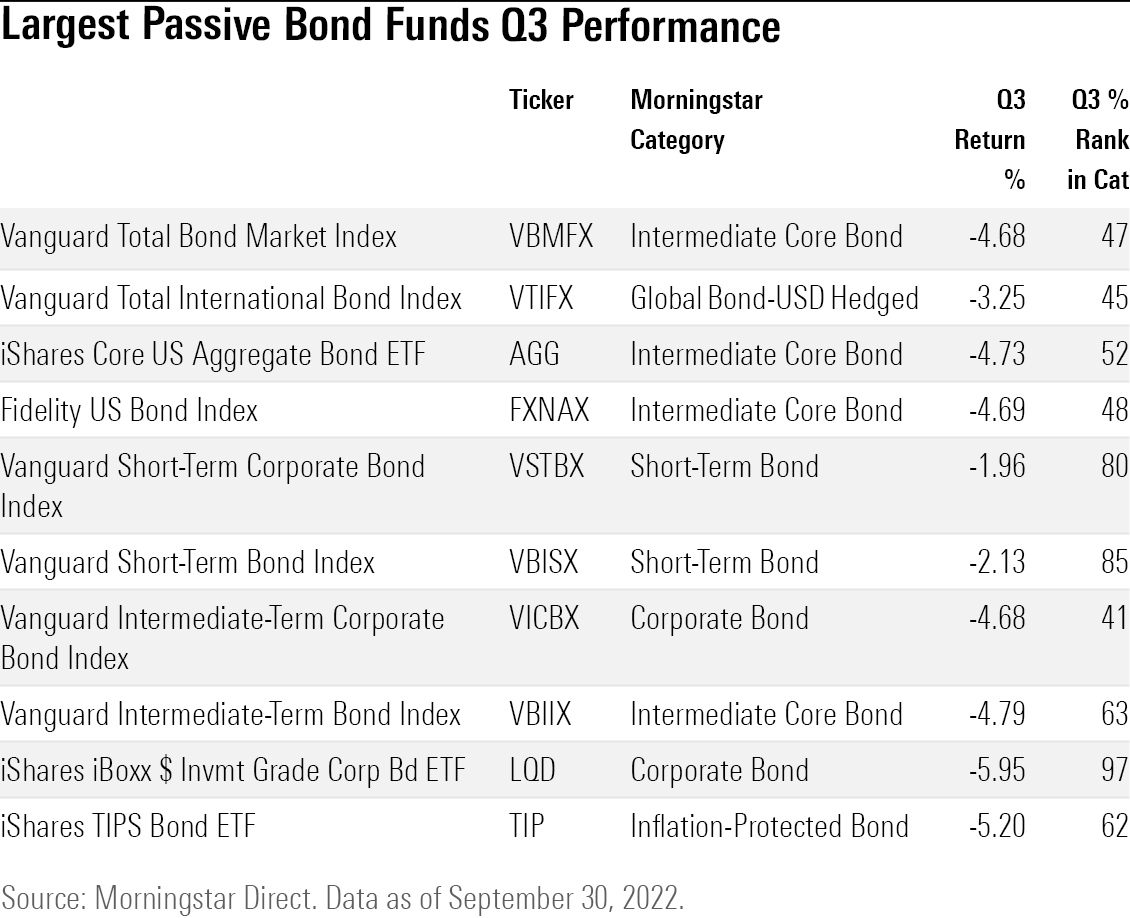

Vanguard Total Bond dropped 4.68% in the third quarter, bringing its year-to-date loss to 14.65% and its 12-month loss to 14.74%.

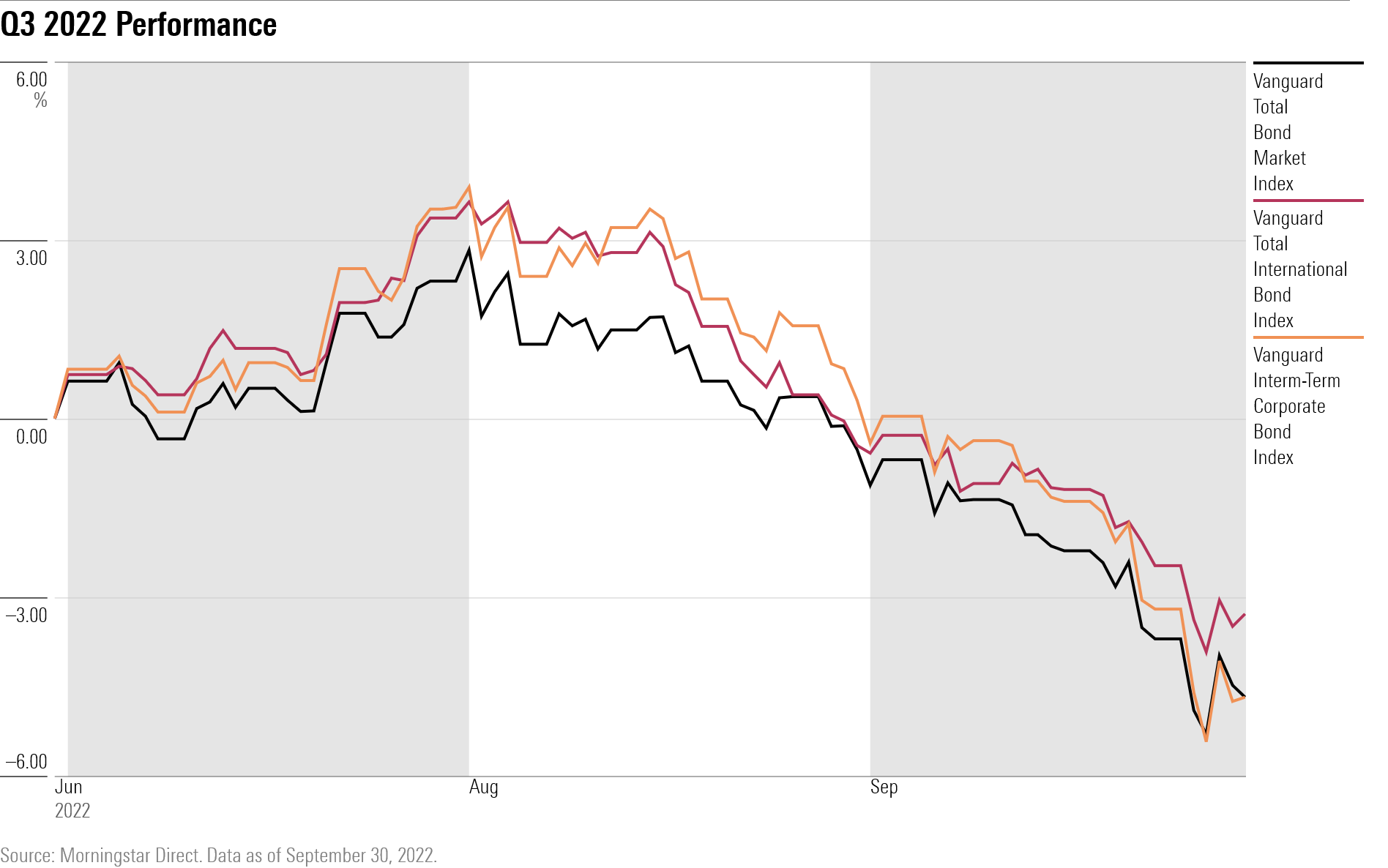

As with the stock market, the third quarter began with a relief rally. Bond funds that invest in debt issued by corporations rallied higher when the chance of a recession appeared lower. Corporate bonds are seen as vulnerable in a recession, which could make it harder for some companies to pay their debts.

The Vanguard Intermediate-Term Corporate Bond Index VICBX was nearing gains of 4% for the quarter as of mid-August, but by the end it was in negative territory by roughly that amount as inflation raged and interest rate hikes continued.

Harder hit was iShares iBoxx Investment Grade Corporate Bond ETF LQD. The fund has been one of the worst performing corporate bond funds this year. It invests in longer-term bonds than the average fund in the category, which has punished the fund as interest rates rise. The fund has lost 21.24% through the third quarter of this year.

Funds that invest in longer-term bonds suffer when interest rates rise because the fixed payments of these bonds become less attractive as new bonds are issued with higher interest rates. Stuck with holding these bonds for longer periods, their prices decline when yields increase. One way to measure this is by calculating a bond’s duration, which measures in years how sensitive a fund is to interest rate increases.

“The fund’s average duration tends to be in the highest quartile of its category, standing at 8.7 years as of July 2022. This has hurt its performance when interest rates rise, including the year to date through July 2022,” writes Morningstar associate manager research analyst Lan Anh Tran. On the year, corporate bond funds have fallen further than the average intermediate-core bond fund. The average corporate bond fund is down 17.92% compared with the average drop of 14.67% in intermediate-core bond funds.

Vanguard Total International Bond Index VTIFX outperformed U.S.-focused indexes early in the quarter, but ended down 3.25%. The fund invests in non-U. S. investment-grade bonds, but reduces its exposure to changes in currencies by utilizing hedging strategies.

Funds that invest globally, but don’t employ hedging strategies to offset movements in currencies, have struggled as the U.S. dollar hits a 20-year high against other currencies. The surging dollar hurts the value of non-U. S. investments for U.S. fund owners. On average, global funds that hedge away changes in local currencies lost 6.04% in the quarter while global bond funds hedged to the U.S. dollar lost only 3.47%.

Vanguard Short-Term Corporate Bond Index VSTBX held up the best among the largest passive bond funds, only losing 1.96% in the quarter. The same credit dynamic played out among short-term bond funds with the broader Vanguard Short-Term Bond Index VBISX falling slightly more with a 2.13% loss.

Funds that promise inflation protection aren’t immune to the effects of rising yields on their prices and those invested in longer-dated Treasury Inflation-Protected Securities have struggled. “Changes in the Consumer Price Index will impact a TIPS’ price by adjusting its principal value, but an increase in interest rates can have an outsize impact on the price because of the longer-duration profile,” Morningstar analysts explained in an article from March.

The $26.4 billion iShares TIPS Bond ETF TIP posted a 5.20% loss for the quarter bringing it year-to-date loss to 13.69%.

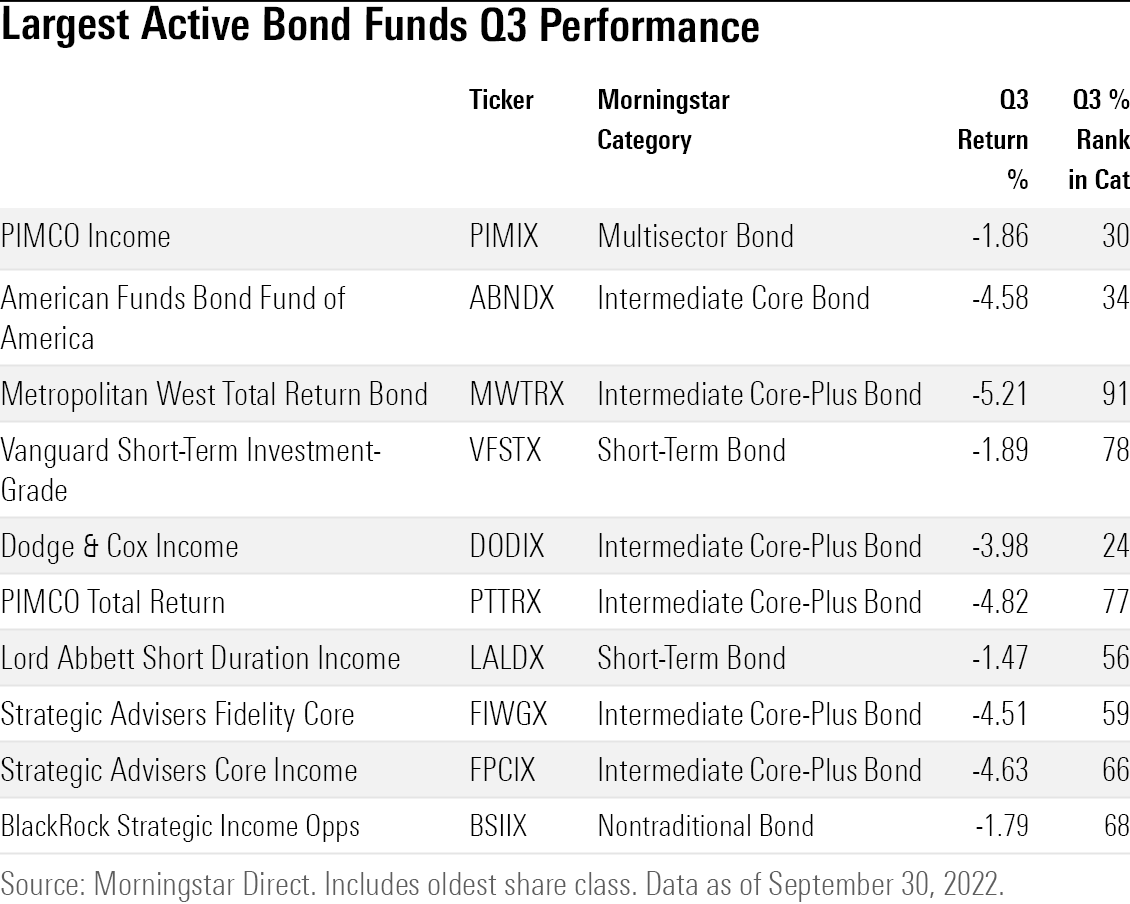

The largest actively-managed bond fund, the $119.5 billion PIMCO Income PIMIX, lost only 1.86%. (Returns are based on performance for each funds’ oldest share class.)

Morningstar strategist Eric Jacobson wrote in May that “the strategy fared better than many multisector bond Morningstar Category peers in the face of rising global bond yields by entering the year with a 1.15 year duration, much of it coming from a 5.5% exposure to inflation-indexed bonds.”

BlackRock Strategic Income Opportunities Fund BSIIX held up the best among the largest bond funds. The fund declined 1.79%, though still lagged its peers in the nontraditional bond category.

“Lead managers Rick Rieder and Bob Miller have made the most of the strategy’s leeway across a variety of market environments, including both weak and strong credit markets as well as periods of rising and falling interest rates,” Jacobson wrote.

In the intermediate-core bond category, the $68.6 billion American Funds Bond Fund of America ABNDX lost 4.58%, but held up better than its peers. Morningstar manager research analyst Sam Kulahan writes that the “managers actively manage the portfolio’s duration,” which is typically less than the average intermediate-core bond fund.

Though short-term bond funds held up better than most other groups, actively-managed Lord Abbett Short Duration Income LALDX and Vanguard Short-Term Investment-Grade VFSTX both lagged peers.

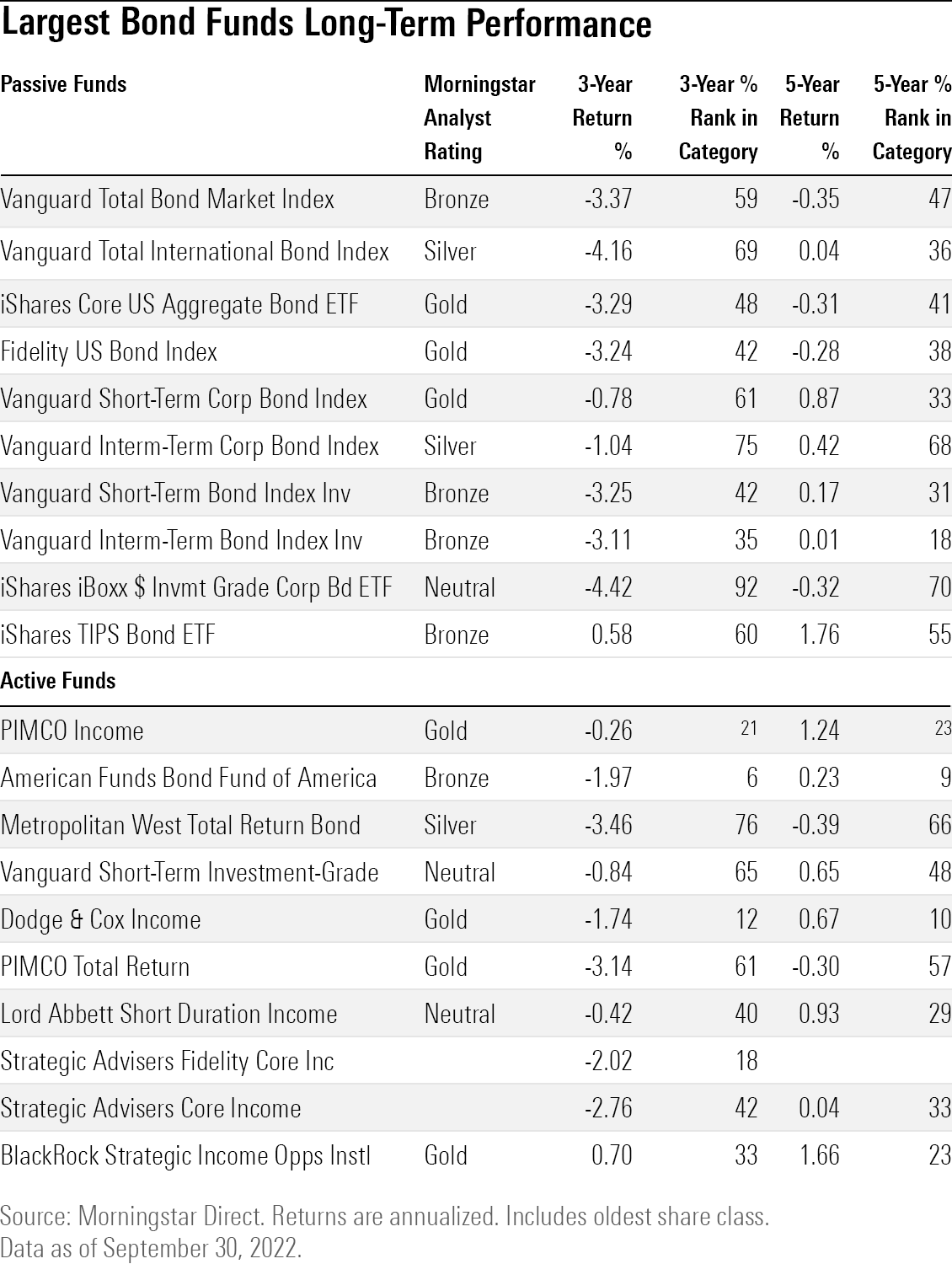

While equity funds are still showing gains over longer time periods, 2022 has eroded what were once gains for longer-term investors. iShares Core US Aggregate Bond ETF AGG is showing a 0.31% loss over the past five years.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)