How the Largest Stock Funds Did in the Third Quarter

These funds clocked their third-consecutive negative quarter.

By the time the books closed on the third quarter, investors in the largest U.S. stock funds saw their 2022 losses deepen.

Up until the final days of the quarter, it looked as if a handful of the most widely held stocks might end the third quarter with minimal losses, but a punishing last week sent most into negative territory. And when investors zoom out to the full year, returns still look grim.

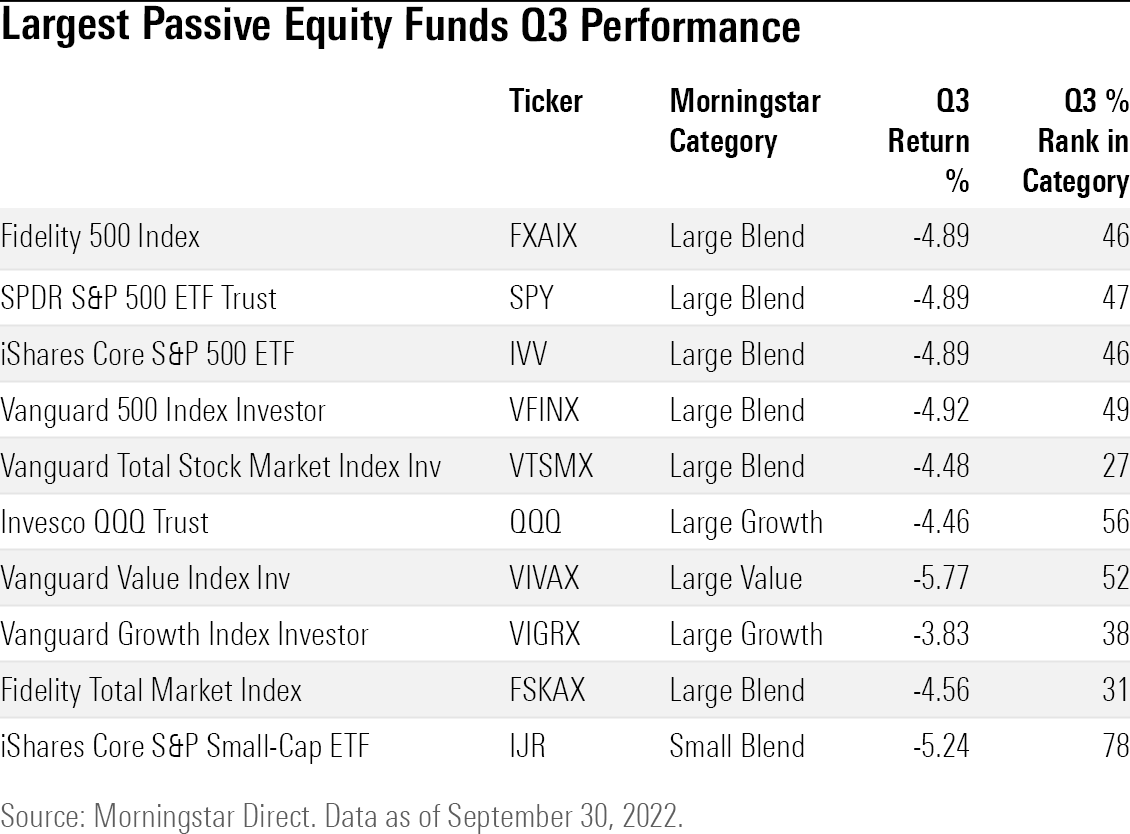

For example, the largest U.S. stock fund, the $326.8 billion Fidelity 500 Index FXAIX, ended the third quarter down 4.89%, bringing its year-to-date loss to 23.88%. This puts the fund on track to its worst year since 2008, when the index fund lost 37.03%.

The broader Vanguard Total Stock Market Index VTSMX held up slightly better, losing 4.48%.

Funds focused on growth stocks, which tend to be more sensitive to higher interest rates, saw their returns jump early in the quarter when it looked like the Federal Reserve would let up on interest-rate hikes. At the same time, value funds, which had held up better than growth funds during the first-half slide, lagged the rebound.

Even with the market’s retreat in the second half of the quarter, most growth funds still held up better than those focused on value stocks. Invesco QQQ Trust QQQ lost 4.46%, and Vanguard Growth Index Investor VIGRX declined 3.83%.

Value-oriented funds suffered larger losses in the quarter but finished the third quarter with better returns than growth-oriented funds for the year. Dodge & Cox Stock DODGX lost 7.19% in the quarter, putting it in the 83rd percentile in the large-value Morningstar Category. Hurting the fund was FedEx FDX (down 34%), GSK PLC ADR GSK (down 26%), and Sanofi AS ADR SNY (down 24%), according to Morningstar Direct.

At the same time, dividend-heavy strategies didn’t provide the kind of shelter from market declines as they had in previous quarters. American Funds Washington Mutual Investors Fund AWSHX and American Funds Fundamental Investors ANCFX fell further than the average large-blend fund.

The largest actively managed U.S. equity fund, the $193.1 billion American Funds Growth Funds of America AGTHX, turned out a 2.70% loss, buoyed in part by a large cash stake and cyclical holdings including Tesla TSLA, which gained 28%. Netflix NFLX, which plagued a number of growth funds last quarter, also rallied 35%, helping the fund.

Vanguard Primecap VPMCX had a tough quarter because of its technology and healthcare holdings, attribution from Morningstar Direct shows. FedEx and Adobe ADBE hurt the firm along with a disappointing quarter from AstraZeneca AZNCF and Intel INTC.

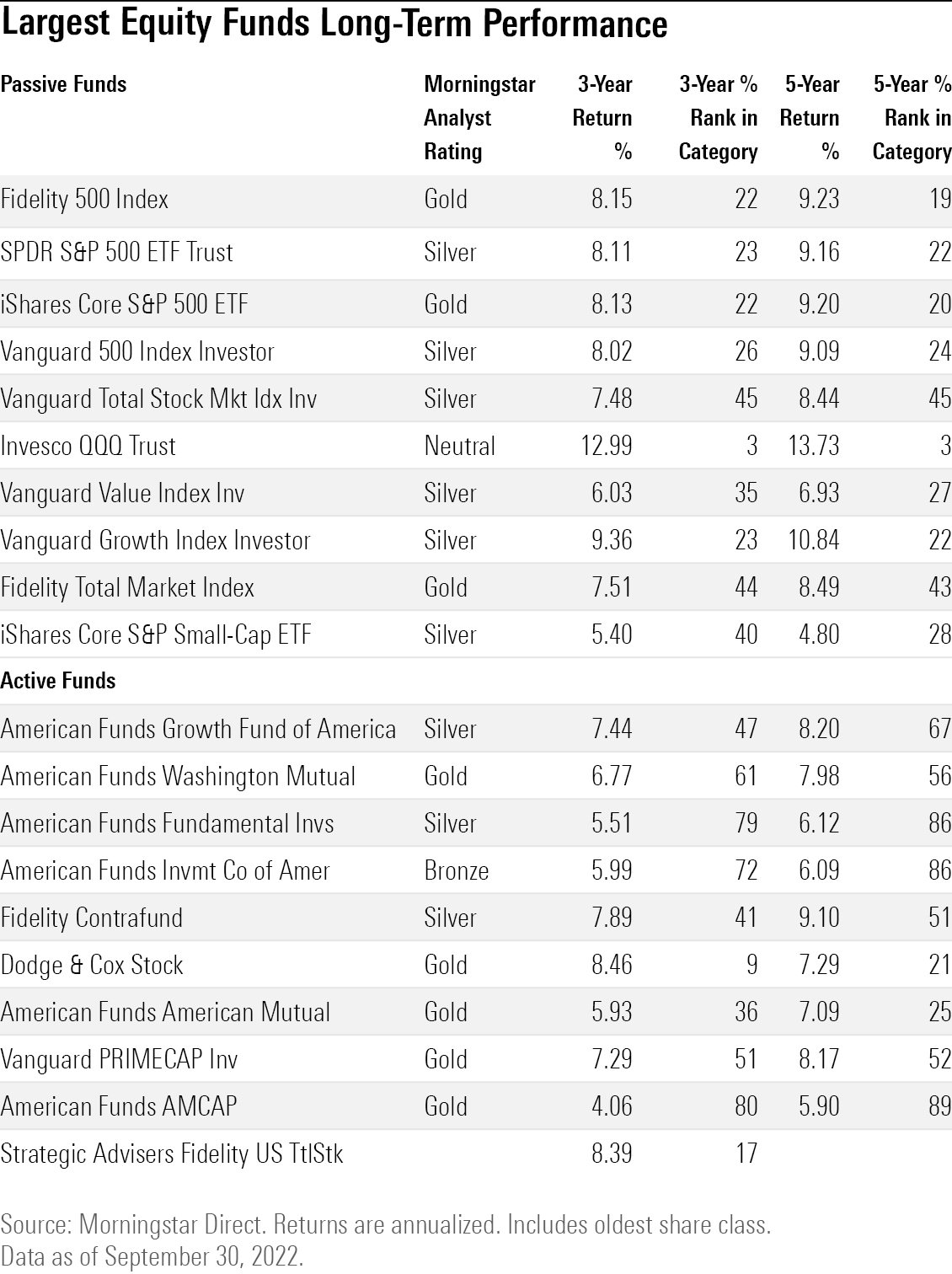

Over time periods greater than a year, U.S. equity funds are still showing positive returns. The Fidelity 500 Index is up 8.15% on an annualized basis over the past three years, while the Invesco QQQ Trust is up 12.99% over the same period.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/N7VBPGEKIZDBPEAHLKIWYNRLBE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)