Yes, It's a Strong Jobs Report, but July Probably Overstates the Case

Surge in hiring confirms the economy isn’t in recession, but the Fed will be focused on inflation

If the U.S. economy is in a recession, somebody forgot to tell employers.

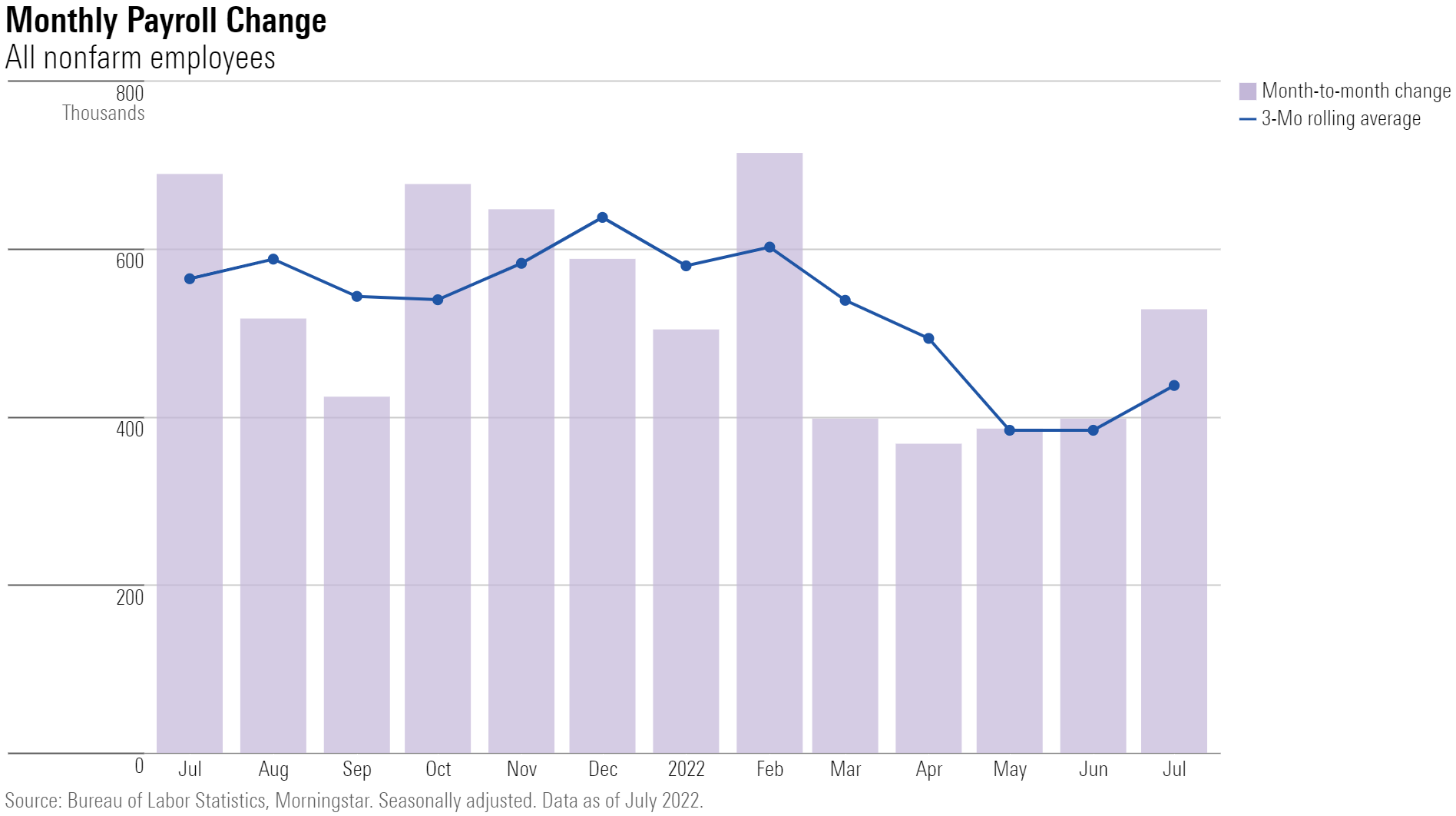

After a few months of moderating job growth, the U.S. economy kicked back into high gear in July when it came to job creation. The July jobs report from the Bureau of Labor Statistics showed total nonfarm payroll employment rose by 528,000 for the largest monthly jobs increase since February and roughly double the pace of new hiring that economists had expected.

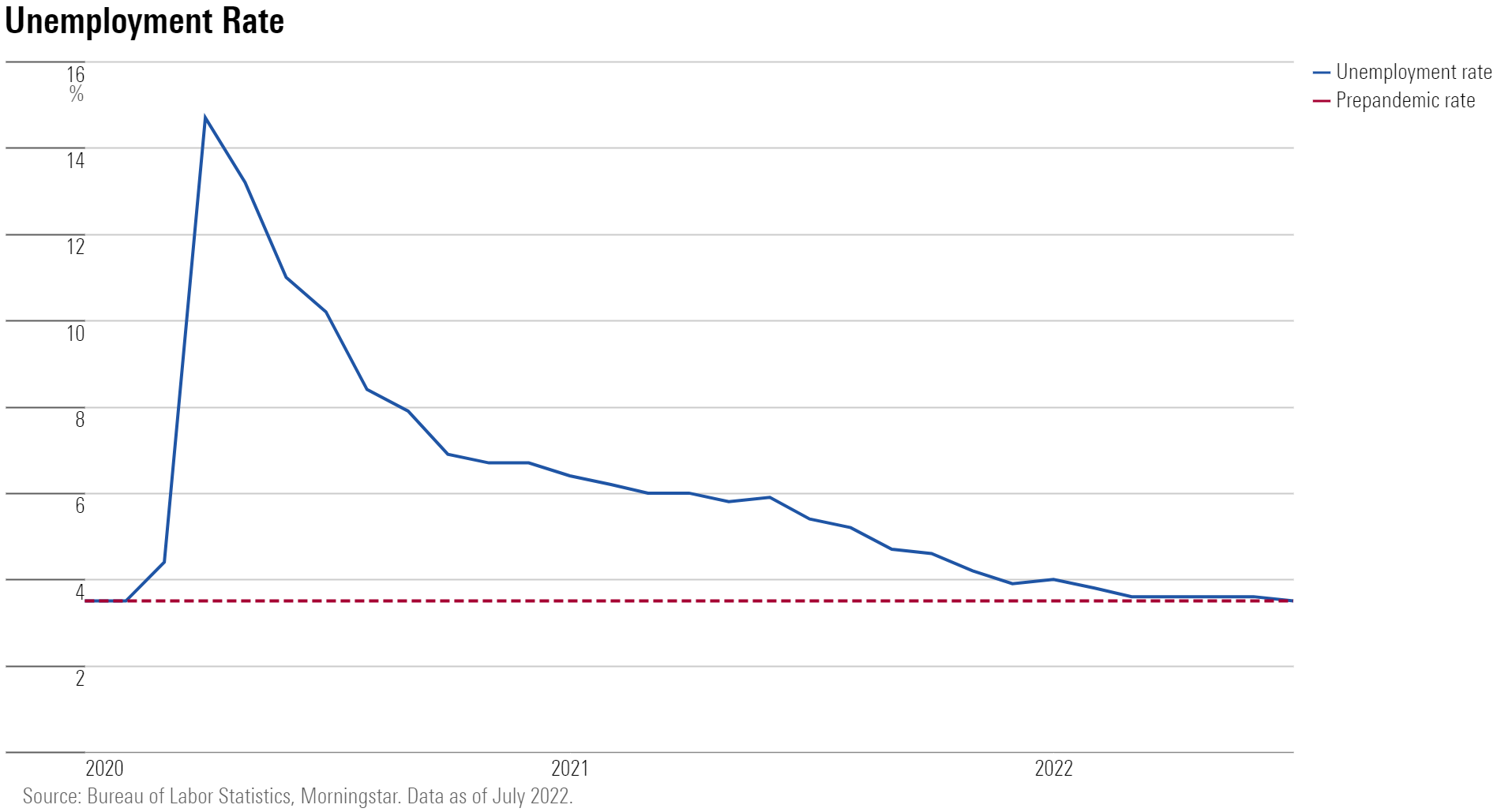

With the rise in payrolls, and a decline in the unemployment rate to 3.5%, the jobs market has returned to prepandemic levels of employment.

“Today's strong jobs report helped confirm that the U.S. economy has not yet entered a recession, but we shouldn't overstate the importance of this one report,” says Preston Caldwell, Morningstar’s U.S. chief economist.

A selloff in the bond market, and a return to expectations for continued very aggressive interest rate increases from the Federal Reserve following the jobs report is an overreaction, he says. “The Fed's actions will depend more on upcoming inflation news than today's jobs report, especially given all of the caveats regarding the signal provided by today's report.”

The coming week will bring the July Consumer Price Index report. Inflation hit a fresh four-decade high in June.

“Additionally, employment is a lagging indicator, and we think economic headwinds caused by Fed tightening won't fully play out until 2023,” Caldwell says. “So it's unsurprising that the job market is still registering some strength. The decline in GDP in the first half of 2022 was largely noise, in our view, not a genuine recession.”

On the employment front, the 528,000 surge in hiring for July came after job growth had leveled out for several months following the late 2021 explosion in employment. With the July numbers, the three-month moving average of nonfarm payroll employment, which helps smooth out the month-to-month noise, rose to 437,000 from 384,000 in June. That’s still down substantially from the peak hit in December of 637,000.

The unemployment rate fell back to its prepandemic level of 3.5% after hovering at 3.6% for several months.

Caldwell notes that the two distinct parts of the employment report—payrolls come from a survey of businesses, and the unemployment rate from a survey of households—are telling fairly different stories about the jobs market. He says that while the payrolls data are usually a better signal of economic health, it is worth considering the household data as well.

“While seemingly an arcane data issue, we can't ignore the glaring divergence between the headline payroll employment data and the alternative household survey,” he says. “Although nonfarm payroll employment has averaged a robust increase of 500,000 over the past three months, household employment has increased an average of merely 100,000. The truth is probably somewhere in between.”

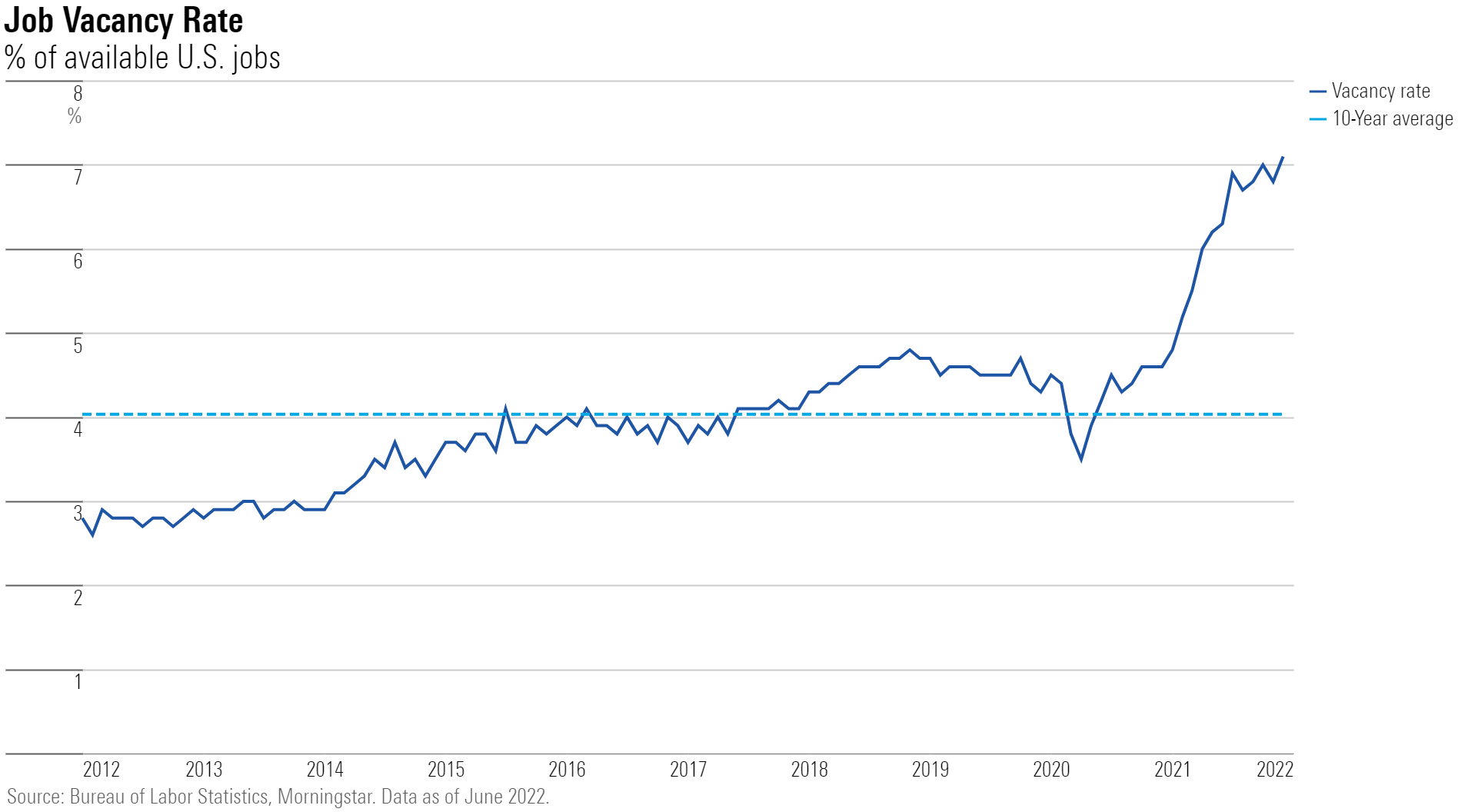

Caldwell also points to other data showing a more mixed picture on the job market that suggests the Federal Reserve is successfully cooling off the labor market, such as the government's Job Openings and Labor Turnover Survey.

“One the one hand, the job opening rate has backed off of recent record highs, falling to 6.6% in June from 7.2% in April,” Caldwell says. “It's particularly encouraging that this occurred even while the unemployment rate was largely unchanged, because it suggests that the Fed can curb the worst excesses of the job market without provoking massive job loss.”

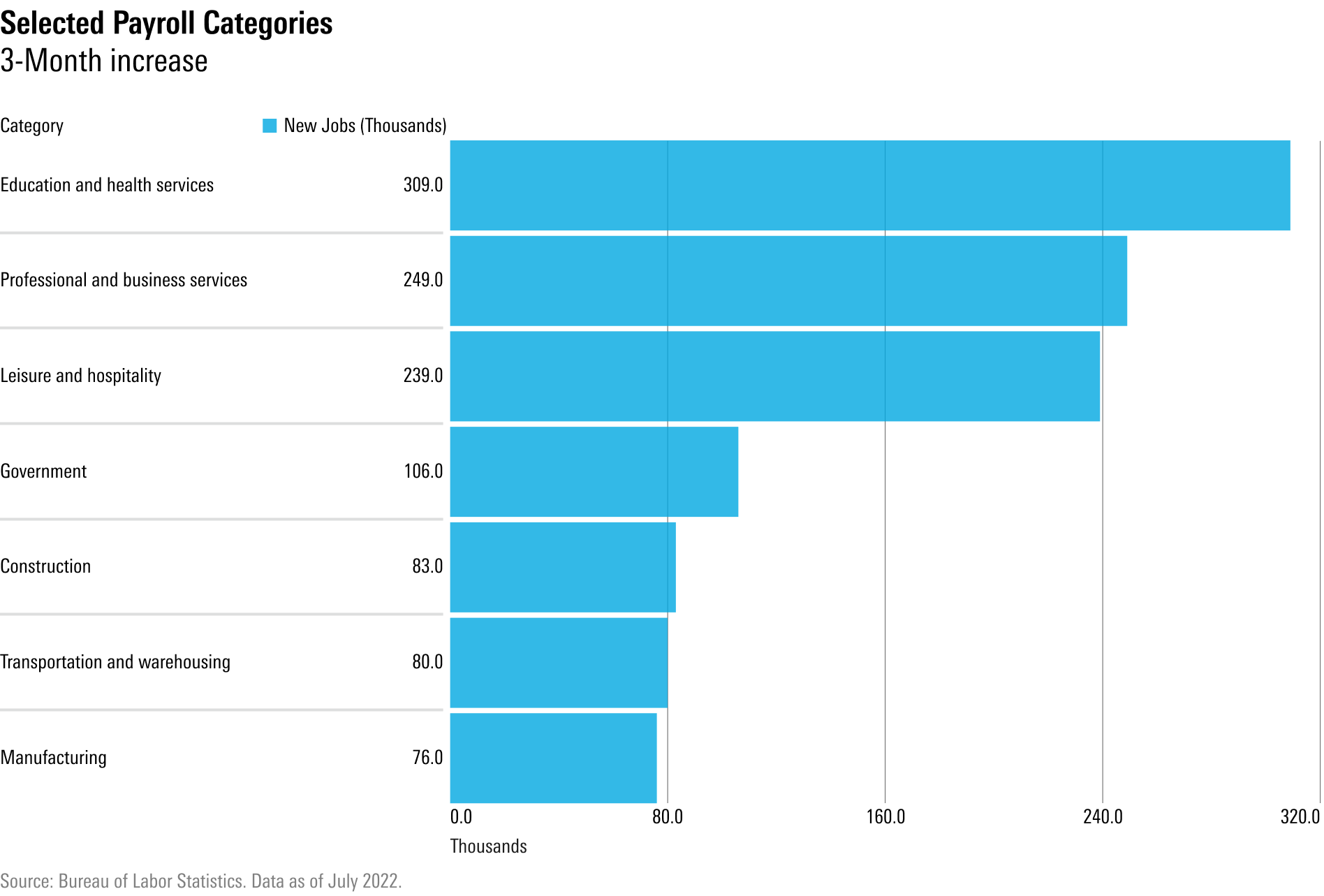

Within the July jobs report, the Labor Department said gains were broad-based, led by leisure and hospitality, professional and business services, and healthcare industries. Leisure and hospitality added 96,000 jobs, but employment in that industry remains below its February 2020 level by 1.2 million.

Over the last three months, education and health services have been the biggest driver of job gains.

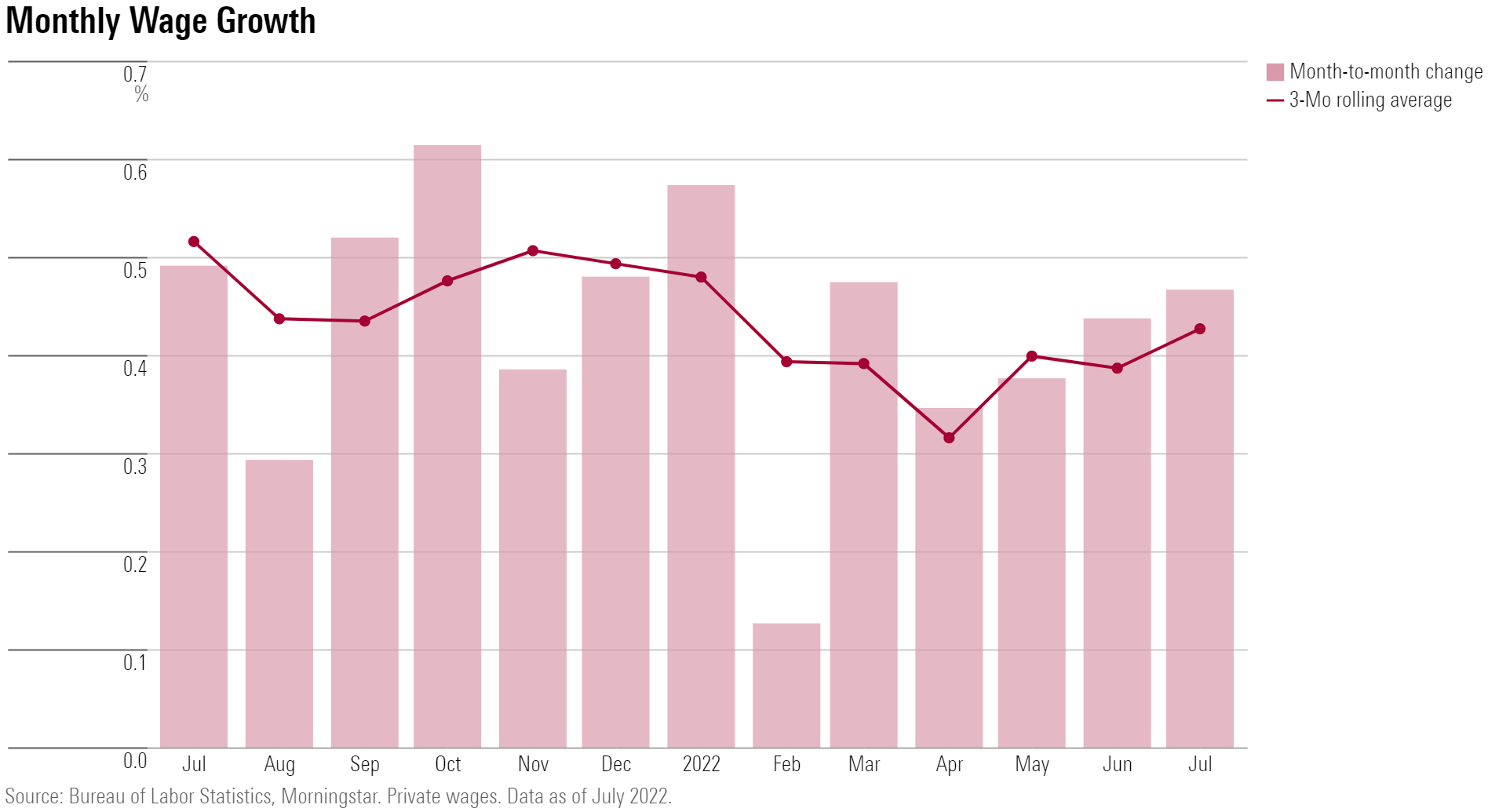

Along with the surge in hiring, the jobs report showed the labor market tightness continues to place upward pressure on wages. Average hourly earnings for all employees on private nonfarm payrolls rose 0.5% to $32.27, up 5.2% from year-ago levels.

“Wage growth ticked up to 5.3% annualized in the three months ending in July, after having trended down earlier in the year,” Caldwell says. “The alternative employment cost index showed a more alarming 6.2% annualized wage growth in the fourth quarter. Wage growth of 5%-6% is consistent with inflation of 3.5%-4.5%, so the Fed has more work to do in ensuring that wage growth is supportive of achieving its 2% inflation target.”

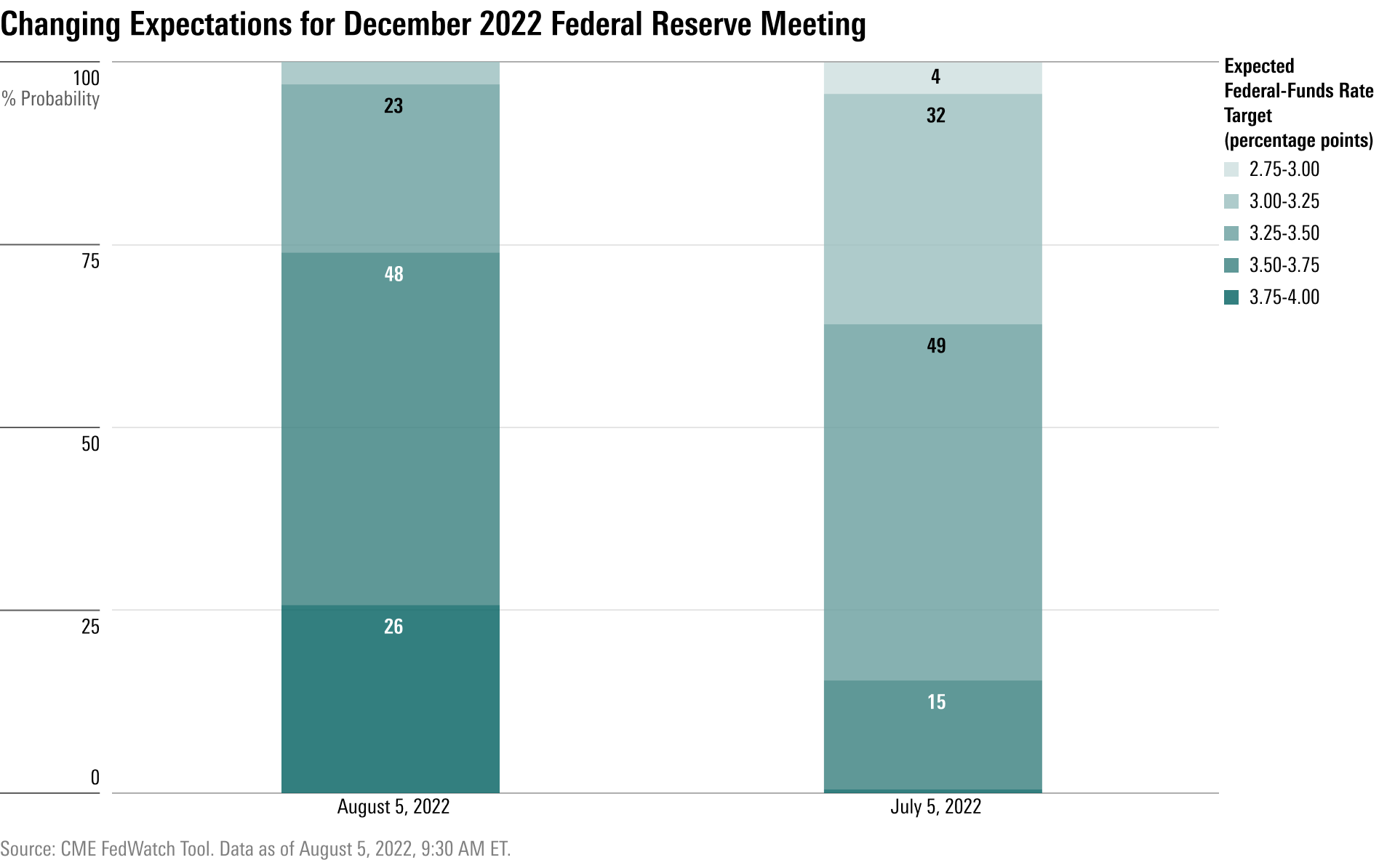

The jobs report sparked investors to shift back toward expecting very aggressive rate increases from the Fed in coming meetings.

In July, the Fed announced it was raising the federal-funds rate by 0.75 percentage points for the second time this year. Before this year, a rate hike of this size hadn't been seen since 1994. The market expects aggressive rate hikes to continue: 65% of market participants now expect the Fed will hike its target rate another 0.75 percentage points to 3.00%-3.25% in September, according to the CME FedWatch Tool.

But when it comes to the Fed, the next move depends on how inflation looked in July, Caldwell says. “The Consumer Price Index data next week will be more important in determining whether the Fed hikes rates by 0.5 or 0.75 percentage points in September.”

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)