Why We Expect Inflation to Fall in 2024

Wondering when inflation will go down? We’re optimistic about what’s ahead.

For now, it looks like inflation will return to normal without a recession.

As we had expected, inflation fell sharply in 2023 after reaching its highest level in over 40 years in 2022. In 2024, we project inflation to return to normal levels, in line with the Federal Reserve’s 2% target.

In our latest Economic Outlook, we detail that the drop in inflation has been driven principally by the unwinding of price spikes owing to supply chain resolutions and by the slowing pace of economic growth because of the Fed’s tightening.

We expect inflation to average 1.9% from 2024 to 2028—falling just under the Fed’s 2.0% inflation target.

If inflation proves stickier than expected, the Fed stands ready to do whatever’s necessary—including inducing a recession—to bring inflation down to 2%. But our base case is a soft landing, with inflation returning to normal despite only a modest and temporary deceleration in gross domestic product growth.

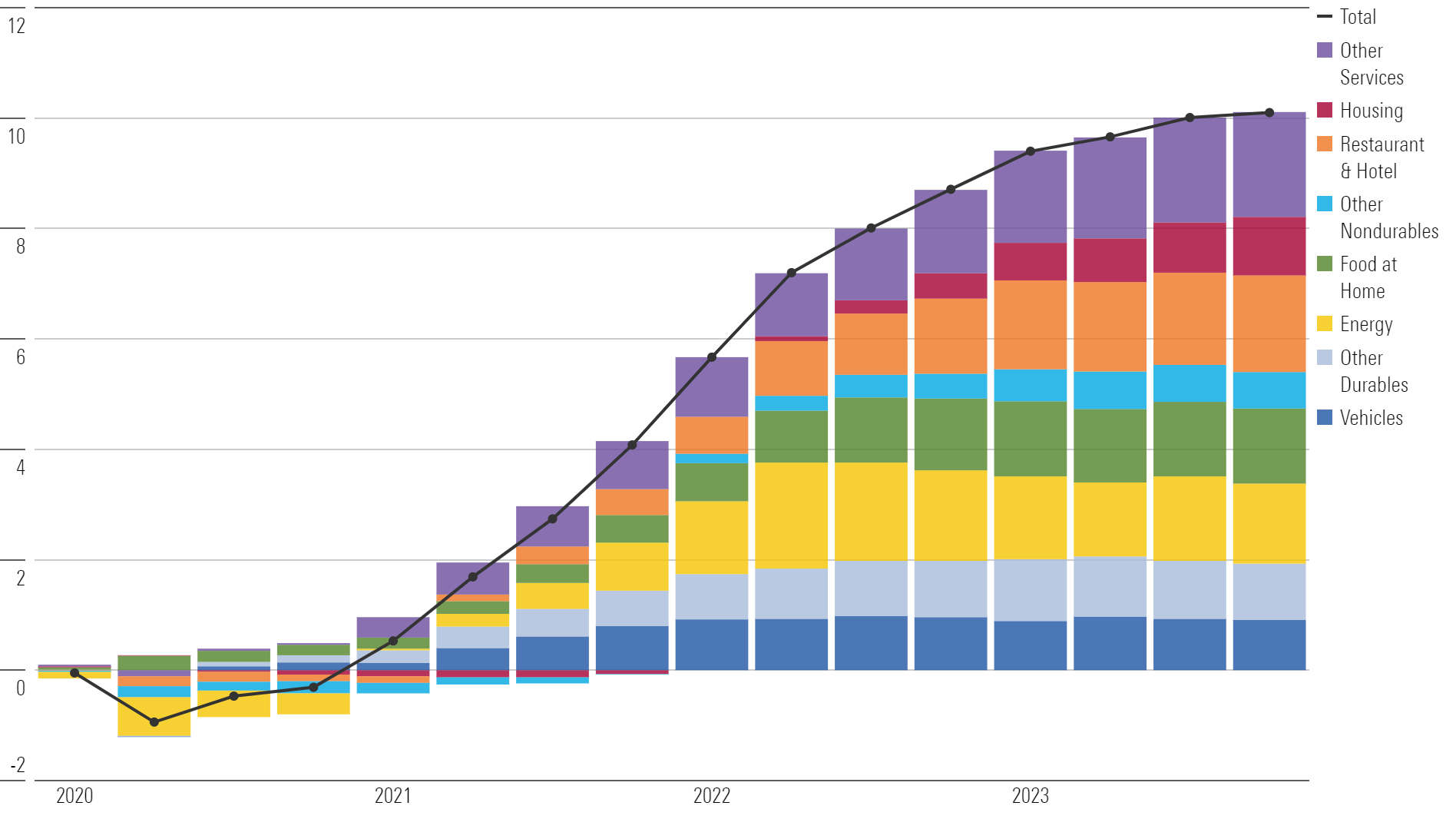

PCE Inflation (%)

Headline Inflation Has Plunged Since Mid-2022

The Personal Consumption Expenditures Price Index, or PCE Index, which is our (and the Fed’s) preferred inflation measure, fell from a peak of 7.1% year-over-year growth in June 2022 to just 2.4% as of February 2024.

Consumer Price Index inflation, which has some methodological differences with PCE, has fallen even more dramatically year over year. It had peaked at a higher rate (8.9%) owing to a higher weighting in energy. CPI inflation was 3.2% year over year in February 2024.

Core inflation has also been on a gradual downtrend since early 2022, though its decline is less impressive compared with headline inflation. Because core inflation strips out the impact of volatile food and energy prices, economists often use it as a cleaner measure of inflation’s underlying trend. Core PCE inflation was 2.8% year over year in February 2024, slightly higher than the overall inflation rate. Core CPI inflation is running a bit higher at 3.8% year over year, owing to a higher weighting in housing.

Inflation Measures, % Growth Year Over Year

Categories That Have Played an Outsize Role in Excess Inflation

The postpandemic jump in inflation began with only a handful of spending categories.

Excess inflation (the difference between cumulative inflation versus its prepandemic average) was only 5.7 percentage points in the first quarter of 2022. At that time, durable goods, energy, and food at home accounted for nearly 70% of that excess inflation, despite being only 20% of total consumption.

Since then, inflation has spread to several other categories. These other categories, which include housing, vehicles, and more, now account for about half of excess inflation. Still, the partial deflation in these categories has helped slow the overall inflation rate substantially. And, we see the inflation in these categories as more of a one-time catch-up effect.

PCE Excess Inflation by Category

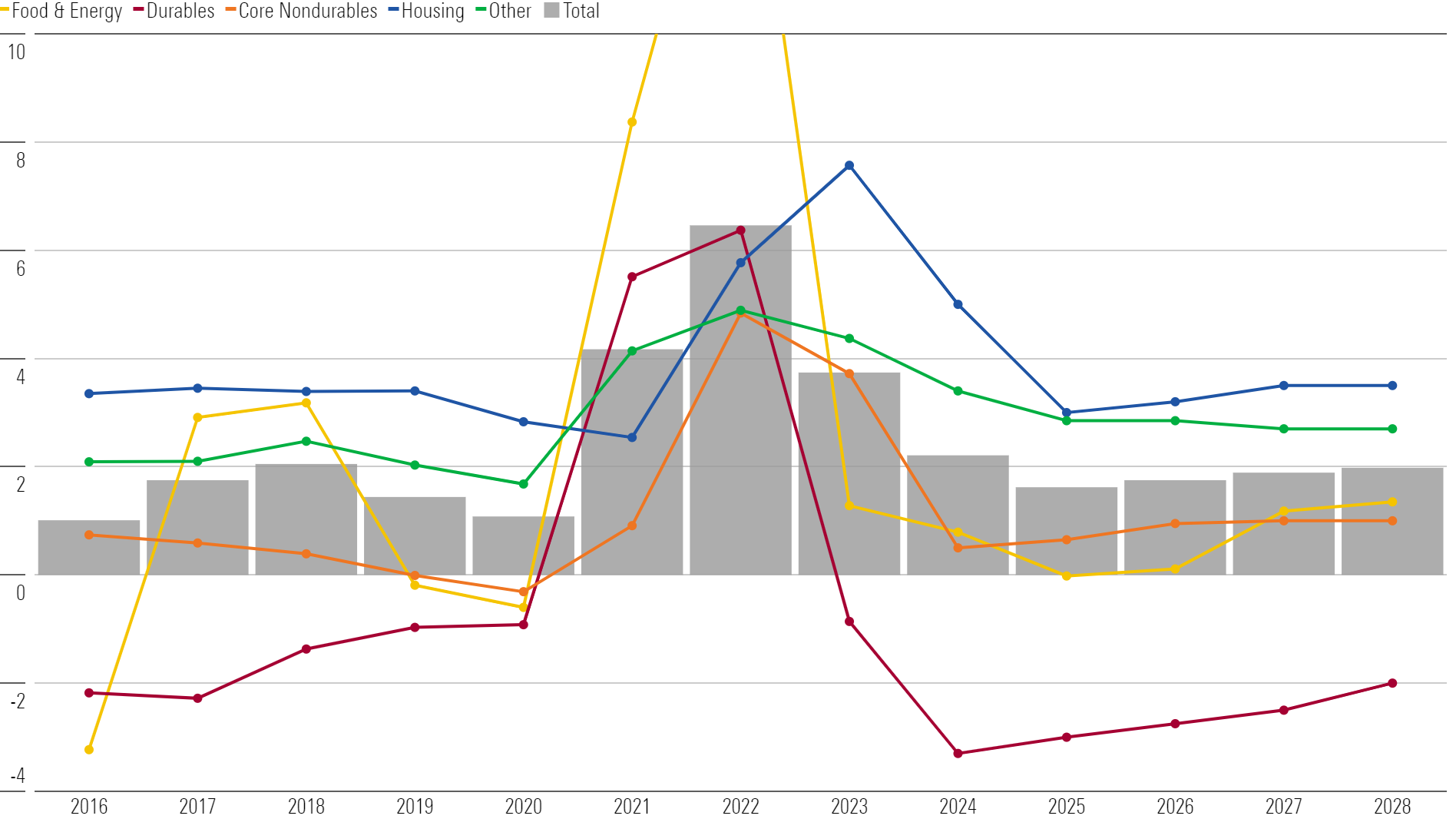

Where We Expect Inflation to Fall the Most Over 2024-28

Given the role of industry-specific supply shocks in driving historically high inflation, we take a bottom-up approach to forecasting inflation for the next five years. That is, we start by examining the underlying components and work toward macro trends.

Here’s where we expect the greatest drop in inflation (and sometimes outright deflation) between 2024 and 2028:

- Durables: Major supply constraints are lifting. In particular, the semiconductor market is likely to flip from shortage to glut over the next few years. The normalization of spending patterns (shifting back to services) is also easing pricing pressure on goods. We expect about one third of the excess inflation in durables to unwind by 2027.

- Food and energy: We expect prices to subside as the industry adjusts to disruption from factors such as the Ukraine war, and one-off events such as the outbreak of Highly Pathogenic Avian Influenza in 2022, which especially elevated egg and poultry prices.

- Housing: Housing inflation has accelerated markedly over the past year, but we don’t expect this to last. Assuming market rent growth doesn’t reaccelerate, it’s inevitable that housing inflation will fall back to normal.

In all other components of the Personal Consumption Expenditures Price Index, we expect moderate wage growth and the absence of any long-lasting supply disruptions to keep inflation at restrained levels. And the economy growing well below potential through 2024 will cause widespread deflationary pressure.

PCE Inflation Forecast: Key Components (% Growth)

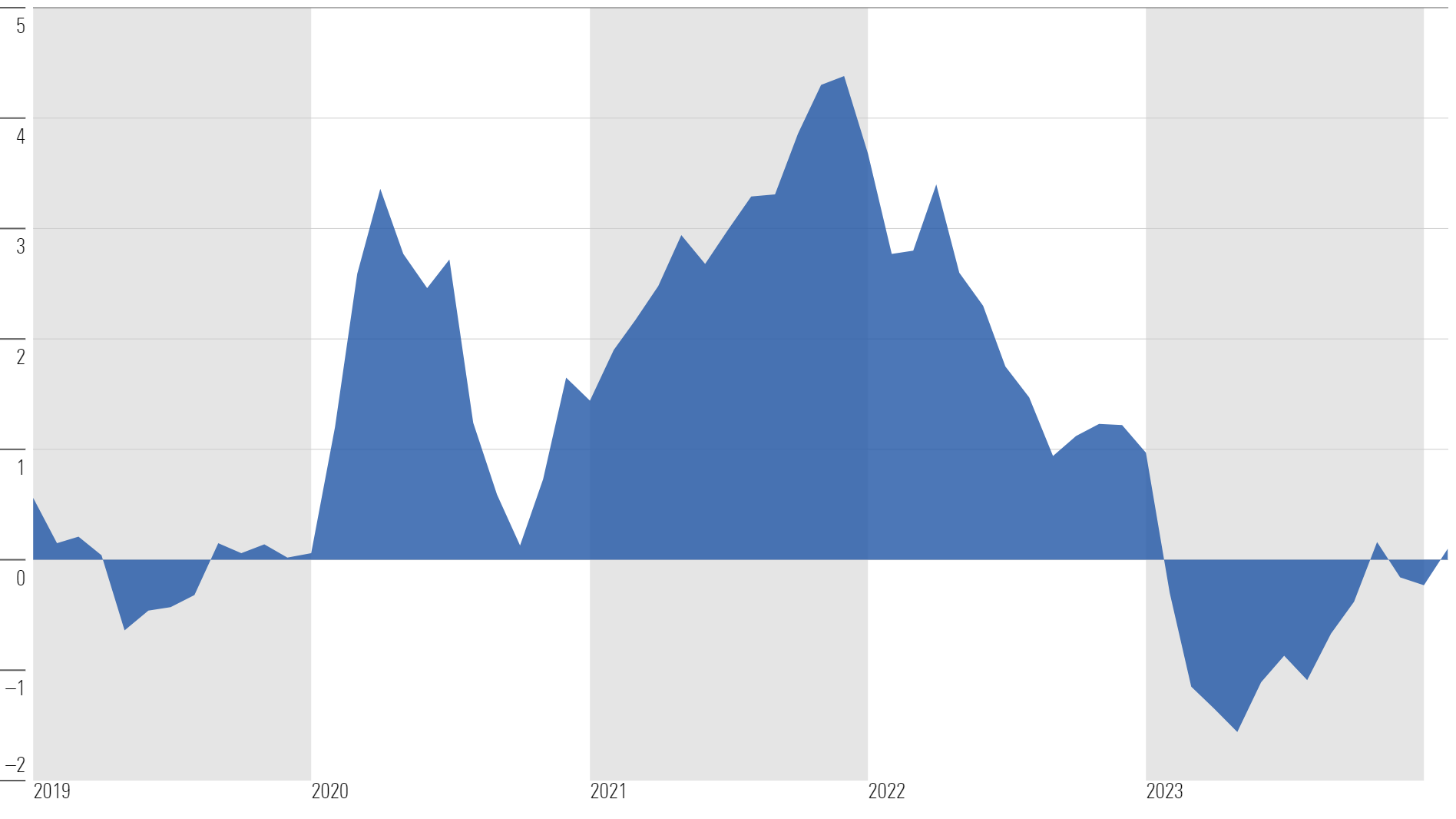

Supply Chain Healing Will Bring Goods Prices Down

Numerous production and logistical disruptions have contributed to inflation in durables and other parts of the economy. But supply chains are healing as demand normalizes and capacity catches up: The Federal Reserve Bank of New York’s Global Supply Chain Pressure Index is showing supply chain conditions about in line with prepandemic levels.

Global Supply Chain Pressure Index (New York Fed)

There’s more help on the way. One indicator on the logistics side is that there are enough container ships set to be delivered over the next several years to expand the current fleet by 30%. And manufacturing capacity is expanding in the United States and other major economies, such as China.

Other key takeaways about supply chains include:

- Supply chain improvement won’t be fully reflected in lower prices right away, just as core goods prices didn’t peak until about a year after supply chain paralysis set in.

- Producer prices for transport have fallen compared with a year ago, as have import prices.

- Elevated retailers’ gross margins are still propping up high consumer prices.

Housing Market Inflation in 2024 and Beyond

Because price indexes capture the cost of living, and most people don’t sign a new lease or buy a new house every year, it takes time for housing prices in price indexes to capture changing market conditions. For this reason, CPI inflation is still running fairly hot owing to the accumulated runup in market rents since 2021.

That said, here’s where the housing market currently stands:

- Market rents are now decelerating sharply in response to falling housing demand and expanding apartment supply. Rent growth fell to only about 1.7% year over year as of December 2023, from its peak of 15.7% in February 2023. This is causing CPI shelter to finally decelerate, which we expect to persist over the next year until housing inflation returns to normal.

- We expect home prices to fall as weak home demand will continue to weigh on housing prices. We expect home prices to remain about flat in nominal terms over the next several years and thus converge much of the way back to the prepandemic trend. This will return the CPI shelter index to normal.

- Lower housing prices will also aid in returning housing affordability to more reasonable levels. From a cost perspective, lower home prices should become more palatable for builders as easing supply constraints reduce the cost of construction inputs.

A Soft Landing Is Our Base Case for Inflation in 2024

Our base case is that inflation will return to normal in 2024, even as real GDP growth remains positive in year-over-year terms—a “soft landing.”

Over the past year, inflation has fallen around 300 basis points even as real GDP growth has accelerated. That performance has defied the predictions of those in the stagflation camp who thought that a deep economic slump would be needed to root out entrenched inflation. Instead, the inflation-GDP trade-off has been very kind, thanks to the loosening of supply constraints, as we had long anticipated.

Still, we’ve been surprised by the resiliency of economic growth in the face of aggressive rate hikes from the Fed. This means the “overheating” scenario has increased in probability, where the economy grows at a rollicking pace and inflation remains in the 3%-4% range.

We still think that the Fed’s rate hikes executed thus far will eventually slow GDP growth sufficiently and that inflation will drop to 2% (while avoiding an outright recession). The effects of these rate hikes are still accumulating throughout the economy as borrowers roll over to higher interest rates and exhaust their financial cushions.

This article was compiled by Emelia Fredlick and Yuyang Zhang.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XF7WENSYN5BFBFLPPFH7BJYUHE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)