Fed on Track for June Rate Cuts and More

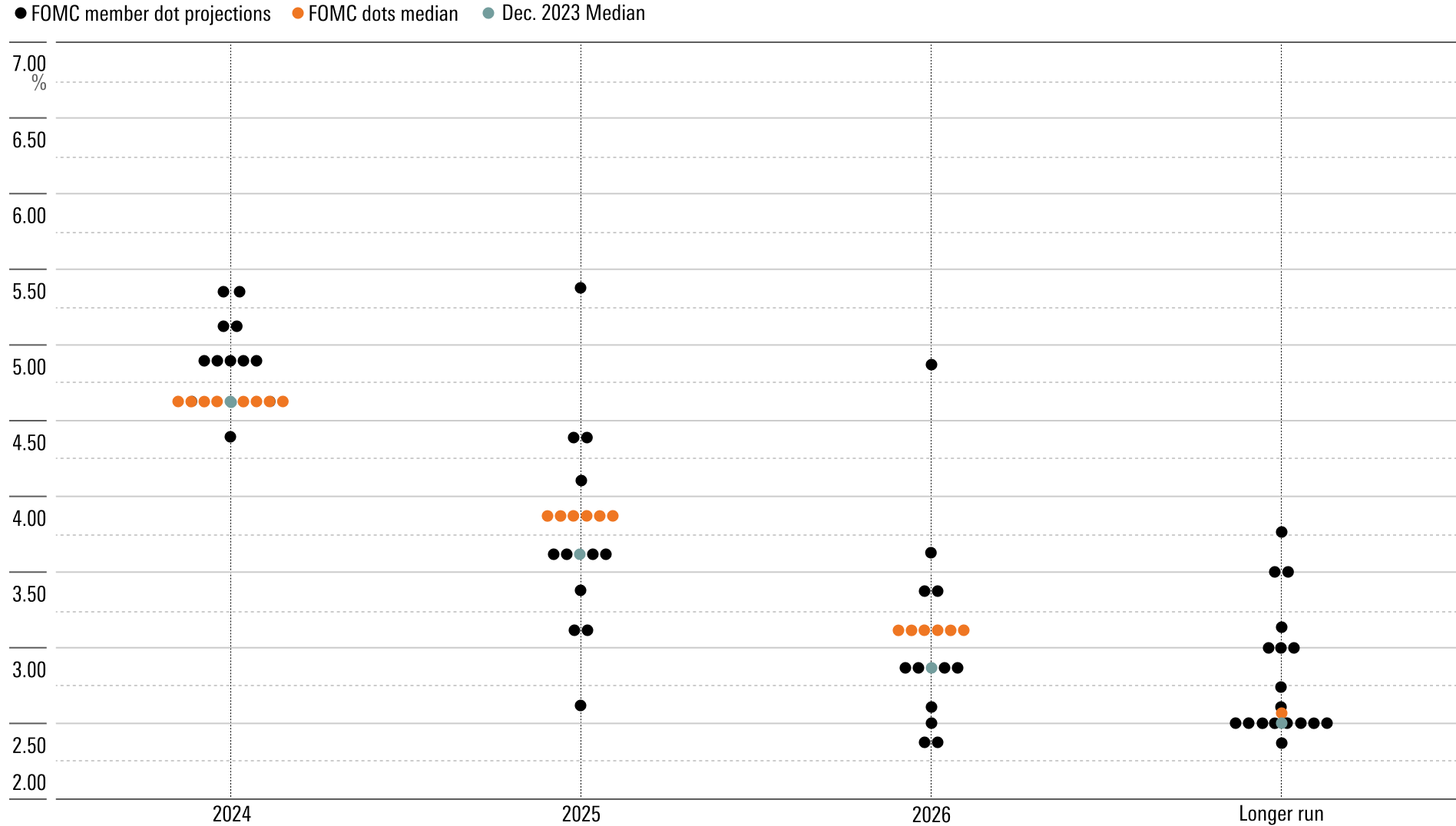

We’re looking for deeper rate cuts than the Fed’s dot plot suggests.

While the Federal Reserve delivered an expected policy decision Wednesday by keeping interest rates unchanged, we anticipate falling inflation to lead to five rate cuts by year-end. With our year-end 2025 forecast for a federal-funds rate target range of 2.25%-2.50%, we still think the central bank will cut rates much more than it currently believes it will in 2024 and 2025.

The Fed kept the rate unchanged at its March meeting, which had been widely predicted over the past two months. At its prior meeting, Chair Jerome Powell threw cold water on the notion of March rate cuts, especially given the surprising uptick in inflation in January and February.

The federal-funds rate currently stands at a target range of 5.25%-5.50%, following 500 basis points in hikes implemented from March 2022 to July 2023—the largest increase in four decades.

Treasury Yield and Federal-Funds Rate

The federal-funds rate is well into “restrictive territory” as assessed by the Fed, meaning rates are above normal levels, designed to cool economic activity and reduce inflation. Once inflation is back at the central bank’s 2.0% target, the rate should be made closer to “neutral” longer-run levels, which Federal Open Market Committee members currently assess at around 2.6%.

Progress on Inflation

In 2023, inflation made great progress toward returning to normal. Inflation averaged 6.5% in 2022 (using the PCE price index), the highest level since 1981, but dropped to 3.7% in 2023. In the second half of 2023, inflation averaged a 2.1% annual rate, with core inflation at 1.9%.

However, the first two months of 2024 have brought a rebound, with core PCE inflation averaging about a 4% annualized rate. Essentially no one expects inflation to remain this high for the rest of the year. Still, this uptick could signal that inflation may return to the Fed’s 2% target more slowly than forecasters anticipated several months ago.

For its part, the Fed has nudged its latest inflation projections slightly upward, now expecting fourth-quarter 2024 core PCE inflation at 2.6% year-over-year (from 2.4% in its prior projection). It’s also raised its expectation of gross domestic product growth in 2024. The median FOMC member expects three federal-funds rate cuts in 2024, unchanged from its prior projections, despite the uptick in inflation.

The Fed has been more even-keeled than the market when assessing inflation’s underlying trend. Powell noted that FOMC members were keen not to overreact to positive inflation readings in the second half of 2023, just as they are not overreacting to the poor data from January and February. He said the “overall story hasn’t changed … inflation is moving down gradually on a sometimes-bumpy road toward 2%.”

We expect inflation for the rest of 2024 to be slightly lower than the Fed anticipates, owing to softening economic growth and a continued deflationary impulse on goods from supply chain improvement. We expect core PCE inflation to post at 2.2% year over year by the fourth quarter of 2024 (below the Fed’s 2.6%). This underpins our view that the Fed will enact five rate cuts this year, bringing the federal-funds rate down to a 4.00%-4.25% target range at year-end.

Fed to Cut Rates Aggressively

Moreover, we expect the federal-funds rate to fall to 2.25%-2.50% by year-end 2025, significantly below the Fed’s projection of 3.75%-4.00%, as seen in the dot plot of FOMC forecasts. We expect inflation in 2025 to average slightly below the Fed’s 2.0% target at 1.6%, while the Fed still expects average inflation of 2.3% in 2025.

The Dot Plot: Federal-Funds Rate Target Level

The Fed also suggested it will begin tapering off long-term security sales, or quantitative tightening, “very soon.” The central bank has reduced its securities holdings by around $1.5 trillion since 2022. These sales help put upward pressure on longer-term interest rates, though the exact impact is hard to quantify.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XF7WENSYN5BFBFLPPFH7BJYUHE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)